A Regulatory And Competitive Analysis Of The Asia-Pacific Dental Bone Graft Market

By Kamran Zamanian, Ph.D., and Celine Mashkoor, iData Research Inc.

Development of the dental bone graft substitute (DBGS) market in Asia-Pacific has greatly lagged behind the progress made in the United States. Allografts are widely used in the United States and have grown to become the DBGS material of choice by the majority of dental professionals. However, allograft DBGS materials remain a small market in Asia-Pacific. The region remains highly reliant on synthetic and autogenous bone for dental bone graft procedures.

In the past, local companies in the region lacked sufficient resources to invest in research and development of biomaterials. But recently, domestic companies have emerged to produce and distribute DBGS products to their local markets. Qualified donor tissues of allograft materials are highly scarce in the region and technological advances of xenograft materials are more recent and require extensive clinical trials. Consequently, the region remains highly dependent on foreign imports for DBGS products.

However, stringent medical device regulations in Australia, South Korea, Japan, and China limit foreign competition, especially within the allograft and xenograft markets. Recent medical device approvals and domestic R&D efforts are set to alter market trends and generate significant DBGS market growth for the Asia-Pacific market.

Development Of DBGS Submarkets: Regulations And Competitors By Country

The establishment and development of the xenograft, synthetic, and allograft DBGS markets vary greatly within the Asia-Pacific region. Food and drug associations and local governments dictate the competitive landscape by requiring licensed approvals and related regulations.

South Korea

In South Korea, xenograft, allograft, and synthetic products are approved by the Korean Food and Drug Administration (KFDA) and distributed to the market for dental bone grafting purposes. In order to obtain approval, the domestic Ministry of Food and Drug Safety (MFDS) requires that you first appoint a Korean License Holder. Foreign manufacturers without a direct office in South Korea are not allowed to submit medical device registrations to the MFDS. This highly restricts foreign competitors from entering the market, as they often do not have an established subsidiary in the region. Additionally, relying on a sponsor to do so is risky, and setting up a new subsidiary is extremely costly. Clinical testing takes years and further soaks up a company’s resources.

Geistlich is one of the few foreign companies that has adequate means and global recognition, and consequently has been successful in entering the Korean market for its xenograft products. In 2011, Geistlich established a South Korean subsidiary to facilitate license approvals in accordance with KFDA regulations.

As a result of the company’s success, the DBGS market for xenograft products has grown dramatically. In 2014, xenografts represented over 57% of the total DBGS units in South Korea. Geistlich’s success has also stimulated the local market in terms of development. A growing number of South Korean companies — namely CowellMedi, NIBEC, Genoss, and Oscotec — have emerged to produce and distribute xenograft products to local markets.

In the case of allografts, South Korea has developed a sophisticated tissue bone bank entity that caters to domestic demand for allograft products. Foreign imports of allograft materials are highly restricted due to the risk of disease transmission, and thus the market continues to rely on domestic allograft DBGS products. This thereby limits growth of the allograft market, as donor materials that meet regulatory standards are relatively scarce.

Therefore, xenografts will remain the dominant DBGS market in South Korea. Growth of xenograft and allograft markets will lead to significant growth of the overall DBGS market. Through the forecast period, the DBGS market in South Korea is expected to grow at a CAGR of 9.8% by 2021.

Chart 1: South Korea DBGS Unit Share by Material Type (2014/2018/2021)

Australia

Historically, the Australian market has mainly relied on synthetic and autogenous dental bone graft materials for DBGS procedures. More recently, xenograft and allograft products have become available to the market. Xenograft and allograft products must be registered with the Australia Register of Therapeutic Goods (ARTG), which is regulated by the Therapeutic Goods Administration (TGA). If a foreign company has no local presence in Australia, they are required to appoint a TGA Sponsor to facilitate the device regulation and approval process.

Geistlich was the first successful company to be granted TGA approval for its xenograft products through its sponsor Henry Schein. In 2014, Geistlich established a local headquarter in Sydney to better serve the market. As of January 1, 2015, Geistlich announced that it would be distributing directly to specialists, while Henry Schein will continue to manage its GP consumer base in Australia. Geistlich’s presence in the market is set to generate significant market growth for xenografts and the overall DBGS market.

In the past, allograft products were strictly imported into Australia on the basis of an extensive licensed approval. Allografts only became available to the Australian market in 2011 through BioHorizons. The company is authorized to distribute its allograft products on a per-patient approval basis to the Australian market. As of 2014, the status of BioHorizons allograft products remained under pending TGA approval. In 2015, approval is expected to be granted, beyond which the allograft market in Australia is set to demonstrate significant growth and more closely reflect the trend of the DBGS market in the United States (with allografts representing a major portion of the market).

Chart 2: Expected Unit Share of DBGS Market in Australia 2021

China

Since 2001, allograft materials for DBGS procedures have been distributed to the Chinese market through the Shanxi Tissue Bank. The State and Food Drug Administration (SFDA) in China oversees all medical device approvals. Clinical evaluation in the form of clinical trials must be conducted before any medical device is put into production.

Allograft materials in China are largely restricted to domestic donors and are distributed by tissue banks. As domestic and appropriate allograft materials remain scarce, China’s market for DBGS heavily relies on xenografts. Geistlich is one of the only foreign companies to gain SFDA approval and has established a subsidiary in China since 2008. This has led to a dramatic growth of the xenograft market in the region.

A growing number of regional biomaterial companies namely, Sunmax Biotechnology and Tianjin Sannie Bio, have emerged to produce and distribute xenograft materials. Due to the limitations on the supply of allograft materials and the growing availability of xenograft products, the xenograft market is expected to remain the dominant DBGS market in China far into the future.

Chart 3: Allograft, Synthetic, and Xenograft Unit Share Analysis China (2011-2021)

Japan

The Japanese market for DBGS is the most underdeveloped relative to other countries in the Asia-Pacific region. Synthetic materials represent the vast majority of products in Japan. Allografts are not yet approved, and xenograft products only recently gained approval.

Language barriers and a complex registration process make Japan one of the most time-consuming markets for medical device manufacturers to enter. Companies interested in selling their products to the Japanese market must comply with Japan’s Pharmaceutical and Medical Device Law (PMDL) regulations. For foreign manufacturers, complying with PMDL can be challenging.

The xenograft market in Japan was only established in 2012, when Geistlich obtained Pharmaceutical and Medical Devices Agency (PMDA) approval for its xenograft products. However, the Japanese market continues to display aversion from the use of bovine bone products for DBGS procedures. This is set to limit market growth within the Japanese market through the forecast period.

Additionally, allograft products still remain absent in the Japanese market due to stringent regulations on human donor materials and the lack of an established tissue bank in the region. Geistlich is expected to generate significant growth for the xenograft market, but the country will remain highly reliant on synthetic materials due to cultural preferences. Geistlich’s entry into Japan and the corresponding growth of xenograft products is set to generate DBGS market growth at a CAGR of 5.7%.

Chart 4: Xenograft and Synthetic Unit Share Analysis Japanese DBGS Market (2014-2021)

Overall Asia-Pacific Competitive Landscape

Limitations of scarce allograft material supplies in the region and cultural preferences make xenograft materials the preferred choice of DBGS products across the Asia-Pacific region. This is highly advantageous for Geistlich, as its product portfolio is focused on xenograft products.

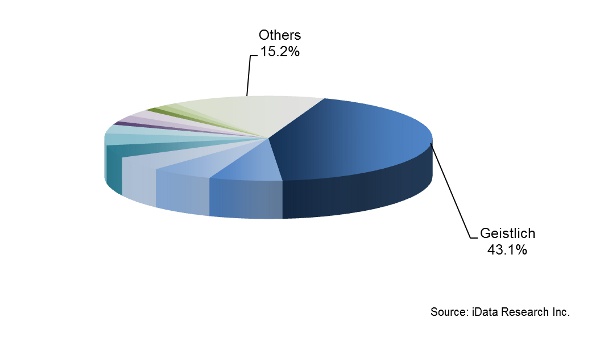

Geistlich holds a monopoly position for the xenograft market in Australia and Japan, where it is the only company with full approval to distribute its products. In South Korea and China, Geistlich also holds an overwhelming portion of the xenograft market. In 2014, Geistlich held a 43.1% share of the total DBGS market for the overall Asia-Pacific region. The company’s recent establishment in Japan and newly established subsidiary in Australia are expected to generate significant revenue growth through the forecast period. The company is set to face limited competitive pressures due to a costly and stringent approval process within the xenograft market. However, Geistlich is expected to face more competitive pressures from the allograft market, especially in Australia.

Chart 5: Competitive Landscape DBGS Market for the Overall Asia-Pacific Region (2014)

About iData Research

iData Research (www.idataresearch.com) is an international market research and consulting group focused on providing market intelligence for medical device and pharmaceutical companies. iData covers research in: diabetes drugs, diabetes devices, pharmaceuticals, anesthesiology, wound management, orthopedics, cardiovascular, ophthalmics, endoscopy, gynecology, urology, and more.

About The Authors

Celine Mashkoor is a market research analyst at iData Research. She takes on a senior role for the dental unit of analysts and possesses global expertise on various dental markets. She most recently published market reports on dental implant and related dental regenerative markets for the U.S. and Asia-Pacific region. Her current focus has now shifted towards the European market, and a published report is currently in the pipeline. Connect with Celine on LinkedIn or contact her at celinem@idataresearch.net.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry.