3D Printing In Biomedical Applications: Overview And Opportunities

By Atin Angrish

It is a well-known fact that additive manufacturing (AM) technology, more commonly known as 3D printing, is not currently at a maturity level that makes it suitable for mass manufacturing — it is an expensive and time-consuming process compared to conventional technologies. However, additive manufacturing does have one significant advantage over more established approaches: the ability to make custom parts usually meant for short-run production. As a result, it becomes an ideal technology for fabrication of parts in industries that typically do not operate in economies of scale.

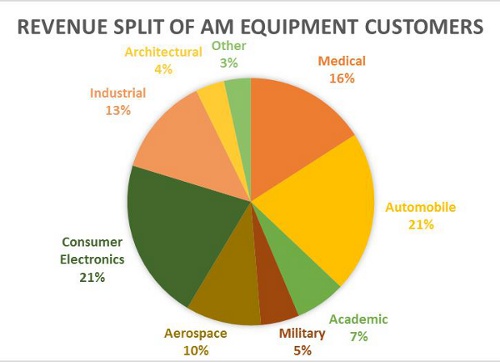

One such example is the biomedical industry. Transparency Market Research estimates that the 3D printing market for medical applications generated revenues of nearly $346 million in 2012, and that the number will grow to almost $1 billion by 2019. According to a survey by Wohlers Associates, one of the leading additive manufacturing research agencies in the world, the total market size for 3D printing products and services across all industries is about $2 billion, almost evenly split between products and services in 2013. The compound annual growth rate (CAGR) of overall additive manufacturing industry revenue has been about 25% per year for the last 25 years. The approximate share of 2013 revenues by industry sector can be seen in Figure 1 below.

Figure 1: Industrial split of AM equipment customers (Source: Wohlers Report, 2013)

We observe that the medical sector contributed almost 16% of the overall revenues by 3D printing technologies. That puts medical behind only automobile and consumer electronics, both key users of the technology. However, the major difference between the sectors is that the medical industry uses additive manufacturing for direct production of products, while the others use it primarily for prototyping purposes.

The medical implants space holds particular promise for 3D printing. Consider one specific segment: Global Industry Analysts suggests that the international market for orthopedic instrumentation is expected to reach about $56 billion by 2017. That figure includes not only instruments but also implants, where we are already seeing additive manufacturing being used. According to some industry estimates, 80% of global implants will be made using additive manufacturing in the coming two decades.

These trends open the door to a wide range of opportunities for prospective entrepreneurs and major organizations alike. Companies including Arcam AB, Stratasys, POM Group, Kennametal Stellite, and others are already exploring biomedical applications of 3D printing. In addition, numerous research institutes are also working towards development of better medical implant technologies using additive manufacturing. The list includes the University of Michigan, North Carolina State University, the University of North Carolina, Princeton University, Carnegie Mellon University, Case Western Reserve University, Pennsylvania State University, the University of Pittsburgh, and many others.

In the sections that follow, we will look at four of the largest potential application areas for additive manufacturing in the biomedical space.

Orthopedic Implants

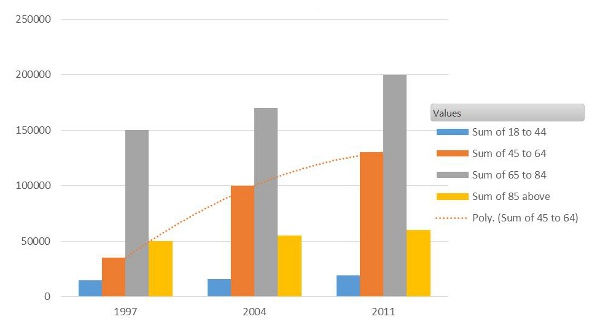

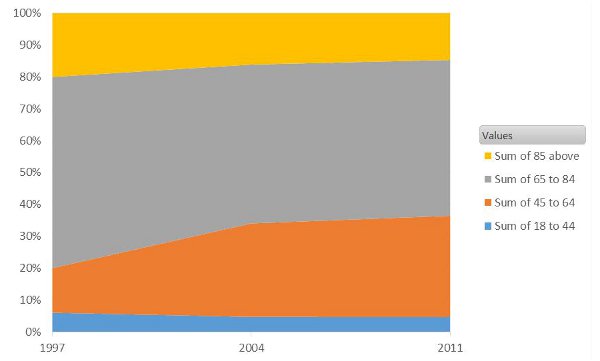

According to a report released by the Agency of Healthcare Research and Quality in 2011, the number of people in need of orthopedic implants has risen drastically in the past few years. The most notable statistic here is that the number of people between the ages of 45 and 60 in need of such implants — especially knee replacements — has risen sharply, which could be attributed to changes in lifestyle over the past few decades. The following graphs illustrate this information more succinctly.

Figure 2: Distribution of adults in need of a knee replacement in the U.S. (Source: Agency of Healthcare Research and Quality)

Figure 3: Percent distribution of adults in need of knee replacement in the U.S. (Source: Agency of Healthcare Research and Quality)

However, a look at the treatment of these problems reveals more interesting facts. Currently, five major implant manufacturers in the United States have almost 100% of the market share. These companies have an iron grip on the U.S. knee implant market, courtesy of their immense financial strength and the high barriers to entry presented by strict FDA regulations. This has led to immensely high cost of treatment and lack of new suppliers in the market.

Several organizations are looking to take advantage of this trend. Arcam AB has developed an electron beam melting (EBM) technology for additive manufacturing of harder metals such as titanium and associated alloys and is focusing on the market for orthopedic implants. Several other companies such as LayerWise and EnvisionTEC are also focusing on the use of 3D printing for orthopedic implant development.

In academia, several Washington State University research initiatives appear promising, such as the recent development of calcium phosphate-based ceramic bone grafts (suitable for low-load-bearing bones) and titanium prostheses (suitable for high-load-bearing applications). Although this innovation is not yet suitable for humans due to lack of extensive testing, it certainly is a step in the right direction.

Dental Implants

Orthopedics is not the only sector of biomedical implants that has seen a stark rise in adoption among younger Americans. Dental implants are another area with a growing customer base where additive manufacturing has seen a high level of acceptance. Dental implants are hardly covered by insurance, and a single tooth implant can cost up to $5,000. Traditional methods of manufacturing dental implants would often involve development of standard implants of various sizes, from which a dentist would choose the one that most closely fits a patient’s dental structure. This often led to people finding dental implants uncomfortable at best and painful at worst. (Similar problems occur in ear implants and hip replacement procedures.) These problems are often manifestations of a simple issue: Lack of “make to order” implants for each and every patient. Additive manufacturing promises to change all that.

Dental implants using additive manufacturing have long gained acceptance by the medical community and are now being used widely to fabricate accurate braces and dental restorations. This has, in turn, led to a number of companies developing 3D scanning software, materials for crowns and mandible sets, and dental restoration pieces.

These technologies have also enabled companies to develop new business models that previously were either difficult to reliably sustain or completely nonexistent. For example, the development of transparent, customized braces that do not require any manual adjustments is one such innovation that has been made possible by a convergence of material innovations and scanning technology advances. A number of major companies are currently involved in various stages of the dental implant value chain. Some of the major names are EOS imaging, Arcam, Materialise, Stratasys, and 3D Systems.

Tissue And Organ Implants

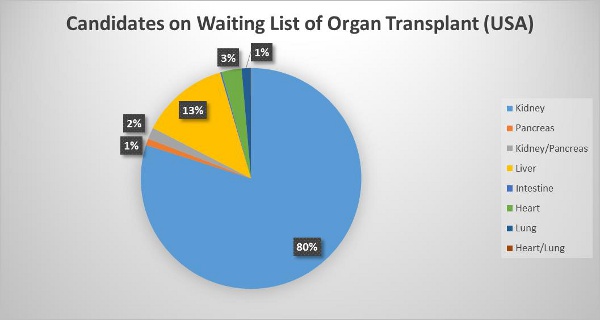

Another major problem that additive manufacturing has the potential to solve is the problem of organ donation. As of September 23, 2013, almost 80% of the total candidates on the organ donation waiting list are waiting for a kidney. That means more than 97,000 people in the U.S. alone are in need of a kidney transplant.

Figure 4: Percentage of people on the U.S. organ transplant waiting list by organ type (Source: Organ Procurement and Transplantation Network)

Patients must either find a donor who matches his or her requirements or wait for a suitable donor (or look to the black market, where the average cost of a single kidney is approximately $150,000). This lack of donor organs leads to almost 18 deaths every day in the U.S.

Recent advancements in 3D printing could eventually provide a solution to this problem. 3D printing has been used by researchers at companies such as Organovo to literally grow organs such as kidneys and livers with stem cells.

An $85 million research initiative called the Armed Forces Institute of Regenerative Medicine (AFIRM) joins more than 30 companies and research institutes in an effort to develop advanced treatment methods for severely wounded soldiers. The group recently developed a skin tissue printing machine based on 3D printing technology, which enables printing of human skin tissues to be directly implanted on a human limb. This is a major breakthrough for saving the lives of countless soldiers in battlefields.

Prosthetics

The fourth biomedical application for 3D printing is the development of prosthetics. Commercially available medical prosthetic devices manufactured using traditional practices are typically either too expensive or too unsophisticated. Regardless, prosthetics usually run between $10,000 and $15,000. Plus, each person’s limbs are and subtly different from another’s, and this needs to be reflected in the design of the limb.

Almost 185,000 amputations take place in the U.S. every year, about 54% of which are attributed to vascular problems and 45% to accidents, according to the Amputee Coalition, a nonprofit supported by the Centers For Disease Control and Prevention (CDC). A majority of these amputations are of extremities, which are subject to high levels of variance from individual to the next. Although a number of effective low-cost prosthetics for extremities are available (such as the Jaipur foot), these are often uncomfortable to the amputee, especially on the point of contact between the stump and the prosthetic. More comfortable prosthetics are available but at a much higher cost. Clearly, this is a potentially large market whose needs have gone unanswered for a very long period of time. Additive manufacturing can address the cost and customization factors inherent in the prosthetics space.

Conclusion

Additive manufacturing will pave the way to an entirely new outlook on medical implants and devices. Recent advances in 3D printing technology and materials are accelerating its adoption in the biomedical industry. In coming installments in this series, we will look more closely at the individual biomedical application areas and their drivers for additive manufacturing technology.

About The Author

Atin Angrish is a 3D printing enthusiast and industry analyst. He is working as an associate consultant for ZoomRx Healthcare Research and has previously worked in the Technical Insights Division of the market research firm Frost & Sullivan. His main professional focus is on advanced manufacturing technologies and their convergence with different industries. Angrish earned his bachelor’s degree (Hons) in mechanical engineering from the Birla Institute of Technology and Science (BITS Pilani), India. He can be reached at angrish.atin@gmail.com.