Edwards CEO Touts Increased Adoption of TAVR Program

By Jof Enriquez,

Follow me on Twitter @jofenriq

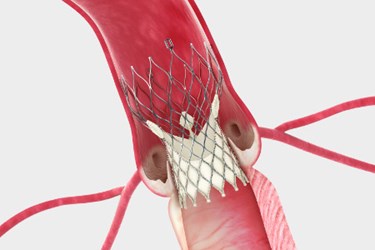

Edwards Lifesciences reported a strong fourth quarter performance built on increased adoption of transcatheter-based heart valve therapies, and company CEO Michael A. Mussallem believes momentum will likely continue this year as the company receives more indications for its Sapien 3 implant.

Mussallem said in a call with analysts that unexpected procedure growth during the holiday season lifted Transcatheter Heart Valves sales by 50 percent during the fourth quarter. The growth was driven primarily by increased utilization of the Sapien transcatheter aortic valve replacement (TAVR) device, which was utilized in 400 centers at the end of 2015. The number is at the high end of the original estimate, and Edwards is adding more National Coverage Determination (NCD)-qualified centers in 2016.

On expectation of continued therapy adoption, Mussallem said the company is upgrading its 2016 THV global sales estimate from $1.3 billion to $1.5 billion, and 2016 sales growth should be between 15 percent to 25 percent.

"We believe the strong growth and adoption of TAVR in the U.S. was driven by the growing body of clinical evidence, increased physician experience, and high procedural success," Mussallem told analysts. "Many hospitals are responding to the increased demand by modifying their schedules to perform more procedures each week. We see this trend continuing as TAVR provides an attractive therapy option for a large number of untreated elderly patients."

Sapien adoption rates also trended upwards and grew double-digits in Japan and Europe.

"We are very proud of Edwards' performance in 2015 and the momentum we bring into 2016," Mussallem said in a separate statement. "Our focused innovation strategy can transform patient care and drive value to both the healthcare system and shareholders. We are enthusiastic about the continued expansion of transcatheter-based therapies for the many structural heart patients still in need, which positions us for a bright future."

Edwards estimates the global TAVR market to be worth $5 billion by 2021, factoring in expanded indications beyond what regulators have granted so far.

FDA last year cleared Sapien 3 for treatment of high-risk patients suffering from severe, symptomatic aortic stenosis, based on the PARTNER II clinical trial. Just recently, Sapien 3 received FDA approval for the PARTNER 3 investigational device exemption (IDE) trial to study elderly patients suffering from severe, symptomatic aortic stenosis, and who have been identified by low mortality risk if they undergo standard surgical aortic valve replacement. Edwards also plans to pursue an additional indication for intermediate risk patients receiving Sapien implants.

"In 2016, expanding the indication to treat intermediate risk patients remains a key focus. We expect data from the intermediate risk cohorts in two studies to be presented at the American College of Cardiology Meeting in April, a randomized study of SAPIEN XT versus surgery and a study of SAPIEN 3," Mussallem explained during the call.

"Assuming positive results and an expedited FDA review, we're planning for a late 2016 U.S. approval," he added. "We expect our Continued Access Program for intermediate risk patients in the U.S. to continue until commercial approval. We plan to use the U.S data in a CE Mark submission in Europe."

Including clinical trial spending, Edwards hiked R&D expenditure, primarily for its TAVR and transcatheter mitral valve replacement (TMVR) programs, with R&D as a percentage of sales set at 16 percent.

Edwards is a leader in the burgeoning TAVR market, and plans to duplicate its success with the underserved TMVR market with early-stage U.S. clinical studies underway.

"We're investing in a number of structural heart initiatives. We continue to make progress on our CardiAQ-Edwards, transcatheter mitral valve program, or TMVR, and our FORMA system for reducing tricuspid regurgitation," Mussallem said during the call. "Our mitral team is currently working on enhancements to the CardiAQ-Edwards valve platform, including additional sizes, delivery system refinements, and the addition of Edwards' clinically proven bovine pericardial tissue. We're also currently developing additional next-generation TMVR products that leverage our experience."

As for the impact of the device tax suspension, the company expects a minimal positive impact to 2016 earnings.

"We are evaluating the opportunities to reinvest the savings from the two-year suspension of the U.S. medical device excise tax. We're deploying a disciplined process to explore value-creating opportunities to accelerate existing programs or initiate new ones," Mussellam told analysts.