Auris Grows Surgical Robotics Business With $80M Hansen Acquisition

Auris is expanding its robotic surgery portfolio with the acquisition of Hansen Medical in a deal worth $80 million. Hansen specializes in intravascular robotic catheter systems and was co-founded by Frederic Moll, a serial entrepreneur and current CEO of Auris.

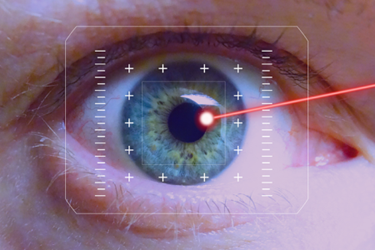

Auris has been developing a robotic microsurgical system designed for ophthalmic surgery, and signed a co-development deal with BIOLASE in 2013 for a robotic system that removes cataracts. Since then, the company has been quiet about its developments, even after a financing round in 2015 that attracted a host of 25 “all-star” investors and raised $150 million.

In the $80 million deal to acquire Hansen, Auris agreed to pay 40 percent over the closing price of Hansen shares and, according to a press release, certain Hansen stakeholders have agreed to invest approximately $49 million in Auris once the transaction is completed. With Hansen, Auris acquires the Magellan Robotic system, used in endovascular procedures to navigate peripheral blood vessels, and the Sensei Robotic System, a robotically steerable catheter system.

Hansen has posted revenue losses over the past three years, according to The Wall Street Journal (WSJ). In January, president and CEO Cary Vance confirmed that the company was considering “strategic options,” which included a possible licensing transaction, a partnership, or a sale.

“We are pleased with this outcome, which we believe maximizes value for our shareholders,” said Vance in a recent press release. “The combined capabilities of Auris and Hansen Medical will accelerate the proliferation of medical robotics to advance patient care.”

Fred Moll, who is a co-founder and current CEO of Auris, served as CEO of Hansen from 2002 to 2010 and has co-founded two other surgical robotics companies, Intuitive Surgical and Origin Medsystems.

“Hansen Medical has developed a technology leadership position in the field of intravascular robotics,” said Moll. “There remains a significant opportunity in flexible robotics, and I am excited to combine with Hansen Medical to advance this market.”

Over the past year, several prominent names in medical device technology have invested heavily in robotic-assisted surgical (RAS) systems. J&J’s Ethicon recently acquired NeuWave, which expanded its surgical oncology portfolio, and J&J signed a deal with Verily to launch a surgical robotics joint venture, Verb Surgical. Smith & Nephew also recently made a hefty investment in robotic surgical systems with its $275M acquisition of Blue Belt Surgical.

Stryker CEO Kevin Lobo commented in an earnings call that his company’s robotics M&A strategy would set his company apart from competition.

In an effort to get out ahead of regulatory challenges presented by RAS systems currently in development, the FDA hosted a workshop last July to discuss the systems with industry stakeholders.