Demand For Minimally Invasive Procedures Drives U.S. Neurovascular Device Market

By Beverly Allan and Kamran Zamanian, Ph.D, iData Research Inc.

Stroke is the fourth-leading cause of death in the United States and is a leading cause of serious, long-term disability. Approximately 800,000 people have a stroke in the U.S. every year, and quick treatment is vital to prevent death or disability.1 Neurovascular medical devices are required to quickly and effectively treat strokes. Technological advancement in these devices, as well as patient demand for minimally invasive procedures is driving growth in the neurovascular device market.2

Great Opportunity For Growth In Mechanical Thrombectomy

Over 85 percent of strokes are ischemic strokes, caused by an obstructed artery that supplies blood to the brain.1 The gold standard treatment for years has been medical therapy, the administration of a clot-dissolving medication called tissue plasminogen activator (tPA).3 However, this drug must be administered within four hours of symptom onset, and it is not effective in all cases.3 In recent years, innovative treatment options have entered the market and are projected to experience rapid growth, due to the unmet medical needs that they fulfill.2

Favorable results from clinical trials have led both the American Heart Association (AHA) and the American Stroke Association to update their guidelines, which now recommend the use of mechanical thrombectomy in the treatment of ischemic strokes.3 Stent retrievers are one form of mechanical thrombectomy, and two such products currently are approved for the U.S. market, Medtronic’s Solitaire Flow Restoration device and Stryker’s Trevo ProVu Retrieval System. These devices are inserted into the patient’s body endovascularly, and then maneuvered to the blocked blood vessel to grab the clot.

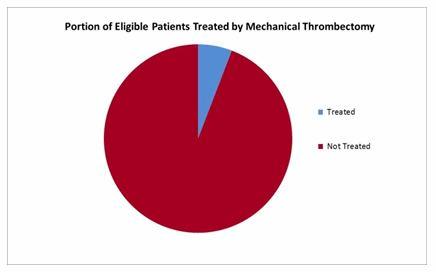

The other option is the use of thrombectomy catheters, which use vacuum aspiration to remove the clot. Penumbra’s Ace 68 system offered is the only device of its kind currently on the market in the U.S. Both Medtronic and Stryker have estimated that more than 240,000 patients are eligible for mechanical thrombectomy every year in the U.S., and current procedure numbers demonstrate that there is considerable room for market growth.2,4 Stent retrievers and thrombectomy catheters often are used in conjunction. However, this may change in coming years as Medtronic, Stryker, and Penumbra battle for market share.2

Technological Innovation Advances Aneurysm Treatment

Even though hemorrhagic strokes are less common, medical devices for their treatment represent the vast majority of the neurovascular market.1,2 Hemorrhagic stroke occurs when a weakened blood vessel ruptures, which leads to an accumulation of blood in the brain. Usually, this weakened vessel is either an aneurysm or arteriovenous malformation (AVM). In some cases, aneurysms and AVMs are detected and treated prior to their rupture to avoid these strokes.

Historically, surgical clipping was the most common treatment, but after the International Subarachnoid Aneurysm Trial (ISAT) demonstrated improved clinical outcomes with endovascular coiling versus clipping, this market experienced a decline.5 Approximately 28 percent of aneurysms still are clipped in the U.S., and aneurysm morphology, location, and physician preference all impact the treatment decision.2

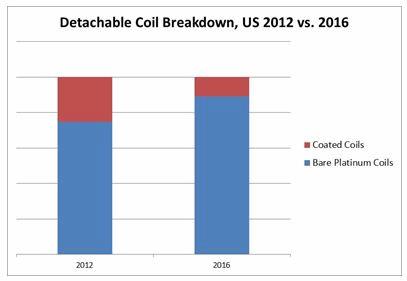

Six companies have moved into the detachable coil market as it experiences rapid growth, which has been driving pricing pressure.2 In addition, the average selling price of coils has been declining due to the market transitioning back to the use of bare platinum coils, versus coated coils, which commanded a premium price.2 This transition is expected to continue as clinical trials have failed to demonstrate improved clinical outcomes with coated coils.2 In difficult cases, such as wide-neck intravascular aneurysms, stent-assisted or balloon-assisted coiling is conducted.6 However, innovative new aneurysm treatments already are cannibalizing market share from coils.

In 2011, Medtronic’s Pipeline flow diverter stent was approved by the FDA for treatment of large or giant wide-necked aneurysms.7 The device’s second generation was approved in 2015.8 It is estimated that over 20 percent of large aneurysms now are being treated by this device.2 New, competing technology is poised to enter the market within the next few years, which may shift the competitive landscape.

Superior Access Devices Drive Endovascular Treatments

Interventional navigational devices, such as guidewires and microcatheters, are used to deliver detachable coils and stent retrievers, as well as liquid embolics and stents. As microcatheters and guidewires become smaller and easier to use, and minimally invasive endovascular treatments become feasible for more procedures, the need for surgical intervention decreases. Technological advancement of these access devices has driven growth in unit sales of the devices.2

Acquisitions Alter Competitive Landscape

Innovation in neurovascular devices, which allows for more procedures to be conducted using minimally invasive endovascular approaches, is therefore driving competition between major U.S. medical device companies. Medtronic’s 2015 acquisition of Covidien brought the company several innovative, lucrative products, making Medtronic a major competitor in the neurovascular device market. Medtronic acquired both the Solitaire flow restoration device and the Pipeline flow diverter stent, as well as a range of coils, catheters, guidewires, and stents. Medtronic reported 43 percent and 20 percent increases in its third and fourth quarters, respectively, for its neurovascular division revenue, for which it credits sales growth in the Solitaire and Pipeline devices.9,10

Stryker’s 2011 acquisition of Boston Scientific Neurovascular similarly positioned the former as a major player in the market; Stryker now is a leading competitor for several products in the neurovascular arena.1 Other notable contenders include Codman & Shurtleff Inc. and Terumo Microvention, each of which also offers a broad portfolio of products in the neurovascular market.

Conclusion

Technological advancements in medical devices for the treatment of ischemic and hemorrhagic stroke offer improved clinical outcomes for hundreds of thousands of Americans every year. There is a large target population, and therefore significant room for market growth. In addition, the development of new technology is driving growth through product innovation in a competitive market. Demand for minimally invasive procedures will continue to drive this race, and recent acquisitions have resulted in Medtronic and Stryker as leading competitors.

About The Authors

Beverly Allan is a Research Analyst at iData Research and was the lead researcher for the 2016 U.S Neurological Device Market Report. She is currently working on the 2016 European Neurological Device Market Report.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

Resources

- Mozaffarian D., et al. Heart disease and stroke statistics—2015 update: a report from the American Heart Association. Circulation. 2015.

- U.S. Neuromodulation, Neurovascular, Neurosurgical and Monitoring Device Market-2017. iData Research. Accessed Aug. 18, 2016.

- Powers. W.J et al., (June 29, 2015). 2015 AHA/ASA Focused Update of the 2013 Guidelines for the Early Management of Patients With Acute Ischemic Stroke Regarding Endovascular Treatment. Stroke, 46 (10): 3020-3035.

- Med Device Online. (June 30, 2015). Stent Retrievers, Left Atrial Appendage Occlusion Devices Could Revolutionize Stroke Care.

- Molyneux, A. (Oct. 26, 2002). International Subarachnoid Aneurysm Trial (ISAT) of neurosurgical clipping versus endovascular coiling in 2143 patients with ruptured intracranial aneurysms: a randomised trial. The Lancet, 360(9342):1267-1274.

- Wang, F., et al. (May 15, 2016). Stent-assisted coiling and balloon-assisted coiling in the management of intracranial aneurysms: A systematic review & meta-analysis. J Neurol Sci., 15(364) 160-166.

- FDA Approval. (April 6, 2011). Pipeline Embolization Device.

- Medtronic's Pipeline Flex Embolization Device Receives FDA Approval — Press Release. Feb. 5, 2015.

- Medtronic Reports Third Quarter Financial Results — Press Release. March 1, 2016.

- Medtronic Reports Fourth Quarter and Fiscal Year 2016 Financial Results – Press Release. May 31, 2016).