Effects Of The Affordable Care Act On Urological Procedures And Associated Device Markets

By Dr. Kamran Zamanian, CEO, and Nick Choy, research analyst, iData Research Inc.

A political, economic, social, and technological (PEST) analysis of the U.S. urological device market with a focus on the possible impacts that policy changes can have on Medicare and Medicaid Reimbursements, procedure volumes, sales volumes, and market values of medical devices.

The interplay between political, economic, sociodemographic, and technological factors will likely contribute to the growth of the U.S. urological device market in the near future. Many Americans can reap the benefits generated by the most technologically advanced generation of humankind. These improvements afford us longer lives, the ability to spend more time with our loved ones, and improved quality of life — just in time to service the largest population of men and women over the age of 60 years in history. Sociodemographic factors will likely drive demand for medical devices in the U.S., but healthcare reform will probably have one of the most significant impacts on the decisions stakeholders in the medical industry will make. The Affordable Care Act (ACA) ushers changes that affect the economic incentives of physicians, manufacturers, insurance providers, and other players along the healthcare provision continuum. These changes arise from the seemingly competing priorities of lowering costs while raising quality, and will likely have diverse effects in various markets.

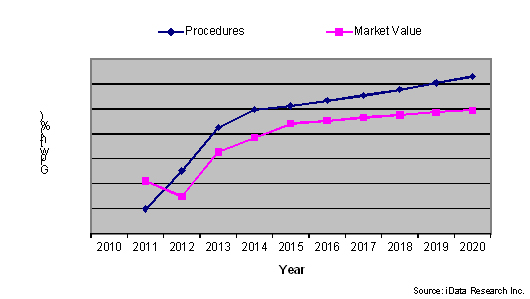

Trends In Procedure Volumes And Market Value, Urology Market, U.S., 2010-2020

The Impact Of Sociodemographic Factors And Market Dynamics

The baby boom generation, the silver tsunami, and the aging population all name the same phenomenon. In the context of the medical device industry, this essentially amounts to the enlargement of the patient pool and an increase in the market size of potential consumers. From 2013 to 2020, the population of women and men over the age of 65 is expected to grow at a compound annual growth rate (CAGR) of 3.4 percent. Furthermore, through Medicaid, the ACA could increase insurance coverage by over 20 million people within the next decade. Thus, sociodemographic drivers coupled with healthcare reform will likely increase demand for urological procedures and the devices used to perform them.

Products to treat diseases that are highly correlated with age could benefit the most from the aging population. For example, benign prostatic hyperplasia (BPH) describes the enlargement of the prostate. When the prostate grows sufficiently large, it can block the normal flow of urine, cause frequent urination, and increase the risk of urinary tract infections, as well as other symptoms. Approximately half of men exhibit evidence of BPH by age 50, a proportion that increases to 75 perecent by age 80. Nearly half of these cases are clinically significant and require treatment. The population of men over the age of 60 is expected to grow by an annual average of 1.5 million from 2013 to 2020.

iData Research’s 2014 U.S. urology report estimates over 3 million procedures were conducted in 2013 in the markets covered by the report. Some of these procedures were performed concurrently during the same session or for the same patient over a time period. Other types of specialists may have executed the procedure as well. There are approximately 10,550 active urologists in the U.S., which means, on average, each one performed around 300 procedures in 2013. If the population growth rate outpaces the ability of physicians to meet their needs, the number of urologists will become a bottleneck in the provision of urological treatment. This will drive the demand for time-saving devices, provided they yield similar patient outcomes.

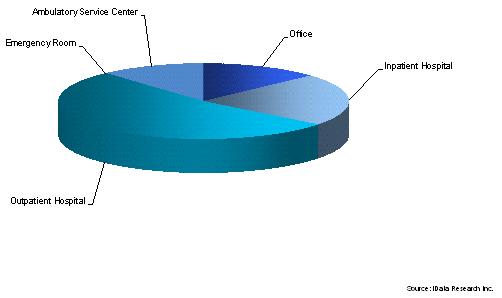

Private practices owned and operated by one or two urologists have declined as more urologists return to the employment of hospitals or become members of larger group practices. High overhead costs, partly due to malpractice costs, contribute to the economic instability of this practice setting. There are approximately 5,700 registered community hospitals in the U.S. Of these, approximately 15 to 20 percent are for-profit institutions, over 50 percent belong to multihospital systems managed by a central entity, and 25 to 30 percent belong to a network of healthcare providers. These trends play a significant role, as they alter the purchasing models of capital equipment. Manufacturers increasingly market their products collectively with greater bargaining power. Moreover, reimbursement rates and physician fees for procedures vary by treatment setting. In a hospital setting, for example, the reimbursement rate for a procedure could be $700, while in an office setting, it could be as high as $2,000. An alternative procedure to alleviate the same disease, however, could be reimbursed for $800 and $1,500 in a hospital or office setting respectively. Thus, the incentives for physicians to conduct certain procedures vary by treatment setting.

Breakdown Of BPH Procedures By Treatment Setting, U.S., 2013

As the population ages, so too does the current pool of urologists, the majority of whom are over the age of 50. Younger urologists are exposed to different technologies and techniques. For example, members of the old guard are more familiar with extracorporeal shockwave lithotripsy (EWSL) to treat kidney and urinary stones. In addition to a number of other factors, this noninvasive treatment has lost popularity to endoscopic stone management modalities, which younger urologists tend to favor. Of endoscopic modalities, laser lithotripsy procedures are expected to grow at a moderately high rate over the next few years. However, endoscopic modalities are invasive and carry higher risks for comorbidities and complications compared to noninvasive treatments. Policies introduced by the ACA incentivize patient outcomes in a way that could alter models used to calculate net benefits and return-on-investments from capital equipment purchases.

The patient pool will increase from 2013 to 2020, but shifting market dynamics on the healthcare provider side will determine which procedures — and the medical devices used to perform them — will grow. Healthcare reform is a critical factor that will affect the incentives of healthcare providers and suppliers.

Healthcare Reform: Shaping Incentives

It is estimated that approximately 40 percent of procedures conducted in hospitals are paid for by Medicare and nearly 20 percent are paid through Medicaid. Medicare policies have an even greater impact on urological procedures that are correlated with age. For example, Medicare covered 60 percent or more of BPH interventions in 2013. Thus, facility reimbursement rates and physician payments will likely have a large impact on determining which procedures are performed.

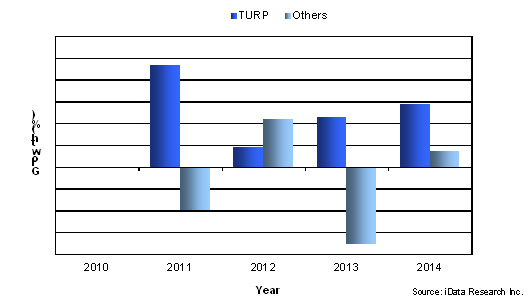

Growth In Hospital Outpatient Reimbursement Rates, BPH Procedures, 2010-2014

As of early 2014, laser BPH procedures performed in hospital outpatient settings will receive the highest reimbursement rate of $2,549.41, a 0.01 percent decrease from 2013. But, growing at a CAGR of 5.3 percent, reimbursements for transurethral resection of the prostate (TURP) procedures have increased the most from 2010 to 2014. In hospital settings, physicians receive the highest fees for performing outpatient TURP procedures followed by laser enucleation. At the same time, outpatient TURP procedures and laser enucleation procedures have increased while almost all other modalities have declined. However, in non-facility settings, physicians receive substantially higher payments for performing transurethral microwave thermotherapy (TUMT), transurethral needle ablation (TUNA), and laser vaporization procedures. Given the movement of urologists away from small private practices to hospitals, it is likely that physicians will have the most financial incentives to perform TURP and laser enucleation procedures.

The ACA strives to improve insurance coverage, lower healthcare costs, and raise the quality of healthcare service. It introduced pilot payment models in 2013 that incentivize quality. For example, one type of bundled payment model will reimburse for an episode of care. This single payment would cover all aspects of treatment required for the patient. Clinicians can freely apply the payment to the type of procedures that will maximize patient outcomes while minimizing costs. The facility would be responsible for retreatments and unanticipated costs. This builds on a 2008 policy that ceased reimbursements for certain hospital-acquired conditions. To maximize the institution’s net benefits, physicians will likely select procedures that yield the highest efficacy rates relative to the costs.

Another quality incentivizing initiative is the Medicare Hospital Value-based Purchasing Program. Of all Medicare payments to participating facilities, 1.25 percent is set aside in a pool, and hospitals are scored against each other across a range of metrics. Bonuses and penalties are determined based on performance and are distributed to participants from the pool that was set aside. Forward-looking stakeholders have probably begun planning changes in anticipation.

Percutaneous nephrolithotomy (PCNL) is an invasive modality for treating kidney stones. In many cases a nephrostomy tube is placed to facilitate urine drainage at the end of PCNL procedures. There is a growing trend towards “tubeless” procedures to lower costs and reduce risk of infections. Growth in units sold of nephrostomy tubes is expected to increase at a CAGR of 3.3 percent, which is below the predicted CAGR of 4.9 percent for total nephrostomy procedure volumes. This example illustrates a relatively straightforward decision that meets the ACA’s goals of reducing costs and improving outcomes. But, it will likely result in lowering the value of the nephrostomy market.

Monopolar TURP procedures have been labeled as the gold standard for treating BPH, and monopolar electrodes are also the cheapest disposable available. Furthermore, in an outpatient hospital setting, TURP procedures yield the highest reimbursements. Under the current system, benefits are maximized by conducting monopolar TURP procedures. If patient outcomes become a factor in calculating reimbursements, the economic returns from using more expensive devices could exceed those of cheaper ones. Bipolar transurethral vaporization of the prostate (TUVP) procedures have been shown to reduce hospitalization and catherization duration. But, bipolar electrodes cost significantly more than their monopolar counterparts. Minimally invasive procedures such as photoselective vaporization of the prostate (PVP) have also been shown to reduce costs and blood loss. It has been argued that laser enucleation procedures generate the best outcomes.

It remains to be determined which initiatives will be implemented across the entire system and to what extent. In the meantime, under the current Medicare system, reimbursement rates will continue to determine which procedures are performed the most.

Trends In Technology

Population growth will likely drive a growing divergence between the number of patients and the number of urologists. This will likely drive demand for technologies that can expedite the time it takes to complete procedures. As owners of small, private practices are absorbed into larger organizations, purchasing trends of capital equipment will change. Hospitals and members of healthcare networks or systems have larger budgets and can share ownership of equipment on a mobile basis. But, most institutions face tight budget constraints that make versatile technologies seem attractive. High-powered holmium lasers can be used to treat kidney stones as well as BPH. The latest products from the leading manufacturers of ESWL capital are multifunctional urology tables that can perform lithotripsy. In the short run, procedures with high reimbursement rates reduce the payback period of capital equipment used to perform them and can increase returns on investment. However, impending healthcare reforms could shift the paradigm for calculating net returns of capital over the long run.

Navigating Uncertainty

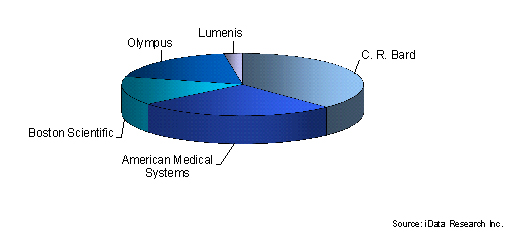

Leading manufacturers in the U.S. urological device market employ various strategies or have unique strengths inherent in their products to help navigate the changes sparked by healthcare reform.

C. R. Bard acquired Rochester Medical Corporation in 2013. Rochester’s offering of intermittent catheter and male external catheter complements Bard’s dominance in the Foley catheter market.

American Medical Systems’ specialization in men’s and women’s pelvic health positions is to benefit from the aging population. Furthermore, expected changes to reimbursement policies in a number of segments the company has leadership in are predicted to be favorable. The company has continued to improve on its flagship products and introduce new innovations to the market in several segments.

Breakdown Of Some Market Leaders In Urological Device Industry, U.S., 2013

Boston Scientific offers many products in the stone management, urinary incontinence, and nephrostomy device markets. Nitinol stone retrieval devices have become more popular than stainless steel products despite higher average sale prices. The net benefits provided by nitinol products, such as reduced risk of injuring patients, exceed the additional costs.

Olympus leads the bipolar TURP electrode market and has released products that facilitate enucleation of the prostate. The company has a history of innovating in the TURP device market and is expected to maintain its position in this segment.

Lumenis leads the holmium laser market. High-powered holmium lasers can be used in laser lithotripsy procedures as well as laser enucleation of the prostate. The versatility of this type of product reduces the payback period for facilities that invest in this type of capital.

Additional Information Is Available

The information contained in this article is taken from a detailed and comprehensive report published by iData Research Inc. (www.idataresearch.net) entitled 2014 U.S. Market for Urological Devices. For more information and a free synopsis of the above report, please contact iData Research at info@idataresearch.net.

iData Research is an international market research and consulting firm focused on providing market intelligence for the medical device, dental, and pharmaceutical industries.

Watch iData’s short company movie at http://www.idataresearch.net/discoveridata.html