EU Gynecology Market: Incontinence Sling Market Fading, Opportunities Favor Lasers

By Fallyn Thompson and Kamran Zamanian, Ph.D, iData Research Inc.

In 2015, the European gynecology market was valued at €228.62 million. Gynecology is a dynamic market with significant technological shifts and an increase in procedure numbers across Europe. As women become more comfortable discussing sexual health with medical professionals, the market garners greater attention and receives more funding. Increases in potential patients seeking treatment will correlate with more liberal cultural environments and countries with supportive reimbursement and legislation.

Overall, patients prefer less invasive outpatient procedures that can be performed in their doctor’s office, instead of hospital procedures that would potentially require general anesthesia. Minimally invasive laser treatments for vaginal atrophy, dyspareunia, and stress urinary incontinence are capitalizing on this trend and represent the fastest-growing market in European gynecology for both 2015 and 2016.

Minimally invasive laser treatments are not new; Italian manufacturer Deka Lasers first developed a non-ablative fractional laser system for clinical evaluation in 2004[i]. It is important to note that vaginal rejuvenation laser treatments are different and should not be confused with laser vaginal rejuvenation therapies.

The MonaLisa Touch was the first CO2 fractional laser treatment and utilizes a V2LR (Vulvo-Vaginal Laser Reshaping) scanning system. The first clinical trials began in 2008, leading to development of the V2LR system, and a number of pilot clinical studies were published in 2014 with excellent preliminary results[ii][iii]. While longer-term studies continue to be conducted, the use of lasers for vaginal treatments has proven a safe and effective treatment option.

The MonaLisa Touch was the first CO2 fractional laser treatment and utilizes a V2LR (Vulvo-Vaginal Laser Reshaping) scanning system. The first clinical trials began in 2008, leading to development of the V2LR system, and a number of pilot clinical studies were published in 2014 with excellent preliminary results[ii][iii]. While longer-term studies continue to be conducted, the use of lasers for vaginal treatments has proven a safe and effective treatment option.

The market has expanded to ten notable competitors internationally, with five main competitors present in the European market. Each competitor differentiates itself across a wide range of gynecological laser types. CO2 lasers were the first minimally invasive lasers used in gynecology, but Nd: YAG (yttrium-aluminum-garnet) and Er:YAG (Erbium-YAG) combined laser systems, as well as a hybrid fractional laser (HFL) system, have emerged as strong competitors.

The efficacy of laser treatments is supported by clinical evidence for the treatment of vaginal atrophy. The use of lasers, and the comparable success of different types of lasers, is less certain for the treatment of stress urinary incontinence. Patient feedback has been positive and the results indicate that the stimulation of collagen restoration, in combination with the contraction of the elastic fibers, creates vaginal tightening, increasing support to the mid-urethral area[iv]. The restoration of collagen also thickens the mucosal quality of the vaginal wall and the treatment is applied to the entire pre-urethral space[v][vi].

Female Urinary Incontinence Slings As A Catalyst Boosting Laser Treatments

The advantages of laser technology have been generating interest with gynecologists since the beginning of the forecast period; however, the stress urinary incontinence market has fueled rapid growth in this market. Physicians are seeking alternative treatment options for patients suffering from urinary incontinence. Traditional treatment options — female urinary incontinence slings — received damaging healthcare warnings from the FDA in 2008 and 2011, and the U.K.’s Medicine and Healthcare Products Regulatory Agency (MHRA) also has documented the devices’ adverse side effects. Although the warning primarily surrounds synthetic slings, both the synthetic and biological sling markets have experienced a drop in procedure and sales numbers.

The female urinary incontinence sling market has undergone a significant shift so far in 2016. In 2015, Astora Women’s Health accounted for 25.5 percent of the market share. Endo Health Solutions acquired Astora (then known as American Medical System’s Women’s Health division) in 2011. But, Astora was shut down on March 31, 2016 following over 22,000 lawsuits regarding AMS’ vaginal mesh products for the treatment of pelvic organ prolapse and urinary incontinence[vii]. Astora’s market share has seen been redistributed among the four remaining European competitors.

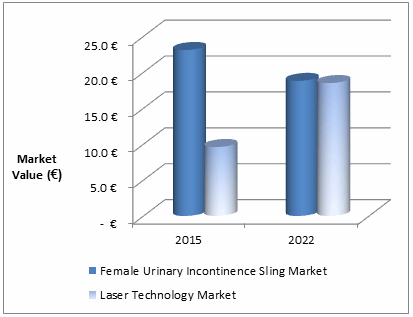

The aging demographic in Europe ensures that the number of potential patients is increasing. Although urinary incontinence is not limited to higher age brackets, it does affect a greater percentage of women in higher age demographics. The female urinary incontinence sling market is under stiff competition from competing meshes, autologous tissue, and allogenic grafts, as well as laser treatments for mild to moderate cases of stress urinary incontinence. Over the next year, the laser market is projected to cannibalize 10 percent of the European urinary incontinence procedure market, and the forecast is projected to continue at an exponential rate.

The aging demographic in Europe ensures that the number of potential patients is increasing. Although urinary incontinence is not limited to higher age brackets, it does affect a greater percentage of women in higher age demographics. The female urinary incontinence sling market is under stiff competition from competing meshes, autologous tissue, and allogenic grafts, as well as laser treatments for mild to moderate cases of stress urinary incontinence. Over the next year, the laser market is projected to cannibalize 10 percent of the European urinary incontinence procedure market, and the forecast is projected to continue at an exponential rate.

Laser treatments are encountering minimal competition. Offering an incisionless, minimally invasive procedure, laser treatments are unique in the field of gynecology, with very few alternative treatment options available for direct competition. Overall, the procedures are gaining recognition and patient interest, driving European market growth. The largest trend in laser technology is the transition from dermatologists’ predominantly performing non-invasive, in-office laser procedures to gynecologists investing in the systems.

The clinical evidence for laser treatments also offers a promising future for the industry. Currently, the laser technology market can be sub-divided into vaginal atrophy procedures and stress urinary incontinence procedures. This also affects the competitive landscape, as brand recognition for the different procedures varies between competitors. As more clinical data becomes available, it also is expected that laser treatments will become increasingly utilized for dyspareunia treatments, and as a treatment option for symptoms associated with estrogenic decreases.

New technology is generating excitement and disproportionately driving the growth of the European gynecology market across different segments. As an emerging technology, laser treatments are expected to become a standard market segment within the field of gynecology. Alternatively, the female urinary incontinence sling market is expected to shift significantly. While more women will require treatment for urinary incontinence, the sales and market share for mesh slings is expected to be reallocated to alternative treatment options.

About the Authors

Fallyn Thompson is the lead research analyst at iData Research for global gynecological device markets encompassing the U.S., Asia-Pacific, and 15 countries in Europe.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

References

European Market Report Suite for Gynecological Devices 2016 – MedSuite

- Ronconi L, Galli M. MonaLisa Touch®: The Latest Frontier in the Treatment of Vaginal Atrophy. DEKA. 2015 May.

- Ronconi L, Galli M. MonaLisa Touch®: The Latest Frontier in the Treatment of Vaginal Atrophy. DEKA. 2015 May.

- Salvatore S, Nappi RE, Zerbinati N, Calligaro A, Ferrero S, Origoni M, Candiani M, Leone Roberti Maggiore U. A 12-week treatment with fractional CO2 laser for vulvovaginal atrophy: a pilot study. Climacteric. 2014 Aug;17(4):363-9. doi: 10.3109/13697137.2014.899347.

- Wellmark Blue Cross and Blue Shield; © 2016. Use of Fractional CO2 Laser Therapy (MonaLisa Touch), Radiofrequency Technology and ER YAG Laser Therapy for Vaginal Rejuvenation and Vaginal Tightening. May 2015 [Updated: April 2016].

- Fistonić I, Findri-Guštek Š, Fistonić N. Minimally invasive laser procedure for early stages of stress urinary incontinence (SUI). Journal of the Laser and Health Academy. Vol. 2012, No. 1. ISSN 1855-9913

- Alcalay Menachem MD, Bader Alexander MD, Ksenija Selih Martinec MD, Guy Gutman MD. The Effect of Vaginal CO2 Laser Treatment on Stress Urinary Incontinence Symptoms. Alma Lasers Surgical. April 2016.

- Mesh Medical Devices Newsdesk. Endo Will Stop Making Pelvic Mesh and Close Women’s Health Division. 2016 March 2.