Going GLocal: MedTech Strategies For Emerging Economies

By Isha Suman, Decision Resources Group

With developed markets nearing their saturation stage, medtech companies are increasing their focus on emerging economies — India and China, in particular. These markets are currently expanding and offer a plethora of growth opportunities. However, while these markets offer lucrative business opportunities, they also demand a unique marketing strategy from medtech companies.

The traditional marketing, sales, and distribution models applied in developed markets have had limited success in the emerging markets. These are some of the common hurdles, as well as the ways companies are addressing them:

- Unlike the developed markets, emerging economies limit the training surrounding product handling, reprocessing, and sterilization to urban areas, which often results in a greater number of cases of device mishandling and malfunction. Therefore, in such situations, having local service personnel who are able to support customers and to replace devices promptly is the point of parity.

- Unlike Western cultures, which usually have complete or partial reimbursement, emerging economies have a high share of out-of-pocket health expenses. In light of these high out-of-pocket expenditures, cost is a more important factor in emerging economies, compared to Western cultures, apart from service and quality, when facilities are making purchasing decisions.

- Product design also holds a pilot seat in such economies. Devices that are easy to handle, portable, easy to understand, and require less laboratory set up are much preferred over more complicated devices that require careful handling with laboratory support at all times.

Thus, we advise medtech to go “GLocal”— to remain global in vision, yet customize offerings according to specific unmet needs of customers in emerging economies. For medtech companies to go GLocal, they need to make strategic decisions on frugal innovation and to create marketing plans for emerging economies.

Frugal Innovation

Some companies eliminate select features from devices they market in Western cultures, and then introduce those altered devices at lower prices in emerging economies. However, they often do not succeed, because these markets are unique in terms of their requirements. Customers in such markets require more features for lower prices. Innovations that meet this requirement in emerging economies are called “frugal” innovations.

There are many local and global companies that have successfully marketed their devices in these regions because they have followed the concept of frugal innovation in their product design and hence offered benefits suitable for the actual needs of the market.

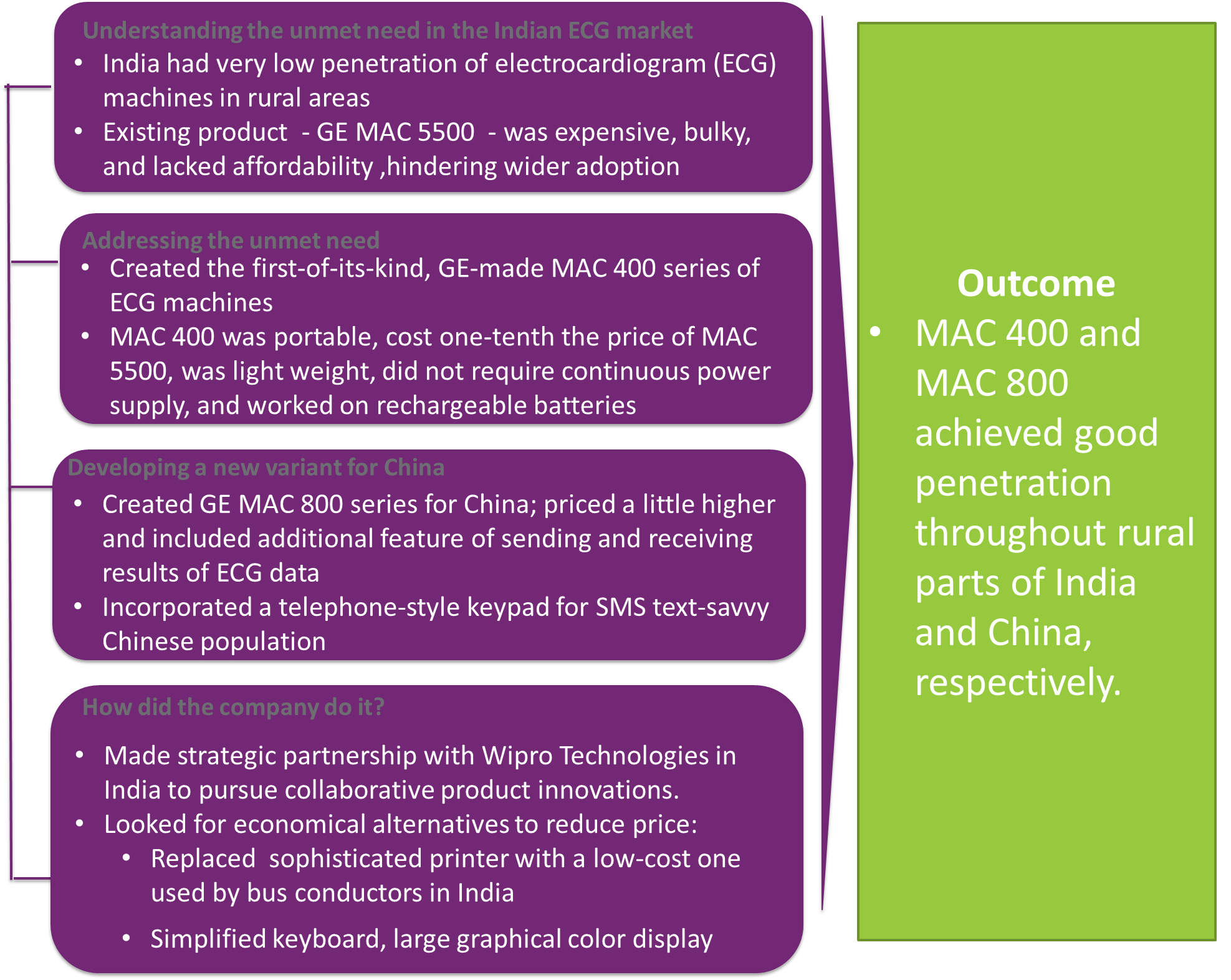

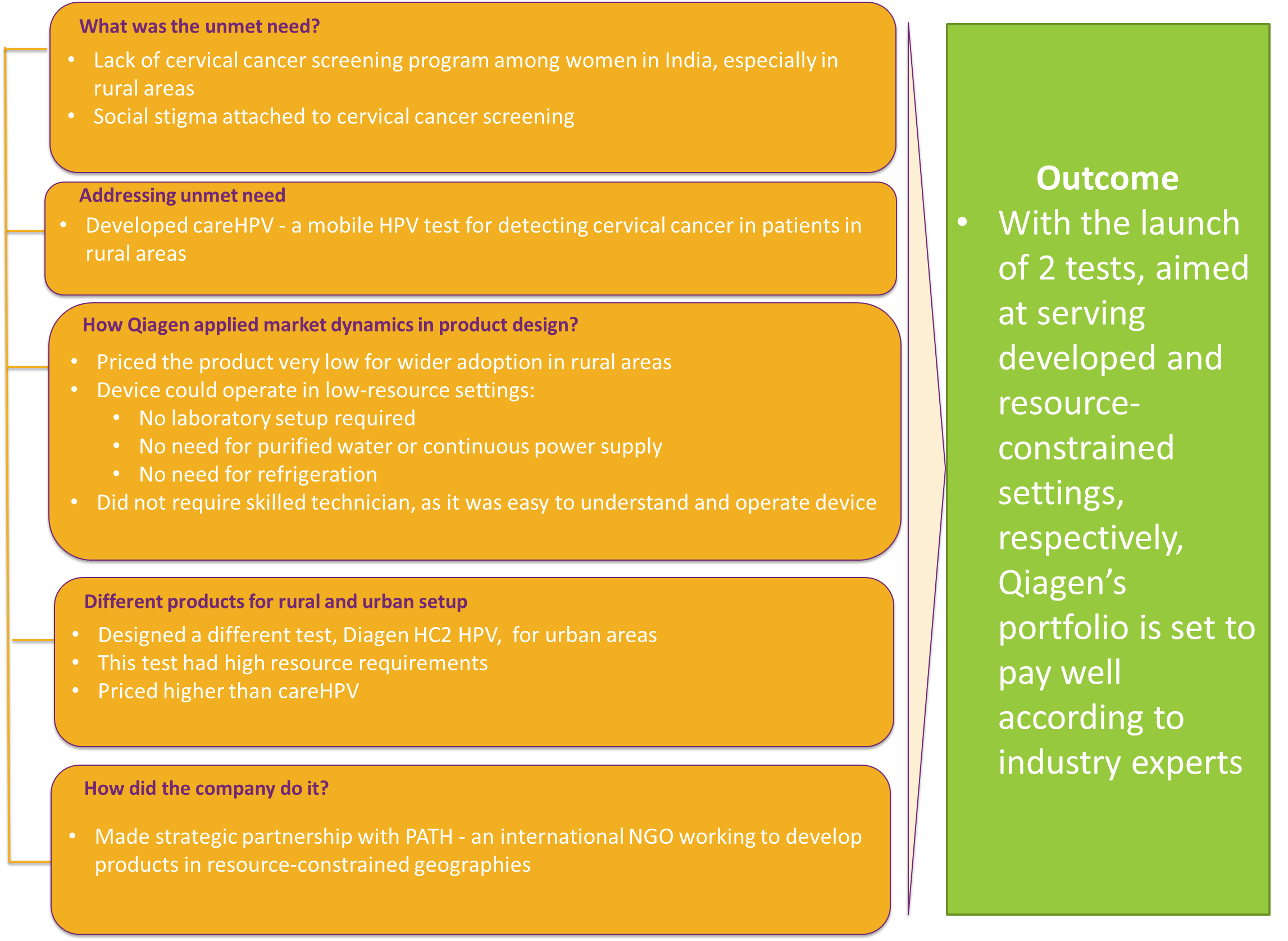

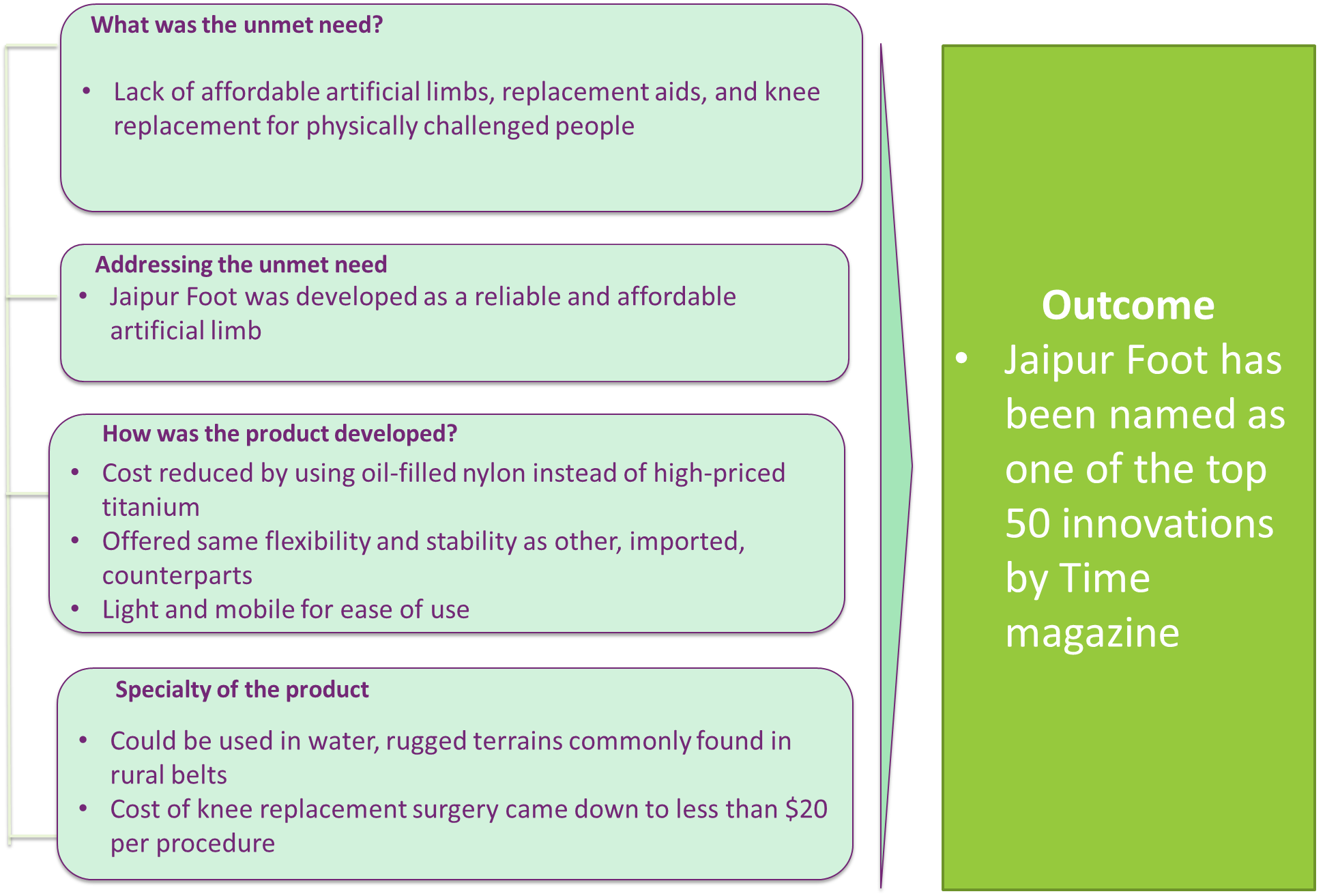

Below are some examples of successful frugal innovations, applied with GLocal marketing strategies in emerging markets:

Abbott

Qiagen

Jaipur Foot

GLocal Marketing Strategy

We suggest a three-pronged strategy for going GLocal:

1.Establish strategic partnerships with stakeholders

As seen in the cases of GE Healthcare, Qiagen, and Abbott, establishing partnerships with other stakeholders for collaborative innovation pays off in the long run, because it gives companies better insight into the market. These stakeholders could be professional bodies, research institutes, local companies with strong footprints in domestic market, or insurance companies.

Working in partnership with research institutes, professional bodies, or local companies will help companies not only to build innovative products, but also to establish better brand image in emerging economies. Companies can partner with local insurance players for two purposes. First, they can create special finance-based schemes to drive better adoption of products. For example, Medtronic has partnered with Maitrika foundation for its ‘Healthy Heart for All’ program, dedicated to improving access to its heart devices, including stents, implantable pacemakers, cathode ray tubes, heart valves, and implantable cardio verter-defibrillators on EMIs. Medtronic also provides financial assistance of up to 85 percent of device or therapy cost, and interest-free payment plans ranging in duration from six months to five years. Such tailored insurance and finance schemes reduce the initial price barrier for product adoption,

2.Develop a dual strategy for rural and urban markets

The urban and rural markets do not function in the same way, and marketing strategies that work well in urban areas do not apply for rural belts. Taking this into consideration, companies should aim to develop a scalable marketing strategy that can be tailored to urban and rural settings accordingly.

3.Invest in startup ventures developing innovative products for local markets

Medical devices require years of large-scale investment in R&D. In order to minimize risks associated with developing a brand new product, companies can invest in local startup ventures, which develop innovative products that address unmet needs of the local customers. Two examples worth pointing out are Wrig Nanosystems and Forus Health.

Wrig Nanosystems, a medtech startup in India, made a device called the TrueHb Hemometer, which can measure hemoglobin in few minutes. Because the cost of this device is much lower than existing alternatives, it has been adopted widely by modern hospitals chains like Max and Fortis, and even some state governments in India.

Forus Health, another healthcare startup in India, has made a device called 3nethra, which is an ophthalmology screening device. While designing this portable device, the company kept in mind the sparse number of ophthalmologists in India and the lack of market penetration of ophthalmology screening devices. Forus Health’s device can be easily carried in a backpack and is affordable to most facilities in rural belts (it costs just about one-sixth the price of its competitors). The product has been successful in the country and is also getting recognized in other parts of the world.

Conclusion

Overall, in order to be successful in emerging economies, medtech manufacturers need to go GLocal, combining global vision with local expertise to reap the enormous benefits these emerging markets can offer.

Overall, in order to be successful in emerging economies, medtech manufacturers need to go GLocal, combining global vision with local expertise to reap the enormous benefits these emerging markets can offer.

To achieve this, manufacturers should collaborate with other stakeholders and to develop products that fulfill the unmet needs of the emerging market. Furthermore, companies should design a two-pronged strategy for urban and rural markets: Offer simple, portable, easy-to-use, and more affordable versions of devices in rural markets, and high-quality, top-notch products to urban markets. Finally, companies should develop strategic alliances with local and niche startup companies that specialize in developing low-cost, innovative products for such geographies.

About The Author

Isha Suman is a team lead, Research and Operations, at Decision Resources Group. She works on syndicated market research reports for medtech in the endoscopy division of the company. Isha holds a postgraduate degree in marketing from Indian Institute of Management and a bachelors degree in telecommunications from Visveswariah Technological University