How An ACA Repeal Could Impact Medtech

By Jason Lau, Decision Resources Group

Donald Trump’s presidency has generated considerable uncertainty for the future of the U.S. healthcare system. As a signal of his commitment to repeal the Affordable Care Act (ACA), President Trump’s first executive order, signed just hours after taking office, granted federal agencies broad powers to “waive, defer, grant exemptions from, or delay” any ACA provisions that pose a fiscal burden. Prior to this, the U.S. House of Representatives had passed a budget reconciliation bill for the repeal process to begin — budget reconciliation allows changes to legislation that carry a fiscal impact, and can pass with a simple majority in the Senate.

However, given that Republicans only hold a simple majority of 52 seats in the Senate, short of the 60-seat supermajority needed for a complete repeal, it is expected that their power to dismantle the ACA without opposition from Senate Democrats will be limited to those provisions that are tied to the budget.

On the other hand, President Trump has been adamant that any changes to the ACA should not result in the loss of health insurance for Americans who currently have it, including those with pre-existing conditions. Indeed, some Republicans have voiced concern about rushing the repeal without a workable replacement plan to supersede the current system. Trump also has recently tempered expectations about a swift repeal of the ACA, admitting it may take longer than originally thought.

All of this is to say that an ideal version of the health law is not easy to achieve, and certainly not one that can be rewritten and implemented anytime soon.

This article — the first in a two-part series — will discuss how repealing certain parts of the ACA will impact the medtech industry. Part two of the series, where I assess the impact of Trump’s trade policies on medtech, will follow next week.

The end of Medicaid expansion and the individual mandate

If block grants were to be used, their amounts likely would be significantly less than what the states currently are accustomed to receiving. During the first three years of Medicaid expansion, participating states are fully funded by the federal government to cover newly eligible recipients, with gradual reductions thereafter. A block grant system likely would revert federal funding levels back to the pre-ACA matching rate, as calculated by the Federal Medical Assistance Percentage, which offered a national average of 57 percent — about $1.40 in federal funding for every dollar spent by the state. Interstate funding differences will be maintained to account for Medicaid participation, but one can expect a decrease in funding overall.

Hospitals that are already financially pressured under the ACA because their patient mix has shifted to a larger proportion of Medicaid patients — since Medicaid reimburses at a much lower rate than what private insurers provide — will feel even more heat under a block grant system. Hospitals that cannot withstand further financial losses may be forced to close, consolidate, be acquired, or stop offering revenue-losing procedures. For medtech companies, a further consolidation of providers will erode their negotiation power relative to ever-growing group purchasing organizations; this will have a negative impact on device prices and revenues.

Aside from these drastic measures, hospitals serving a high volume of Medicaid patients, particularly those in rural areas, will need to rely more heavily on supplemental payment types, such as disproportionate share payments (DSP), in order to stay afloat. Ironically, under the ACA, this would be challenging, because reductions in DSPs are scheduled to start in 2018. However, if the ACA is repealed, there is a chance that DSP reductions will be delayed or suspended, thus partially making up for the funding loss due to block grants. Indeed, hospital executives have been pushing for a return of lost DSPs under the ACA, although a full restoration is unlikely to happen.

In general, the ACA’s ability to provide equal coverage to people with pre-existing conditions comes from the individual and employer mandates, which require everyone to be insured either through their employer or by purchasing personal coverage. A repeal of these mandates will lead to a decline in premium contributions from individuals who no longer opt for health insurance. This will force private insurers to increase premiums on remaining individuals in order to cover their costs; these remaining individuals tend to be higher-risk and more reliant on their coverage. Thus, the effect of repealing the individual mandate on the medtech industry is difficult to assess because it is unclear how many people would terminate coverage and whether it would impact procedure volumes.

Additionally, if a repeal were to happen, reductions in Medicare payments to healthcare providers under the ACA could be reversed. Again, this may not have much of an effect on the medtech industry. In fact, this could be a positive development if a greater number of people enroll in Medicare Advantage plans going forward, because it would encourage providers to purchase more devices, or higher-cost devices, in order to offer the premium services expected from Advantage plans.

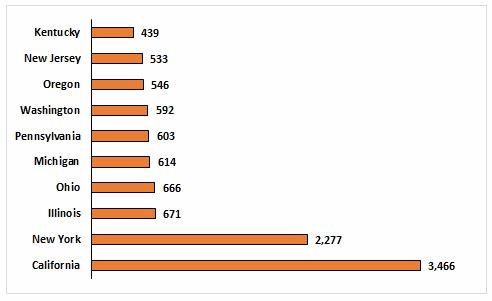

Considering the potential changes that could happen to Medicaid, Medicare, and the individual mandate, the biggest impact on the medtech industry would come from a switch to a block grant system and a reduction in Medicaid funding. One obvious impact is a decrease in service and procedure volume compared to the levels seen under expanded Medicaid, which will reduce demand for medical devices, especially those used in procedures to treat the elderly and poor.

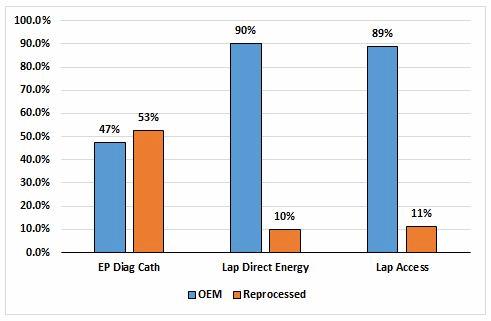

Lastly, reduced funding means that reprocessed devices will gain popularity. Already used in a number of electrophysiology and laparoscopic procedures (Fig. 3), reprocessed devices are known to be safe and less expensive than their OEM counterparts, making them an attractive option in high-volume or financially constrained facilities. Greater use of reprocessed devices means that third-party reprocessing companies like Stryker and SterilMed will stand to gain.

Reduced access to preventive health services

Under the ACA, preventive health services recommended by the U.S. Preventive Services Task Force are required to be covered by private health plans. These include screening procedures, such as mammographies for breast cancer, Pap smears for cervical cancer, and colonoscopies for colorectal cancer. A repeal could eliminate these requirements or significantly reduce access to these services through funding cuts, leading to fewer people getting screened. While physicians will continue to encourage screening participation, the requirement of a co-pay will mean those who are less able to afford such a co-pay may opt for less frequent or delayed screenings. This may lead to the detection and diagnosis of cancers at a later stage, which will increase demand for oncology treatments, but will reduce the demand for diagnostic tests and biopsy devices in the near term.

The contraception mandate is a guarantee of free birth control to women with health insurance. This mandate is not part of the ACA per se, but is commonly thought to be based on the view that contraception is a preventive health service. Instead, the mandate is enforced by the Department of Health and Human Services (HHS), which means that it can be eliminated without repeal and on President Trump’s regulatory authority alone.

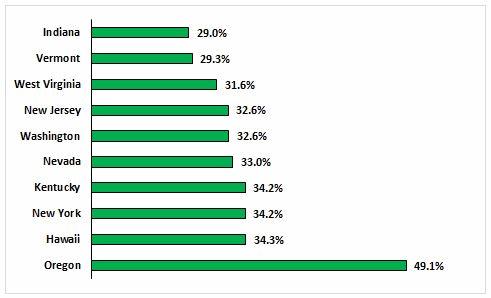

This is why, since Trump was elected in November, Planned Parenthood has reported a 900 percent increase in women asking for an intrauterine device (IUD). Fearing they would not receive the pill for free much longer, women were looking for the implantable device as a long-term solution instead. While this was a short-term boon for Bayer — which manufactures the Mirena, the leading hormonal IUD on the market — if contraception coverage is eliminated, demand for the Mirena will decline because women will be reluctant to pay out of pocket for it (the device costs over $1,000 to implant, including physician fees). That said, a decline in IUD sales will be much more dramatic in pro-life states, but not so much in states that have preemptively passed legislation to retain free contraception for women even if a repeal occurs (examples include New York, California, and Maryland).

Tom Price and the suspension of bundled payments

The confirmation of Tom Price as Secretary of HHS on Feb. 10 provides some clarity to what an ACA repeal might involve. Firstly, Price was the sponsor of a 2015 reconciliation bill aimed at repealing the ACA, which had passed through Congress but was vetoed by then-President Barack Obama. One of the provisions in that bill was a restoration of DSP cuts. This could help hospitals receive funding even if there are cuts to Medicaid base payments. With Price holding greater sway now, one can expect the Republicans will develop many parts of their replacement plan around the 2015 bill with his guidance.

Price also has been an outspoken critic of free birth control, because he believes there is “not one” woman in the U.S. who cannot afford it. Now that Price has broad powers to change or suspend Centers for Medicare and Medicaid (CMS) initiatives, he will undoubtedly work with Mr. Trump to end the contraception mandate.

Lastly, Price believes that the broad enforcement of bundled payments is an example of CMS overextending its reach — the federal government encroaching on the healthcare decisions that Americans should make for themselves. Price believes it should be providers who choose whether or not to enter a bundled payment structure, such as the Comprehensive Care for Joint Replacement (CJR) model developed for knee and hip replacement procedures.

A suspension of bundled payments, though, could have a positive effect on the medtech industry. For example, with the CJR model, the financial incentive to reduce readmissions and postoperative complications has led to more rigorous patient selection and longer preoperative evaluation times, which delays the procedure and has a limiting effect on procedure volumes. Suspending the CJR model would increase the number of patients being selected and would hasten when a patient undergoes the procedure. Returning to a fee-for-service approach would therefore mean a greater volume of joint implant sales in the short term.

Some positives, some negatives for medtech

In sum, a repeal of the ACA will not be comprehensive, but limited to provisions that do not face a challenge from Senate Democrats through the reconciliation process. Some possible changes, such as an end to Medicaid expansion and a reduction in preventive health services, could be detrimental to the medical device industry, whereas other changes, such as a suspension of bundled payments, could offer a brief respite in the current environment of cost containment, which would support industry and market growth.

To that end, it should be noted that a repeal of the ACA is unlikely to take effect until 2018 at the earliest, since 2017 coverage already has started and will continue for at least one calendar year. More importantly, because any changes will be tied to the budget and involve rewriting the tax code, their implementation would start no earlier than the completion of a tax overhaul, which, at the earliest, would take until the start of 2018.

About The Author

Jason Lau is a Principal Analyst at Decision Resources Group, where he covers markets related to endoscopy and minimally invasive surgery. His areas of focus include gastroenterology, bariatrics, and urology. He holds a B.Sc. from the University of Toronto and a M.A. from New York University.