How Brexit Will Impact The UK Medical Device Market

By Beata Blachuta, Decision Resources Group

The world is still reeling from the UK’s decision to exit the European Union (EU) – known universally as Brexit. The ripple effects of this unprecedented move are expected to affect every industry in the UK, including the country’s medical device market. While it is still early, and speculation grossly outweighs measurable outcomes, there are several areas where the UK’s medical device market is vulnerable to an EU exit.

A Weaker Economy And A Weaker British Pound Will Limit The UK Medical Device Market

Post-Brexit instability and a decline of the UK’s economy will have the potential to negatively impact the country’s medical device market. The British pound is experiencing 30+ year lows, dropping in value from $1.50 against the USD, before the Brexit vote, to $1.27 now. As a result, Britain has dropped from the fourth to the fifth-largest world economy. And, there is speculation that the pound will reach parity with the USD by next year.

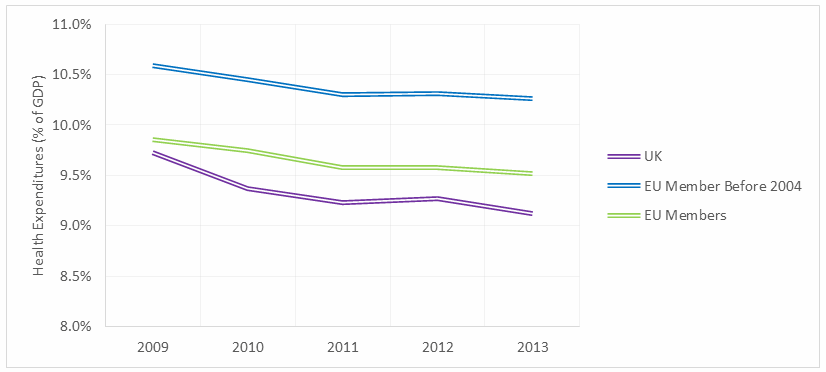

As it stands, the UK’s total health expenditures as a proportion of GDP are lower than the EU average, and even lower when compared only to countries that joined the EU before 2004, when many Eastern Bloc countries were granted membership (Fig. 1). While some of the cost savings may be attributed to lower physician salaries and a streamlined administrative network, those factors do not account for the full difference. Some of the disparity is a result of lower quality and quantity of health care in the UK, compared to its pre-2004 EU counterparts.

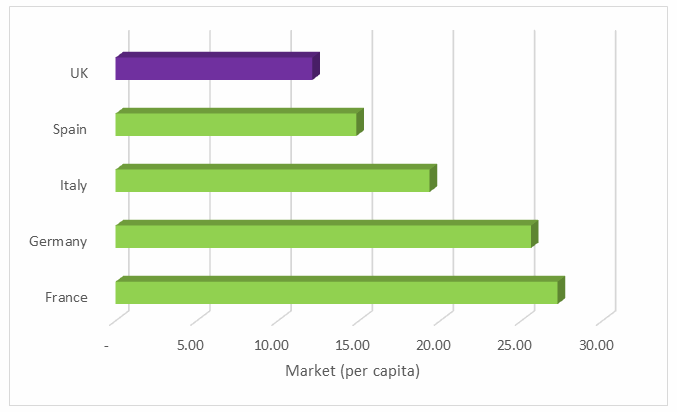

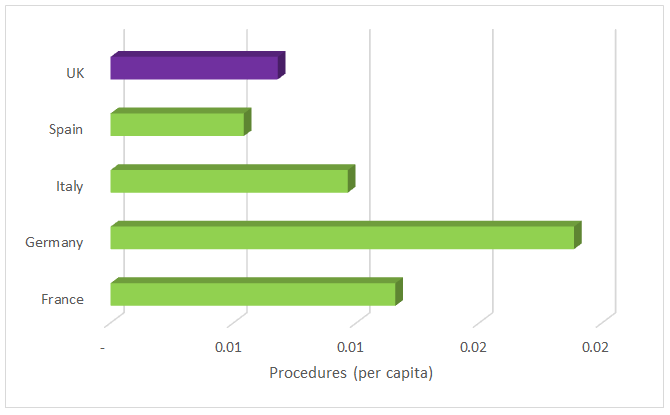

Medical device market revenues are smaller per capita in the UK compared to its counterparts in the EU5 — Germany, France, Italy, and Spain (Fig. 2). This discrepancy is partially attributable to a slower adoption rate for new, more expensive devices due to the National Health Service’s (NHS) conservative and lengthy process of establishing reimbursement for these devices. However, that is not the only reason: Procedure volumes in the UK also are low, second only to Spain (Fig. 3).

A declining UK economy will likely have negative implications on health spending and new device reimbursement approval rates. Moreover, procedure volumes may be affected as a cost-constrained system moves towards less expensive, even if less effective, treatment options. Paired with a trend of choosing less expensive devices, the medical device market in the UK is likely to take a dive. As it stands, manufacturers often bypass this small market during initial launch efforts for new devices, impacting the country’s access to the most recent lifesaving technologies – a trend which may pick up speed in coming years and put the UK healthcare system even further behind its EU peers.

However, supporters of the Leave campaign continue to assure us that all is not “doom and gloom,” and that it is possible for the UK’s economy to bounce back as the Brexit dust settles and the political landscape stabilizes, resulting in renewed investor confidence. But, it is clear from an examination of current health spending in the UK that simply bouncing back to a pre-Brexit economy is not going to be enough. What the UK needs — and needed even before the Brexit vote — is expansion of healthcare coverage and growth in the medical device market, both of which are unlikely even if the UK’s economic future was not so gloomy.

Another side effect of a faltering pound is a proportional decrease in purchasing power, which will affect device average selling prices (ASPs), further dampening UK’s struggling medical device market. And since the UK relies heavily on medical device imports, the effect is unlikely to be staunched by the export of locally manufactured devices, even if there is growth in revenue as export markets become more attractive abroad. This is especially true if local manufacturers rely on imported raw materials and must raise prices to offset higher manufacturing costs. And, while higher medical device ASPs in the UK may not result in decreasing procedure volumes, they are likely to block market expansion by limiting procedure volume growth.

The UK Medical Device Market Relies Heavily On Physician Immigration

The NHS’ slow system of establishing reimbursement for new medical devices creates significant lag in the adoption of new medical devices in the UK. While this has the obvious effect of dampening the market by limiting the sales of new devices with high ASPs, it also has a subtler, but no less damaging, effect on the UK health care system – a lack of local physicians specializing in new surgical techniques that involve emerging medical technologies.

The reasons for this deficit are two-fold: First, newly trained UK physicians are leaving the country for regions where they can utilize and be well-compensated for their skills (as suggested, at least in part, by high emigration rates among UK doctors). Second, UK physicians are not choosing training in specialties that are not supported by the country’s reimbursement system. As a result, when NHS finally grants reimbursement for a new device, quick adoption relies heavily on the immigration of specialists. As an industry source once told me, even if there is a lack of physicians specializing in a procedure, once reimbursement is established, specialists appear “as if by magic,” most of them from foreign countries.

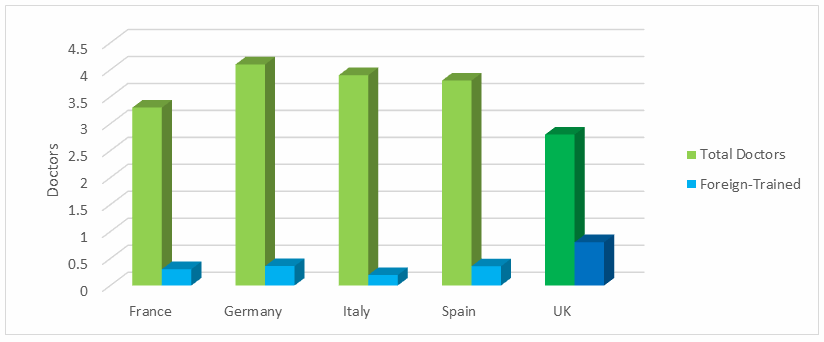

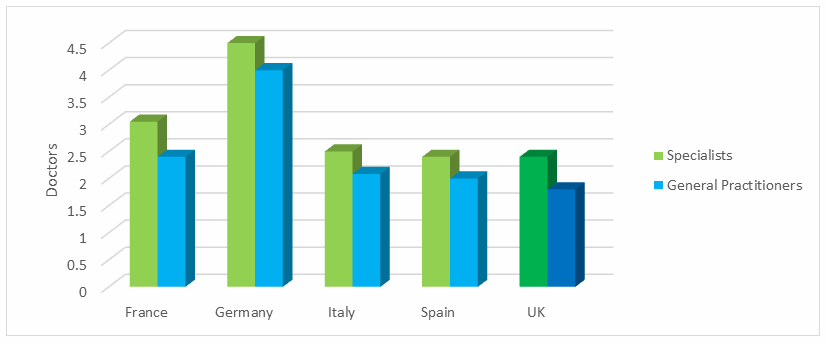

Indeed, the proportion of foreign-trained doctors in the UK is significantly higher compared to the rest of the EU5 countries (Fig. 4). And, with fewer doctors per capita than its EU5 peers (Fig. 4), the UK needs to hang on to its foreign contingent, which will be difficult if a post-Brexit UK closes its doors to immigration. Insufficient access to doctors not only dampens procedure volumes by limiting patient access to specialists, but also by limiting the number of patient referrals as patients face inadequate access to even basic healthcare.

Sure, some may argue that this problem can be softened by balancing the decrease in immigration with a decrease in emigration and even an increase in repatriating doctors currently practicing abroad. However, unless the NHS overhauls the reimbursement system and facilitates quick establishment of new device reimbursement, allowing early adoption, emigration of newly trained specialists with a lack of work will continue. Moreover, lower overall procedure volumes and a small and slow-growing medical device market are unlikely to entice repatriation.

In addition, closed borders are unattractive to specialists in demand globally, even if the UK adopts a point system to facilitate immigration of skilled workers. This is in part due to extra regulation and the resulting financial hurdles associated with a closed-border system. Moreover, a skilled worker looking for opportunities abroad may not choose a country with closed borders, as that choice could limit future opportunities. In fact, it will be interesting to see if the Brexit vote drives specialist emigration from the UK, as workers not only lose confidence in a shaky economy with dwindling prospects, but also actively seek opportunities abroad to maintain access to the European job market.

Finally, there is another factor adding complexity to this situation: UK physicians’ wages are notoriously low. In the case of salaried general practitioners, wages are significantly higher outside the UK. The UK’s general practitioner salaried wages only are competitive with regions touting even lower physician wages, like Eastern Europe and India. Similarly, in the case of specialists, wages are on par or lower than most other EU countries (Fig. 5). So, while those wages may not be driving doctors abroad (unless they are being picked up by countries with significantly higher wages, like Germany and the US), they are unlikely to entice repatriation if a physician has put down roots abroad. Moreover, there is less opportunity for self-employment in the UK, and in that demographic, the wage gap is even more pronounced. Thus, it is unlikely that repatriation efforts will be successful.

Despite these trends, the number of doctors in the UK has been growing steadily since 2000, growing by 50 percent by 2013. Also, the number of medical graduates has doubled in that same time period. This growth has been driving expansion in the UK medical device market, but the trend is likely to slow, further limiting UK market growth. As above, while gloomy predictions for a post-Brexit UK may not be realized, it is unlikely that an unstable future and a shaky economy will lead to healthcare system expansion and medical device market growth going forward. And, the UK healthcare system is not in a place where it can afford to stagnate.

The Regulatory Approval Process For Medical Devices Is Unlikely To Change Significantly In The UK

What about the effects of Brexit on the regulation of medical devices? The UK is a full voting member of the European Committee for Standardisation (CEN), which is unlikely to change, no matter what the UK’s new relationship with the EU looks like.

If the UK follows Norway’s footsteps and signs the European Economic Area (EEA) agreement, or opts for the European Free Trade Association (EFTA) agreement like Switzerland, there would be little or no impact on UK’s regulatory approval of medical devices. Even if the UK completely disassociates with the EU and decides to leave the CEN, it could build a relationship with Europe through the World Trade Organization’s (WTO) established trade rules, and it still could establish a UK-based regulatory system that unilaterally recognizes CE Mark certification as evidence on which to grant approval. Australia recently adopted such a system for all but the highest-risk devices in an effort to streamline the approval process by reducing both time and cost necessary for medical device approval.

Final Thoughts

So how will Brexit affect the medical device market? I agree with the doom and the gloom. The UK’s economy has already taken a large enough hit to cause a ripple effect on every industry, including medical devices. While the magnitude of the impact remains unknown, and it may not be so bad after all, it is unlikely that the medical device market will get the boost in the UK it desperately needs.

About The Author

Beata Blachuta is a Senior Analyst at Decision Resources Group, where she analyzes global cardiovascular medical device markets. She is DRG’s authority on neurovascular and neurosurgical devices. Beata holds a PhD in Molecular and Cellular Biology, with a minor in Business from the University of Arizona.