J&J Leads $28M Investment In Israeli Cardiac Implant

Israeli medtech startup V-Wave, which specializes in implantable devices for chronic heart failure (CHF), announced that Johnson & Johnson Innovation (JJDC) led a $28 million fundraising round. The round also included TriVentures, Pura Vida, and BioStar Ventures, as well as previous shareholders Eli and Nir Barkat’s BRM fund, Pontifax, and Edwards Lifesciences. This latest round of investment is expected to fund clinical trials required for regulatory approval in the U.S.

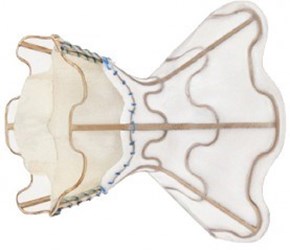

A leading cause of hospitalization for CHF patients is left atrial pressure (LAP), which research shows can be regulated with a “unidirectional inter-atrial shunt” inserted through a catheter. According to the Cardiovascular Research Foundation, clinical data presented at the EuroPCR 2014 showed improved functional status, hemodynamics, and quality of life in the three months following implant of the V-Wave.

“The successful and uneventful first-in-man experience with the V-Wave device showed the feasibility of applying this new therapy in heart failure patients,” said lead researcher Josep Rodés-Cabau at the conference. “Confirmation of these results in a larger number of patients with longer follow-up may open a new avenue for the treatment of patients with heart failure.”

Rodés-Cabau reported that 2 percent of the global population suffered from CHF, with an estimated 1.2 million new cases annually, a number expected to double in coming years. Globes estimated that the condition costs the U.S. health system $30 billion per year, due to the expense of in-patient care and high rate of rehospitalization.

The V-Wave implant was developed in Israel, funded by an intial $7.5 million, led by Edwards Lifesciences, BRM, and Pontifax, and the company reports there have been over 30 patients successfully implanted with the device since 2014. V-Wave is run out of offices both in Israel and the U.S., with an international leadership team of cardiovascular entrepreneurs.

“With the backing of our new and prior investors, we can now accelerate a clinical evaluation of a new therapy applicable for a large segment of HF patients who need additional treatment options,” said V-Wave CEO Neal Eigler to Globes. “Together with company President Erez Rozenfeld, we are building a team with the potential to make V-Wave’s unidirectional shunt achieve the data and milestones needed for regulatory approvals and commercialization in the U.S. and around the world.”

Earlier this week, JJDC announced another investment in Israeli start-up technology, leading a $15 million investment round aimed at ramping up manufacturing operations for CartiHeal’s implanted device indicated for bone regeneration.

Israel is home to an estimated 700 medtech companies and had the most medical device patents per capita in the world in 2013. By 2018, the Israeli med device industry is expected to grow by 40 percent, from $1.1 billion in 2013 to $1.8 billion.

Philips CEO Frans van Houten told Globes that his company has increased its investment in Israeli medtech by 60 percent in three years, commenting that his visit to Israel in 2012 sparked a desire to set up an investment platform. Together with Teva Pharmaceuticals, Phillips plans to pour $100 million into innovation-investment platform Sanara Ventures over the next eight years.