Suture Anchors For Rotator Cuff, Shoulder Labrum Repair Soar To New Heights

By Dr. Kamran Zamanian, CEO, and Dylan Freeze, Senior Research Analyst, iData Research Inc.

With the introduction of all-suture anchors and PEEK CF (carbon fiber-reinforced polyetheretherketone) anchors by Biomet and Parcus Medical respectively, there will be a higher level of growth seen in the rotator cuff and shoulder labrum repair markets. All-suture products only require the drilling of approximately a 3 mm hole, rather than the 5mm hole that is normally necessary for suture anchors composed of other materials. This provides surgeons more “real estate” in the rotator cuff with which to work.

In the shoulder labrum, for which the all-suture product was originally designed, only a 1.4 to 1.6 mm drilled hole is necessary, rather than the traditional 3 - 3.4 mm. This should allow surgeons to perform surgery on patients who have less healthy labral tissue available. The PEEK CF products are more durable than regular PEEK products and should become popular as an alternative for most surgeons.

Growth Of The All-Suture Market In The U.S.

Rotator cuff tears, which are the most common type of cuff tear for younger people, can be the result of a traumatic injury, such as falling on an outstretched hand. However, rotator cuff tears typically arise from repetitive use in activities such as throwing a ball or constant lifting. The muscles thin out over time and become more susceptible to injury. As a result, rotator cuff tears are much more common in the older population, especially for those over the age of 40. During an arthroscopic rotator cuff repair procedure, the tear is generally repaired using a combination of stitches and anchors, which are made of various resorbable and non-resorbable materials.

A labrum tear can occur as a result of repeated joint stress or following shoulder dislocation. A common tear in this region of the body is the superior labrum tear in an anterior to posterior direction (SLAP lesion). A tear or stretch of the labrum leads to shoulder instability or looseness of the joint. In a labral repair procedure, the torn tissue is fixed with a combination of sutures and anchors, often referred to as glenoid anchors. These devices are sold at essentially the same cost as those in rotator cuff repair, but are manufactured for specific use in the labrum.

Suture anchors were originally manufactured from metal, PLA (polylactic acid), and, more recently, PEEK materials. In 2007, however, biocomposite suture anchors entered the market and changed the market landscape. These materials are made of either tricalcium phosphate (TCP) or hydroxyapatite (HAP) and have been shown to enhance bony in-growth after being resorbed. In general, arthroscopic surgeons regard bioabsorbable materials as advantageous compared to their metal counterparts, because resorbable devices allow for easier revisions, are less likely to cause articular damage, and negate risks related to implant removal.

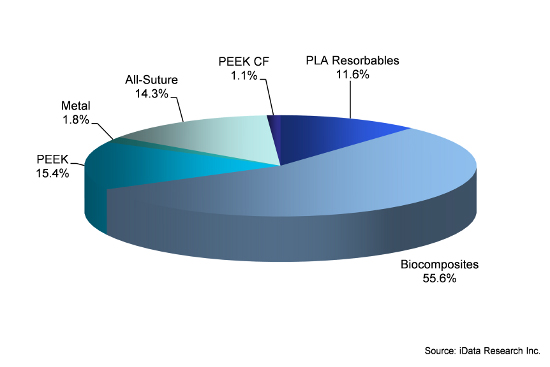

The trend towards bioabsorbable materials is also affecting the market for shoulder-specific devices. Interest in biocomposite resorbable materials has been rising for shoulder fixation and will likely become a significant segment in the future. In 2013, biocomposite suture anchors comprised 64.9 percent of the total rotator cuff repair market and 55.6 percent of the total shoulder labrum repair market. This was caused by a steep drop in the usage of metal and PLA products, resulting in a dramatic shift in the market over the past five years. However, biocomposite products will not remain completely dominant due to the entry of all-suture anchors to the market in 2010. All-suture anchors were first introduced by Biomet as a less invasive suture anchor, and they have gained a great deal of popularity among surgeons in the United States. In 2013, the all-suture market comprised 4.9 percent of the total rotator cuff repair market and 14.3 percent of the total shoulder labrum repair market. The all-suture market will grow at a strong rate over the foreseeable future as surgeons begin to adopt these products for both rotator cuff and shoulder labrum repair applications.

Shoulder Labrum Repair Market by Segment, U.S., 2013

The Emergence Of PEEK CF Materials In The U.S.

Also entering the market in 2010 were Parcus Medical’s new PEEK CF suture anchors (made with polyetheretherketone or other polyesters, plus carbon fiber materials). Their main selling point is the strength and stiffness of the PEEK CF suture anchor, which is said to be nearly double the strength of a regular PEEK anchor. This is due to the carbon fiber fill in the product.

In 2013, the PEEK CF market only comprised 1 percent of the total rotator cuff repair market, but, according to forecasts, the market will grow at a compound annual growth rate (CAGR) of 22.1 percent to comprise 1.3 percent of the market by 2020. Similarly, in 2013, the PEEK CF market comprised 1.1 percent of the total shoulder labrum repair market, but this market is projected to grow at a CAGR of 30.6 percent to comprise 2 percent of the market by 2020. As long as surgeons find PEEK CF products advantageous to PEEK products over the long run, an influx of companies should begin developing PEEK CF products, which will further drive the market.

First To Market: Biomet And Parcus Medical Holding Ground

As many people in the industry are already aware, being first to market is of great advantage as long as due diligence on quality control has been performed for the product in question. The first company to enter the market matches all of the market demand, and it becomes difficult for following competitors to garner interest in its own products.

In the case of the all-suture anchor product mentioned above, the first company to develop the product and take it to market was Biomet. Its all-suture anchor, sold under the name JuggerKnot, was released in 2010. Originally designed for instability (shoulder labrum) repair, the JuggerKnot also gained popularity with surgeons for rotator cuff repairs. Biomet launched the JuggerKnot to supplement its ALLthread line, which contains PEEK, resorbable, and titanium suture anchor products, as well as the company’s MaxBraid PE Suture.

As is the case with most first-to-market competitors, Biomet still holds the majority of the rotator cuff repair market. They also enjoy a similar position in the shoulder labrum repair market. Currently, other companies selling all-suture products include Stryker with its ICONIX and ConMed Linvatec with its Y-Knot All-Suture Anchor, but many other companies are expected to enter this space over the next few years.

In 2010, Parcus Medical began selling its PEEK CF V-Lox suture anchor product, which is marketed as twice as strong as regular PEEK products. The company currently holds most, if not all, of both the rotator cuff and shoulder labrum markets, as its competitors have not developed a product that has received FDA approval. If the efficacy of this product is truly substantial and surgeons can support these claims through patient follow-ups, then this market should see an influx of additional companies entering the market.

Additional Information

The information contained in this article is taken from a detailed and comprehensive report published by iData Research Inc. (www.idataresearch.com) entitled U.S. Market for Orthopedic Soft Tissue Repair. For more information and a free synopsis of the above report, please contact iData Research at info@idataresearch.net.

iData Research is an international market research and consulting firm focused on providing market intelligence for the medical device, dental, and pharmaceutical industries.