The Changing Role Of The Radiologist — And Its Impact On Medical Device Manufacturers

By Felix Lam, Associate Consultant, Decision Resources Group

Radiology has long stood on the front lines of patient care. For years, an expanding population of aging and increasingly unhealthy patients has been driving the increasing use of diagnostic imaging in the U.S. for nearly all medical conditions. However, in recent years, with the country coming through an economic recession and the government instituting a number of healthcare reform initiatives, the entire practice of diagnostic imaging has been under a microscope. The rapid expansion of radiology has brought with it a rise in associated costs.

While much of this procedure volume expansion is justified, there is also a component to this enormous growth that is unnecessary. Overutilization of imaging is defined as imaging that is unlikely to improve patient outcomes, and this has been an area of focus for policy-makers, particularly given numerous reports suggesting that this phenomenon describes a considerable percentage of imaging procedures. In a capitated world, this represents a significant avenue for potential cost savings.

The reasons for this imaging surplus are varied and nuanced, and include lack of knowledge among referring physicians, physicians hedging their bets for fear of future litigation, and physician self-referral. But, one of the most significant drivers of imaging overutilization is the U.S. healthcare system and its traditional fee-for-service nature. In such a system, physicians are conditioned to protect their bottom line and perhaps disproportionately emphasize financial considerations compared to clinical ones.

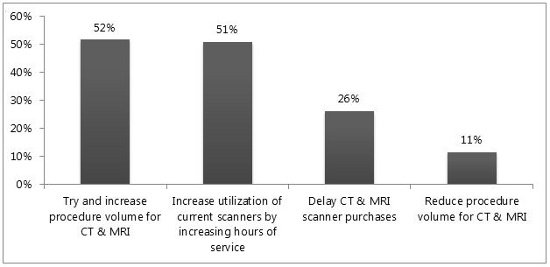

In a recent survey of 120 radiologists and radiology department administrators, respondents were asked about their plans for adapting to reductions in Hospital Outpatient Prospective Payment System (HOPPS) reimbursements for computed tomography (CT) and magnetic resonance imaging (MRI). The majority of responses were centered on the intention to increase procedure volumes in order to offset the lower payments (see Figure 1). Whether these increased procedure volumes are the result of imaging centers focusing on the expanding number of patients seen or increasing scans per patient is unknown. In either case, the impact of efforts to reduce imaging reimbursement amounts, in order to reduce overall costs in a fee-for-service system, will be mitigated to some extent by the provider’s efforts to maximize revenues.

Figure 1: Intended responses to reimbursement cuts for MRI and CT, by % of respondents

Regardless of the reasons for such a disproportionate increase in imaging costs, and despite ongoing debate regarding the big-picture impact of increased imaging, these and other alarming statistics have put a target on the radiology department. It is perhaps this truth that has many leaders in the healthcare community eager to shift to a new era of value-based care. Within this new paradigm, providers have had to rethink the organization of their radiology departments, which are increasingly changing roles from profit centers to cost centers. Purchasing priorities are likewise shifting, with an increased emphasis on acquiring equipment as part of an overall facility strategy to manage population health, reduce costs, and reduce length of stay.

As the practice of radiology changes, radiologists themselves are similarly finding the landscape rapidly shifting beneath their feet. This is due to a fundamental misunderstanding about the profession of radiology, which stands to be undermined even further moving forward. Many patients imagine the radiologist as a button-pusher that passes along images to a physician, unaware of the expertise involved in reading studies and making recommendations for further care. Indeed, the notion of radiology as a commodity is a growing concern for radiologists. In addition, uncertainty regarding the future of healthcare and radiology economics has significantly cooled the demand for radiologists, while at the same time competition from the growing practice of teleradiology has put further pressure on the traditional radiology department.

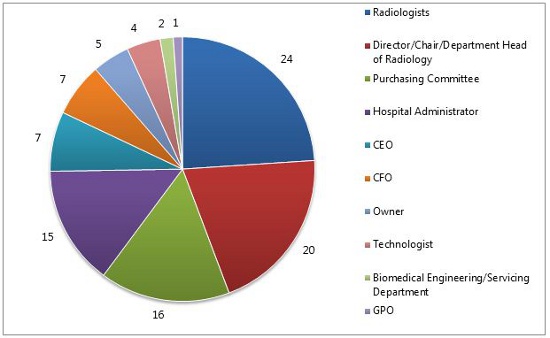

While often viewed as a threat to profitability by the radiology field, the shift to a value-based payment system can actually benefit radiologists in the long-term; as radiologists are increasingly called upon to cooperate more closely in delivering coordinated care, the value of their expertise will become more apparent. For instance, in a recent survey, radiologists and radiology department administrators indicated their positions as being most impactful in the equipment purchasing process at their facilities (see Figure 2).

Figure 2: Relative importance of various stakeholders in radiology purchasing process

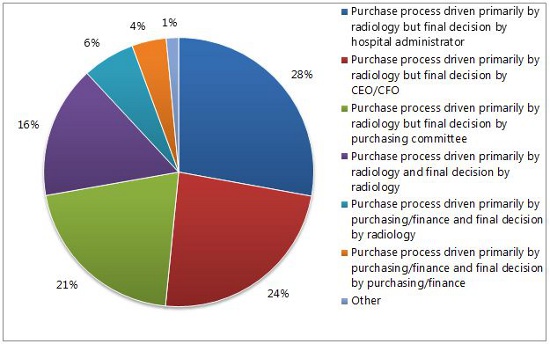

As stakeholders, then, radiologists and department administrators should solidify their role in the future of the decision-making process by keeping in mind broader facility goals, making sure each purchase fits into a coordinated delivery plan and, above all, continuing to prioritize patient needs. Indeed, although the purchasing process is driven primarily by the radiology department, the final decision is made elsewhere (see Figure 3). This arrangement necessitates continued open communication between radiologists and hospital managers and executives, especially as purchasing committees continue to become the norm.

Figure 3: Purchasing process and decision makers, by % of respondents

Fortunately, diagnostic imaging remains strong despite all these difficulties. Though reimbursement cuts and concerns about unnecessary imaging have resulted in procedure declines, spending on medical imaging equipment continues to move forward. In the end, diagnostic imaging is an essential part of healthcare, and technological advances will continue to expand its capabilities. As the radiology landscape changes, it will be imperative for radiologists to remain involved in these discussions and define their role as participants rather than passengers.

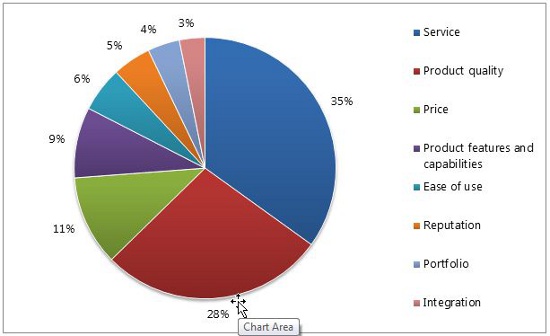

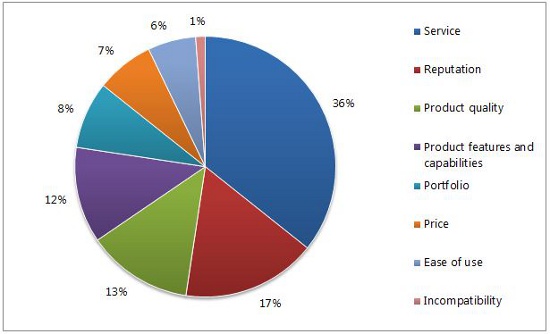

Despite the ongoing changes for radiology, the challenges of adapting to this new reality need not fall solely on the shoulders of hospitals and radiologists. For their part, medical device manufacturers can provide significant support and assistance. Gone are the days when vendors could focus solely on equipment sales. Facilities are demanding a greater degree of partnership with vendors, including the provision of training and education, servicing, and assistance with the big picture concerns about cost savings and overall quality of care. Indeed, when radiologists and radiology department administrators were asked about the factors associated with vendors that were best able to meet their needs, “service” was rated as most important, over and above equipment quality and even cost (see Figure 4).

Figure 4: Reasons given for why a vendor was best able to meet the needs of the radiology department

Similarly, service is also the factor most cited as a reason a vendor was unable to meet the needs of the department (see Figure 5). The implications are clear — in this new landscape, vendors will live or die by the intangibles, and success will fall to those that can anticipate the new challenges facilities face and provide the best solutions.

Figure 5: Reasons given for why a vendor was least suitable for meeting the needs of the radiology department

About The Author

Felix Lam is an associate consultant at Decision Resources Group. He has authored several reports on the diagnostic imaging systems markets in his previous role as an analyst in the diagnostic imaging and healthcare information technology division of the company. Felix holds a M.Sc. degree in molecular biology from the University of Western Ontario.