The Global Cardiac Surgery Devices Market: Minimally Invasive Takes the Stage

By Emily Gilbert and Kamran Zamanian, Ph.D., iData Research

Cardiac surgery devices include devices ranging from niche patent ductus arteriosus (PDA) closure devices to the frequent coronary artery bypass grafting (CABG) devices.

There has been a shift in surgery approach away from invasive open-heart surgery toward minimally invasive surgery (MIS). Driven by the approval of transcatheter aortic valve replacement (TAVR), this approach has cannibalized a portion of the traditional procedure method since its approval two decades ago. This cannibalization is occurring in all of the four main valves: the aortic, mitral, pulmonary, and tricuspid valves. Leading companies in the cardiac surgery market have developed and launched transcatheter devices in recent years, further popularizing that segment.

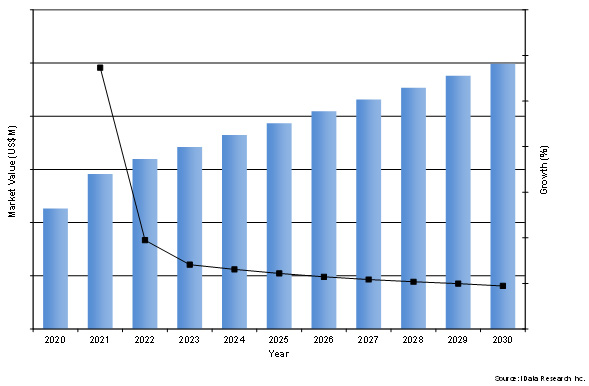

Our new market research analysis estimates that the global cardiac surgery market will increase over the forecast period, with a market value of around a quarter of a billion by the year 2030.

Demographic Changes In Cardiac Surgery Device Demand And Supply

One factor affecting growth of all cardiac surgery devices is the aging population around the globe. According to the United Nations (UN), the process of population aging is most advanced in Europe and in North America, where approximately 25% of the population were 60 years old or over in 2017. By 2050, older people are expected to account for 35% of the population in Europe, and by 2070, this number is expected to exceed 50%. Globally, Western Europe has the top five oldest populations. As the number of people over the age of 60 in a population increases, the risk of cardiac events also rises. In addition to aging, the shift toward a more sedentary lifestyle has led to a rise in cardiovascular disease across the globe. It is estimated that a little under half of all deaths in Europe are caused by cardiovascular disease. The rising number of patients needing cardiac devices implanted is a driving factor in the overall increase in units sold in every region in this report.

The overall increase in heart disease has fueled and will continue to fuel the shift to minimally invasive surgery. The MIS shift is expected to have a notable role in the rise in devices implanted. Transcatheter devices (sometimes referred to as percutaneous) are seeing the highest growth in implantation. The transcatheter repair methods have emerged as popular options for repairing all four heart valves. Further pushing the transcatheter procedures is the supportive use of cerebral embolic protection devices in select regions. Using the transcatheter approach reduces procedure times while also reducing patient recovery time. This rise in transcatheter procedures is reflected in the reduced share for CABG procedures and their associated approaches, including endoscopic harvesting procedures.

Figure 1: Forecasted Market Value of the Global Cardiac Surgery Device Market between 2023 and 2030

New Treatment Methods

In the early 2000s, the use of TAVR was approved across the globe. The FDA granted approval four years after Europe gave the procedure a CE mark. In TAVR, a valve is mounted inside a stent. The stent is then compressed so that it can fit inside a small delivery sheath. The TAVR valve is then delivered to the aortic valve, the stent is expanded, and the biological valve inside begins to work. This approach is considerably less invasive than the CABG procedure, which, prior to TAVR, was one of the most performed cardiac surgeries.

There are benefits of the less invasive approach for both the patient and the surgeon. Among the benefits for patients are reduced recovery times, shorter hospital stays, and fewer reported complications. The surgeon, on the other hand, spends less time operating on each patient, as the TAVR procedure is more time efficient. The benefits of using the transcatheter approach have caused a reduction in the number of CABG procedures performed annually. This reduced share of CABG procedures is most notable in the off-pump CABG approach. Patients who would have gotten a CABG done, particularly high-risk patients, are increasingly preferring to have a TAVR performed instead.

Transcatheter Expansion

The benefits of going with TAVR instead of CABG, as mentioned above, are similar for two other valves in the heart: the mitral and pulmonary valves. Recently, two products gained approval for implanting valves on the mitral and pulmonary valves in Europe via the CE mark. As a result, transcatheter pulmonary valve replacements (TPVRs) and transcatheter mitral valve replacements (TMVRs) are expected to see expansion around the globe. The exception to the trend is the tricuspid valve. The aortic, mitral, and pulmonary valves experience regeneration more frequently. The aortic valve is most commonly replaced, followed by the mitral valve and, finally, the pulmonary valve.

Market expansion of devices relating to transcatheter devices is also occurring. This secondary market growth is present with regard to all four heart valves with cerebral embolic protection devices.

Cerebral embolic protection devices can be used across all four heart valves. As the device is used to prevent clots from forming post valve repair, it is considered a nonessential part of transcatheter procedures. With regional approval for use, adoption of the device remains limited despite the rise in transcatheter procedures. Boston Scientific, the first company to have an approved device globally, is invested in studies for expanding the market over the coming years and is expected to be a driver of the rapid rise in market value expected within the market.

Medtronic relaunched the Harmony transcatheter pulmonary valve (TPV) system in early 2023. The device is a minimally invasive alternative to open-heart surgery for congenital heart disease patients with native or surgically repaired right ventricular outflow tract. Durability issues with the device led to a voluntary recall in 2022; however, collaborative work with the FDA has brought it back to the market. This device will see increasing global adoption over the 10 years. The Harmony TPV system brings a change to the TPVR market: before Medtronic, Edwards Lifesciences was the only company in the market with its SAPIEN XT and SAPIEN 3 valves.

The TMVR market is now defined with the approval of Abbott’s Tendyne TMVI device in Europe and North America in 2020. Expansion into the rest of the world has not yet been completed. Prior to the device approval, mitral valve implantations were done through open-heart surgery. It is expected that with Tendyne offering a minimally invasive option, the number of mitral valve implantations will see growth in the coming years. The mitral valve has seen increased interest and company investment in treatments in the last few years from Abbott. The company also offers the most popular transcatheter mitral valve repair (TMVr) device, the MitraClip. The device’s popularity gives Abbott a significant role in establishing just how fast this market expands globally.

It is expected that the transcatheter trend will not extend to the fourth heart valve, the tricuspid valve, for some time. The tricuspid valve is often coined as the forgotten valve as it is the least repaired and replaced of all the heart valves. However, Abbott is in the transcatheter tricuspid valve repair (TTVr) market with its TriClip G4 device; however, it is in the early stages of development and not expected to spur TTVr market expansion for the time covered in this report.

Conclusion

The global cardiac surgery market has seen large changes in recent years in response to shifting patient demographics. With the increasing number of those who need surgery and the rise of transcatheter devices to repair and replace four major valves, the market is expected to see new growth. This new growth in an old market is expected to continue to fuel device innovation and research over the forecast period.

About the Authors

Emily Gilbert is a research analyst at iData Research. She develops and composes syndicated research projects regarding the medical device industry, publishing the U.S., EU, and global interventional cardiology series as well as the U.S. and EU cardiac surgery reports.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.