5 Things You Need To Know About The Point-Of-Care Technology Market

By Milos Todorovic, Lux Research

The healthcare industry is in the midst of a transformative change. It is undergoing reform through initiatives that focus on improving patient outcomes, tying provider reimbursement to quality metrics (rather than traditional fee for services), adopting electronic patient records, and developing accountable care organizations. One of the major enablers of these changes is the proliferation of point-of-care (POC) technologies that offer the promise of improving outcomes and reducing costs through increased access to and use of diagnostic and monitoring solutions. POC technologies have the potential to improve the management of various diseases and conditions, especially in resource-limited settings where healthcare infrastructure is weak and access to quality and timely medical care is a challenge. These tests offer rapid results, allowing for timely initiation of appropriate therapy and/or facilitation of linkages to care and referral. Most importantly, POC devices can be simple enough to be used at the primary care level and in remote settings with no laboratory infrastructure. These solutions can potentially empower patients to self-test in the privacy of their homes, especially for stigmatized diseases such as HIV and other sexually transmitted diseases.

The POC market encompasses a wide range of products used by healthcare professionals and consumers, both within and outside of traditional centralized care settings, such as laboratories and large imaging wards. Given the diversity — both in terms of applications and technologies — we have set out to explore the role of POC technologies across example disease/condition-segmented application spaces and assess their potential to disrupt existing solutions. Based on conversations with industry experts representing technology developers, users, and administrators in charge of technology procurement and our analysis of the POC segment of the medical devices industry, we have reached the following five conclusions:

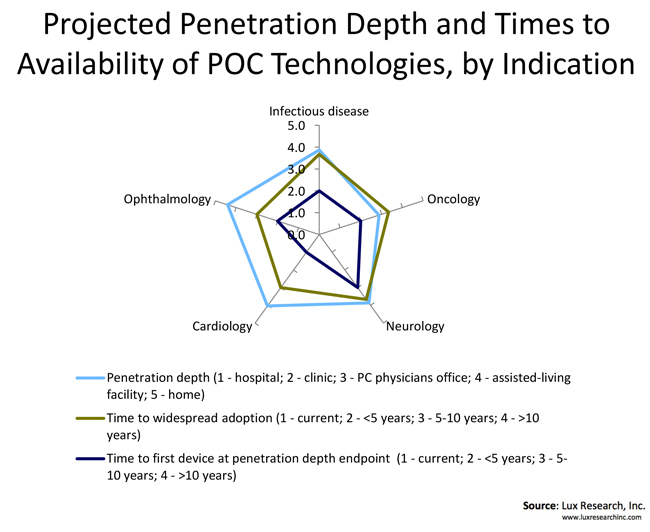

1. Many, but not all, indication spaces will ultimately see consumer devices used outside of traditional care settings.

Most of the studied indication spaces (cardiology, oncology, neurology, infectious diseases, and ophthalmology) will see POC technologies proliferate outside of the traditional care settings of hospitals and doctor’s offices, and into assisted-living facilities and homes. A notable exception is oncology, where the consensus is that the POC devices will reach up to primary care physician’s offices. At the other end of the spectrum is ophthalmology, where the expectations are that consumers will have multiple devices at their disposal for self-diagnosis and monitoring of conditions such as macular degeneration, cataracts, and glaucoma. We also see the field of infectious diseases having a sizeable number of solutions placed in consumer hands for at-home use.

2. The near-term opportunity is in traditional care settings.

While many solutions are being developed for consumer markets, the bulk of the users that are ready to embrace POC technologies and can consume large volumes of devices and consumables in the next five years are doctors in hospitals and clinics. We also predict that the demand from primary care physicians will grow significantly over the years, as the shift of diagnostics from centralized labs and imaging wards towards practitioners’ offices can open new revenue streams for these small offices, impacting profit margins significantly. Companies developing POC devices should consider dedicating most of their resources to delivering solutions for the clinical markets, since the path to profitability is typically much clearer, both in terms of market size and pay structure.

3. Consumer markets will take time to blossom.

Even though certain segments of the POC consumer markets, particularly the sports and fitness market, have grown at a substantial pace over the last several years, the majority of diagnostics and monitoring POC applications for clinical indications such as cardiology and infectious diseases are in their infancy when it comes to consumer markets. In our opinion, these solutions will first have to be proven in traditional settings before both the consumers and regulators feel confident enough to enable the widespread adoption. Ultimately, the consumer market will become a significant source of revenue for the medical devices industry, but it will take at least five years to 10 years. For certain indications it may take even longer before the consumer sales approach the market potential.

4. Different technologies will fare differently when it comes to market penetration.

In vitro diagnostic (IVD) devices will find their way far down the care settings continuum for all indication spaces. We expect to see a steady stream of solutions from both small startups and large corporations aimed at addressing, for example, circulating tumor cell detection performed in the doctor’s office or rapid malaria screening in rural Africa. On the other hand, electrodes-based devices and novel imaging seem to lend themselves to more focused application spaces, as they often require highly trained operators and medical experts to interpret the results. While the advances in algorithms and data analytics will eventually technically enable the use of these devices outside of hospitals and clinics, it will take longer for regulators to certify complex image interpretation-based diagnostics and monitoring solutions for use in assisted-living facilities and homes.

5. There is a pronounced need to substantiate health economics claims for POC technologies.

POC medical device developers are increasingly realizing that the industry will have to prove the often nonchalant claims of cost reduction potential brought by POC technologies. The majority of these claims are based on the assumption that the savings will be realized over a longer period of time by reducing or completely eliminating redundant testing procedures and clinical visits, enabling earlier diagnostics and patient-centric workflows, and engaging the general population to proactively monitor their health status and apply preventive measures before becoming ill. Although the logic behind these assumptions is sound, they are often not founded in any health economic studies that would independently test the hypotheses and verify the economic impact. The health insurance industry and other payer systems around the world are already starting to demand that developers and proponents of POC devices substantiate their long-term cost savings claims, as they become increasingly wary of the economic impact of increased testing at usually higher prices than standard procedures that can occur as a consequence of the widespread adoption of POC technologies. Therefore, companies working in the POC space should consider pooling resources to fund the necessary health economic studies, as the future of the entire industry may depend on their ability to convince payers to start favoring POC diagnostics and monitoring over more traditional approaches.

About Lux Research

Lux Research provides strategic advice and ongoing intelligence for emerging technologies. Leaders in business, finance, and government rely on us to help them make informed strategic decisions. Through our unique research approach focused on primary research and our extensive global network, we deliver insight, connections, and competitive advantage to our clients. Visit www.luxresearchinc.com for more information.

About The Author

As an analyst at Lux Research, Milos Todorovic leverages relationships with leading innovators and thought leaders to provide insight into biotechnology opportunities. He is currently driving Lux Research's emerging biotech research efforts, exploring innovations aiming to improve the quality, accessibility, and affordability of healthcare.

As an analyst at Lux Research, Milos Todorovic leverages relationships with leading innovators and thought leaders to provide insight into biotechnology opportunities. He is currently driving Lux Research's emerging biotech research efforts, exploring innovations aiming to improve the quality, accessibility, and affordability of healthcare.

Milos has a strong background in biomedical electronics, optics, and human physiology and an interest in strategic marketing and “white space” technologies. His strong capacity for envisioning creative solutions to engineering problems and the ability to rapidly evaluate and embrace new concepts and approaches uniquely enable him to comprehensively analyze new technologies from a system and application perspective.

Prior to joining Lux Research, Milos was a project leader and biomedical systems designer with GE Global Research, where he developed technologies with applications ranging from vital signs monitoring to cell harvesting to optical data storage. He received his Ph.D. in biomedical engineering and M.S. in electrical engineering from Texas A&M University. His graduate research focused on novel high-resolution optical imaging modalities for applications such as cancer detection and wound assessment. He has published more than 20 peer reviewed journal papers, conference proceedings, and technical reports and has multiple patents in the area of medical devices.