U.S. Minimally Invasive Spinal Implant Market To Outpace Growth In Traditional Spine Market

By Kamran Zamanian, Ph.D., and Dylan Freeze, iData Research Inc.

Growth in the spine market today is largely driven by the rapid rise in popularity of some motion preservation devices, most notably artificial discs, and vertebral compression fracture devices. Certain traditional fusion markets are expected to show strong rates of growth, but the overall market will eventually begin to stabilize in value as minimally invasive spine (MIS) procedures become increasingly popular among surgeons. Though the minimally invasive spine market will see the highest rates of growth, many traditional spine market segments are expected to continue to increase over the next few years.

Interest in the minimally invasive spinal implant market is largely driven by the advantages of minimally invasive surgery over open surgery. These include reduced trauma, shorter hospital stays, lower post-operative medication use, and earlier return to work. However, growth is expected to slow due to increasing penetration of MIS procedures into the traditional fusion market and increases in the competing motion preservation market. The minimally invasive and traditional spinal implant markets are expected to approach a combined market value of over $9 billion by 2020.

MIS Sacroiliac Joint Fusion To Exhibit High Growth Rates

Sacroiliac (SI) joint dysfunction was once thought to be a less common cause for lower back pain. However, recent studies have shown that SI joint dysfunction (SIJD) may be responsible for up to 30 to 35 percent of lower back pain. Growth of this spinal treatment has historically been limited by the diagnosis process. One important factor in the future growth of the SI joint fusion market is new information surrounding adjacent segment disease. As this undertreated source of lower back pain was being increasingly studied, SI‑BONE answered the call, introducing the iFuse Implant System (iFuse), the first minimally invasive system on the market geared towards SI fusion. SI-BONE received FDA approval to market its iFuse implants in November 2008.

Early in 2014, the American Medical Associations’ Editorial Panel decided to make a change that will significantly impact the MIS SI joint fusion market. Along with artificial disc replacement and vertebral augmentation, there will be changes to minimally invasive sacroiliac joint fusion coding. This change is expected to take place early in 2015 and will drastically change the market landscape. This change is due to a study conducted by the International Society for the Advancement of Spine Surgery (ISASS), as well as the Society for Minimally Invasive Spine Surgery (SMISS), which determined that due to the prevalence of the procedure, as well as the highly evolved standard of care, the procedure should be reimbursed to make the surgery more accessible to all patients.

As of February, May, and August of 2014, Palmetto, Novitas, and Priority Health, respectively, approved and began covering MIS SI joint fusion procedures as a reimbursable surgery. These three Medicare Administrative Contractors (MACs) were the first three companies to do so in the United States. Additionally, on January 1, 2015, Noridian Healthcare Solutions, an MAC which covers approximately 9.4 million Medicare beneficiaries, began covering minimally invasive sacroiliac joint fusion procedures.

In the coming years, the market should see private insurers, such as United Healthcare, Blue Cross, and Blue Shield, begin covering MIS SI joint fusion procedures as well, which will in turn further drive market growth. Many patients have waited for such a time when the reimbursement policies make the procedure more affordable. As of January 1, 2015, minimally invasive sacroiliac joint fusion surgery obtained a category I CPT code. This should open the door for more MACs to begin reimbursing procedures, and once this occurs, the backlog of patients awaiting reimbursement coverage will start to see treatment.

The MIS sacroiliac joint fusion market is expected to grow at a high double-digit rate between 2015 and 2020. As SI-BONE is the market leader for product sales in this segment, the company should see high levels of revenue growth over the next several years.

Motion Preservation To Drive Growth In Traditional Spine Market

In 2014, the U.S. artificial disc market, which consisted of the lumbar artificial disc (LAD), cervical artificial disc (CAD), and interspinous process decompression markets, increased by a rate of over 8% over the previous year. Rapid growth has been attributed primarily to the emergence and expansion of cervical discs (CADs). Growth of the artificial disc market between now and 2020 will be fueled primarily by CADs due to their simpler approach, favorable clinical results, and lower ASPs, along with a favorable reimbursement environment. Moreover, the emergence of second generation artificial disc designs will further augment the market.

The lumbar artificial disc (LAD) market has experienced significantly lower procedural growth than the CAD segment as a result of a lack in clinical efficacy data and poor reimbursement. In 2014, the reimbursement environment severely limited the number of LAD procedures performed. However, reimbursement policies are expected to change because Medicare and other organizations are considering reimbursement for newer LADs. Many LAD products that are approved for use in Europe have historically performed well because they tend to have fewer risks and complications than DePuy’s Charité, the first (and previously, the only) LAD device available in the U.S. market. Furthermore, DePuy had replaced the Charité with a newer model, the INMOTION, which was designed to overcome many of the disadvantages faced by its predecessor. As clinical data continues to emerge and new products are introduced to the market, the LAD segment is expected to stabilize over the next five years.

Reimbursement conditions for CADs are more favorable than LADs as they have less associated inherent surgical risks, have fewer clinical contraindications, and are easier and safer to install. CAD is expected to be one of the fastest growing segments in the spine market as a result of these strong driving factors and their effects. Growth in the CAD market will eventually decelerate as CADs begin to reach a high level of penetration into the cervical fusion market.

The CAD market has experienced slow growth since 2009 due to the disruptive transition and integration process between Kyphon and Medtronic, coupled with a challenging product launch. However, as new competitors such as Paradigm Spine have emerged with their own interspinous process decompression (IPD) devices, this market is expected to return to mid, single-digit growth.

The IPD market emerged in November 2005 when St. Francis Medical Technologies commenced the distribution of their interspinous device, the X-STOP, which is indicated for treatment of mild to moderate lumbar spinal stenosis. In December 2006, Kyphon initiated an agreement to acquire St. Francis Technologies by late 2007. In November 2007, Medtronic acquired Kyphon and its product line, including the X-STOP, was integrated into Medtronic’s portfolio.

Medtronic Dominates Traditional And MIS Spine Markets

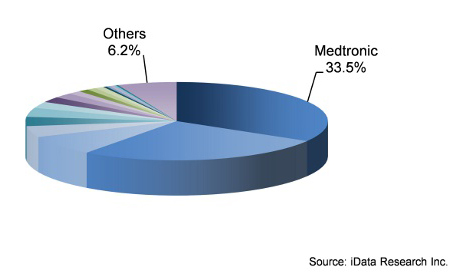

Though many companies such as Globus Medical, NuVasive, and K2M have begun to gain popularity among surgeons in the overall spine market, the majority of the market share still belongs to the two giants: Medtronic and DePuy Synthes. Medtronic has remained the leader in both the traditional and MIS markets for a while now — and this trend doesn’t seem to be shifting, as the company’s large portfolio of spine products and massive sales force prove to be too much for any competitor to break. As the largest portion of Medtronic, the spinal and biologics sectors were a strong factor behind the company’s growth over the last few years.

Leading Competitors, Spinal Implant Market U.S., 2014

DePuy Synthes is not to be taken lightly either, as it held the lead in the cervical fixation, motion preservation, and facet fixation markets. While it would be unreasonable to call their direct competition an afterthought, the main challenge ahead for Medtronic and DePuy Synthes lies in maintaining their strong market shares with many smaller, more specialized companies working to garner larger shares of the market.

About The Authors

Dylan Freeze is the team leader for the analyst division at iData and specializes in orthopaedic market research. He has published many articles in online journals such as Med Device Online and Medical Device and Diagnostic Industry. You can reach him at dylanf@idataresearch.net or on LinkedIn.

Kamran Zamanian, Ph.D., president and CEO of iData Research Inc., has spent over 20 years working in the market research industry. He is a founding partner of iData Research, an international market research and consulting group that provides market intelligence to the medical device, dental and pharmaceutical industries.