Medtech Confidence In The U.S. And What It Means For Manufacturers

By Karen Gierszewski, Principal Analyst, Decision Resources Group

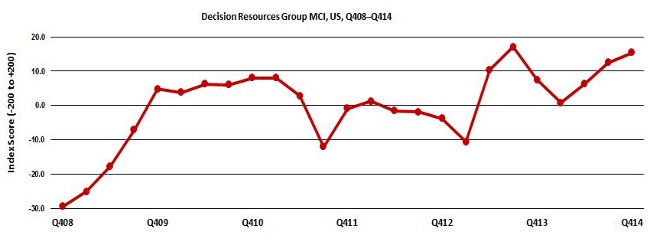

At Decision Resources Group, we’ve been measuring how confidence in the medtech industry has changed since the financial crisis in 2008, with a particular focus on the United States. Our analysis, called the Medtech Confidence Index (MCI), measures facilities’ confidence in the national economy, their financial health, and their procedure volume outlook, once per quarter.

Using six full years of data, we’ve put together an interesting picture of how confidence in medtech has changed over time — and the results may surprise you.

Q4 2008 To Q1 2011: Major Recovery And Holding Steady

It should come as no surprise that confidence in the medtech industry reached a low at the end of 2008. Even those who don’t avidly follow economic news were well aware of the dire economic situation. Accordingly, facilities’ confidence in the national economy, their own financial health, and their procedure volume outlook was very low. Fortunately, despite some ups and downs since then, we've stayed well above 2008 confidence levels.

Our index increased strongly until Q4 2009, when confidence plateaued somewhat. Although confidence stabilized on the positive side, the Affordable Care Act — also known as the ACA or “Obamacare” — was signed into law in Q1 2010. Facilities, unsure how healthcare reform would impact them, reported feeling less confident in their financial health. New phrases like “comparative effectiveness,” now standard in our lexicon, came into use and represented another source of confusion.

Meanwhile, confidence in the U.S. economy stayed well below zero. Through 2010, a quick recovery from the financial crisis seemed more and more like a dream and, although the economy continued on an upward trend, perceptions stayed very negative.

Q2 2011 To Q1 2013: Downward Slide

In 2011, the eurozone debt crisis really took shape. Although this technically occurred on the other side of the ocean, the U.S. economy was affected as well, especially as anxiety over the eurozone debt crisis combined with fallout from the 2008 recession, such as new regulations and continued litigation. Occupy Wall Street, a protest movement born of outrage over bank bailouts, also began late in 2011 and spread across the world, deepening facilities’ negative impression of the economy. Therefore, Q3 2011 marked another low point, with medtech confidence swinging heavily to the negative side.

Although improving economic indicators pushed the MCI back up in Q4 2011, the index couldn’t maintain that upward trajectory and slid down gradually throughout 2012. Contributing factors in that decline included the eurozone’s struggle to emerge from its debt crisis and high U.S. unemployment, both of which affected confidence in the U.S. economy.

Furthermore, the U.S. Supreme Court upheld Obamacare in July 2012, and President Barack Obama was reelected at the end of the year. Healthcare facilities seemed uncertain as to whether this was good or bad for their financial health. Early in 2013, the budget sequestration, which included 2 percent cuts to Medicare provider payments, also negatively impacted facilities’ perceptions of their financial health. As a result, by Q1 2013, the MCI had reached another low point, dropping close to the Q3 2011 level.

Q2 2013 And Onward: Things Are Finally Looking Up

Finally, in Q2 2013, the MCI mounted a recovery. All three major stock indices rose that quarter, while unemployment declined. This trend continued into Q3 2013. In late 2013 and early 2014, however, confidence slid back down to around zero. Although the U.S. economy was showing positive signs at this time, the lack of robust growth was hindering perceptions of economic recovery. Furthermore, the slow start and technical glitches surrounding the launch of the health insurance exchange website, Healthcare.gov, likely caused facilities to question whether the ACA would deliver on its promise of more insured patients. Interestingly, although the MCI tracked major medtech companies’ stock prices fairly well to that point, share prices generally did not reflect this confidence blip as 2014 started. This anomaly suggests that this particular fall in confidence didn’t cause facilities to dramatically change their purchasing patterns, but just made them a bit uncertain about how the next few months would unfold.

Nonetheless, later in 2014 facilities began to see the benefits of healthcare reform, noting fewer uninsured patients and increasing procedure volumes. News of the rebounding U.S. economy further increased confidence. Although index scores in Q4 2014 didn’t quite reach the high water marks of Q3 2013, the upward trajectory is promising. Now that many pieces of Obamacare also have been rolled out, uncertainty surrounding healthcare reform will not be as much of a factor influencing facilities’ perceptions of their financial health and procedure volume outlook. Economic forecasters also are reasonably confident about 2015 and 2016, though this optimism has been somewhat tempered by lukewarm Q1 2015 results.

What Does This Mean For Manufacturers?

Medtech manufacturers have long known that the industry is not immune to economic fluctuations, as nice as it would be to imagine that GDPs don’t affect healthcare. In all the time we’ve been tracking the MCI, confidence in the economy has never risen above zero, despite the fact that the U.S. economy hasn’t been in a recession in six years — so we can only imagine what scores would be like if the economy was booming. It’s also interesting to see how the introduction of Obamacare and the shift toward value-based healthcare have caused confusion among facilities on whether these changes are good or bad for them.

However, the good news for manufacturers is that the procedure volume outlook of facilities is more stable than their financial health outlook or their perception of the national economy. Even when confidence in facility financial health and the national economy fell strongly, the impact on the procedure volume outlook of facilities was less noticeable, which is good for manufacturers that sell devices at the per-procedure level. However, the reverse is also true: procedure volumes do not necessarily increase dramatically in times of high confidence. Overall, in times of low confidence in the economy, financial health, and procedure volumes, facilities will anticipate budget constraints and accordingly choose to delay major capital equipment purchases, or they will opt for lower-cost devices. In times of higher confidence, facilities will be more willing to invest in new equipment or novel devices.

Ultimately, medtech manufacturers don’t have to be passive observers of changing demand for procedures and medical devices as facilities’ confidence in their environment changes. Now more than ever, facilities are asking medtech companies to help them sort out the confusion of this new, value-based world, in a “let’s help each other make money” approach — an approach touched on in our last article. Medtronic has exemplified this mindset with its new solutions business for cath labs, geared toward improving operation and efficiency, and the company promises its services will expand significantly in the wake of its Covidien acquisition. Another major medtech manufacturer, Boston Scientific, also has embraced this approach through partnerships with MedAxiom and TogetherMD, promising to improve care pathways for heart failure, atrial fibrillation, structural heart, and ischemic heart disease.

These partnerships are especially important for companies looking to capitalize on the growing demand for care created as a result of the greater number of insured patients under Obamacare, as I discussed in a recent blog post. Because of greater access to insurance, more patients are seeking care, but there has not been a corresponding increase in access to physicians or emergency rooms. In fact, a recent physician survey indicates that access to primary care physicians in the U.S. will decrease. So, to take advantage of this growing demand for care, companies can work with facilities to improve efficiencies and to increase patient throughput. In this way, medtech manufacturers can play an active part in improving facility confidence in their procedure volume outlook and facility financial health, spurring new device purchases.

With new partnerships forged between medtech manufacturers and facilities, and medtech helping facilities to navigate these ups and downs, we might just see confidence in medtech grow to a new high.

About The MCI

Decision Resources Group conducts regular surveys of medical device-utilizing facilities to understand procedure volumes, brand-level purchasing habits, and device prices, with over 2,000 surveys going out each quarter. As part of these surveys, facilities are asked about their perception of the national economy, their financial health, and their procedure volume outlook. These answers are then aggregated and used to calculate the MCI.

About The Author

Karen Gierszewski is a principal analyst at Decision Resources Group. She has contributed to various product lines at DRG, covering a broad range of medical device and healthcare markets, including Medtech 360 market assessment reports, presentations on the state of the overall industry, the company blog, and other marketing materials. She holds an HBA from the Ivey Business School at Western University.