A Novel Medtech Strategic Framework For Post-COVID-19

By Mike Fix and Ross Meisner, Guidehouse

As the novel coronavirus (COVID-19) ravages the healthcare industry and the world, medical device companies with products used in elective procedures have taken a huge hit. The good news is, as healthcare systems begin again to expand beyond emergency and urgent cases, pent-up demand will exist for elective procedures.

But, which procedures will take priority? Clinical resources are depleted, the economy has tanked, and more people are unemployed, uninsured, and uneasy about seeking care.

Many medtech company leadership teams are scrambling to figure out what to expect as the market reopens, and how to plan a business strategy in this unprecedented time. While no one can predict the future, applying a “means, manifestation, motivation” assessment framework can help you anticipate where your product fits in the recovery continuum, as well as determine viable market development strategies for the reopened marketplace.

Means, Manifestation, Motivation Framework

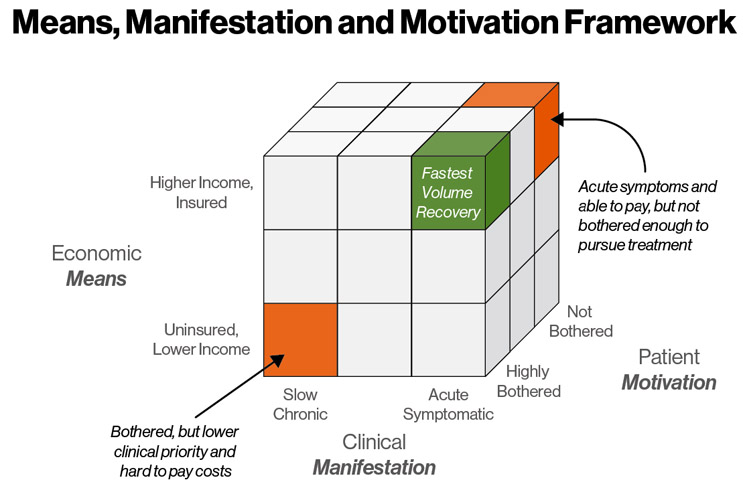

The framework assesses three dimensions: economic means, clinical manifestation, and patient motivation. It also assesses where these dimensions intersect to help you focus a value proposition that drives market adoption. This framework helps you understand how and why procedures may be prioritized, as well as which patients are most likely to first seek treatment. It can also help you plot your investment strategy and begin designing market tactics to drive uptake (Fig. 1).

The recovery for most elective procedures will not be fast because all three factors are headwinds. Even though pent-up demand is accumulating, it is unlikely demand will flood back into the healthcare system because of the barriers outlined below.

The elective procedures recovering fastest will be highly bothered patients with acute symptoms who have the financial means to pay all out-of-pocket costs.

Economic means refers to a patient’s ability to pay any associated out-of-pocket costs. It comprises factors including household income, household size, employment status, insurance coverage, and general affluence. In the post-pandemic market, you need to consider what has changed for your patient pool as a result of COVID-19.

Given the highest U.S. unemployment rate since the Great Depression, how many of your potential candidates lost their jobs or were forced to reduce hours? How many still have insurance coverage? Has their insurance changed? What is their likely out-of-pocket portion? Are they at risk of job loss in this unstable market and unwilling to take time off? Have they drained their savings?

Some conditions also have demographic correlations that may impact your procedure uptake. For example, people with obesity tend to have lower incomes, so they might lack the economic means to afford an elective procedure with high out-of-pocket expenses (versus the average population). Conversely, the majority of people with heart failure are over the age of 65 and covered by Medicare, so their disposable income and insurance coverage may remain largely unchanged.

Clinical manifestation refers to symptom severity. COVID-19 probably has not materially changed your patient prevalence or incidence population (unless you serve respiratory patients). Rather, it has caused patients to refrain from seeking treatment to avoid the hospitals and reduce risks of coronavirus exposure. This has created a bolus of unserved patient candidates for your procedure.

To estimate how many unserved patient candidates will begin seeking care, estimate the manifestation rate of candidates’ severity level, as well as the likely accumulation of such patients in waiting. This means an analysis of annual incidence rates, patient survival without treatment, and current treatment rates to calculate the size of the growing untreated bolus.

In addition, factor in the capacity constraints and resource burden of health systems. Considering COVID-19 cases and other emergencies will take precedence — and that healthcare facilities are likely to continue to have limited resources and supplies for some time after the market fully reopens — priority will likely be given to the most urgent cases and conditions. If a capacity limitation exists, healthcare facilities will prioritize patients based on mortality and quality of life risks. They might also prioritize patients based on those least at risk for serious COVID-19 symptoms, or those who need procedures requiring the shortest time in hospital.

To approximate what your patients’ priority relative to others in the elective procedure pipeline, review symptomatic and situational factors. Are your patients’ conditions more severe or mild, acute or chronic, urgent or routine, compared to other conditions competing for treatment? How has the incidence and prevalence bolus of those patients seeking care from your target physician customers changed due to delays in treatment?

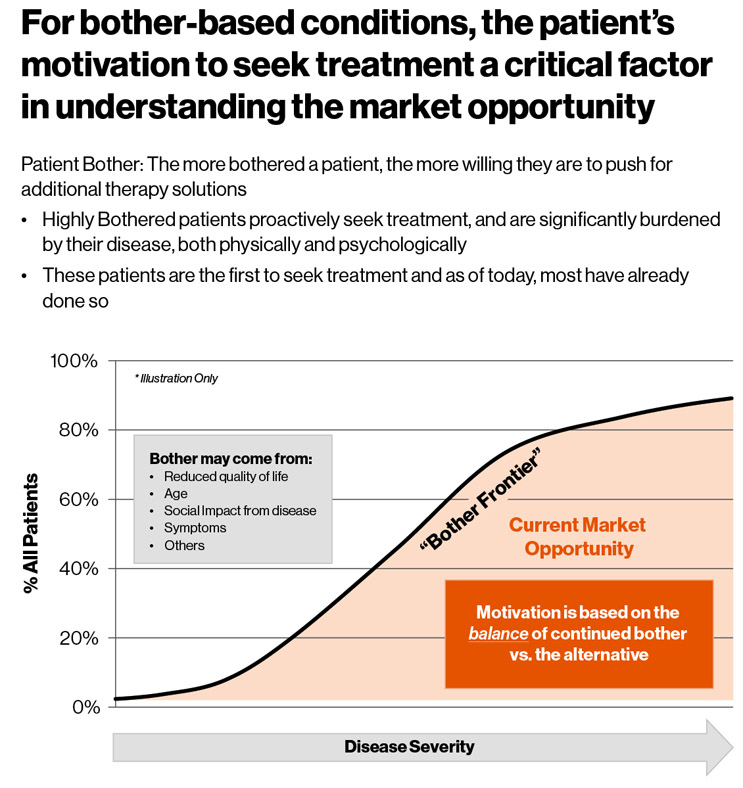

Patient motivation is a major driver of treatment rates and refers to the personal threshold for a patient deciding to seek therapy. This dimension is individualized and highly subjective because each person interprets discomfort and urgency differently — one person’s mild back ache is another person’s debilitating pain. Despite its subjective nature, motivation can be quantified across a given therapy’s patient population by applying this general rule: the percent of indicated patients who are bothered is the percent getting treatment (Fig. 2).

The pandemic will impact the threshold for bother (for a patient to act) for several reasons, which can depress demand for your procedure:

- People will be more fearful of entering a healthcare facility and exposing themselves to potential infection.

- With social distancing practices in place, many people have created the habit of avoiding exposure to other people and will be slow to re-engage.

- Even if patients have the economic means, the uncertain economy increases the reluctance to spend money, with out-of-pocket healthcare expenses competing against other living expenses and a desire to augment savings during uncertain times.

In other words, people will be more likely to ask themselves, “Am I really sick enough to take these risks? Is it worth spending the money?” And so, more often than before COVID-19, people will continue to decide to delay treatment even as the healthcare system reopens.

Weighing the Three Dimensions

Based on the current climate in the United States and the world, even once the market fully reopens, the impact of COVID-19 on the demand profile of elective procedures is likely to remain for months — even years.

Clinical manifestation will be the first factor influencing which patients get treated as the industry self-corrects over time, because healthcare is a prioritization exercise. Physicians will develop standardized clinical recommendations on how to address COVID-19-fueled clinical barriers, addressing resource scarcity and the risks associated with certain patient populations coming into the hospital environment. Both barriers will be dictated by the size of the hospitalized COVID-19 population at any given time, which is expected to ebb and flow (unpredictably at this time).

The economic piece is more difficult because it is dictated by the health of the national economy and unemployment rates. Medical device manufacturers can help offset costs by offering financial assistance to patients or setting up value-based initiatives with providers. But, until the economy recovers, the financial risks of getting elective surgery might outweigh the benefits for many more patients than pre-COVID-19.

The most difficult piece to predict will be, as always, patient motivation. Even if hospitals are open and have capacity, and the economy has been resuscitated, fear, uncertainty, and doubt will linger and drive people’s behaviors. The more your treatment is based on a patient’s personal choice, the more likely they will stay on the sidelines longer.

Framework Provided Insights

Applying this framework to your elective procedure will result in a better understanding of the nuances potentially affecting your therapy’s utilization rate.

The real power of the means, manifestation, and motivation dimensions is where they intersect — providing powerful insight regarding where your product falls on the priority spectrum as the markets reopen. In the simplest terms, if your patients tend to rank high on each of the three dimensions, they will likely be among the first admitted for treatment, because they know they are sick (manifestation), they are motivated to seek care (motivation), and they are still financially capable of paying for treatment (means). The reverse is also true: your business may experience slower recovery due to the prioritization of healthcare capacity going to other treatments

To accelerate demand, help your customers understand the COVID-19 comorbidity risk for your patients and focus marketing efforts to address the elevated bother threshold holding patients back. You can also help physician customers understand the changes in your post-COVID-19 indicated population so they can focus on the patients that need your procedure the most and are still able to afford it.

About the Authors

Mike Fix is a Director in Guidehouse’s Life Sciences practice. He has more than 15 years of experience across the pharmaceutical and medical device industries. Mike's work focuses on leading engagements assessing market landscapes for startups, mid-size, and multinational pharma and medtech clients. He also manages and develops the firm's market development software application. Most recently he has worked on projects in therapeutic areas including chronic venous insufficiency (CVI), coronary artery disease, emphysema, heart failure, hospital acquired infection, migraine, and obesity.

Ross Meisner is a partner in the Guidehouse’s Life Sciences practice and has 30 years of experience building high technology companies. In 2007, he co-founded Dymedex Consulting to become the thought leader for understanding medical market dynamics. Additionally, he co-founded and held leadership positions at four other start-ups and two international joint ventures. Prior to Dymedex, Ross was director of Global Market Development at Medtronic, implementing new methods to identify untapped growth opportunities across geographies.