An Analysis Of The Pelvic Organ Prolapse Repair Medical Device Market

By Hudson Lynn and Kamran Zamanian, Ph.D., iData Research Inc.

Pelvic organ prolapse (POP) refers to a condition through which bodily changes cause the organs held in place by the pelvic floor to drop. Different types of prolapse exist: cystocele, a prolapse of the bladder into the front wall of the vagina; hysterocele, a prolapse of the uterus into the back, front, or top of the vagina; rectocele, a prolapse of the rectum into the back wall of the vagina; urethrocele, a prolapse of the urethra into the lower front wall of the vagina; and enterocele, a prolapse that contains loops of bowel.

Pelvic floor repair is a procedure that treats pelvic prolapse of the vagina or the uterus using a vaginal approach. A transvaginal or intra-vaginal mesh is inserted to support the organs in the pelvis. An alternative to pelvic floor repair is sacrocolpopexy, which is another surgical method to repair pelvic organ prolapse. With sacrocolpopexy, incisions are made through the abdomen and mesh is used to lift the apical portion of the vaginal vault to suspend the vagina. This method may be performed laparoscopically, robotically assisted, or openly through the abdomen. While pelvic floor repair is reported to have shorter recovery times than the abdominal method of surgical treatment, pelvic floor repair has had more reported adverse effects. Both of these procedures may be performed concomitantly with a hysterectomy or surgery for stress urinary incontinence.

Pelvic organ prolapse is incredibly common and may affect 50% of women, though the severity of the condition may vary drastically and, in some cases, may be resolved with non-surgical treatments. As of 2019, however, approximately 15% of American women were estimated to require surgical repair for POP at some point in their lifetime. The iData market report on gynecological devices encompasses a chapter on the POP market, which is further segmented into the transvaginal mesh and sacrocolpopexy mesh markets.

Introducing The Procedure

When a patient is diagnosed with POP, the first course of action is non-surgical medical treatment, which may include medication, physical therapy, or pessaries. Oftentimes, the first step to treatment is to get fitted for a pessary device to uphold the pelvic organs. Other non-surgical courses of action include Kegel exercise or biofeedback therapy. If these approaches do not suffice, then POP may be better treated via a surgical technique.

Two main types of meshes can be utilized: transvaginal mesh and sacrocolpopexy mesh. After multiple reports of complications and growing concerns on patient safety, transvaginal meshes have been banned in the U.S., Australia, and New Zealand. As a result, the overall demand is expected to continue the transition from transvaginal to sacrocolpopexy procedures.

FDA Recalls And Litigation

In 2016, Astora, which was previously a market leader, terminated its vaginal mesh production due to legal issues. The discontinuation is apparent in the sudden decline of the total POP repair device market value. The market continued to decline in the years after but met another large drop between 2019 and 2020. Due to safety concerns and numerous litigations, the FDA recalled all transvaginal mesh products in April 2019.

Patients that previously received transvaginal mesh were increasingly reporting complications such as pelvic pain, painful intercourse, and mesh protruding through vaginal skin and, oftentimes, taking legal action.

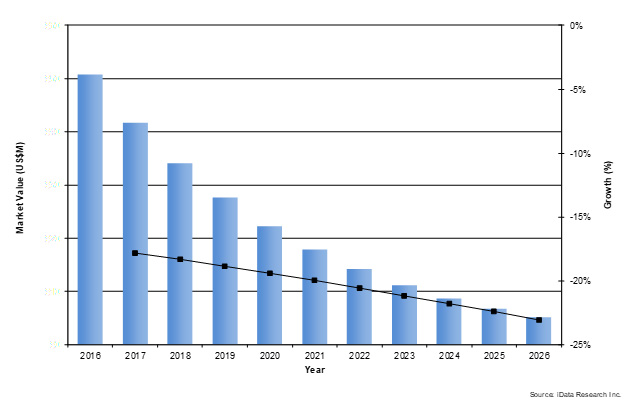

There are also ongoing safety concerns with sacrocolpopexy mesh devices, which have been intensified by the general poor publicity of meshes. Although still available for sale in the United States, sacrocolpopexy mesh devices may result in mesh erosion and cause damage to the vagina and other organs. Furthermore, even when treated with sacrocolpopexy mesh, there is still a risk of vaginal prolapse arising again. There have also been reported cases of stress incontinence and painful intercourse in patients treated with sacrocolpopexy mesh devices. According to iData Research Inc., the total sacrocolpopexy mesh market in the U.S. will consequently decline at a 21.2% CAGR over the next five years.

Figure 1 Sacrocolpopexy mesh market in the U.S. via research from iData Research.

Post-Recall Era: Shuffling Of The Market

Since Astora left the market in 2016, the shares of the remaining companies were shuffled around, enabling Coloplast to attain the leading position in the U.S. pelvic organ prolapse repair device market in 2019. Coloplast offered a line of products under the name of Restorelle that consisted of a full array of products for pelvic organ prolapse repair. These products included the Restorelle L and the Restorelle Y (synthetic meshes for sacrocolpopexy procedures) and the Restorelle DirectFix (synthetic mesh for anterior and posterior transvaginal repair). Although transvaginal mesh devices were recalled by the FDA in 2019, the recall didn’t occur until April. As such, some profit was still generated by transvaginal mesh products in Q1 of 2019. Coloplast also offered the Axis and Suspend, which are biologic meshes.

What Does The Future Hold?

A large opportunity for product innovation exists on the market for pelvic organ prolapse. POP continues to be a widespread issue, affecting an overwhelming volume of women at some point in their lifetime. However, the primary course of surgical treatment is losing favorability, as safety concerns and lawsuits further accumulate.

Another factor that could become an opportunity for innovative POP products is the lack of alternative surgical procedures. If a non-surgical approach fails to improve a patient's condition, then the surgical solution will be considered. Even with other surgical procedures available, such as the use of native tissue or hysterectomy, these treatments either have less long-term support or have a higher risk involved. Additionally, those other surgical procedures have traditionally not been as popular as mesh treatment.

Women’s healthcare is shifting toward minimally invasive procedures. As sacrocolpopexy can be done laparoscopically, it is expected that this trend will help support growth in sacrocolpopexy procedure rates. Sacrocolpopexy is also cutting-edge in the sense that the procedure can be performed using robotically assisted technology, bolstering procedure numbers. However, despite reported cases of stress incontinence and painful intercourse in patients treated with sacrocolpopexy mesh devices, the lack of better solutions creates an opportunity where innovative new products and treatments could enter and dominate the market.

This and other trends in gynecology can be found at iData’s latest report suite on the topic here.

About the Authors:

Hudson Lynn is a research manager at iData Research. He develops and composes syndicated research projects regarding the medical device industry, publishing the Global Gynecological Devices report series.

Hudson Lynn is a research manager at iData Research. He develops and composes syndicated research projects regarding the medical device industry, publishing the Global Gynecological Devices report series.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

About iData Research

For 16 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers its clients to trust the source of data and make important strategic decisions with confidence.