An Overview of The Remote Patient Monitoring Device & Telehealth Market

By Jonathan P. Gertler, MD, and John E. Osborn, JD, MIPP

Remote patient monitoring (RPM) has been present conceptually in clinical medicine for many years and its current prominence is the result of many years of evolutionary technology. The migration from invasive to noninvasive means of physiologic monitoring initially drew interest to diminish the potential complications of invasive procedures as well as during recovery from critical illness. The increase in remote monitoring today parallels the rise in accuracy of remote and efficient noninvasive physiologic monitoring and the utility of multiple measured parameters incorporated into one device or system. The disintermediation of what was previously expensive hospital or specialized area-based testing centers for a variety of conditions, the utility of these devices to monitor and diagnose conditions in real time and on a real-life basis, and the algorithm-driven approach to physiologic data are all noteworthy elements of the shifting care paradigm.

Factors enabling this trend include improved technology; a meaningful expansion of the infrastructure by which patients can access integrated delivery systems and communicate with physicians and other providers; a greater fluency among the general population, including the geriatric population, with these technologies; and, recently, the pandemic and the need to minimize the risk of patients being exposed to a deadly virus.

With this level of interest in the migration to remote patient monitoring, investment dynamics have changed considerably. It is worth reviewing the current trends in the investment space and the M&A and public markets, as well as the criteria and parameters by which investments, either in the United States or across the border, will need to be measured to identify those opportunities that hold greatest promise for this evolving system.

Investment Dynamics

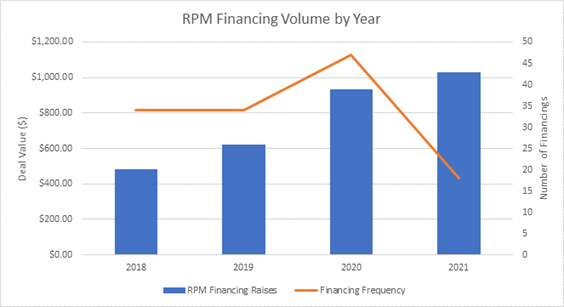

Perhaps overshadowed by the immense amount of capital pouring into the biotechnology sector and the continual news of large valuation and early-stage initial public offerings, medtech and health tech in particular have shown increasing financing activity as well as clear criteria for the various stages when investment and acquisition/IPO exitability will occur. A review of financing activity is shown in Figures 1 and 2 below.

Notably, private financing, as depicted in Figure 1, demonstrates a greater number and total deal volume relative to the IPO market and speaks to the clear recognition that remote patient monitoring, correlated to the overall improvement in infrastructural healthcare and medical technology quality, is an increasingly attractive investment sector.

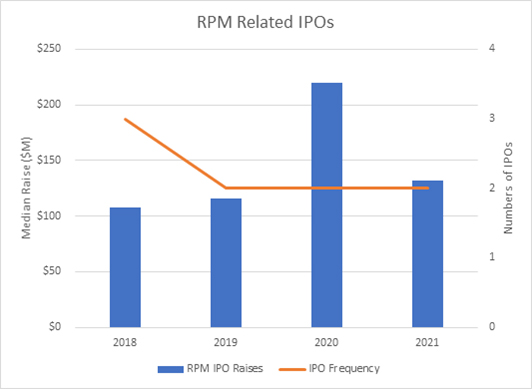

RPM related IPOs (Figure 2) have demonstrated a steady uptick, with an enormous surge during the pandemic; partial year 2021 data show even further growth and activity. Amount financed and the frequency of IPOs are both trending up significantly, and both trends reflect the market dynamics and clinical evolution noted above.

FIGURE 1: RPM private financing activity

Courtesy: Back Bay Life Science Advisors

FIGURE 2: RPM public market activity

Courtesy: Back Bay Life Science Advisors

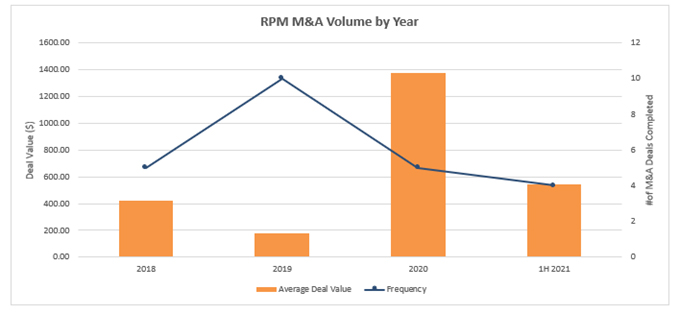

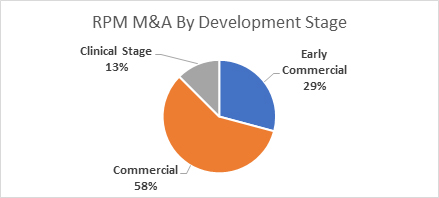

Perhaps one seminal difference in these markets is that technology-driven versus biologically driven investment tends to come in smaller amounts with clearer inflection point criteria. A review of the M&A markets (Figures 3-6) reveals that, unlike the biotech markets, where licensing, partnering, and M&A can happen even in preclinical stages and sometimes at seemingly excessive valuation and outsized rounds, the medtech and health tech markets primarily require revenue traction to demonstrate candidacy for acquisition. RPM is still a smaller piece of the overall medical technology pie, but the M&A markets will usually lag the financing markets and we fully expect further consolidation in the space.

The reasons for this are multiple: Disruption of patient care patterns is met with general suspicion by integrated delivery networks as, although streamlining patient care and improving quality are highly attractive economic principles, shifting to new approaches can be costly and, ultimately, not readily integrated with the infrastructure at hand.

FIGURE 3: M&A volume for RPM companies

Courtesy: Back Bay Life Science Advisors

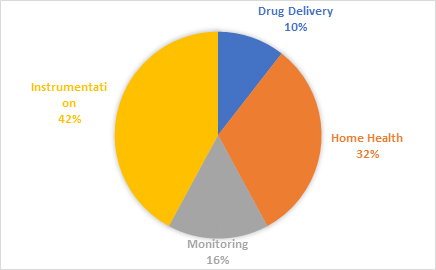

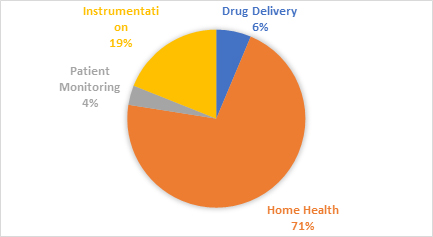

FIGURE 4: Device deal volume by sector

Courtesy: Back Bay Life Science Advisors

FIGURE 5: Deal volume by modality

Courtesy: Back Bay Life Science Advisors

FIGURE 6: Stage of RPM companies at acquisition

Courtesy: Back Bay Life Science Advisors

Company Development Challenges

The number of health tech and remote patient monitoring plays under development at times seems staggering. Amazon recently selected 10 companies out of 427 applicants for its health tech incubator, and innumerable conferences and company meeting programs are scheduled monthly.

Interestingly, countries outside the United States with strong technology developments in the biosensor space, e.g., the Nordic countries, have shown tremendous interest in entrepreneurial efforts to enter the U.S. markets, as evidenced by numerous Nordic-U.S. competitions, meetings, and company forums and the numerous biosensor-related companies that have been started in the region.

These companies, however, as is true of the United States based efforts, have challenges in numerous categories. The challenges common to all companies are, among others: integration with the dominant IT infrastructure and electronic medical records (EMRs) of larger integrated networks; proving actionable results that have care-driven solutions in response to diagnostics data; providing reliable physiologic monitoring, usually with an established parameter that can measure not only within normal ranges but also when pathology is being displayed; and data sets that give confidence that quality of care, prevention of hospitalization or repeat hospitalization, and economic befits accrue from their use. Secure data transfer is, of course, paramount. A further complication for companies formed abroad is that the principles tested are often tested in regional systems where payer dynamics and care delivery differ markedly from those of the U.S. Although cancer biology is equivalent in Helsinki and St. Louis, the same is not true of the complexity of having health technology adopted into our larger medical centers and integrated systems.

Reimbursement As A Driver Of RPM Adoption

Reimbursements for medical devices and for health technology advances in general are now more forthcoming, but only after clear demonstration of utility and meaningful differentiation. This in turn has also been mitigated in part by the recognition during the pandemic of the need for additional reimbursement codes for health tech delivery and, specifically, remote patient monitoring; however, the hurdles of demonstrated proof of clinical utility remain (see below). In contrast to capital intensive and high-risk drug development that the biotechnology markets have leveraged, health technologies must demonstrate technical proficiency; the ability to coexist and “talk to” delivery systems; a meaningful impact on quality of care; reproducibility and dependability of data; and, especially in the world of biosensors creating a data set for physiologic conditions, an actionable clinical response to the information generated.

Reimbursement for RPM and telemedicine has evolved considerably during the pandemic, as is reflected in federal policy changes. Although a clear hurdle for investors, these changes provide meaningful opportunity for the right technologies to come to investment and fruition.

Telehealth Reimbursement

The COVID-19 pandemic has dramatically increased the use of telehealth services. For example, at UnitedHealth Group alone, telehealth services increased from 1.2 million visits in 2019 to 34 million in 2020. In response, both public and private payers have reevaluated restrictions and at least temporarily loosened existing reimbursement limitations for certain telehealth procedures and remote physiologic monitoring.

Although certain telehealth services have enjoyed Medicare reimbursement since 2002, the gradual increase in usage has resulted in expanded coverage for “remote check-in” and monitoring. Beginning in 2019, a new procedural terminology code describing RPM as “the collection and analysis of patient physiologic data that are used to develop and manage a treatment plan” was set apart to support the reimbursement of remote monitoring services. For 2021, CMS proposed a wider range of coverage and reimbursement for RPM, including remote monitoring of basic physiologic parameters, collection and interpretation of data, and treatment management services.

Before 2020, there remained various third-party payer restrictions in place related to telehealth services, including geography, technology, the extent of services provided, and where services can be provided and by whom. The onset of COVID-19 spurred immediate changes. In response, the federal Centers for Medicare and Medicaid Services (CMS) waived geographic and location services, and many states waived or liberalized physician and other HCP licensure requirements that effectively allowed out-of-state practice via telehealth. In addition, CMS has proposed a rule under which it would cover remote therapeutic monitoring services.1

Medicaid patient coverage has been expanded in turn by state actions, including those that now allow for expanded services, treatment of certain acute care patients at home through a telehealth platform, relaxed consent requirements, and certain licensing requirement waivers.

There are currently dozens of bills pending in Congress and in state legislatures that would make permanent telehealth policy changes following the end of the public health emergency, including the continuing elimination of geographic restrictions, expansion of the types of covered services, and establishing fraud and abuse monitoring safeguards. In addition, both government and private payers are evaluating usage data to assess quality, effectiveness, cost and privacy, and other patient protections.

Conclusion

Remote patient monitoring is a final common pathway in developments in biosensing, cloud-based communication, integration with existing integrated delivery systems, and IT infrastructure. It has accelerated through the pandemic due to its critical utility in patient care. Although many of the hurdles have been overcome, e.g., technology, reimbursement, behavioral, and infrastructural, challenges remain in determining those technologies, patient populations, and systems that are best served by RPM. RPM financing activities reflect strong interest among different classes of capital, and the public exits and M&A markets still speak to the need to overcome critical adoption and commercialization hurdles. It is evident that both societal need and investment interest are accelerating and will support robust sector development for the foreseeable future.

About The Authors:

Jonathan P. Gertler, MD, is managing partner and CEO of Back Bay Life Science Advisors and managing director of BioVentures Investors MedTech Funds. He has more than 30 years of clinical and scientific experience and extensive advisory work with biotechnology, diagnostic, medical device, and healthcare IT companies in both the private and public sectors. A former vascular surgeon and founder of several life science companies, he is a frequent speaker and writer on strategic issues facing life science companies at all stages. Connect with him at www.bblsa.com.

Jonathan P. Gertler, MD, is managing partner and CEO of Back Bay Life Science Advisors and managing director of BioVentures Investors MedTech Funds. He has more than 30 years of clinical and scientific experience and extensive advisory work with biotechnology, diagnostic, medical device, and healthcare IT companies in both the private and public sectors. A former vascular surgeon and founder of several life science companies, he is a frequent speaker and writer on strategic issues facing life science companies at all stages. Connect with him at www.bblsa.com.

John E. Osborn, JD, MIPP, is a senior advisor with the Washington office of Hogan Lovells US LLP. He has worked with BioVentures Investors and its portfolio companies since 2018. Prior to that, he had two decades of senior executive experience in prominent life science companies, including Cephalon, DuPont Merck Pharmaceutical Co., and McKesson’s US Oncology unit. Osborn is a regular contributor on health policy and regulatory issues for Forbes.com and STAT. Connect with him at www.bioventuresinvestors.com.

John E. Osborn, JD, MIPP, is a senior advisor with the Washington office of Hogan Lovells US LLP. He has worked with BioVentures Investors and its portfolio companies since 2018. Prior to that, he had two decades of senior executive experience in prominent life science companies, including Cephalon, DuPont Merck Pharmaceutical Co., and McKesson’s US Oncology unit. Osborn is a regular contributor on health policy and regulatory issues for Forbes.com and STAT. Connect with him at www.bioventuresinvestors.com.

- Jul 2021: Expanded RPM coverage https://mhealthintelligence.com/news/cms-expands-remote-patient-monitoring-coverage-in-proposed-2022-pfs; Jan 2021: CMS Proposed Reimbursements https://mhealthintelligence.com/news/cms-clarifies-2021-pfs-reimbursements-for-remote-patient-monitoring