Boston Scientific Invests $25M In Novel Stent Technology

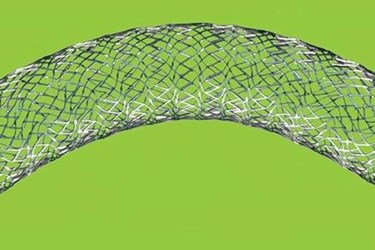

Veniti, start-up developer of a suite of devices indicated for deep venous disease, has secured $25 million in Series D funding from Boston Scientific. These funds will allow Veniti to complete a clinical trial and regulatory filing for its Vici Venous Stent system and continue development of the company’s pipeline and commercial operations.

When the walls of veins weaken or become damaged by venous disease, they can narrow or collapse, a condition that can lead to dangerous thrombosis or blood clotting, chronic leg swelling, and painful ulcers. A 2015 study published in Circulation found that stent placement in patients with iliofemoral venous outflow obstruction (VOO) results in “high technical success and acceptable complication rates”, regardless of the obstruction’s cause.

Veniti’s Vici Venous stent system received a CE Marking last April and was used successfully to treat a patient with post thrombotic syndrome — a condition that causes extensive VOO — in London. Stephen Black, the National Health Service (NHS) vascular surgeon and consultant who oversaw placement of the stent, commented that he was encouraged to see the industry working directly with physicians to develop novel technology for specific clinical needs.

A clinical trial evaluating the Veniti Vici Venous stent system in 200 patients with chronic VOO is currently recruiting participants at 30 sites worldwide, under an investigational device exemption (IDE) issued by the FDA. Veniti has estimated that the VIRTUS study will be completed in July of 2021, with help from funds secured from Boston Scientific.

“We are extremely pleased to be partnering with such a high quality industry leader to advance our core technology, the Vici Venous Stent,” said Jeff Elkins, president and CEO of Veniti, in a press release. “This financing will allow us to complete a number of critical milestones and support more physicians treating patients suffering from venous outflow obstruction around the world.”

In recent years, Boston Scientific has been exploring business opportunities in less-saturated markets, especially in the cardiovascular space. As a result, the company has offset its revenue slowdown in cardiac rhythm management (CRM) and reported its best quarterly performance in over a decade earlier this year.

Boston Scientific also recently acquired Cosman Medical and its portfolio of radio frequency (RF) ablation solutions for patients with chronic pain.