3 Challenges To The Orthopedic Biomaterials Market In 2019

By Austin Ngo and Jeff Wong, iData Research

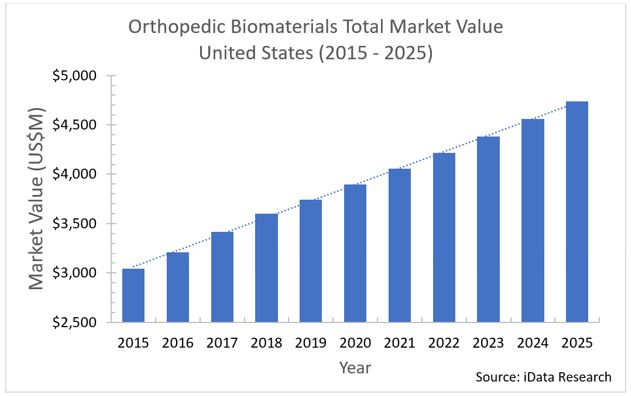

In recent years, several market pressures have caused a shift in market outlook for orthopedic biomaterial products. Although the market continues to grow year over year, average selling prices (ASPs) are declining as a result of these pressures. Our research shows that these ASPs are declining at a rate of nearly 5 percent annually across particular segments of this market.

Despite declining prices, technological innovation and other developments have maintained the market’s growth, drawing in patients with easier-to-perform and more efficient procedures. However, manufacturers may need to shift strategies as prices continue to decline.

1. Orthopedic Biomaterial Products Face Reimbursement Challenges

Apart from its clinical efficacy, the hyaluronic acid viscosupplementation market has largely been supported by its ease of reimbursement for treatments by health insurance providers. However, as of October 2017, Anthem classified all hyaluronic acid products to be “not medically necessary,” and ceased to provide reimbursement to its subscribers for these treatments.2

This act is feared by physicians and patients as setting a precedent that other insurance providers will follow, and no longer cover hyaluronic acid products. Since Anthem announced its decision, users of these products have been demanding that manufacturers lower prices as, without reimbursement, the products are too expensive for most patients.

The market for bone graft substitutes faces similar challenges. Because synthetic bone grafts do not contain any human tissue, they are less likely to be accepted by health insurance providers. This is because the manufacturing processes of these products varies across manufacturers, resulting in a lack of evidence for each product’s clinical efficacy. Many insurance providers, such as UniCare, provide coverage for allografts and demineralized bone matrix grafts, but not for synthetic grafts – putting significant pressure on manufacturers to lower prices on all bone graft products.

Despite this, the market for synthetic bone grafts is the fastest-growing among the different bone graft materials. This is partially due to improved technologies that patients perceive as having less risk of disease transmission than is normally associated with human tissue.

2. Manufacturers Pushed To Lower Prices On Premium Products

As more expensive premium products — such as cellular allografts and growth factors — develop in the market, additional companies are expected to produce their own products to ride the upward trend. Companies are likely to be driven to lower their prices due to the increased competition, offsetting the growth of unit sales. In many cases, these products, although proven to be effective through clinical trials, fail to convince patients that they are worth the premium pricing.

Less costly procedures and materials, such as bone graft substitutes, remain preferred among some patients. Many leading manufacturers, such as DePuy Synthes, are investing much more into marketing their premium products, hoping to gain a competitive edge before the market becomes too saturated with competitors.

3. Increased Product Diversification

In addition to competitive pricing, a greater range of products will mean more indications being covered. Originally, Medtronic was the sole company with a growth factor product, using BMP-2, and it was only indicated for lumbar spine procedures. In 2015, Wright Medical launched its own product using the recombinant human platelet-derived growth factor, which is applicable to foot and ankle procedures. Later, in 2016, Cerapedics released a growth factor product that uses the P-15 synthetic small peptide, which is used to treat cervical degenerative disc disease. The introduction of these products indicates a trend among biologics companies to fill a clear market gap in the growth factor segment.

FDA regulations of growth factor products are stringent, which results in them only being approved for specific indications. Indeed, several orthopedic treatments remain without an available growth factor option for patients. As of 2018, several manufacturers were in the process of developing new products in this market segment. Considering this, the growth factor segment is anticipated to grow significantly in coming years, and then to maintain steady growth as products become more available. Like most biomaterial products, they will be pushed by competition to lower prices — a pressure augmented by the emergence of new premium products.

The market for hyaluronic acid viscosupplementation is experiencing a similar situation. In recent years, several new products have been introduced to the market, including the first two-injection product by Fidia Pharma. The market for the two-injection hyaluronic acid treatment has proven to have tremendous potential, and is expected to grow over 30 percent annually.

A shift in preference towards treatments requiring fewer injections remains to be seen, as competitors currently focus on distributing one- and three-injection products. Many pharmaceutical manufacturers from overseas are entering this rapidly expanding market by partnering with established companies in the U.S. through distribution and royalty agreements. For example, Teva Pharmaceutical will be distributing a hyaluronic acid product in the U.S. manufactured by South Korea-based Hanmi Pharmaceuticals beginning in 2019.3

Conclusion

Growth in the U.S. orthopedic biomaterials market will continue, driven by increasing demand for orthopedic procedures, as well as the emergence of new products. The market will become more competitive, likely leading to significant pricing changes – mostly reductions. The lowered prices are expected to be offset by the massive growth potential in unit sales.

However, competition is not the only factor driving prices down. Many orthopedic biomaterial products are scrutinized by health insurance providers and are not eligible for reimbursement. Without reimbursement, treatments using these products become far too expensive for many patients, leading to pressure on manufacturers to lower prices even further.

About the Authors

Austin Ngo is a Research Analyst at iData Research and was the primary researcher on the US Market Report Suite for Orthopedic Biomaterials 2019 – MedSuite among other projects.

Jeffrey Wong is the Analyst Director at iData Research. Through many years of analysis, he has been the lead on most of iData’s medical, dental, and pharmaceutical market research and now drives research strategy, product development and consulting research.

About iData Research

iData Research (https://idataresearch.com/) is an international consulting and market research firm, dedicated to providing the best in market intelligence for the medical device, dental and pharmaceutical industries.

Resources

1 US Market Report Suite for Orthopedic Biomaterials 2019 – MedSuite, iData Research

2 https://ohiorheumatology.com/advocacy/anthem-threatens-hyaluronic-acid-injections-treatm.aspx

3 http://www.koreabiomed.com/news/articleView.html?idxno=3219