China Poised To Overtake U.S. And Japan As Top Telemedicine Market

By Simon Trinh and Kamran Zamanian PhD, iData Research Inc

Currently, the U.S. and Japan are leading the world in telemedicine, with the U.S. ahead of Japan in this regard. However, Japan is poised for high growth, due in part to its historic problem with long hospital wait times — the nation currently is ranked the highest in the world, with an average length of stay of 18 days).1 The U.S. also is poised for high growth as a result of its continuous R&D efforts to improve monitoring outside the hospital. With all the attention around the U.S. and Japan, it’s easy to forget about smaller markets, like China. However, China — with its 1.4 billion inhabitants — has great potential to exceed the U.S. and Japan in this market, and there are three key reasons this may occur.

1. Large Underserved Population

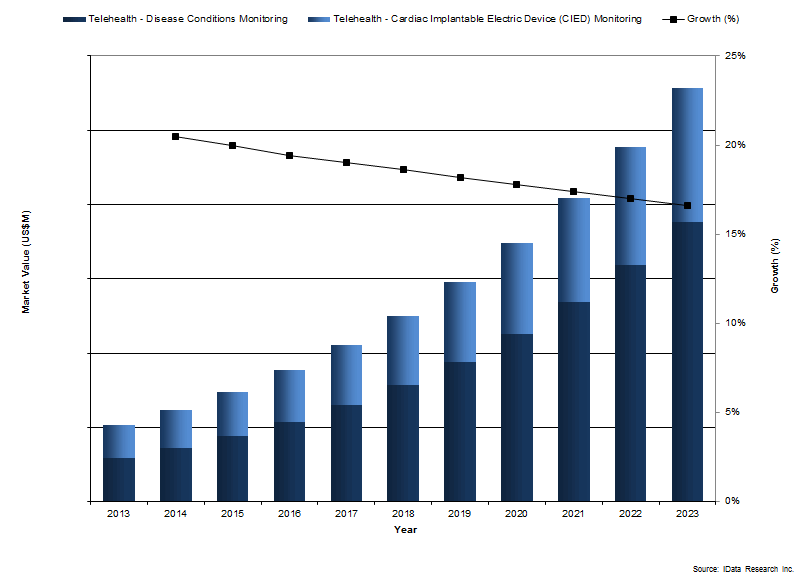

Due to China’s emphasis on economic growth and its massive population, it’s just a matter of time until China becomes the world’s leading telehealth market. Over the next six years, it is expected that China will outgrow the rest of the world in telehealth, growing at a compound annual growth rate (CAGR) of more than 15 percent.

2. Healthcare Access For The Middle And Lower-Class

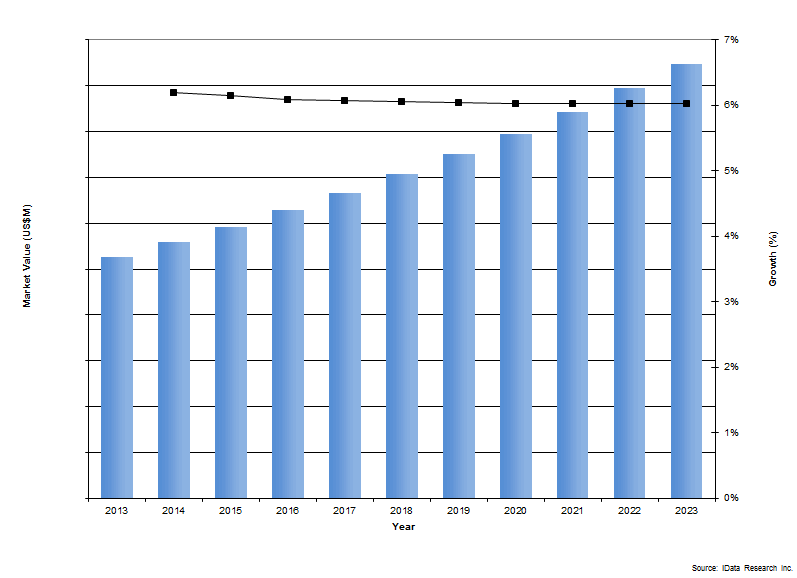

Rural areas that don’t have easy access to hospitals can use telemedicine, which is good for two reasons. First, it doesn’t put too much strain on current hospitals to monitor more patients1 — in order for current hospitals to monitor more patients using telemedicine, they don’t need more staff or more overtime hours. Rather, it’s just a matter of bandwidth, and having the right infrastructure in place to receive medical data from patients in rural areas. Second, telemedicine saves the Chinese government money2. The Chinese government has been adamant in pushing for better healthcare coverage in tier 2 and tier 3 hospitals (i.e., places that offer easily accessible healthcare for the middle and lower-class), and it costs less to install the central stations/servers than it does to build an entire hospital. Over the next six years, it is expected that China will outgrow the rest of the world in the total market for patient monitoring equipment, growing at a CAGR of 6 percent.

3. Improvement To Clinical Workflows And Communication Along The Care Continuum

Advanced telehealth platforms can help hospital staff to quickly capture each patient’s reason for the call or visit, prioritize care delivery, suggest the best treatment, and identify additional information resources. This is very important for hospitals in China, where wait times are so long that an illegal scalping system has emerged, whereby perfectly healthy people register for a spot to visit the hospital and sell these spots to others who are in need — at three times the appointment’s face value. 2

A major driver for this market is health policy reform, particularly those changes surrounding the legal guidelines for telehealth services. The main reason behind the lack of national fiber optic cables going into the villages is the persistent lack of formal recognition of telehealth as a valid healthcare practice by government organizations, creating a major bottleneck. At the moment, China lacks clear guidelines for telehealth, even though it is widely believed that China has no choice but to utilize telehealth in order to service its 1.4 billion inhabitants.

In 2014, China issued legal guidelines addressing telehealth for the first time. The new guidelines provide a more comprehensive framework, including:

- A definition of telemedicine services

- Requirements imposed on medical institutions which provide telemedicine services

- Guidelines in the implementation of telemedicine practices

Despite this step forward, many issues and questions still remain, including:

- Unclear boundaries between telehealth and other internet-based healthcare services (mHealth)

- Contradictions between the new telehealth guidelines and previous government-commissioned programs, which covered telehealth use in senior care facilities.

- Undefined legal restrictions for foreign medical institutions competing in China. This, of course, is great for international leaders in the telehealth space, but remains an open issue.

The Chinese market still is undergoing frequent and drastic changes in terms of regulations, shaped by efforts to contain the growing healthcare budget and increase market transparency. Specifically, in some markets, the prices are being directly reduced by the government. For example, it was announced that the government aims to reduce pricing for surgical devices by 15 to 25 percent. Furthermore, the Chinese healthcare tender system also is directly controlled by the government, and changes every two to four years. Therefore, if the Chinese government suddenly decides to give more tenders to a local low-cost producer, then the ASP of the entire market segment will decline accordingly.

Other Market Drivers In China’s Telehealth Market

Technological Advancements — As technologies become more efficient, effective, and safe to use, the market for remote monitoring devices will continue growing and adoption will increase. Increased availability of wireless data transmission networks will facilitate the development of platforms for telehealth. Growth in this market is expected to be quite strong in countries where the wireless infrastructure necessary for telehealth is already in place.

Increased Healthcare Spending — The patient monitoring device market in China is benefitting from overall increased healthcare spending in the nation due to economic growth. In 2008, China’s healthcare spending was a mere 4.3 percent of total GDP, whereas in 2014, healthcare spending increased by more than 30 percent to reach 5.6 percent of total GDP. During this same time period, world healthcare spending only increased 3 percent.

Demographic Changes — China’s over-65 population is rapidly increasing, mainly due to the size of the Chinese population as a whole. However, the percentage of the population aged 65 and older remains below the world average, and is projected to remain this way over the forecast period. Moreover, growing incidence of cancer and end-stage kidney disease will contribute to higher expenditures on healthcare, including patient monitoring equipment and devices.

The worldwide market for telehealth is inarguably a booming industry. But only time will tell which market competitors will emerge as global leaders.

About The Authors

Simon Trinh is a Senior Research Analyst at iData Research. He specializes in research for patient monitoring and cardiology-related medical devices.

Kamran Zamanian, Ph.D., is a Senior Partner and CEO at iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research is an international market research and consulting firm, dedicated to providing the best in business intelligence for the medical device industry. Our research empowers our clients by providing them with the necessary tools to achieve their goals and do it right the first time.

We have built a reputation and earned our clients’ trust based on consistent and uniquely intelligent research that allows our customers to make confident decisions and impact their businesses. A combination of market expertise and over a decade of experience has resulted in a deep understanding of the medical device industry that has inspired innovation and propelled our clients to success.

References

China Market Report Suite for Patient Monitoring Devices 2017 – MedSuite, iData Research Inc.