China's Healthcare Reforms: Medtech Manufacturers Must Remain Cautious

By Michael Custer, Solidiance

China’s healthcare market has been resilient in recent years, and it will continue to grow rapidly at a Compound Annual Growth Rate (CAGR) of over 19 percent from a market size of (USD) $350 million in 2014. The success of China’s healthcare system is reflected through its universal healthcare coverage, bringing the insured rate up from 50 percent of the population in 2005 to 95 percent by 2011. And, despite achieving universal coverage — a rarity for developing countries — China has been able to keep costs relatively in check, spending just 5.5 percent of its gross domestic product (GDP) on healthcare in 2014. In contrast, the United States spent 17.1 percent of its 2014 GDP on healthcare.

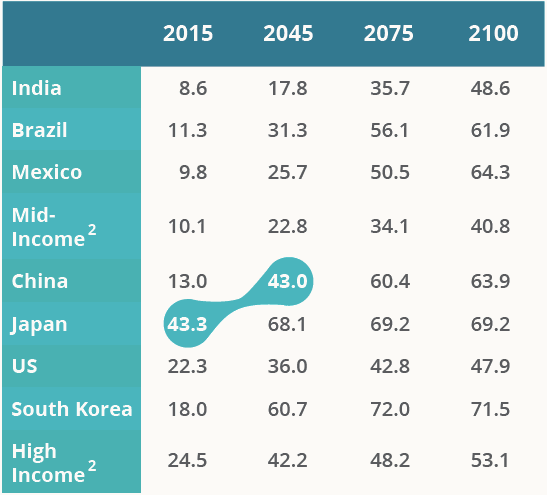

However, as China’s population continues to age at an alarming rate, healthcare expenditure also is likely to rise. China’s old age dependency ratio, a reliable predictor of healthcare costs, will match that of modern-day Japan by 2045.

Old Age Dependency Ratios For Selected Countries, Country Groups (%)

1 - Old age dependency ratio = total number of people over 65 years old )/ (working age population- total people from 15-64 years old)

2 - Average of middle income countries and average of high income countries as defined by the United Nations

Moreover, China’s population is becoming increasingly unhealthy. The rates of many chronic diseases, as well as cancer, are on the rise in China due to pollution, poor diet, and unhealthy lifestyle choices. To put this in perspective, the diabetes rate in China is already higher than that of the United States.

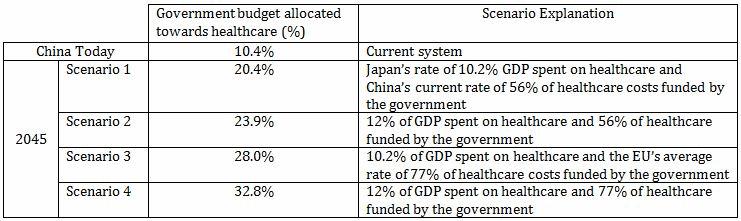

If no reforms are enacted upon the current system, these trends will lead to enormous strains on the government’s budget. It is projected that 20 percent of China’s government budget will be allocated to healthcare by 2045. That figure is nearly double China’s healthcare expenditure today, trailing only New Zealand and the United States.

Under more realistic scenarios, considering China’s growing health problems and an increased share in healthcare funded by the government, the share of state budget allocated towards healthcare will range from 24 percent to 33 percent — figures that are by far the largest in the world.

Four Scenarios: China’s Healthcare Market In 2045, Resultant Of Government Spending On The Sector

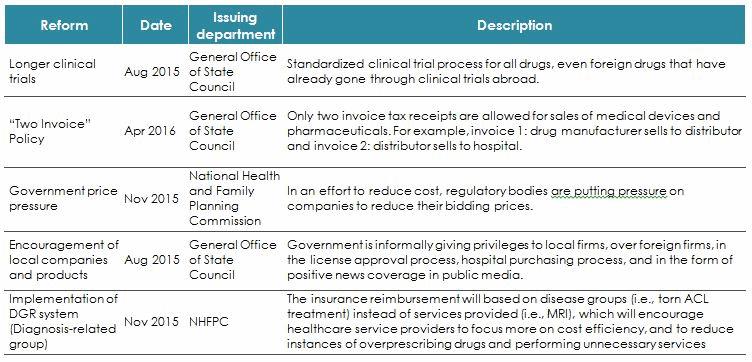

Without the necessary changes, China’s current healthcare system will become unaffordable. The latest round of reforms, launched towards the end of 2015, are thus aimed at ensuring sustainability by reducing costs, so as to create a more efficient healthcare system for China’s people. The reforms, if implemented effectively, will have significant impacts on companies operating in the sub-sectors of medical devices, pharmaceuticals, and healthcare services.

Reforms Impacting Foreign Medical Device Companies Operating In China

The two main methods by which the government hopes to achieve price reduction in the device sector are direct pressure on manufacturers and the implementation of a “two-fapiao” invoicing system. A fapiao is similar to a receipt; in China, invoices are used not only to record a transaction, but also as a way for the government to monitor the tax paid on any transaction.For foreign medical device manufacturers, the reforms are especially worrisome, as the government is both applying significant downward price pressure on the industry and taking steps to encourage the development of local champions in device segments that currently are dominated by foreign manufacturers.

Fortunately, because the device sector is relatively small, compared with pharmaceuticals, it is not expected to face significant direct price pressure for several years, as the government will focus on reducing the costs of pharmaceuticals first. The two-fapiao invoicing system, however, is expected to launch in 2017 for most provinces, and has the potential to cause significant headaches for device companies.

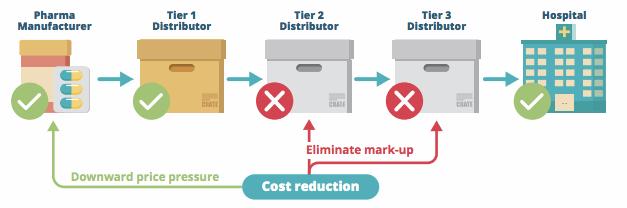

Two-fapiao invoicing consists of cutting out tier 2 and tier 3 distributors, and thus reducing the mark-up on medical devices for hospitals and healthcare facilities. The policy states that, from device manufacturer to hospital, there must be only two transactions (fapiaos): first, the manufacturer sells to distributor, and second, the distributor sells to the hospital/healthcare facility.

Potential Impact Of Reform On Medical Device Channels In China

Cutting out smaller distributors may not directly impact the margins of manufacturers, but it does significantly impact a manufacturer’s channel management and strategy. Currently, it is the smaller tier 2 and tier 3 distributors that maintain relationships with hospitals and perform the on-site setup services necessary for certain categories of devices. Larger, tier 1 distributors do not possess the technical skills and expertise needed to effectively perform this type of in-service.

However, selling directly to tier 2 and tier 3 distributors is difficult, as these smaller distributors often do not have the financial resources to pay up-front for most medical device products, and rely on financing and payment terms from the tier 1 distributors.

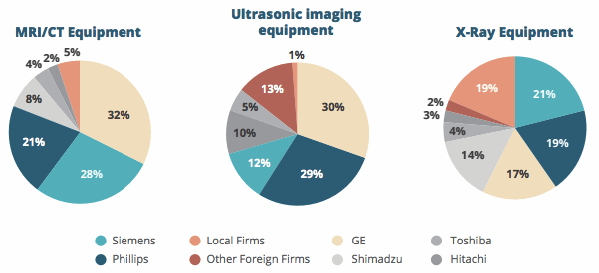

Foreign device manufacturers also will face increased hurdles and challenges in competing with local competitors. Similar to its initiatives in other industries, the Chinese government wants local medtech companies to upgrade their manufacturing and technical capabilities to better compete in higher-value medical device products. Currently, foreign firms dominate many markets for higher-value medical devices.

Multinational Corporation Dominance In China’s High-End Medical Device Markets, 2013

The government hopes to end this foreign monopoly by better encouraging the development of local companies. Informal efforts by the Chine government to increase the competitiveness of local device companies include allowing local companies to easily undertake green channels — a faster approval and registration process for new devices — and pressuring hospitals to buy a higher percentage of local products.

How Foreign Medical Device Companies Can Overcome Operational Challenges In China

Despite the reforms adding complexity, it is important to remember that China’s healthcare market is large and growing rapidly, with value projected to surpass (USD) $1 trillion by 2020. With a market of that size, numerous strategies are apparent for multinational medical device companies to capitalize on opportunities in China.

One such strategy is to focus on developing and introducing new and innovative products. Innovative medical devices will continue to demand a premium in post-reform China. Additionally, maintaining the edge that foreign multinationals have in R&D and technology is crucial for future success. It is important to “stay ahead of the curve” and combat efforts to boost the technical capabilities of local companies.

Another strategy is for device companies to pursue multiple brands/product lines. Adding a low-cost brand or “generic” product lines that target different customer groups is a way to maintain brand value while increasing market size and revenue. One way to pursue this multi-brand approach is through M&A — acquiring a local competitor would have the added benefits of cutting down costs and time for registration, as the foreign firm would be able to apply through a local entity for some products.

About The Author:

About The Author:

Michael Custer is a Consultant at Solidiance, based in Shanghai, China