Connected Drug Delivery Devices: Emerging Market Trends

By Pooja Sharma, Global Market Insights

The global healthcare landscape is undergoing a dramatic shift with the increasing adoption of connected drug delivery devices. These smart solutions integrate digital connectivity — often via Bluetooth — with traditional drug administration tools, improving treatment adherence, dosing accuracy, and real-time monitoring.

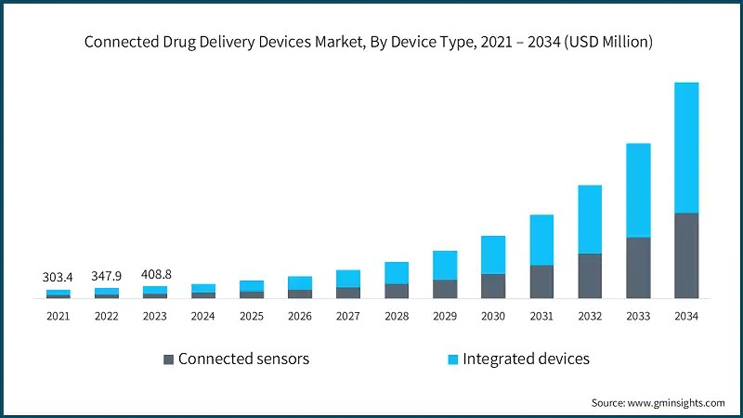

According to industry reports, the global connected drug delivery devices market was valued at over $491.2 million in 2024 and is projected to reach $7.25 billion by 2034, growing at a robust CAGR of 31.8% during the forecast period. The growth is largely driven by the increasing prevalence of chronic diseases, expanding homecare trends, and rapid penetration of the Internet of Medical Things (IoMT) in healthcare systems.

Integrated Devices Lead The Way In Smart Drug Administration

Integrated devices — those combining both the drug reservoir and the smart module — are gaining prominence due to their compact design, ease of use, and data accuracy. Unlike add-on modules, integrated devices offer seamless delivery and monitoring in one compact solution. These are particularly beneficial for elderly patients and those managing chronic respiratory conditions like COPD and asthma.

Recent advancements in device miniaturization and sensor technology have made integrated drug delivery tools more intuitive. A notable example is the June 2024 collaboration between Aptar Digital Health and SHL Medical, which aims to enhance connected drug delivery systems by integrating Aptar’s Software as a Medical Device (SaMD) platform into SHL’s autoinjectors and specialty drug delivery devices. This partnership reflects the growing trend toward comprehensive digitally enabled solutions that support patients on injectable therapies with real-time monitoring and disease management capabilities. These integrated systems not only track patient compliance but also allow clinicians to remotely adjust dosage or medication schedules based on real-time analytics.

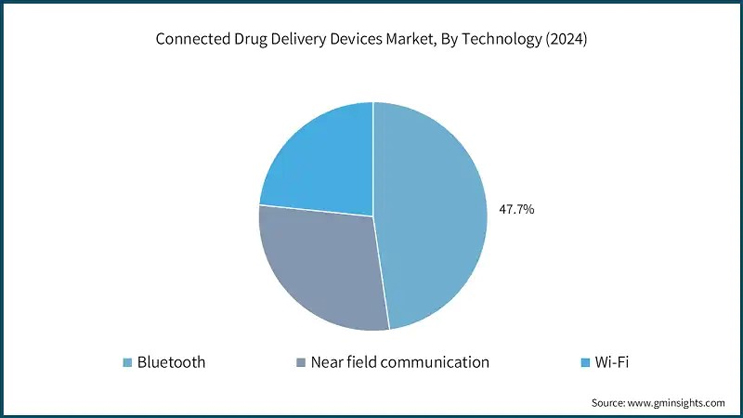

Bluetooth Technology Revolutionizing Remote Patient Monitoring

Bluetooth-enabled devices are currently dominating the connected drug delivery landscape, allowing real-time data sharing between patients and healthcare professionals via smartphones or tablets. The ease of integration with mobile health apps and electronic health records (EHRs) has positioned Bluetooth as the cornerstone of digital therapeutics.

In October 2024, Insulcloud expanded into the U.S. market after receiving FDA clearance for its Insulclock CAP device — a Bluetooth-enabled smart cap that transforms disposable insulin pens into connected diabetes management tools by providing real-time monitoring and therapy optimization alerts. Similarly, in October 2022, Merck KGaA extended its partnership with Biocorp to co-develop a tailored version of Biocorp’s Bluetooth-enabled clip-on device, specifically designed for one of Merck’s drug delivery systems, further showcasing the technology’s adaptability.

The Bluetooth segment alone accounted for 47.7% of the market share in 2024, thanks to low energy consumption, enhanced security, and interoperability across various platforms. Moreover, the increasing use of AI and cloud-based platforms in healthcare is likely to enhance Bluetooth’s functionality in predictive analytics and customized treatment plans.

Respiratory Applications Dominate Due To Chronic Disease Burden

Respiratory diseases like asthma and COPD represent the largest application area for connected drug delivery devices. According to the Asthma and Allergy Foundation of America, approximately 28 million people in the U.S. — or about one in every 12 individuals — are affected by asthma. Of this total, nearly 23 million are adults aged 18 and older. These conditions require strict medication adherence and real-time monitoring to prevent exacerbations.

Smart inhalers embedded with sensors are playing a critical role in improving patient outcomes in respiratory care. These devices remind patients when to take medication, monitor inhalation techniques, and record usage data, which can be analyzed for personalized treatment optimization. A prime example is Aptar Pharma’s HeroTracker Sense, launched in February 2022. This innovative digital solution transforms standard pressurized metered dose inhalers (pMDIs) into smart, connected devices that help patients with chronic respiratory conditions like asthma, COPD, and cystic fibrosis track inhaler usage and adhere more closely to prescribed therapies.

Programs like the NIH’s PREPARE study (Patient-Centered Outcomes Research Institute-funded) have demonstrated that connected inhalers improve asthma control and reduce emergency visits, further validating their effectiveness in clinical settings.

Homecare Settings Spur Demand For Smart Therapeutics

The homecare segment is witnessing exponential growth, supported by the growing demand for remote monitoring tools, especially post-COVID-19. Home-based connected drug delivery solutions enable patients to self-administer medication safely while remaining under the digital supervision of clinicians.

This segment accounted for $198.5 million in revenue in 2024 and is expected to expand significantly as healthcare systems worldwide emphasize decentralized care models. Devices tailored for respiratory care are at the forefront, providing autonomy to patients with chronic conditions while reducing hospitalization costs.

Startups as well as established players are developing home-compatible spirometry devices and inhalers that not only manage symptoms but also transmit data directly to cloud-based physician dashboards for remote assessments. For instance, in January 2024, NuvoAir Medical announced that its innovative Air Next Spirometer received 510(k) clearance for in-home use as a full-function spirometer. This regulatory approval enables NuvoAir to scale its clinical operations and extend access to respiratory care, ensuring that patients with heart or lung conditions receive timely and effective monitoring.

North America Leads Adoption With Robust Infrastructure And Policy Support

North America dominates the connected drug delivery devices market, holding a noticeable share of the global revenue in 2024. This is largely due to the region's well-established digital health ecosystem, favorable reimbursement policies, and high awareness about smart healthcare technologies.

Government initiatives encouraging remote care and chronic disease management have further accelerated the adoption. Programs under the U.S. FDA’s Digital Health Innovation Action Plan support market approval for smart therapeutics, paving the way for faster deployment of connected devices.

Moreover, North America houses several pioneering players such as Adherium, Respira Labs, and Becton, Dickinson, and Company, all of which are actively investing in R&D to expand the capabilities of connected drug delivery systems.

The U.S. market is setting benchmarks in terms of technology penetration, regulatory support, and consumer readiness. With rising healthcare costs and increasing chronic disease prevalence, stakeholders are turning toward digital solutions that improve clinical efficiency and patient engagement.

According to the CDC, chronic illnesses like cancer, heart disease, and diabetes are the primary causes of death and disability in the United States. Individuals with chronic and mental health conditions account for 90% of the nation’s $4.5 trillion in annual healthcare spending — which bodes well for the connected drug delivery industry.

U.S. consumers are more willing to adopt remote health tools. According to the American Medical Association, physician adoption of remote monitoring devices increased significantly — from 12% in 2016 to 30% by 2022, making the U.S. a fertile ground for innovation and commercialization in connected therapeutics.

Eminent Companies Operating In The Connected Drug Delivery Devices Sector

- Adherium

- Aptar Pharma

- AstraZeneca

- Becton, Dickinson, and Company

- Bigfoot Biomedical

- Cohero Health

- Eli Lilly and Company

- Insulet Corporation

- Novartis

- Novo Nordisk

- Phillips Medisize

- Propeller Health

- Teva Pharmaceuticals

- West Pharmaceutical Services

- Ypsomed

Looking Ahead: The Future Of Connected Drug Delivery Devices

As healthcare transitions from reactive to preventive and personalized models, the role of connected drug delivery devices will continue to expand. With AI, the IoT, and wearable tech integration on the horizon, future devices may offer predictive analytics to preempt medical crises and support even more efficient remote interventions.

For companies operating in this space, the focus will be on interoperability, cybersecurity, and user-centric design to maximize market traction. Collaboration between pharmaceutical firms and medtech innovators will be key to achieving widespread adoption and regulatory success.

Connected drug delivery devices are more than just a technological innovation — they are a paradigm shift in how medication is administered and managed. From integrated devices that simplify drug dosing to Bluetooth-enabled systems that redefine remote monitoring, this market is ripe with opportunities. With respiratory care and home settings at the core of this transformation, North America, especially the U.S., will continue to be the torchbearer in this smart healthcare revolution.

To purchase/access the full market research report, it can be found here.

About The Author:

Pooja Sharma is a writer at Global Market Insights who writes about technology, healthcare, and chemical sectors.

Pooja Sharma is a writer at Global Market Insights who writes about technology, healthcare, and chemical sectors.