Dental 3D Printing: Disruptive Trends In The Digital Dentistry Market For 2021

By Taylor Parkkila and Kamran Zamanian, Ph.D., iData Research Inc.

Dental 3D printers have experienced a surge in popularity in recent years, reflecting the increasing range of applications  and opportunity for revenue generation offered by these systems. Powerful software modules from leading CAD (computer-aided design) software producers allow for straightforward integration of dental 3D printers into existing laboratory workflows, while user-friendly chairside modules allow clinicians the ability to design and fabricate on-site with minimal expertise. With a wide range of new competitors in the market, there is now a dental 3D printer available at nearly every price point to meet a wide range of individual needs, with some starting as low as just a few thousand dollars.

and opportunity for revenue generation offered by these systems. Powerful software modules from leading CAD (computer-aided design) software producers allow for straightforward integration of dental 3D printers into existing laboratory workflows, while user-friendly chairside modules allow clinicians the ability to design and fabricate on-site with minimal expertise. With a wide range of new competitors in the market, there is now a dental 3D printer available at nearly every price point to meet a wide range of individual needs, with some starting as low as just a few thousand dollars.

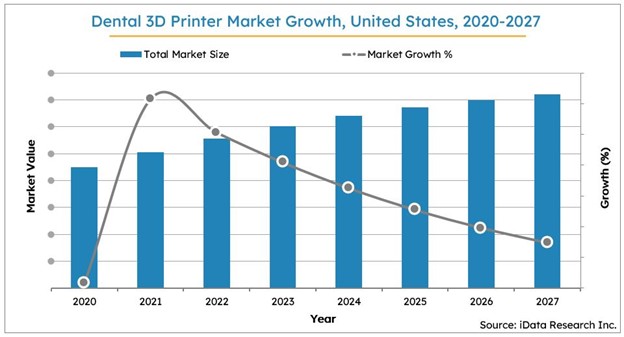

Figure 1: Access iData’s U.S. dental 3D printer market report to view more granular data.

As a result of innovation in hardware, materials, and software, 3D printers have become a staple in many dental laboratories and practices. Despite the COVID-19 pandemic, unit sales in 2020 exceeded 4,000 dental 3D printers, reflecting modest growth over 2019; as the economy recovers throughout 2021, the market is projected to jump back up to double-digit growth for the foreseeable future.1 While only around 40% of dental laboratories currently own a dental 3D printer,2 many own as many as five or 10 individual units. As this is still a relatively new market, significant growth potential remains in both clinical and laboratory spaces. Many laboratories choose to devote specific printer units to specific materials and applications, due to the simplicity of using a single resin in a single machine. As a result, it is likely that labs will continue adding printers as new applications emerge. Overall, a handful of exciting industry trends will drive dynamic growth in this market in the coming years.

3D Printed Dentures Set To Disrupt The Market

While validated workflows for the digital production of prosthetics like crowns and bridges have existed for years, digital dentures are still relatively new in comparison. The first digital dentures to be offered in the U.S. market were milled dentures, produced using existing CAD/CAM workflows and pucks of denture base material or monolithic combination materials. While some predicted that these milled dentures would quickly become the standard of care, industry adoption has been relatively mild in comparison; 2019 survey data from the National Association of Dental Laboratories (NADL) indicates that less than 10% of full-arch dentures were produced digitally at the time. While this has no doubt increased in the intervening years, 3D printed dentures are now set to disrupt this market space. Newer materials, such as the Lucitone Digital Print from Dentsply Sirona and the Formlabs Denture Base Resin, are indicated for long-term use in the mouth, despite a lack of studies on their long-term efficacy.

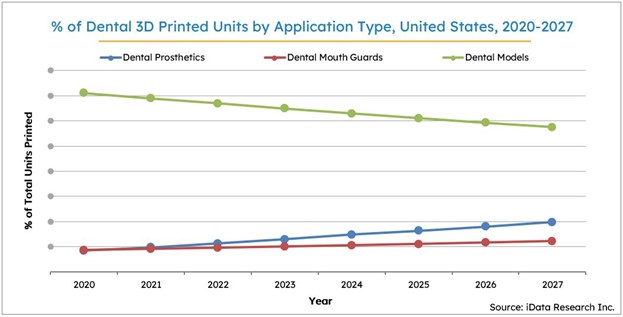

Figure 2: Access iData’s U.S. dental 3D printer market report to view more granular data.

3D printed dentures provide several workflow advantages and patient experience improvements that traditional dentures, and even milled digital dentures, cannot match. The primary selling point for digital dentures on the clinical side is that fewer patient visits are required to fit the final prosthetic; this is true of both printed and milled dentures. On the laboratory side, both kinds of digital dentures are significantly less labor-intensive than traditional denture production. Print time depends on the 3D printer used: on the lower end of the price spectrum, Formlabs claims its Form 3B can print eight denture bases in approximately nine hours. Whip Mix, a distributor of the Asiga Max, projects a print time of just over an hour for three denture bases. Printers with larger build plates can produce digital dentures even faster. As such, 3D printers provide an excellent opportunity to provide low-cost dentures: they can be mass-produced, depending on the size of the printer being used.

The resin is often cheaper than the materials required to complete a traditional denture; while the aesthetic quality of a 3D printed denture may not yet match that of a premium traditional denture or a monolithic milled denture, the cost and time savings make them an excellent choice for economy and provisional options.

Altogether, while digital dentures are still an emerging application, they will stimulate significant growth in the 3D printing market as technology involves. Many economy denture providers are already exploring 3D printing in their workflows, and efforts to produce stronger, more aesthetic materials are ongoing. Emerging business models will stimulate this growth: while the long-term lifespan of a printed denture is not yet well understood, replacements can be printed from the same design file in-house or in the laboratory. This may provide valuable peace of mind to patients and clients alike.

Implant Dentistry – Growth Opportunity For 3D Printing

Implant dentistry is rapidly becoming the standard of care in many practices, and it provides significant advantages over traditional dental care: implant-supported dentures offer a significantly improved patient experience and preserve bone structure better than removable dentures do. Implant-supported crowns have emerged as an alternative to bridgework for replacing missing single teeth. While implants come at a price premium, they are part of the modern dental focus of preserving natural bone structure and dentition wherever possible.

Implant dentistry provides a significant growth opportunity for dental 3D printing. As implants are increasingly provided by general practitioner (GP) dentists, surgical guides are emerging as a more popular tool for guided surgical installations. Dental 3D printers are capable of rapidly producing these guides at significantly diminished cost, compared to traditional sources. However, dental 3D printers offer another advantage for implant providers: provisional arches and crowns. In All-on-4 implant cases, wherein four implants support an entire arch of teeth, a premanufactured full arch of acrylic teeth is typically installed during the healing period. Dental 3D printers are now capable of printing customized crowns and full arches for indefinite use in the mouth, offering practitioners the ability to produce more of their materials in-house. This is a significant growth opportunity for dental 3D printer manufacturers.

Newly Developing Sales Models For 3D Printers

The emergence of new sales models for dental 3D printers may drive additional growth in this rapidly developing market. Traditionally, dental 3D printers were simply sold as capital equipment. Service and support agreements are available through distributors, and they vary based on the needs of the customer. Rental models are not widespread in this industry, perhaps because of the relatively low investment cost. There is one notable exception to this trend, however: Carbon, which entered the dental space in 2017 with its M2 printer, offers its equipment on a rental basis only. As a higher-priced option, Carbon offers its printers with a comprehensive service, design, and support agreement—with the caveat that you don’t own the printer at the end of the leasing term. As a market leader in the dental 3D printer space, the long-term success of Carbon’s model may become indicative of broader trends within this market.

In addition to straightforward rental and service packages, however, a new trend is emerging within the market. Given the relatively low investment cost for many printers, with a host of options under $15,000, some distributors are now offering materials subscription packages. These emerging models include the printer at a heavily discounted price, or even for free, alongside a subscription to a particular quantity of resin. This emerging sales model highlights an important aspect of the industry: the dental 3D printer market’s true value lies not in the capital equipment itself but in the materials used and the final products it can produce.

Conclusions

The dental 3D printer market has experienced rapid growth in recent years and is poised to continue experiencing double-digit growth in the near future. Emerging applications within both laboratory and clinical markets will continue to drive adoption of this technology. As materials improve, printed dentures and partial dentures will continue to become a popular choice for rapid, low-cost production.

Manufacturers are successfully overcoming some reservations regarding 3D printed prosthetics within the market; comprehensive customer support and marketing efforts will continue to change the perception that 3D printers are difficult to use, and the learning curve will continue to flatten as hardware becomes more user-friendly and software becomes more powerful. On the whole, rapid technological innovations within this industry are driving a growing perception that dental 3D printers have a place in the long-term future of an increasingly digital dental world.

References

- U.S. Market Report for Dental 3D Printers with COVID19 Impact Analysis (2021), iData Research Inc.

- NADL 2019 Materials & Equipment Survey, National Association of Dental Laboratories.

About the Authors

Taylor Parkkila is a research analyst at iData Research. She has been involved in syndicated research projects regarding the dental industry, publishing the U.S. Digital Dentistry and Dental Prosthetics report series.

Taylor Parkkila is a research analyst at iData Research. She has been involved in syndicated research projects regarding the dental industry, publishing the U.S. Digital Dentistry and Dental Prosthetics report series.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

About iData Research

For 16 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers its clients to trust the source of data and make important strategic decisions with confidence.