4 Emerging Approaches to Medtech Contracting Agreements

By Joanne Clark, Bhavesh Patel, and Mireia Cortina, Life Sciences Practice, CRA

In recent years, a range of factors, including increasing budget pressures, requirements for real-world data, the availability of more innovative medical devices and technologies, and the shift toward value-based care are driving the development of new pricing and reimbursement models in the medical device sector. As the industry is considering different options, many device manufacturers are increasingly needing to address uncertainties and pushbacks from payers. A recent analysis led by our life sciences team at CRA found that there are several rapidly emerging challenges hindering adoption of innovative pricing and contracting schemes for medical devices, including:

- Lack of payer belief that new medical technologies provide added value compared to more well-established devices or technologies

- Uncertainty among stakeholders regarding how to align contracting agreements with current tendering/procurement processes for medical devices

- Widely held acceptance among payers that traditional funding mechanisms (e.g., bundled payments, diagnosis-related group systems) are easier to manage and less complex than new funding models

- Difficulty in collecting and using real-world data to support product performance and meet payer evidence requirements.

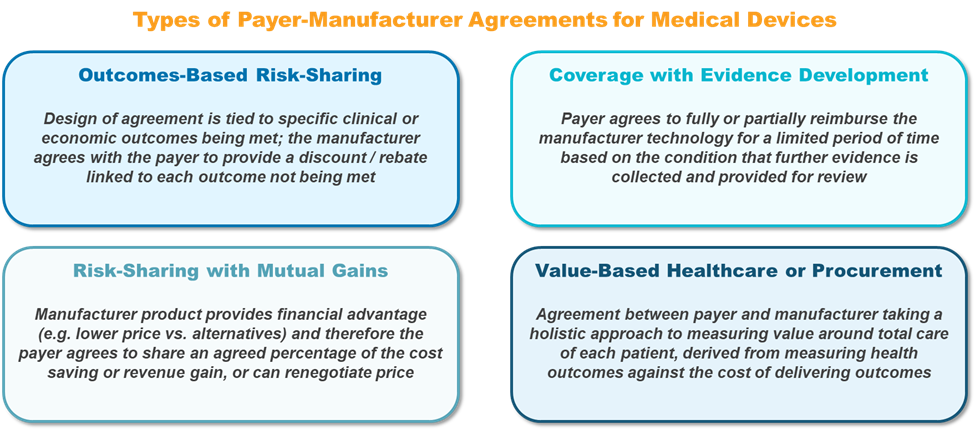

Despite these potential hurdles, device manufacturers continue to work to engage with payers and build support for innovative pricing and contracting schemes. In recent years, they have identified opportunities to further refine strategies to address payer concerns about reimbursement of novel medical devices and technologies. Their efforts have resulted in the emergence of four primary types of contracting agreements: outcomes-based risk-sharing, risk-sharing with mutual gains, coverage with evidence development, and value-based healthcare or procurement (Figure 1).

Figure 1: Types of innovative contracting agreements in the medical device sector. Source: CRA analysis.

Outcomes-Based Risk-Sharing

There are several examples of medical technology companies that have successfully managed to achieve payer reimbursement with innovative agreements, most commonly through use of outcomes-based risk-sharing models. An outcomes-based model requires that products meet specific and timed clinical targets to be eligible for reimbursement. This model can reduce the risk of funding for unsuccessful treatments with medical devices and help address the issue of limited data supporting product efficacy and safety at launch.

In one example, Medtronic negotiated an outcomes-based risk-sharing agreement with hospitals that offer its TYRX technology, an absorbable antibacterial envelope used with pacemakers, implantable defibrillators, and neurostimulation implants for the prevention of infections.1 While the TYRX technology offers significant clinical benefit compared to traditional and lower-cost antibiotic treatment post-implantation, the cost is higher. Historically, the cost to treat a single infection and replace an infected implant has been relatively high — roughly $48,000 to $83,000 in the U.S. and £31,000 in the UK. Medtronic negotiated an outcomes-based risk-sharing agreement in which the company agreed to pay select costs to replace an infected device that was fitted with the TYRX envelope to address payer concerns.2 The design of this agreement allows payers to easily track the number of patients who receive the TYRX envelope and their treatment outcomes. Medtronic reported rapid growth of its TYRX envelope technology, especially in the U.S., following payer adoption of its innovative agreement.

Similarly, Cardiva Medical implemented outcomes-based risk-sharing agreements with several U.S. medical centers for VASCADE, a technology primarily used to close puncture sites in large vessels in the femoral vein.3 In cases wherein treated patients experience complications post-surgery, Cardiva agreed to cover select associated costs. Following broad payer adoption of this outcomes-based risk-sharing model, the company has reported decreases in site closure-related complications and associated management costs.

Risk-Sharing With Mutual Gains

Risk-sharing agreements coupled with mutual gains are another pricing option that medical device companies are proposing to gain payer reimbursement. In these types of agreements, device manufacturers offer financial advantages such as lower product prices compared to alternative devices. Concurrently, payers agree to share a mutually agreed-upon percentage of cost savings or revenue gains. Payers are also often given the option to renegotiate the price of a product.

Medtronic recently implemented this type of risk-sharing model for its MiniMed insulin pump system, the first hybrid closed loop system able to automate insulin delivery to patients. Self-adjusting insulin pumps, including the MiniMed system, have been shown to improve clinical outcomes and reduce diabetes-related healthcare costs. However, many payers and health insurance companies decline to cover novel technologies for diabetes care because, in most cases, patients already use multiple daily insulin injections, and the introduction of new insulin pumps may cause unnecessary disruption in care and costs. Medtronic negotiated a risk-sharing model with Aetna in 2017 in which they provided the MiniMed system for a discounted price in exchange for payments based on patient outcomes (e.g. achieving target HbA1c levels) and differences in the total cost of care.4 With this model, Medtronic and Aetna are able to share savings for delivering or exceeding clinical outcomes and target costs.

In another example, Bruin Biometrics LLC entered into a risk-sharing agreement with healthcare providers in the UK for its Provizio Subepidermal Moisture (SEM) Scanner, which is used for pressure injury or ulcer risk assessments.5 The mutual gain in this agreement is reflected in the fact that payments to Bruin Biometrics are tied to the early detection of tissue damage and the prevention of ulcers.

Coverage with Evidence Development (CED)

Many device manufacturers have also recently adopted pricing models in which payers offer full or partial reimbursement for a limited time based on the condition that additional safety and efficacy data will be collected and provided for review. Companies such as Boston Scientific and Edwards Lifesciences have implemented such reimbursement models to address payer concerns about limited clinical evidence and proven value of new devices. This innovative approach is seen with reimbursement of the transcatheter aortic valve implantation (TAVI) technology in the treatment of symptomatic aortic valve stenosis through CED models in South Korea and the U.S.6,7 Payers in South Korea provide partial reimbursement for the high-cost TAVI technology based on real-world evidence and data collection. Payers also require that the TAVI technology is re-evaluated by health technology assessment (HTA) bodies every three years. Conversely, the Centers for Medicare & Medicaid Services (CMS) in the U.S. offers a national coverage policy for TAVI for FDA-approved indications and for uses currently being assessed in clinical trials.

Under a similar CED scheme in Japan, Terumo Medical Corporation offers its HeartSheet technology to patients for the treatment of severe heart failure caused by chronic ischemic heart disease.8 As a new and innovative product, Japanese payers issued conditional approval in May 2019 for a period of eight years. During this time, Terumo must perform comparative clinical studies to continue to demonstrate the safety and efficacy benefits of HeartSheet over traditional treatment approaches.

Value-Based Healthcare Or Procurement

Sometimes healthcare providers or payers traditionally purchase specific medical devices such as implantable cardioverter defibrillators (ICDs) through procurement schemes, which can limit the option to offer value-based healthcare. When patients are implanted with ICDs to treat abnormal heart rhythms, device manufacturers often need to offer comprehensive support services, including technical assistance and remote monitoring to both patients and healthcare providers to guarantee outcomes.9

For example, in 2016, Medtronic collaborated with the Catalonian Agency for Health Information, Assessment and Quality to establish a procurement model to be able to provide more holistic and value-based healthcare to patients who received ICDs.10 The agreement included a €10 million budget for providers to purchase ICDs over the course of four years, and has resulted in a 10% decrease in outpatient visits and implant-related complications, and an increase in collaboration among patient care teams. Based on the success of this value-based procurement agreement, other providers and hospitals in Catalonia are now developing similar contracts.

While there are now several examples indicating that payers are becoming more comfortable with innovative pricing and contracting agreements to support new medical devices shown to provide tangible benefits, there are still uncertainties and concerns. A key challenge is that new technologies must be supported by efforts in payer and clinician education to help demonstrate a product’s value. In cases wherein payers require real-world evidence and outcomes data, manufacturers need to ensure that this information can be easily tracked within healthcare systems. Manufacturers also need to demonstrate a clear benefit (e.g., improved patient outcomes and/or cost savings) for payers to engage in risk-sharing agreements and anticipate that some payers may require regular product reviews or assessments to continue to guarantee reimbursement. To ensure payer buy-in and reimbursement, innovative agreements with risk-sharing elements need to be supported by robust safety and efficacy data, incorporate new and potentially previously untried financial approaches, and lead to a situation that both parties view as beneficial.

References:

- https://www.medtronic.com/us-en/healthcare-professionals/products/cardiac-rhythm/absorbable-antibacterial-envelopes/tyrx-envelope.html

- https://www.medpagetoday.com/cardiology/prevention/66113

- https://www.cathlabdigest.com/content/creating-clinical-and-economic-value-through-risk-sharing-agreements

- https://www.reuters.com/article/us-medtronic-aetna-diabetes/medtronic-deal-with-aetna-ties-insulin-pump-payment-to-patient-results-idUSKBN19H1GB

- Liu, H. et al., “Options for Medtechs in a Value-based Care World,” Informa Pharma Intelligence, (November 8, 2017).

- https://www.cms.gov/medicare-coverage-database/details/nca-decision-memo.aspx?NCAId=293&bc=ACAAAAAAQAAA&

- https://e-kcj.org/DOIx.php?id=10.4070/kcj.2018.0117

- https://www.terumo.com/pressrelease/detail/20160606/299/index.html

- https://www.medtronic.com/us-en/healthcare-professionals/products/cardiac-rhythm/managing-patients/improved-outcomes.html

- https://www.esadeknowledge.com/view/could-public-procurement-boost-innovation-190000

About the Authors

Joanne Clark is a vice president in Charles River Associates (CRA)’s Life Sciences Practice. She is a career business consultant with 20 years of experience solving strategic issues for clients globally. Clark has extensive expertise in global pricing and market access issues and has worked with regional and global business units on brand and above-brand consulting projects. She has extensive experience in pricing and market access assessments for medical devices, including hospital-procured products.

Joanne Clark is a vice president in Charles River Associates (CRA)’s Life Sciences Practice. She is a career business consultant with 20 years of experience solving strategic issues for clients globally. Clark has extensive expertise in global pricing and market access issues and has worked with regional and global business units on brand and above-brand consulting projects. She has extensive experience in pricing and market access assessments for medical devices, including hospital-procured products.

Bhavesh Patel is a principal in CRA’s Life Sciences Practice. He is an experienced strategy consultant with more than eight years of experience in the life sciences industry. He has worked on topics such as pricing and market access, value perception, brand strategy, and launch readiness for life sciences companies. Patel has experience in pricing and market access and commercial assessment projects, including those involving medical devices.

Bhavesh Patel is a principal in CRA’s Life Sciences Practice. He is an experienced strategy consultant with more than eight years of experience in the life sciences industry. He has worked on topics such as pricing and market access, value perception, brand strategy, and launch readiness for life sciences companies. Patel has experience in pricing and market access and commercial assessment projects, including those involving medical devices.

Mireia Cortina is a senior associate in CRA’s Life Sciences Practice. She has seven years of strategic consulting experience in the life sciences with a focus on market access strategy and innovative value-based schemes.

Mireia Cortina is a senior associate in CRA’s Life Sciences Practice. She has seven years of strategic consulting experience in the life sciences with a focus on market access strategy and innovative value-based schemes.

The views expressed herein are the authors’ and not those of Charles River Associates (CRA) or any of the organizations with which the authors are affiliated.