Emerging Technologies And Price Cuts Push The Latin American Dental Implant Market Forward

By Salma Mashkoor and Kamran Zamanian, Ph.D, iData Research Inc

Dental implant fixtures are artificial tooth roots that function to support a missing tooth restoration and aid in the prevention of jaw bone loss1. Throughout Latin America, the dental implant fixture and final abutment market is disproportionately driven by cost-sensitivity. The market in Brazil is predominately composed of local dental companies offering value-priced products, with a great deal of tariffs and expenses that prevent international competitors from penetrating the market. International corporations are even more restricted in Argentina, where the economic conditions are especially troublesome. Due to poor income standards, the bulk of the population in Argentina does not have the financial means for an expensive dental procedure.

The volume of dental implant fixtures and final abutment units in Brazil outnumbered that of any other Latin American country. Brazil is the world’s second-largest market for dental implants, trailing only the United States. The high level of activity within the Brazilian implant market is largely due to the sheer size of the population, which exceeded 200 million in 20163. Furthermore, the number of dentists in Brazil is large, exceeding the volume of dentists in the United States2.

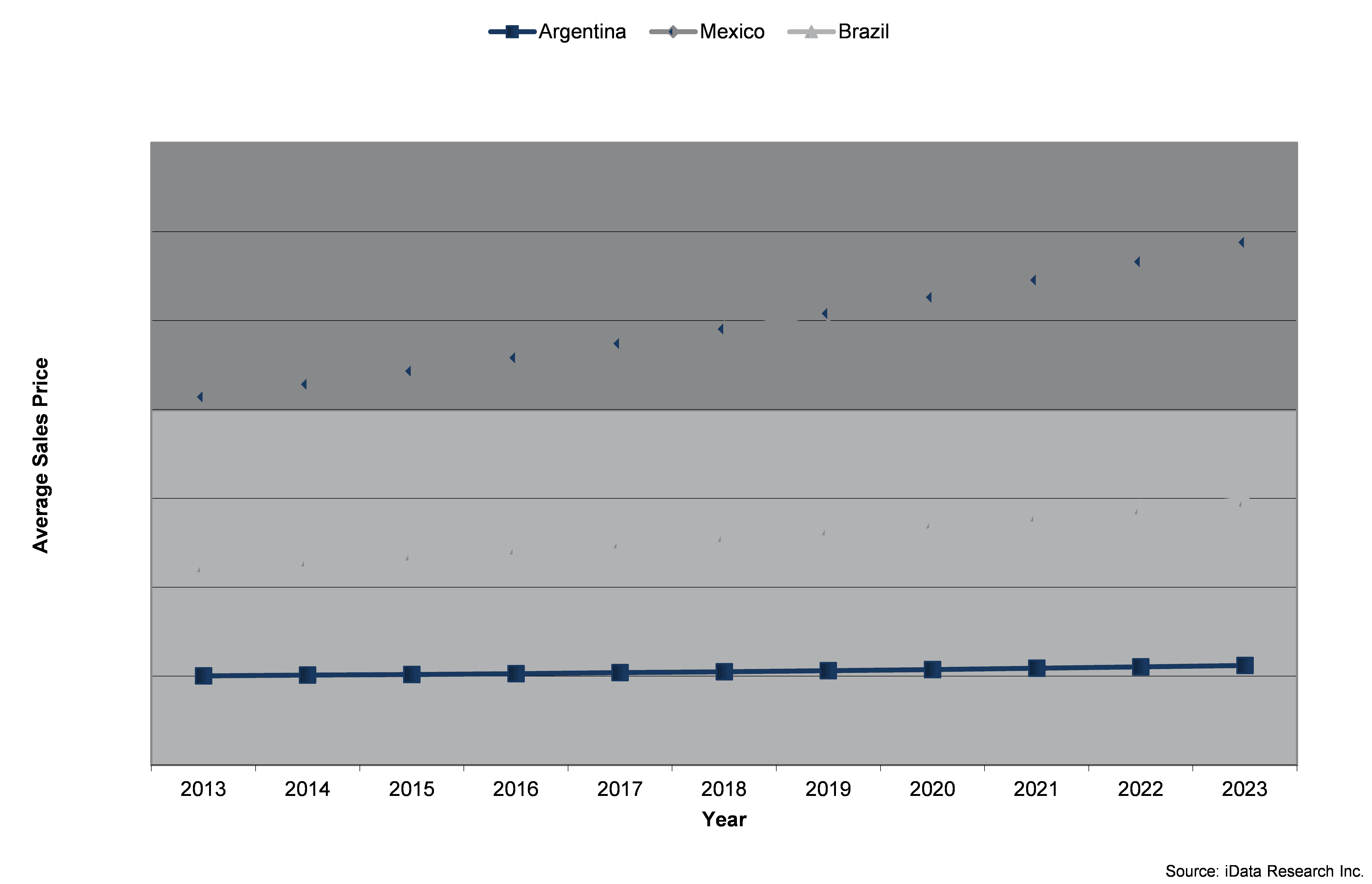

The high-priced market in Latin America is represented by Mexico, where a considerable fraction of international patients are stimulating growth for expensive products, permitting rapid development of premium implant fixtures and abutments4. Aside from these regional differences, the Latin American market for dental implant fixtures and final abutments is evolving in response to emerging support technologies and competitive price pressures.

Emerging Support Technologies

CAD/CAM custom abutments and computer-guided surgery are the most notable emerging technologies on the market in Latin America. Although these developments have been around for quite some time, they have been slow to gain acceptance due to financial constraints1.

Traditionally, stock abutments have been the preferred choice of many implantologists, as they are relatively inexpensive and their titanium-base is stable5. However, CAD/CAM alternatives undoubtedly provide a better fit and an aesthetically-appealing solution5. Mexico has decent utilization rates of these advancements, resulting in higher income levels for Mexican dentists. The use of modern equipment has been further encouraged by the money dental tourists bring to the market. Dental tourism is a major attraction in Mexico, luring in customers with wider budget ranges and enhancing the proportion of premium product sales4. As a consequence, nearly nine percent of final abutment unit sales in Mexico in 2016 were attributable to purchases of CAD/CAM abutments1. This has enabled a larger proportion of dentists to adopt many of the new technological advancements to help further drive their implant business. The Argentinian market, on the other hand, sold the fewest units of CAD/CAM abutments, as a direct result of its weaker economy1. As the technology becomes more affordable and developed, it is expected to grow within the respective regions.

Similar to the trends observed within the CAD/CAM abutment market, Mexico also represented the high-growth market for computer-guided surgery, whereas Argentina continued to be stunted by financial shortages and economic incapacities1.

Price Competition

Implantologists across Latin America often base their purchasing decisions on the most cost-efficient solutions. Several dental companies have engaged in competitive price cuts to accommodate such needs. As such, a variety of companies offering inexpensive implant fixtures and stock abutments have managed to dominate the market. These companies spend far less on marketing, research, and development than major international implant manufacturers, allowing them to remain profitable while selling implants at far lower prices1. Implants from international companies sell at a premium due to their brand power, but their market share is limited because few dentists are willing or able to pay the premium. As such, even the multinational corporations have engaged in price-cutting to compete with the vast assortment of cheaper, local alternatives6. Although the mark-downs on implant fixtures and final abutments do benefit the bulk of the nation that is unable to afford such treatments, they have greatly depressed the overall growth potential of the market1.

Prices in Mexico are relatively high in comparison to Brazil or Argentina, largely due to the dominance of international companies. In recent years, there was a change to the regulatory standards for dental companies in Mexico, leading to a reorganization of the competitive infrastructure. Additionally, a movement towards more cost-effective solutions facilitated the emergence of multiple local companies1. However, as these brands still are in their infancy, their quality does not measure up to the products provided by the big companies, such as Straumann or Nobel Biocare1.

Competitive Analysis

The competitive landscape for dental implant fixtures and final abutment products varies significantly between the countries in Latin America. This is predominately due to the increasing popularity of local companies within each region, which tend to provide products at a lower price point. Premium-priced Straumann was the only competitor that managed to maintain a significant presence in all three countries: Brazil, Mexico and Argentina7.

Straumann caters to a niche of high-end consumers and has maintained a steady profit margin by providing only minimal discounts on their products. Despite the widespread tendency to favor inexpensive dental products, Straumann benefited from continued strong sales of its bone-level implants in Latin America, and its introduction of Roxolid. The combination of Roxolid and SLActive surfaces is designed to address high forces (demonstrating good osseointegration) and any issues related to the reduced diameter of the company’s implants1.

Straumann also made strides on the final abutment market in 2014 with the launch of its Variobase hybrid abutment, which uses titanium-alloy bases with full contour crowns that have the potential to be one-third the price of conventional abutments with copings and crowns1. Technologically advanced products provided by Straumann will ensure its continued presence in Latin American nations.

About The Authors

Salma Mashkoor is a research analyst at iData Research. She is the lead researcher for the 2017 Latin America Dental Implant Report Suite, which included a collection of reports on Brazil, Argentina, and Mexico. Her current work includes the 2017 Latin America Dental Implant, 2017 Latin America Bone Graft Substitute, and 2017 U.S. Dental Materials Report.

Kamran Zamanian, Ph.D., is president, CEO and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research is an international market research and consulting firm, dedicated to providing the best in business intelligence for the medical device industry. Our research empowers our clients by providing them with the necessary tools to achieve their goals and do it right the first time.

We have built a reputation and earned our clients’ trust based on consistent and uniquely intelligent research that allows our customers to make confident decisions and impact their businesses. A combination of market expertise and over a decade of experience has resulted in a deep understanding of the medical device industry that has inspired innovation and propelled our clients to success.

References

-

Brazil Dental Implant Market – 2016. iData Research.

-

Straumann. (2012). Straumann to acquire 49% of Neodent, Brazil’s leading dental implant company [Press release].

-

Brazil Population. (2016). Retrieved Feb. 1, 2017, from Trading Economics.

-

Dental Tourism in Mexico. Retrieved February 1, 2017, from Medical Tourism Corporation website.

-

Hahn, J. The Clinical Advantages of Custom Abutments: Why Customization is Rendering Stock Abutments Obsolete. Inclusive Magazine, 4(2).

-

Straumann Implants in Mexico. (2016, June). Retrieved Feb. 1, 2017, from DentaVacation website.

-

Straumann. (2012, May 16). Unlocking the full potential of emerging markets [Press release].