European Diabetes Care Market Shaped By Innovation, Shifting Competitive Landscape

By Artur Kim and Kamran Zamanian, Ph.D., iData Research Inc.

Diabetes mellitus, commonly referred to as diabetes, is a chronic disease that is characterized by defects in insulin production or usage, or a combination of the two, and affects approximately 415 million people worldwide.1 The European market for diabetes monitoring, treatment, and drug delivery currently is undergoing significant changes in response to technological innovation, pricing pressure, and an expanding competitive landscape. The major segments affected by these changes are insulin pumps, continuous glucose monitoring (CGM), blood glucose test strips, and insulin pen needles.

Increasing Demand For Insulin Pump Therapy And CGM

Diabetic patients are transitioning from traditional medical devices, such as blood glucose meters, insulin pens, and syringes, towards modern products that offer less-invasive solutions and inter-device communication.2 Included in this category of less-invasive products are the CGM and insulin pump segments, which are experiencing particularly high growth in Europe.2

Although the insulin pump market penetration rate is over 30 percent among diagnosed type 1 diabetics in the United States, the market in Europe is generally smaller, with some countries exhibiting less than 5 percent penetration.2 This discrepancy can be attributed to market access issues in Europe, such as the high initial cost of traditional pumps, resulting in unfavorable reimbursement policies and unwillingness of healthcare insurers to cover patients’ treatment costs. Another factor is healthcare professionals’ lack of training and knowledge regarding pump therapy, which significantly reduces its frequency as a prescription for treatment of diabetes. There are exceptions to these circumstances, including Scandinavia, the Netherlands, Germany, and France, which have had historically high penetration rates, ranging from 15 percent to over 30 percent.3,4 Furthermore, pump intake is starting to grow in regions that were relatively slow adopters of pump therapy, especially among the pediatric patient population.2

Growth of the insulin pump market can be attributed to the increasing popularity of CGM-integrated pump systems — both CGM sensor-augmented pumps and conventional pumps compatible with standalone CGM systems. The U.K.’s National Institute for Healthcare and Excellence (NICE) recently recommended sensor-augmented pump therapy as the optimal treatment for type 1 diabetes, due to its ability to perform automated suspension of insulin, thereby decreasing the risk of hypoglycemic episodes and potentially reducing costs for national healthcare organizations and patients.5 Advancements in CGM-integrated pump systems will be driven by the ongoing development of the first commercially available artificial pancreas (AP), and the products that are released in the interim.6 Current product offerings allow patients to substitute their smartphones as CGM receivers, transmit CGM data to insulin pumps, and upload device data to cloud servers to share with physicians, family members, and others.

Recent clinical trials also have shown evidence of sustained improvement in glycemic control in type 2 diabetics on pump therapy, relative to those on multiple daily injection (MDI) therapy.7 These findings demonstrate a large opportunity for the pump market, because type 2 diabetics represent approximately 90 percent of the total patient population, and currently are not covered under pump reimbursement policies.1,2

Pricing Pressure And Regulatory Developments In Test Strip And Pen Needle Markets

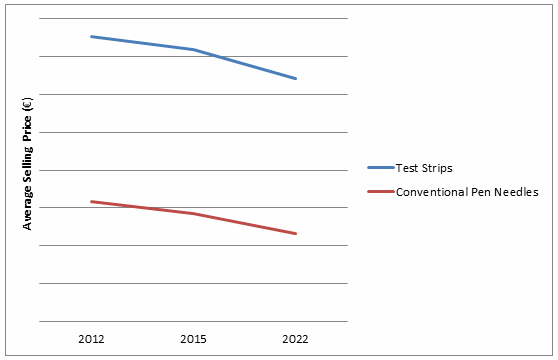

Blood glucose test strips and conventional pen needles represent the consumable components of their respective markets, and therefore generate high-volume unit sales on an annual basis. Both markets have recently experienced a large influx of low-price competitors that have put downward pressure on prices and contributed to market value contractions in certain regions, despite steady unit sales growth.2 The increased number of competitors has decreased the dominance of traditional market leaders, such as the “big four” (Roche, LifeScan, Abbott, and Ascensia) in blood glucose monitoring, and Becton Dickinson in the pen needle segment.

Budgetary pressure on national healthcare expenditure also has contributed to price erosion, as physicians often are encouraged to prescribe the most cost-effective products, provided they fulfill the patient’s health needs.2 Other barriers in the test strip market include restrictions on the quantity of test strips that can be prescribed to each patient per year, and reimbursement eligibility limited to insulin-dependent patients only.2,4 Additionally, tendering processes in markets such as Spain and certain regions of Italy will continue to erode test strip and pen needle prices.2

Safety pen needles, on the other hand, are experiencing substantial growth in the professional setting due to a recent change in healthcare regulation. The European Union (EU) Directive on Prevention from Sharps Injuries in the Hospital and Healthcare Sector was introduced in 2010, and became legally binding in 2013.8 The Directive’s goal is to achieve the safest possible working conditions in the healthcare sector by preventing injuries from medical sharps, such as insulin syringes and pen needles. Enforcement of this regulation has been the primary driver behind growth in the safety syringe and safety pen needle segments, which are specifically designed to prevent needle-stick injuries from occurring. The degree of enforcement varies across regions, and will affect each market accordingly.

Expanding Competitive Landscape

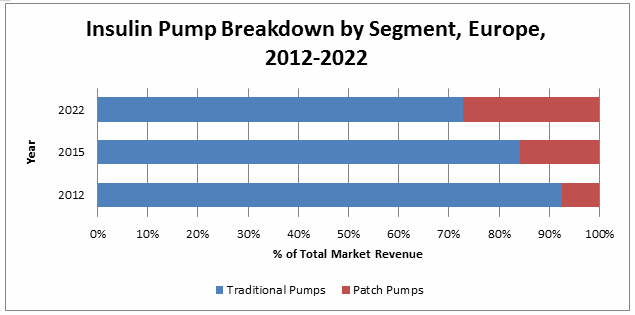

The competitive landscape for diabetes monitoring, treatment, and drug delivery products is rapidly changing, and numerous competitors are expected to enter the European market in the near future. Medtronic’s MiniMed 640G will see its leading position challenged, as companies like Cellnovo, Ypsomed, ViCentra, and others enter the insulin pump market. As a result of this growing number of alternative products, traditional pumps will continue to lose share of the total insulin pump market. Additionally, the insulin pen market will be disrupted by the emergence of simple pumps, or simple infusers, that specifically target the type 2 diabetic population.

Meanwhile, in the CGM competitive landscape, DexCom’s G4 PLATINUM and G5 Mobile will face increased competition from innovative new products that include Senseonics’ implantable 90-day CGM Eversense product, which will be distributed by Roche in Germany, Italy, and the Netherlands. Another disruptive technology is Abbott’s FreeStyle Libre, a flash glucose monitoring (FGM) system that was launched in late 2014 and has been met with outstanding demand in the European market. FGM is described as a hybrid between a blood glucose meters and a CGM, because it uses a wearable sensor to measure glucose levels through the interstitial fluid, but users must manually perform “scans” each time they would like to view a reading from the device. Due to its factory calibration, finger sticks are not required for the FreeStyle Libre, making it a viable and cost-effective alternative to CGM.

Overall, technological innovation, changes in the competitive landscape and continued growth of the diabetic patient population will be the main drivers of the European diabetes care market moving forward.

About The Authors

Artur Kim is a research analyst at iData Research and was the lead researcher for the 2016 European Diabetes Monitoring, Treatment and Drug Delivery Report Suite. His current work includes the 2016 U.S Diabetes Monitoring, Treatment and Drug Delivery Market Report Suite.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research is an international market research and consulting group focused on providing market intelligence for medical device and pharmaceutical companies. iData covers research in: diabetes drugs, diabetes devices, pharmaceuticals, anesthesiology, wound management, orthopedics, cardiovascular, ophthalmics, endoscopy, gynecology, urology, and more.

References

- International Diabetes Federation. IDF Diabetes, 7 ed. Brussels, Belgium: International Diabetes Federation, 2015. http://www.diabetesatlas.org

- Europe Diabetes Monitoring, Treatment and Drug Delivery Market – 2016. iData Research.

- Renard, E., 2010. Insulin pump use in Europe. Diabetes Technol. Ther., 12: S29-S32. DOI: 10.1089/dia.2009.0189

- Euro Diabetes Index 2014

- NICE Published Guidance http://www.nice.org.uk/guidance/dg21

- Francis J. Doyle, Lauren M. Huyett, Joon Bok Lee, Howard C. Zisser, Eyal Dassau

- Diabetes Care May 2014, 37 (5) 1191-1197; DOI: 10.2337/dc13-2108

- Aronson R, Reznik Y, Conget I, Castañeda JA, de Portu S, Runzis S, et al. Sustained efficacy of insulin pump therapy, compared with multiple daily injections, in type 2 diabetes: 12-month data from the OpT2mise randomized trial. Diabetes Obes Metab. 2016 doi: 10.1111/dom.12642.

- Council Directive 2010/32/EU of 10 May 2010 implementing the Framework Agreement on prevention from sharp injuries in the hospital and healthcare sector concluded by HOSPEEM and EPSU [OJ L 134, 1.6.2010, p. 66–72]