European Orthopedic Trauma — Anomalies & Disruptors In A Mature Market

By Fallyn Thompson, Jeffrey Wong, and Kamran Zamanian PhD, iData Research Inc.

Orthopedic trauma is a long-established market influenced by predictable drivers and limiters. Making up the established European market are plates and screws, cannulated screws, intramedullary nails and hip nails, conventional hip fixation and external fixation. Biostimulation devices are an established technology; however, resurgence in bone stimulation makes this a dynamic market.

The overall market value is in decline, which is surprising, given that unit sales are increasing consistently across Europe, facilitated by an aging European population. As people grow older, they naturally lose bone density, causing an increased likelihood of bone fractures. Due to the severe nature of orthopedic trauma injuries, treatment is rarely optional, creating stability in patient volume.

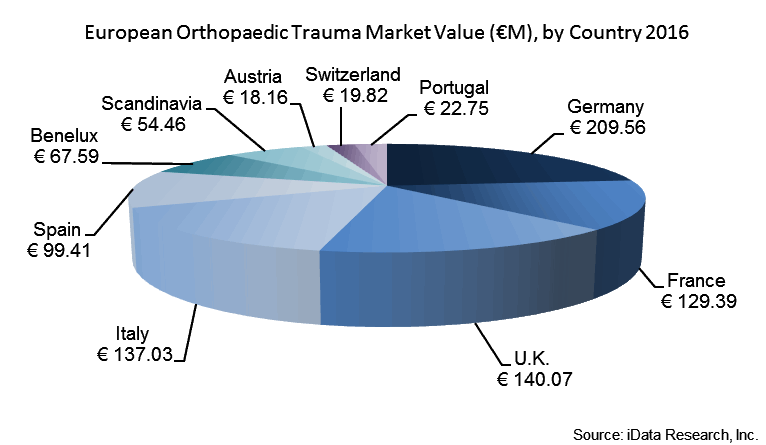

Still, despite the increasing number of patients and procedures, the average sale price (ASP) of these trauma devices is in decline. The maturity of the orthopedic trauma market creates significant competition for established devices, leaving price as the largest differentiator between manufacturers. In 2016, the European market was valued at over €898 million, and it is projected to decline to around €883 million by 2023.

Disrupting the industry are technological advancements replacing traditional orthopedic trauma devices. The influx and rapid adoption of newer technologies — such as locking/hybrid systems, more expensive materials (i.e. titanium), and anatomical contouring — are helping to maintain the ASP. Furthermore, as physicians invest in superior technology, the choice of procedure used to treat certain injuries is changing.

Intramedullary Nails Vs. Plate-And-Screw Hip Repair

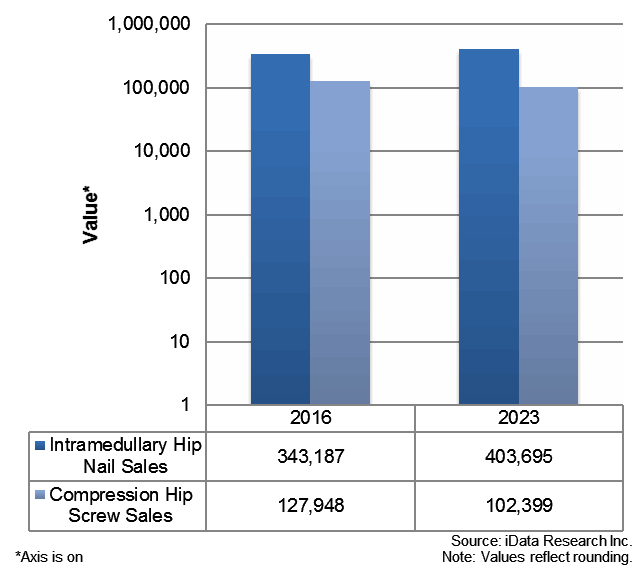

Surgeons are being taught or re-trained to use intramedullary nails (IM), rather than compression hip screws, to repair hip fractures. This transition is due to the shorter length of surgery, lower complication rates, and less bleeding associated with IM nails. In addition to their surgical benefits, IM nails also tend to offer better weight-bearing characteristics than plate-and-screw fixation in the types of fractures for which they are typically indicated (long bones, ankle, and wrist). In contrast, IM nails can require longer incisions to achieve reduction, and there is a greater risk of improper placement of the head screw, creating the potential that repeat surgeries will be required. The outcome is that, while IM nails require a more complex procedure, they are likely to produce a superior outcome. The erosion of the compression hip screw market is largely dependent on education, marketing, and availability of physician training.

The higher unit growth rate within the IM nail and trochanteric hip nail segments, as compared to plate and screw, shows the increasing adoption rate of this treatment option throughout Europe. IM nails are more expensive compared to plates and screws, helping to stabilize the overall market value.

IM nails are exemplary of the changing trends across Europe. The way orthopedic trauma devices are purchased throughout Europe depends on where the manufacturer is located, whether sales are direct or through a distributor, and whether the sale is private or through a tender competition. Public and private tenders are common throughout Europe, and also influence the consistent downward pressure on ASPs.

Additionally, orthopedic trauma requires uniformity in device manufacturing. For example, a manufacturer’s plates will only work with the same manufacturer’s screws. This creates a halo effect for market share, helping to reinforce that the same manufacturer’s brand continues to be selected. Adequate support and staff training are also key to retaining clients. If the support is good and staff is trained on the existing system, it can often be more trouble than it’s worth to retrain medical staff on a new manufacturer’s product portfolio. The stability of market share within the orthopedic trauma market is an anomaly compared to other specialties and types of orthopedic devices.

Germany and Austria have the greatest number of competitors in the IM nail market. Scandinavia is unique in that there are only three top competitors, compared to the four-plus competitors present in all other European countries and regions.

Across Europe, ASP decreases in this market range from a modest -1.7 percent to -3.1 percent, depending on the country. Italy offers one of the most expensive ASPs, while France maintains one of the lowest price points. The shifts between countries preferring traditional methods or new technology are all unique, with less uniformity than past years.

Biostimulation

Biostimulation is not a new technology; however, as hospital costs increase and available resources are increasingly constrained, non-invasive procedures are gaining significant interest. In contrast to the United States, ultrasound technology is growing faster than electrical bone stimulation in the European market.

There are four different types of electrical bone stimulators: pulsed electromagnetic field (PEMF), combined magnetic field (CMF), capacitance coupling external devices, and direct current (DC) internal devices. These devices use varied forms of electromagnetic radiation to treat the fracture. Ultrasound devices are the only bone growth stimulators that do not operate based on electromagnetic principles.

It is important to note that the ultrasound device offered by Bioventus is the only bone growth stimulator in the market that is indicated for fresh fracture treatment. As such, that device’s rate of placement is helping its company capture a large proportion of the total unit volume. Although the split between electrical and ultrasound market seems to be stabilizing, the ultrasound share of the market still is projected to increase over the next several years.

Devices in the orthopedic trauma market are well-established, with long track records of successful results and patient safety. The largest changes are observed in new iterations of traditional devices, such as the adoption of shape-memory staples in lieu of mechanical compression staples. Investments in R&D to achieve increasingly minimally invasive and non-invasive devices will represent the market’s most attractive opportunities for exponential growth.

About The Authors:

Fallyn Thompson is a Senior Analyst and Team Lead specializing in the European Market. Previous publications include Gynaecology and Women’s Health. She is currently researching the Laparoscopy market, due to be published September 2017.

Kamran Zamanian, Ph.D., is a Senior Partner and CEO at iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research is an international market research and consulting firm, dedicated to providing the best in business intelligence for the medical device industry. Our research empowers our clients by providing them with the necessary tools to achieve their goals and do it right the first time.

We have built a reputation and earned our clients’ trust based on consistent and uniquely intelligent research that allows our customers to make confident decisions and impact their businesses. A combination of market expertise and over a decade of experience has resulted in a deep understanding of the medical device industry that has inspired innovation and propelled our clients to success.

References:

Europe Market Report Suite for Orthopedic Trauma Devices 2017 – MedSuite – iData Research Inc.