Factors Shaping The Cardiac Marker, Hematology, And Hemostasis Test Markets

By Atif Nawaz, Alison Casey, and Vishnu Bhargav, GlobalData

We estimate that worldwide sales of disposable reagents for three major in vitro diagnostics (IVD) markets — cardiac marker, hematology, and hemostasis tests — amounted to $5.17 billion* in 2018.

Strong similarities exist across these three IVD markets. For example, all arguably benefit from physician over testing, a practice that many academic publications as well as national and institutional guidelines caution against. Additionally, these markets share many of the same manufacturers, rely heavily on third-party distributors, and contain both point-of-care (POC) and laboratory devices.

There also exist profound differences between these markets and, while the overall value of cardiac marker and hematology test sales is expected to grow over the next decade, we predict the value of hemostasis tests will remain relatively constant. Combined, these three IVD markets are expected to reach $5.75B by 2028

Cardiac marker, hematology, and hemostasis tests are heavily relied upon within healthcare institutions, with applications in emergency departments, physicians’ offices, hospitals, and screening programs. This article explores the global market opportunity for these devices, drawing comparisons over a range of issues expected to impact future sales — including device usage, market trends, and recent regulatory approvals.

Global Market Opportunity, 2018

Cardiac marker tests referred to in this article are devices that measure troponin, brain natriuretic peptide (BNP), and Creatine Kinase - Myocardial Band (CK-MB). The tests are employed for emergency indications, such as acute coronary syndrome (ACS), as well as to diagnose and monitor patients suffering from heart failure (a progressive, chronic condition).

Hematology tests discussed here include complete blood count (CBC) and hemoglobin laboratory tests, as well as hemoglobin, hematocrit, white blood cell (WBC), erythrocyte, and platelet POC tests. These hematology tests are ordered for a range of conditions, including anemia, surgery, pregnancy, and as part of routine blood work. POC Hb and HCT tests are also used to screen whole blood and to source plasma donors.

Hemostasis tests covered in this article are prothrombin time (PT) tests, activated partial thromboplastin time (aPTT) tests, and D-Dimer tests. These devices are frequently used for preoperative coagulation testing of surgery patients, to diagnose venous thromboembolism, and to monitor patients who have been prescribed vitamin K antagonists, such as warfarin sodium.

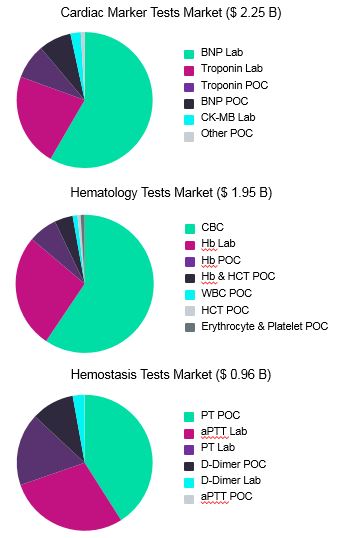

Cardiac marker tests, hematology tests, and hemostasis tests are all commonly ordered devices, and we estimate these markets’ global value at approximately $2.25B, $ 1.95B, and $ 0.96B*, respectively (Fig. 1).

Fig. 1 — Estimated market value, in USD, of different device types contained within the cardiac marker tests, hematology tests, and hemostasis tests markets.*

Our analysis shows that two or three device types dominate each of these IVD markets. For cardiac marker tests, BNP and troponin laboratory tests have the highest sales value. While fewer BNP laboratory tests are sold worldwide than troponin laboratory tests (108.3 million versus 205.9 million), the higher average selling price (ASP) of BNP laboratory tests leads to a larger predicted overall market value ($1.32B versus $0.50B).

Meanwhile, for hematology tests, CBC and hemoglobin laboratory tests generate the most revenue. Here, exceptionally high volumes of CBC test sales grant these IVD devices the highest market value despite their relatively low ASP. Specifically, we estimate that over 2 billion CBC tests were performed globally in 2018, creating approximately $1.16B in revenue. The volume of hemoglobin lab tests was much lower at 189.8 million; however, the higher ASP of this product meant that sales still totaled approximately $0.52B.

Finally, for hemostasis tests, PT POC and aPTT laboratory devices are responsible for approximately 70 percent of global market value. Similar to the cardiac marker tests, the highest-revenue generating device among hemostasis tests is a more expensive product. We estimate that, while the volume of PT POC tests sold is considerably lower than aPTT laboratory tests (91.1 million versus 851.8 million), PT POC tests generate substantially more revenue due to their higher price point ($0.39B versus $0.28B).

Impact of Over Testing

We predict that liberal ordering practices have allowed for strong growth in US sales of cardiac marker tests over the last three years, despite the fact that this IVD market is mostly saturated in Europe. For example, US hospital purchasing data indicates that sales of troponin and CK-MB tests increased dramatically between 2014 and 2018 (Fig. 2A). As there was no concomitant increase in the incidence of ACS, this suggests that the increase in test numbers is coming from suspected ACS patients who undergo cardiac marker testing and test negative (Fig. 2B).

Fig. 2 — (A) Number of troponin and Creatine Kinase - Myocardial Band (CK-MB) tests sold in the US (B) Number of acute coronary syndrome (ACS) and suspected ACS patients tested using cardiac marker tests in the US

In general, troponin is considered the gold-standard cardiac marker for ACS, and tends to be incorporated into all testing strategies. However, a combination of troponin and CK-MB remains the most common testing strategy employed in the US. Additionally, most cardiac marker testing protocols, especially those that include CK-MB, tend to include three time points, rather than two.

Moving forward, we expect North American sales growth of cardiac marker tests will be more limited due to increased oversight and stringency in test-ordering practices. Specifically, we predict that US sales of troponin POC and CK-MB laboratory tests will decrease, whereas sales of troponin laboratory tests will increase — an increase largely attributable to the recent FDA approval of high-sensitivity troponin assays.

While European guidelines recommend the use of high-sensitivity troponin assays for ACS patient management, these devices have only recently become commercially available in the US. Serial testing is not always deemed necessary when using high-sensitivity troponin assays, and this is thought to represent one of many reasons that the number of cardiac marker tests performed per patient tends to be lower in Europe, compared to North America.

Additionally, the European market is expected to exhibit lower rates of supplemental CK-MB testing and reduced POC activities. We predict that high-sensitivity troponin tests will eventually lead to a reduction in the average number of cardiac marker tests performed in the US; however, we expect that this reduction will occur slowly as US physicians take time to familiarize themselves with high-sensitivity devices.

Over testing is also a recognized issue in the hematology and hemostasis test markets, and is likely bolstering current sale volumes. The CBC represents one of the commonly ordered IVD tests. However, numerous academic reports and physician society guidelines now recommend against ordering of routine CBCs prior to low-risk surgeries.

Additionally, it has been suggested that repetitive CBCs in stable patients are unnecessary and can cause phlebotomy-related anaemia [1-4]. We expect that over-utilization of hematology laboratory tests is also being caused by excessive physician ordering practices. One key opinion leader (KOL) stated, “if I’m getting blood drawn, then I will run the basic tests needed for my patient,” which can sometimes translate into redundant tests being completed with no clinical significance.

Similarly, pre-operative coagulation tests are still ordered in most countries and geographical regions, even though there is a growing consensus amongst physicians that, in this scenario, prothrombin time (PT) and activated partial thromboplastin time (aPTT) tests do not provide clinical benefit.

Point Of Care Versus Laboratory Devices

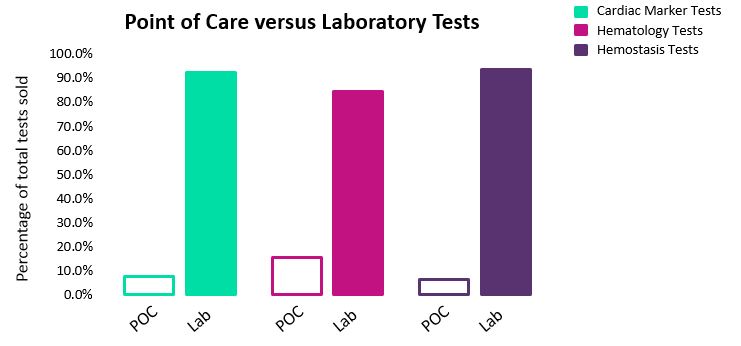

In all three markets, laboratory devices are much more commonly utilized than POC devices (Fig. 3). In general, laboratory based assays are thought of as being more accurate, providing greater insight, and as having cheaper reagents. Conversely, POC devices are capable of more rapid diagnoses and are useful in emergency settings, as well as in rural or remote regions, where access to 24-hour clinical laboratory services is more limited.

Fig. 3 — Percentage of global sales for point of care (POC) versus laboratory devices*

Currently, the POC testing market is heavily reliant on specific niche testing situations; however, as the specificity of tests increase, higher adoption of these devices is expected. In the meantime, we expect that laboratory tests will continue to dominate these markets, and will remain the primary step in diagnosis.

The percentage of global sales attributed to POC devices is slightly higher in the hematology test market then cardiac marker tests and hemostasis tests. This is due to a number of factors, including relatively strong sales of POC WBC tests, and the fact that POC devices are frequently utilized to perform hemoglobin and hematocrit tests on whole blood and source plasma donors. Additionally, panel tests now allow for POC hemoglobin and hematocrit testing alongside other chemistry analytes, which aims to cut down diagnosis time and decrease length of patient stays in emergency departments.

Hematology POC tests represent a complicated IVD market, dependent on a number of factors that often exert opposing effects on device sales. For example, declines in the number of whole blood donations are occurring in many countries around the world, and this is expected to have a negative impact on hematology POC devices.

Conversely, strong ongoing demand for source plasma has led to consistent growth in the number of donations in this sector over the last five years. This trend is expected to continue over the next decade, driving growth of the hematology POC tests market. It should be noted, though, that much of the world’s plasma is produced by commercial blood establishments in countries such as the US and is subsequently transferred to other geographical regions. As such, hematology tests sales performed for source plasma donations will be concentrated within select markets, rather than widespread.

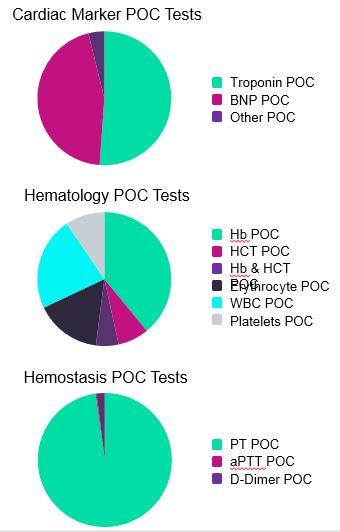

In the hematology and cardiac marker test markets, sales of POC devices are spread across multiple test types. In the hemostasis test market, though, POC sales are largely dominated by PT POC tests. This is due to the substantial proportion of patients worldwide that are still prescribed vitamin K antagonists such as warfarin, phenprocoumon, and acenocumarol (Fig. 4).

Fig. 4 — Market value in USD of the different POC devices contained within the cardiac marker tests, hematology tests, and hemostasis tests markets.*

Patients taking vitamin K antagonists are routinely monitored via hemostasis testing. The typical testing interval is approximately four weeks in many countries, although patients who have recently initiated vitamin K antagonist therapy undergo hemostasis testing much more frequently than those who have maintained a stable dose for six months or more.

Specifically, patients who have recently initiated drugs such as warfarin often undergo PT tests every two days, and then progressively lengthen their testing interval once their International Normalized Ratio (INR) is consistently determined to be within therapeutic range. Although both POC and laboratory devices are used for the monitoring of patients prescribed vitamin K antagonists, POC tests are often employed in this scenario to both facilitate testing in physician offices and enable at-home monitoring.

Expected Impact Of Recent Device And Drug Approvals

Over the last five years, a number of direct oral anticoagulants (DOAC) have received regulatory approval, including apixaban, betrixaban, dabigatran, edoxaban, and rivaroxaban. The impact of these new drugs on the hemostasis test IVD market already is being felt as prescriptions of warfarin and other vitamin K antagonists decrease worldwide. DOAC are also expected to replace some heparin prescriptions, a commonly utilized anticoagulant in countries such as India and China [5].

Patients taking DOAC do not require routine monitoring via hemostasis tests. The ready adoption of DOAC is thus predicted to exert strong negative pressure on the hemostasis tests market, especially for sales of POC PT tests. While laboratory PT and aPTT test sales are also expected to suffer, we predict the adverse effect of DOAC on these two device segments will be mitigated by rising surgery numbers occurring in many countries.

For cardiac marker tests, growth in the number of lab-based troponin tests has been partially driven by the FDA’s recent approval of high-sensitivity assays, as well as the fact that these high-sensitivity assays are widely recommended in other geographical regions.

In January 2017, the Elecsys Troponin T Gen 5 STAT Assay (Roche Diagnostics International Ltd) became the first high-sensitivity (or ultra-sensitivity) troponin assay to receive regulatory approved from the FDA. This assay has been available in Europe, Canada, and the Asia Pacific region for several years, with studies suggesting that it (and other high-sensitivity troponin assays) may facilitate triaging of suspected ACS patients in emergency departments and reduce the need for serial testing in one- to two-thirds of patients.

In June-July 2018, Beckman Coulter Inc. and Siemens Healthineers GmbH secured US FDA 501(k) clearance for their high-sensitivity troponin assays. We expect the introduction of high-sensitivity troponin assays into the US market to increase the popularity of troponin testing and drive sales of this cardiac marker test over CK-MB.

Manufacturers and Third-Party Distributors

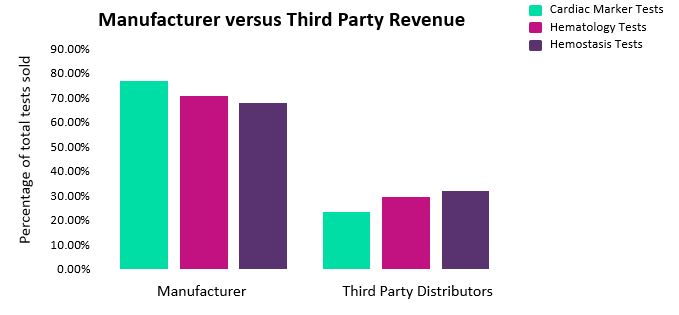

Use of third-party distributors (or vendors) is a common strategy employed in the IVD industry, as it enables manufacturers to both sell their goods more effectively and operate in new or less familiar territories. The cardiac marker, hematology, and hemostasis test markets all exhibit heavy reliance on third-party distributors. Overall, we estimate that approximately 23.2 percent to 32.1 percent of total global revenue for these IVD markets can be attributed to third-party companies (Fig. 5).

Fig. 5 — Percentage of global revenue attributed to manufacturers versus third party distributors.*

We estimate that the proportion of direct versus indirect sales varies considerably, depending on both the device type and manufacturer, with some companies using third-party vendors to carry out over 80 percent of sales for specific product lines. Devices can be sold by a range of third-party vendors, or by one vendor as part of an long-term partnership.

For example, in 1995, Sysmex entered into a worldwide distribution alliance with Dade Behring (now part of Siemens Healthcare Diagnostics) for blood coagulation reagents. In July 2012, both companies renewed this global partnership by signing a five-year global supply, distributorship, sales, and service contract extension, which covers a range of hemostasis laboratory reagents. Similarly, in 2017, Grifols S.A signed an exclusive agreement with Beckman Coulter Inc (Danaher Corp), which allows Beckman Coulter to distribute Grifols S.A hemostasis analyzers and reagents.

Distribution agreements for analyzers and equipment also can positively affect their associated laboratory reagent markets. In 2016, Sysmex entered into a non-exclusive distribution agreement with Medline Industries, which allows Medline to market, distribute, and sell Sysmex hematology analyzers in the US. By expanding sales of Sysmex analyzers to office-based, healthcare practitioners and increasing Sysmex’s installed base of machines, this partnership has potential to drive gains in Sysmex hematology reagents.

In addition to third-party distributors, some noteworthy supply chain agreements exist within these IVD markets. For example, in October 2017, Abbott Laboratories completed its acquisition of Alere Inc. This acquisition included the Triage product line of cardiovascular and toxicology POC tests, as well as supply rights to the Triage laboratory-based BNP assay, which is manufactured by Beckman Coulter Inc (Danaher Corp) and run on Beckman Coulter analyzers. The supply agreement Alere Inc had with Beckman Coulter for the Triage assay is long-standing; it was originally formulated with Biosite Inc in 2003, and transitioned to Alere Inc when that company acquired Biosite in 2007.

Due to anti-trust regulations, Abbott Laboratories immediately divested its newly acquired cardiac marker test devices to Quidel Corp. While Quidel Corp. continues to own these Triage products, Beckman Coulter began legal action against Quidel Corp. late in 2017, seeking rights to sell the latter’s BNP assay directly to its own customers.

In December 2018, the San Diego Superior Court ruled that, while the majority of the agreement will remain in effect for now, the court intends to void the provision that restricts Beckman Coulter from manufacturing or selling a BNP assay to its customers. In response, Quidel Corp announced that it will appeal this court order and continue to argue that Beckman Coulter should honor its agreement with Quidel Corp., as it did with Biosite and Alere.

Conclusion

Altogether, several commonalities exist across the cardiac marker, hematology, and hemostasis test markets, despite the fact that these devices cover distinct patient groups. All three of these IVD markets are large and well-established. Apart from PT POC tests, laboratory-based products tend to command the majority of the market share, and we predict this trend will continue over the next few years.

A myriad of factors determine the future outlook for each of these markets. However, specific parameters — such as physician over testing, strong adoption of DOAC, recent FDA approval of high-sensitivity troponin tests, and changes in the number of whole blood or source plasma donations — are expected to have a significant impact. Finally, revenue distribution within each market is complicated, involving third-party distributors, plus specific agreements or partnerships between manufacturers.

*estimated by GlobalData across 39 countries

About The Authors

Atif Nawaz is a Medical Device Analyst for GlobalData Healthcare across multiple therapeutic areas. Within GlobalData, Atif has experience with the Wound Care, General Surgery, and In Vitro Diagnostics markets, working on market assessment and forecast, including market models and reports. His academic experience includes quantitative and qualitative research methods, health information management, and public health. Prior to joining GlobalData, Atif worked as an Analyst at ConMed Canada and developed an expertise in orthopedics and general surgery while working on ad-hoc projects and liaising with the sales team. Atif holds a BSc (Hons) from the University of Ontario.

Alison Casey is a Medical Devices Analyst at GlobalData Healthcare with a focus on Neurology Devices and In Vitro Diagnostics. Her work collates information from primary participants, key opinion leaders, and secondary sources with real world data to analyze and forecast specific device markets across 39 different countries. Alison has a PhD from Imperial College London, and a strong history of work in oncology. Before joining GlobalData, she worked as a post-doctoral fellow at Princess Margaret Cancer Centre, Toronto where she established collaborations with clinical experts and industry personnel, giving her a thorough understanding of the Canadian healthcare system.

Vishnu Bhargav is a Senior Analyst for GlobalData Healthcare with expertise in In Vitro Diagnostics therapeutic area. He has significant exposure to Cardiovascular, Orthopedics, Wound Care, and General Surgery markets. His work includes developing market models based on in-depth secondary and primary research, competitive assessment, providing market insights and estimates. Prior to joining GlobalData, Vishnu worked as trainee in Vivimed Labs Limited and he holds a MS Pharm degree from National Institute of Pharmaceutical Education and Research (NIPER).

References

[1] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5638475/

[2] https://www.ncbi.nlm.nih.gov/pubmed/29049500

[3] https://academic.oup.com/ajcp/article/147/suppl_2/S154/3059222