5 Steps To Success In Medical Device Clinical Outsourcing

By Joe Popowicz, principal consultant at Emergent Clinical Consulting, LLC

Focus on these areas during study start-up to identify the right partner and secure your trial outcomes.

Even after 10 years, my most uncomfortable breakup is still fresh in my mind. It was a time filled with long bouts of silence and complete misunderstandings. I would ask for something specific, and I would get something completely different in return. Most of the time, it felt as though we were speaking two different languages. We struggled to get on the same page, and I was often left with an overwhelming feeling of frustration. In hindsight, I came to realize that we started off on the wrong foot and should have spent more time getting to know each other. I vowed on the day of that breakup that I would never … select a vendor without a better process.

Although it was a decade ago, the promise is now more important than ever before. Medical device manufacturers continue to adapt to the changing healthcare and regulatory landscapes that demand more clinical evidence, and it is becoming clear that clinical evidence provides a strategic advantage. Whether providing access to the operating room through a value analysis committee review or gaining publications that differentiate products based on their performance, the body of clinical evidence defines a medical device’s success in the market.

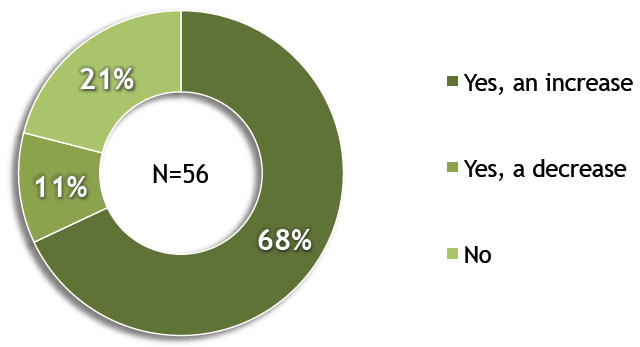

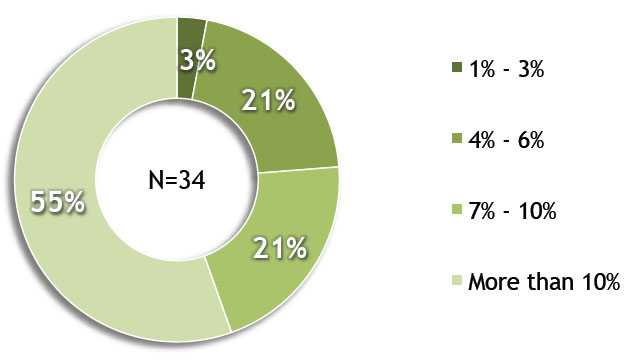

A recent review of ClinicalTrials.gov reveals that medical device trials now account for 10 percent of all interventional trials, the result of a steady increase in recent years.1 With the rise in trial volume comes a need to optimize trials to ensure that sponsors can complete them in a timely manner with the least amount of resources. Corresponding to this trend, a recent Avoca Group survey of medical device sponsor organizations found that 68 percent anticipated an increase in clinical outsourcing over the next three years. In addition, 55 percent of those respondents believed that the increase would be >10 percent over that time period.2

Do you anticipate a change in your amount of clinical outsourcing in the next three years?

Image courtesy of The Avoca Group, Inc.

By what percentage do you anticipate an increase in your amount of clinical outsourcing in the next three years?

Image courtesy of The Avoca Group, Inc.

With an expected increase in outsourcing volume and greater reliance on the model, it is beneficial for sponsors to focus on building a solid foundation and communication plan prior to study initiation. By focusing on five areas during study startup, you can secure the study’s outcome and avoid a bad breakup in your outsourcing future.

1. Determine Core Competencies

Before the first “date” ever happens, start with a clear understanding of what you are looking for in the relationship and the complementary features you value in a partner. Both parties need to convey a clear understanding of what they expect from the relationship in order to build a solid foundation. This is especially true for outsourcing your trial. One of the most crucial steps starts before the proposal leaves your building — gaining a clear understanding of your foundation.

Clarity around areas that will be your company’s core competency and where strategic partnerships will fill the gaps will ensure seamless communication of expectations for the outsourcing strategy. It starts with knowing your assets and how they complement your strategic plan. This is where the road gets bumpy for most organizations, because the focus can be broad, depending on your organization’s capabilities and road map.

Here are four categories of questions to consider when determining your company’s foundation:

Core Competency

- What are the strengths of the current team (study management, clinical monitoring, data management, etc.)?

- Do you have an advocate with an understanding of how to navigate the clinical operations and identify the best vendors in the space?

- Is there a therapeutic or functional area of expertise that you need?

Trial Volume

- Are you a small organization focused on one trial for product approval or a large organization with an extensive clinical portfolio?

- Can your trial volume be leveraged to reduce costs or build process efficiencies?

- Consider the strategic plan for the department. What will the department look like in five years? Will the outsourcing engagement bridge the gap until internal resources can be identified?

Trial Duration

- Will the study duration impact the cost and vendor resource allocation for a trial?

Surgeon/Physician Relationship

- How important is the surgeon or physician relationship to outsourcing decision?

2. Identify Potential Partners

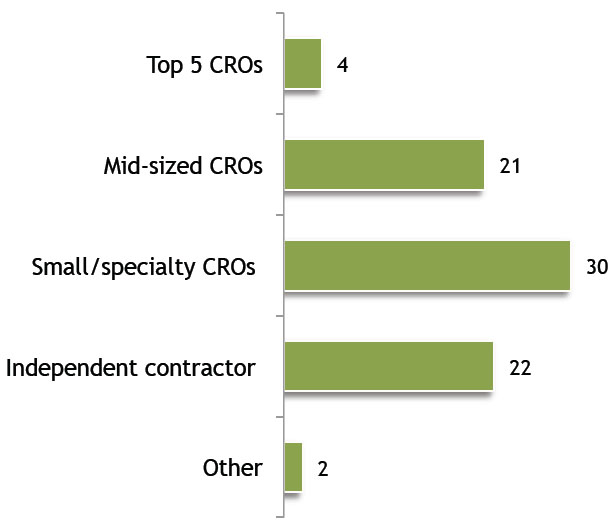

Now that the foundation is set and there is a clear understanding of the needs, it’s time to move into the dating scene — identifying the right partner for your organization. Just as you identified your organization’s core competencies and future plans, it’s important to understand your partner’s niche as well. There is a variety of organizations to choose from: full-service contract research organizations (CROs) of varying sizes, specialty providers focused on specific functional areas of core competency, and independent resources that can act as extensions of the sponsor organization such as consultants and independent contractors. Here are two models to consider during the vendor identification stage:

One-Stop Shop

Using a full-service CRO can provide the added benefit of having one point of contact throughout the life of the study. By hiring a full-service CRO to manage the study, the sponsor will reduce the number of contracts, vendors to manage, etc.

Building A Team

An alternative strategy is to build the ideal team to fit your organization’s needs. By utilizing service providers that specialize in their respective functional areas, a sponsor can select their ideal partner based on their expertise and fit with the organization. This team could be led by a resource within the sponsor organization or by a consultant that can assist the sponsor in identifying and managing the best partners for the trial.

In addition to the type of organization, the diversity of the vendors will also play into the quality of your final decision. Ensure that you invite enough vendors to provide input on your project without having too many proposals to review. During previous engagements, our team has invited as few as four fullservice vendors for a CRO selection and as many as 10 for an electronic data capture (EDC) assessment.

The driving factor in determining the number of invitations was based on our initial confidence in the strategic partners at the onset. In the CRO example where four vendors were invited, it was clear for that study that only a few options would be good fits, and only those vendors were invited to participate in the process. In the case of the EDC assessment, there was a wide array of functionality being considered (delegated study build, self-service options, trial management capabilities, document exchange technology, etc.), so a number of vendors were invited to submit proposals.

When you outsource clinical research services, what types of services do you prefer?

Image courtesy of The Avoca Group, Inc.

3. Standardize Your Materials

At this point, you should have a clear understanding of your organization’s needs and the ideal vendor profile to support your trial; but how do you choose the right partner from the list of options available? A best practice in selecting any service provider is to ensure that there are clear expectations set and that the vendors are being judged consistently across those expectations. Think of it as your dating checklist for vendors.

RFP

A clear RFP ensures that the vendors are receiving consistent information and proposing the appropriate strategy for your organization. Without clear parameters on the study scope, you will likely get varying assumptions in your proposals, which could lead to future change of scopes. Reduce the number of assumptions that need to be made by giving the vendors clear trial logistics in the RFP. Some common study components include trial logistics (sites with locations, subjects, etc.), trial duration (enrollment, maintenance, and followup), number of data pages/points, and monitoring depth/frequency (percentage of source document verification). The more specialized the area, the more specific the assumptions will need to be (i.e., statisticians will need to understand the number of data transfers required if there is a data and safety monitoring board for blinded and unblinded requirements, assumptions on tables, listings, figures, etc.).

In addition to providing the details on the study logistics in the RFP, a timeline for the vendor selection is important to set clear expectations. Even with clear assumptions, there will be questions that arise during the process. The timelines should include a round of vendor questions with your responses, a proposal deadline, and a selection date. Make sure that you share a de-identified set of questions and your responses with all vendors to ensure you receive an “apples-to- apples” set of proposals.

4. Build A Scorecard

It’s time to select your partner; but how do you make the decision while keeping in mind the areas of focus for your organization? To ensure there is close collaboration between the originally identified needs and the selected vendor, build a balanced scorecard.

A balanced scorecard is a weighted tool to help sponsors prioritize the functional criteria and make an objective decision in order to determine the best partner for their organization. The scorecard becomes even more important as the number of sponsor participants increases, ensuring that the views of the group are consolidated into tangible metrics that will assist in the vendor selection process.

When building a scorecard, there has to be clarity on your priorities. Are the costs the biggest driver on vendor selection? If so, be careful of the final outcome, as the lowest cost provider is not always the best option. How does therapeutic or previous medical device experience weigh on your decision process?

Categorize areas, and then score the subcategories with a balanced weighting system, as illustrated in the sample scorecard below. In this example, cost has a 20 percent weight to the overall vendor selection. Each subcategory can be scored between 1 and 10 and then balanced to a weighted average. (A score of 10 in a subcategory will give the vendor 2.22 points because there are nine subcategories.) When building the categories, be sure to have objective measures that are easily assessed during the bid defense, but include one subjective category: a general feeling of having to work with this vendor (their business development approach, the team they present at the bid defense, etc.). Does the team seem trustworthy, knowledgeable, and easy to work with? It’s typically a long engagement process, and sometimes the “gut feeling” should be considered and openly discussed.

Balanced Scorecard Example

5. Select Your Partner

Now that you have received the proposals, it is time to commit to a partner. First, start with a thorough review of the proposals to ensure that all of the components from your RFP have been incorporated. Some areas for consideration during the proposal process include:

- Resource assumptions: Compare resource assumptions across vendor proposals. Are there any discrepancies in assumptions by functional area, job grade, or resource utilization by fulltime equivalent (FTE)? Ensure that there is consistency to avoid future scope creep.

- Price is not always the strongest determinant: The lowest bid is not always the best bid. Make sure that there is a full accounting of the tasks needed to execute the study in order to protect against scope creep due to an underallocated original proposal.

- Apples-to-apples comparison of proposals: Are all of the trial components the same across bids? Ensure that there are no discrepancies between the RFP and proposals in terms of service support, including trial duration, monitoring frequency, data management assumptions, etc.

When all of the proposals are reviewed, there is something to be said for meeting in person. These bid defense meetings have a way of turning into collaboration sessions, which can have tremendous value to the trial outcome and provide inputs for the team during the scorecard completion. A best practice during this time is to communicate to vendors the categories you will be using to make the final decision. This will ensure that they are aware of the important components that you are considering and give them the opportunity to build a presentation tailored to your expectations.

At the end of the process, schedule a readout session for the entire sponsor team. This will be an opportunity to discuss the average vendor scores by category and determine if a clear winner was identified during the process. As with any tool, make sure a dialogue occurs among all members of the sponsor team, so scoring can be openly reviewed and any intangibles can be reviewed.

A “SMART” Case Study

In 2013, Bill Longley, CEO of Scientific Intake, initiated a multicenter clinical trial of the Sensor Monitored Alimentary Restriction Therapy (SMART) device, a nonsignificant risk device for the obesity space. At the time of our working relationship, Bill was far along in the discussions with a CRO to support his upcoming study, but he wanted to validate their experience in the space. We reviewed his goals and initiated a competitive bidding process with three additional full-service CROs and one staffing organization.

When I asked Bill about his experience in implementing a process for vendor selection, he told me, “I now know that finding, selecting, and ongoing management of a CRO is the most important decision a medical device company can make. The decision is complex, and I cannot imagine trying to do this without a methodical process to ensure that we set up the right structure for the trial.

As an entrepreneur, there are a lot of things that keep me up at night, but our process for vendor selection is not one of them.”

By determining Scientific Intake’s core competencies, current clinical needs, and strategic clinical plan, an alternative full-service vendor was identified and selected. This translated into a 23 percent cost savings over the original CRO’s proposal and allowed the company to identify a more experienced partner for the trial. At the time of publication, the trial has completed enrollment and is currently in the followup phase.

Conclusions

Too often, selecting a vendor is viewed as transactional, where the study is regarded as a single engagement in exchange for a set monetary value. In these scenarios, the deeper dynamics of the relationship are ignored, which can ultimately lead to a “breakup” situation like the one I experienced over a decade ago. If you take away one item from this article, it should be that moving from a transaction to a relationship could change the dynamics of the outsourcing approach. This method will help provide clarity on the sponsor’s needs, the vendor’s capabilities, and the best structure to pursue when supporting the trial. By identifying core competencies early in the process, providing clear communication of expectations, and having vigilance in executing the right process for your organization, you can increase the overall success of your outsourcing experience.

About The Author

Joe Popowicz is principal consultant at Emergent Clinical Consulting, LLC. He founded the company in 2013 with the mission of optimizing the clinical trial process for medical device manufacturers while delivering innovations to patients. Although maintaining a small team, the group currently works with a broad range of medical device companies that range in size from members of the Fortune 500 to private, virtual organizations. Prior to starting Emergent, Joe held various positions in the areas of trial operations, enrollment planning, patient recruitment, and data management in both sponsor and vendor organizations. He can be reached at joepopowicz@emergentclinical.com.

Joe Popowicz is principal consultant at Emergent Clinical Consulting, LLC. He founded the company in 2013 with the mission of optimizing the clinical trial process for medical device manufacturers while delivering innovations to patients. Although maintaining a small team, the group currently works with a broad range of medical device companies that range in size from members of the Fortune 500 to private, virtual organizations. Prior to starting Emergent, Joe held various positions in the areas of trial operations, enrollment planning, patient recruitment, and data management in both sponsor and vendor organizations. He can be reached at joepopowicz@emergentclinical.com.

References

1. http://clinicaltrials.gov/ct2/resources/trends#TypesOfRegisteredStudies

2. Avoca Group. “Trends in Medical Device Clinical Outsourcing: Where are we now as an industry and what does the future hold?” Presented at the IIR Partnerships in Medical Device Conference, Chicago, Illinois, June 13-14, 2014