How To Become A MDR Compliance Pioneer

By Peter Rose, Maetrics

European Parliament published the new Medical Device Regulation (MDR) in May 2017. The MDR is an essential revision of earlier Directives, and is intended to establish a robust, transparent and sustainable regulatory framework for medical devices that improves both clinical safety and fair market access for all medtech players.

The specific changes will affect: reclassification including legacy products, reprocessing of single use devices, technical documentation standards, clinical evaluation/evidence standards, vigilance & post-market surveillance, mandatory product liability insurance, transparency through EUDAMED, labelling & the supply chain as well as unique device identification (UDI).

The MDR’s three-year transition period means it will be fully in force by 2020. However, manufacturers that take action now by winning stakeholder buy-in and preparing new business processes stand to gain an ‘early mover advantage,’ with which comes a significant financial opportunity: the MDR Market Opportunity Value.

Industry Capacity Issues

It is fair for manufacturers to assume that they have plenty of time (up until Q1 2020) to comply with the new MDR. However, manufacturers who wait risk that consultants and in-house professionals might already be at full capacity, and therefore unable to assist, at the necessary time. Such manufacturers also are failing to recognise that Notified Bodies (NBs) might be at full capacity, and therefore unable to provide the right certificates at the right time.

The emerging pressures resulting from the MDR for wholesale compliance preparation and certification raise key concerns for the industry.

Notified Bodies

Currently, there is concern about the ability of NBs to service all requirements of the medtech industry. Some NBs have claimed that they are not currently providing quotations for CE Marking services, while others have quoted lengthy lead times for new CE Mark clients. Additionally, NBs will be occupied by a requirement to seek designation under the MDR in the next few months. This issue of capacity for NBs is even more pertinent now, given the multitude of publicised safety issues and breaches, which played a significant role in the new MDR’s development.

NBs already are facing capacity issues: their numbers have dwindled by 20 percent in Europe alone over the last two years, and the new MDR requirements are only going to aggravate this exodus. Couple this with the NBs’ respective Competent Authorities heightening scrutiny of their medical device manufacturers, and it is no surprise that they are in a difficult position. For manufacturers, this necessitates being proactive and factoring in lengthy processes to make sure their NB has enough capacity to assist them.

In-House Capacity

It is no secret that the life science industry is up against a significant skills gap; research shows that up to 80 percent of clinical research professionals work freelance, rather than on full-time contracts[1]. Increased regulation, extreme talent shortages, and the constant pressure to reduce operating costs all are contributing factors motivating companies to consider alternative staff sourcing strategies. Thus, manufacturers who choose (early on) to source external consultants will have a first-mover advantage when it comes to MDR preparation.

The MDR’s Market Opportunity Value

Capacity issues offer early movers a competitive advantage in the same way that they pose temporary market access problems to late adopters. The combination of capacity issues for both in-house personnel and NBs is certainly going to cause a readiness problem for medtech firms who do not invest early on in their compliance preparations.

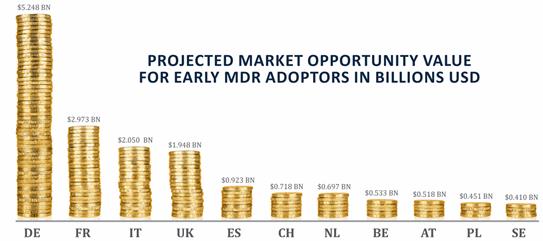

To illustrate the level of opportunity for compliance pioneers, Maetrics has devised a model to demonstrate the Market Opportunity Value (MOV). This estimate values the medical device market that late-moving players could miss out on for the period that it takes them to achieve full compliance. For compliance pioneers, the MOV represents potential additional annual revenues, gained as slow-moving competitors come up to speed with compliance. In fact, manufacturers have admitted that late adopters who unintentionally open their market share to the pioneers may not be able to win back that share.

Maetrics estimates that, across the EU’s ten largest economies, plus Switzerland, the value of medical device markets from which non-compliant manufacturers will be excluded — highlighting the scale of opportunity available to early mover compliance pioneers — is $16.5 billion[2]. The Maetrics MOV model estimates the impact of likely compliance under-capacity in the region at 20 percent of total market value. This is a deliberately conservative model based on interviews with major medtech businesses active in Europe, but gives a sense of scale to the market disadvantage that late movers may experience.

5 Recommendations To Be A Compliance Pioneer

- Develop and implement a proactive and pragmatic MDR compliance strategy as soon as possible

- Appoint team members from different departments of the business to take responsibility for certain processes

- Audit the product portfolio and remove any unnecessary products

- Partner with experienced compliance professionals who can provide guidance through the transition and help develop a comprehensive plan of action

- Book in with Notified Bodies for certification to occur as soon as the NBs are compliant themselves.

Conclusion

Due to the MDR’s impact on so many fundamental medtech processes, expected capacity issues with certifications, and a lack of available preparatory consultants/in-house compliance professionals to fill market requirements over the next three years, the time is now for manufacturers to implement pragmatic strategies to achieve full compliance.

If the market continues in the same manner, then the ultimate result will be that some suppliers will be unable to service their European markets for a period of time, leaving the perfect opening for MDR pioneers to sweep in and fill the gap.

About The Author

Peter Rose, Managing Director Europe, Maetrics, has worked in the medical device industry for over 24 years. He is a lead auditor and a qualified microbiologist, and has been recognized for his extensive experience with sterilization. Mr. Rose also is a Director of Medilink East Midlands, and has lectured at the University of Nottingham, Nottingham Trent University, and the University of Sheffield. He is a member of the Technical Policy Group of the ABHI, sits on the MHRA Medical Device Industry Liaison Group, regularly contributes to industry journals, and is a consistent speaker on industry topics. Mr. Rose holds a B.Sc. degree (Hons) in Microbiology from the University of Sheffield.

[1] Clinical Leader, Clinical Staff Shortage: “Growing Plague” For Pharma & CROs, 6th November 2016

[2] The total market values from which it is derived are based on the latest verified medical market value estimates from a variety of established analysts8. The countries selected represent the top ten EU countries by nominal GDP, plus Switzerland.