Infusion Therapy: Growth In Home And Alternate Care Sectors Supports Market

By Hudson Lynn and Kamran Zamanian, Ph.D., iData Research Inc.

The majority of IV infusions are performed in acute care settings, such as hospitals and other out-patient centers.1 Infusion of medication is a common form of treatment in hospitals across the United States. It is estimated that over 90% of all hospitalizations require insertion of a peripheral IV catheter, and a high percentage of these are connected to an IV set.

Infusion of medication is a common form of treatment in hospitals across the United States. It is estimated that over 90% of all hospitalizations require insertion of a peripheral IV catheter, and a high percentage of these are connected to an IV set.

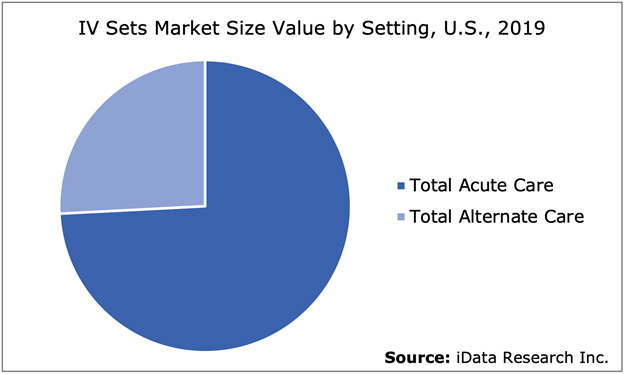

However, a notable portion of the infusion therapy market is also located in alternate care settings, including both out-patient centers and home infusion therapy market segments. In 2019, approximately a quarter of the total market value of the IV sets market was in alternate care. Over the coming years, this portion of the total market is expected to experience strong growth.

Multiple Factors Support Growth Of Alternate Care

One of the strongest drivers in the alternate care market is the shrinking number of hospital beds in the United States. According to data provided by the CDC, the number of hospital beds in the U.S. has been dropping since at least 1975, at which time there was about 1.5 million beds.2 Most recent estimates suggest there is closer to approximately 900,000 beds. However, in that same time frame the U.S. population has been growing from 216 million in 1975 to 328 million in 2019. Additionally, the median age of residents in the U.S. has increased by nearly a decade. Thus, a population that is both increasing and aging population has put an increased amount of pressure on the healthcare system, while at the same time the number of beds has been shrinking.

To combat this, alternate care sites have emerged as a solution. Increasingly often, patients are being transferred from hospitals to alternate care sites to finish receiving care and free up hospital space. Since infusion therapy is a staple of the healthcare system, it makes sense that business in this market would move with its patient base. This shift mainly affects the markets for infusion sets and infusion pumps. It is from these products that the vast majority of the total market revenue is generated, and they are the most widely used devices, as well. However, the shift has also impacted the markets for devices such as needleless connectors, IV filters, and stopcocks.

In particular, notable growth is expected within the home infusion therapy market. Home care is considered a subsegment of the alternate care market. In terms of market share, home infusion therapy comprises a minority segment, but it serves a critical role within the overall market landscape. Treatment in a patient’s own home can be preferable for people who have low mobility or are otherwise unable to be treated within a hospital or other care site.

Growth in the home infusion therapy market is expected to be higher in certain segments than others. Gravity infusion, for instance, is quite popular for home infusion due to its lower cost and ease of use. However, there are also infusion pump segments that should experience notable growth in market share within home infusion, such as electronic ambulatory pumps. These pumps are typically smaller in size and more mobile, making them ideal for the home infusion market.

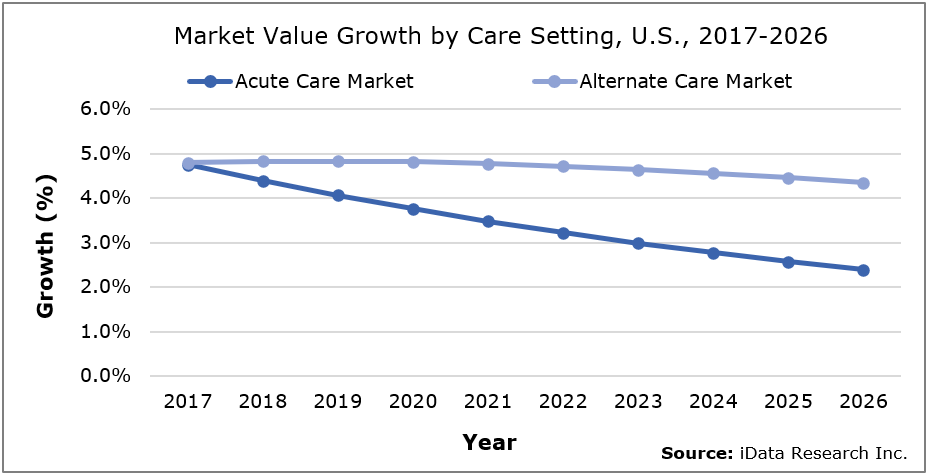

While growth is expected in both acute and alternate care, higher growth rates are expected to be sustained in the alternate care segment, around the mid-single digits. This sustained growth is expected to allow the alternate care market to grow in market share year-over-year as a greater number of infusions are performed in these settings.

COVID-19 Impact On Acute And Alternate Care Markets

The global COVID-19 pandemic has had a significant impact across the healthcare market. Within infusion therapy, the markets for lower-cost disposables are not expected to be significantly impacted. Infusion sets are still an essential component in treating patients, and even though hospitalization rates may take a dip as elective procedures are postponed, many hospitals and alternate sites are expected to maintain their purchase volumes for lower-cost, essential devices.

However, capital equipment markets, such as those for infusion pumps, are expected to take a harder hit in 2020 and possibly beyond. Infusion pumps represent a highly saturated market, and therefore a high percentage of sales are made to replace preexisting devices. These types of purchases can often be postponed by many months, possibly even years, as long as the pump being replaced is not near the end of its expected life cycle. Furthermore, since many healthcare facilities are restricting access to only essential workers and patients, there is no opportunity for company sales representatives to demo new devices, nor can technicians readily enter sites to help setup and integrate new pumps.

That being said, the impact of COVID-19 on the alternate care market is not expected to be as significant as its impact on acute care. As social distancing becomes increasingly important, and hospitals raise concerns about the possibility of being overburdened during the pandemic, more patients are being treated in alternate care sites. In particular, the home infusion therapy market may be impacted the least significantly. During the pandemic, there may be many patients who cannot go to hospitals or other public sites, which increases the use of infusion therapy devices within home care.

Higher Prices In Alternate Care Boost The Total Market

Hospitals and other acute care settings often benefit from group purchasing organizations (GPOs) that allow multiple hospitals to combine their buying power and therefore obtain high-volume discounts from manufacturers. However, alternate care settings traditionally do not receive these same discounts and as a result end up paying a higher cost per device, whether it be a low-cost disposable like IV sets or high-cost capital equipment such as an infusion pump.

The relative premium paid by alternate care sites can vary depending on a range of factors, including device type and manufacturer, but price increases in the range of 10% to 20% are not unreasonable. The higher prices experienced by alternate care sites are also having a positive impact on the total market value. As a higher volume of devices is sold within alternate care, the average selling price across the total market will rise, which supports total market growth.

However, at the same time it is becoming increasingly common for alternate care sites to either partner with or be purchased by larger hospitals. One reason this occurs is to expediate the relationship between the two facilities and allow for easier transfer of patients. In addition, this allows the alternate care sites to begin to benefit from the pricing discounts experienced by the larger sites. As this continues to occur, downward pressure is expected to be applied on the average price paid per infusion therapy device.

Infusion Therapy Market Forecast

Overall, the infusion therapy device market within the U.S. is a fairly saturated space. Most of the device segments have existed for many years and are already integrated within essential healthcare treatments. Therefore, future growth within the market is expected to be moderate but should continue at a consistent pace.

The U.S. population is expected to continue growing and aging, which should ultimately increase the hospitalization rate. In addition, continual updates and improvements to the devices on the market are expected, mostly focused on improving safety features and ease of use. Ultimately, the market is expected to grow at a cumulative growth rate of 2.5% between 2019 and 2026, and the total market value should reach almost $3.5 billion, representing a complete recovery from the COVID-19 pandemic.

About the Authors

Hudson Lynn is a senior analyst at iData Research. He has been involved in custom and syndicated medical device market research projects, publishing the U.S. Infusion Therapy and Vascular Access Report Series. He is currently working on a new report suite on the European Infusion Therapy market.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

About iData Research

For 15 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers their clients to trust the source of data and make important strategic decisions with confidence.

References

- US Market Report Suite for Infusion Therapy Devices – 2020, iData Research Inc.

- https://www.cdc.gov/nchs/data/hus/2017/089.pdf