Innovation Stimulates Growth In The U.S. Gastrointestinal Endoscopic Device Market

By Artur Kim and Jeff Wong, iData Research

The U.S. gastrointestinal (GI) endoscopic device market is increasingly focusing on specialized procedures, such as endoscopic retrograde cholangiopancreatography (ERCP) and endoscopic ultrasound (EUS). This has propelled the launch of innovative devices that address unmet medical needs and drive overall market growth.

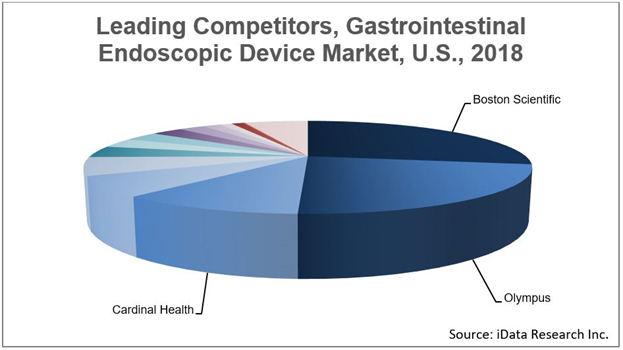

As a result, companies have expanded their market presence through strategic acquisitions and partnerships. Despite the extensive publicity surrounding these new techniques and devices, colonoscopies still account for the vast majority of total GI procedures performed in the U.S. and will continue to have a positive effect on the associated market segments.

ERCP and EUS Innovation

In the past, ERCP procedures were carried out for diagnostic and interventional purposes. However, since the introduction of less invasive diagnostic procedures, such as EUS, ERCP has primarily been used for interventional purposes. During the procedure, the doctor can use a variety of endoscopic tools, including stents, dilation balloons, guidewires, sphincterotomes, lithotripters, cannulas, stone removal balloons, and baskets.

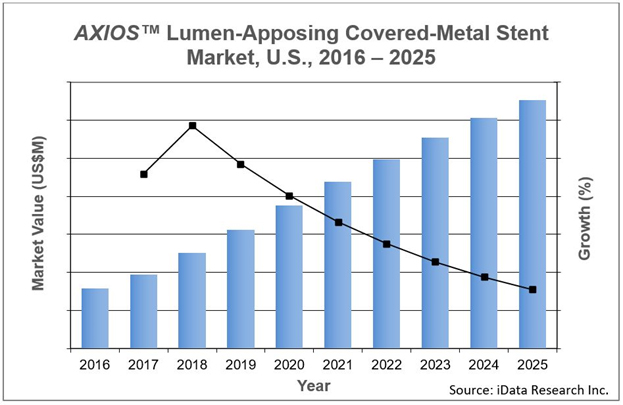

The ERCP device market has experienced significant growth since the introduction of Boston Scientific’s AXIOS™ lumen-apposing covered-metal stent in 2016. The lumen-apposing covered-metal stent market is one the latest innovations in the ERCP space, indicated for transgastric or transduodenal endoscopic drainage of symptomatic pancreatic pseudocysts and walled-off necrosis under EUS imaging guidance.

Boston Scientific obtained the technology through its acquisition of Xlumena in 2015. With over 90,000 cases of pseudocysts and pancreatic fluid collections reported in the U.S. each year, Boston Scientific is positioned to realize substantial gains from sales of AXIOS™, particularly since Boston Scientific is the only company currently active in the U.S. lumen-apposing covered-metal stent market.

However, Taewoong Medical, a South Korean company, entered a distribution agreement with Cook Medical in November 2018, under which Cook Medical will provide U.S. distribution for Taewoong Medical’s metal GI stents. Taewoong Medical currently offers the SPAXUS™ lumen-apposing covered-metal stent in international markets and is expected to enter the U.S. market in the near future.

Another innovative technology offered by Boston Scientific is the SpyGlass™ DS Direct Visualization System, a single-use cholangioscope that attaches to a standard duodenoscope, adding the benefit of digital visualization to an ERCP procedure. One of the most costly and risky components of endoscopy is infection prevention, a rigorous process which entails scopes being manually cleaned, passed through an automated endoscope reprocessor, sterilized and stored in a specialized drying cabinet. SpyGlass™ eliminates all the steps of this process and significantly reduces costs for GI facilities. If single-use devices are developed for other GI endoscopes, unit sales have the potential to grow exponentially.

In the EUS needle market, fine needle biopsy (FNB) devices are a relatively new segment and are primarily used to sample solid tissue masses. The market has shifted, favoring these innovative devices over fine needle aspiration (FNA) devices, primarily used for cyst fluid collection. A notable FNB device is Medtronic’s Beacon™ FNF. It is pre-loaded with two solid gold fiducial markers that enable easy target visualization with an echogenic signature that can be analyzed across imaging modalities, including computed tomography, X-ray, and kilovoltage.

M&A as a Means of Innovation

Similar to other medical device markets, the GI endoscopic device market has been impacted by consolidation in recent years. Large competitors are either entering the market for the first time or expanding their reach through strategic mergers and acquisitions. One of the recent larger transactions occurred in July 2017, when Cardinal Health acquired Medtronic’s Patient Care, Deep Vein Thrombosis and Nutritional Insufficiency business for $6.1 billion. This transaction allowed Cardinal Health to enter the enteral feeding market, where it assumed a dominant leading position due to strong performance in the enteral feeding pump and feeding set markets.

Another important transaction occurred in March 2017, when Ethicon, a subsidiary of Johnson & Johnson, acquired Torax Medical. This acquisition allowed Ethicon to enter the anti-reflux device space, where it led the market with the LINX® Reflux Management System. Given the millions of non-treated individuals in the U.S. with chronic gastroesophageal reflux disease (GERD), Ethicon has the potential to rapidly increase adoption of anti-reflux devices by leveraging its vast distribution network and market presence.

Other key market events include Merit Endotek expanding its biliary and pancreatic stent portfolio through a distribution agreement with Taewoong Medical in June 2018; Olympus entering the esophageal stent market through an exclusive distribution agreement with M.I. Tech in May 2018; and Pentax entering the Barrett’s esophagus ablation device market through its acquisition of C2 Therapeutics in January 2017.

Conclusion

The U.S. gastrointestinal endoscopic device market will continue to be a site for innovative new devices and market competitors will strive to fulfill unresolved medical needs. In order to quickly take advantage of innovative technology, we expect larger competitors will continue to engage in strategic mergers and acquisitions, and will focus on bringing new therapeutic solutions to market.

About the Authors

Artur Kim is a senior research analyst at iData Research and was the lead researcher for the 2019 Europe Report Suite for Gastrointestinal Endoscopic Devices. His work has also included a number of other research projects in other medical device industries.

Jeffrey Wong is the Analyst Director at iData Research. Through many years of analysis, he has been the lead on most of iData’s medical, dental, and pharmaceutical market research and now drives research strategy, product development and consulting research.

About iData Research

iData Research is an international market research and consulting firm focused on providing market intelligence for the medical device, dental and pharmaceutical industries. To learn more about their research go to https://idataresearch.com.

Resources

- U.S. Market Report Suite for Gastrointestinal Endoscopic Devices 2019 - MedSuite, iData Research Inc.