Intracranial Stenting Market: Assessment And Growth Opportunities

By Alison Casey, GlobalData

Intracranial atherosclerotic disease (ICAD) represents a major cause of stroke worldwide and is more prevalent among Asian patients.1-2 However, despite many well-documented clinical trials, treatment of patients with symptomatic intracranial artery stenosis remains controversial.

The SAMMPRIS and VISSIT trials3-4 concluded that aggressive medical management was superior to percutaneous transluminal angioplasty and stenting (PTAS). These trials heavily influenced physicians’ decision making regarding endovascular treatment of ICAD patients and led the FDA to narrow indications for Stryker’s Wingspan stent, which remains the only approved intracranial stent on the U.S. market.5

Despite this, many interventional neuroradiologists have questioned the design and impact of the SAMMPRIS trial. One repeatedly raised concern is the high rate of adverse complications in the PTAS group of SAMMPRIS, compared to those observed in other single-center studies and in China-based studies.6

Earlier this year, results of the WEAVE trial were announced.7 While not a randomized clinical trial, WEAVE demonstrated fewer adverse complications in patients treated on-label (but not off-label) with the Wingspan stent system, suggesting that intracranial stenting may be appropriate for a subset of high-risk ICAD patients.

This article explores the adoption of intracranial stenting across three major markets (U.S., Germany, South Korea) and projects the overall market opportunity according to currently approved indications.

Market Analysis: Intracranial Stenting, 2017-2018

Intracranial stenting is a rare procedure. Taking into account off-label usage and country-specific device regulations, we estimate that the value of the global intracranial stenting market is approximately $24M. However, we project that the number of patients potentially eligible for this procedure, across 30 different countries, is substantially higher, and amounts to a total market opportunity of over $700M.

Fig. 1 — Current and potential market value of intracranial stenting devices across 30 countries, 2017

Low adoption of intracranial stenting is likely due to the negative impact of the SAMMPRIS trial, and the fact that ICAD has a higher prevalence in many Asia Pacific countries, some of which have a developing healthcare infrastructure. In general, the high costs of neurovascular procedures, coupled with a need for extensively trained and experienced specialists, as well as ready access of patients to dedicated neuroradiological facilities, means that intracranial stenting is more limited in countries with fewer resources.

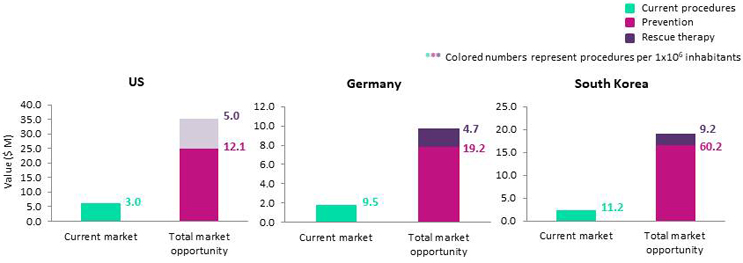

Three key markets for intracranial stenting are the U.S., Germany and South Korea. Of these, the U.S. constitutes the largest market value ($6.3M), while the number of procedures performed per 1x106 inhabitants is greater in both Germany and South Korea (Fig. 2).

Fig. 2 — Current and potential market value of intracranial stenting devices: U.S., Germany, and South Korea, 2017

We predict that key factors limiting adoption of intracranial stenting in the U.S. are strong physician reactions to SAMMPRIS results and a more restricted indication of the Wingspan stent system. Specifically, intracranial stenting in the U.S. is predominantly utilized for preventative purposes to treat ICAD patients who’ve had recurrent strokes despite aggressive medical therapy.5 Conversely, in countries such as Germany and South Korea, intracranial stenting is used both for preventative purposes and for rescue therapy in patients with acute atherosclerosis-related occlusions.8

We estimate that the 2017-2018 market values of U.S. patients who would potentially be eligible for prevention, versus rescue therapy, are $25.1M and $10.3M, respectively (shown by pink and grey bars in Fig. 2).

Although Germany exhibits relatively high adoption of intracranial stenting, we anticipate that the size of this market, and to a lesser extent South Korea, is limited by off-label usage of alternative devices, such as coronary artery stents. In most markets, the Wingspan stent system is the only approved medical device for intracranial stenting. However, there is increasing recognition that, for optimal endovascular treatment of ICAD patients, physicians require access to multiple different devices.

One exception to this is China, which has access to both the Wingspan stent and a strong domestic product, MicroPort Scientific Corp.’s APOLLO stent. Furthermore, a multicenter Chinese registry study completed in 2015 allowed operators to choose between the Wingspan and APOLLO stent systems, based on established guidelines, and demonstrated a lower rate of short-term adverse events compared to SAMMPRIS.3,6

Growth of the Chinese intracranial stenting market is being driven by a combination of factors, including strong product promotion, industry-funded training programs for doctors, government investment in stroke care, and recent Chine Food and Drug Administration (CFDA) approval of larger-size APOLLO devices. Finally, the total market opportunity of intracranial stenting is amplified in both South Korea and China due to epidemiological factors — namely, a higher prevalence of ICAD.

We estimate that substantial differences exist between the current intracranial stenting market value and the total market opportunity, meaning this market has considerable room for growth (Figs. 1,2).

Growth of the intracranial stenting market can be achieved via two means: greater adoption of intracranial stenting for preventative purposes, and/or increased uptake of intracranial stenting for rescue therapy.

It should be noted that, in the U.S., the Wingspan stent system is currently approved as a Humanitarian Use Device (HDE), intended to treat less than 4,000 patients per year.5 However, we estimate that, in 2017, the Wingspan stent was used to treat fewer than 1,000 patients, meaning its HDE status should not limit immediate market growth in North America.

Market Growth And Opportunity: Prevention

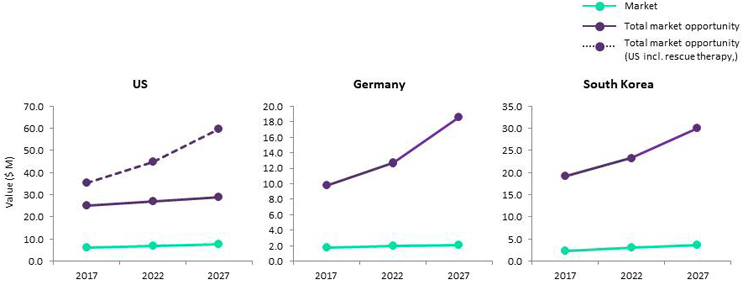

Despite the recently announced results of the WEAVE trial, we do not expect the U.S. and similar intracranial stenting markets to experience strong growth over the next decade (Fig. 3). We predict that the existing, negative perception of intracranial stenting is unlikely to be alleviated without positive findings from a randomized clinical trial that directly compares aggressive medical management to PTAS, and can thus counter the findings of SAMMPRIS.

Ideally, such a trial would incorporate improvements in study design made by the Chinese stenting registry and WEAVE trial, such as more refined patient selection criteria, and allowing operators to choose from multiple different devices. A new trial also would benefit from being located in a country with highly experienced specialists who frequently perform intracranial stenting, and whose history and reputation mean that physicians in other leading markets would have confidence in the outcome. One location that fits these criteria is Germany.

Fig. 3 — Projected growth, intracranial stenting market (blue), and total market opportunity (purple): U.S., Germany, and South Korea

Market Growth And Opportunity: Rescue Therapy

The total market opportunity for intracranial stenting in Germany and South Korea is expected to experience strong growth over the next decade (Fig. 3). This growth is being driven by increases in the mechanical thrombectomy market and associated rescue therapy. Similar growth of total market opportunity is not expected to occur in the U.S., as the Wingspan stent system is not approved for this indication under current FDA-regulations.5

We estimate that, in 2017, the majority of patients eligible for intracranial stenting were recurrent stroke victims with symptomatic ICAD in need of preventative treatment (Figs. 1,2). However, we predict that, by 2027, approximately half of the total market opportunity for intracranial stenting in Germany will consist of patients undergoing rescue therapy. These findings also would apply to the U.S. market, should intracranial stenting devices be approved for rescue therapy by the FDA.

In South Korea, strong prevalence of ICAD translates to a higher proportion of recurrent stroke patients who may benefit from intracranial stenting for preventative purposes. We predict that these patients will continue to make up the majority of future eligible patient pools. Despite this, South Korea currently performs a significant number of intracranial stenting procedures for rescue therapy, and this trend is expected to be maintained over the next 10 years.

Due to strong potential for future market opportunity growth, a clinical trial exploring the benefits of intracranial stenting for rescue therapy in patients with acute atherosclerosis-related occlusions may be warranted. Similar to any WEAVE follow-up studies, such a trial also would benefit from carefully considered patient selection criteria, experienced operators, and a range of available device options.

Conclusion

Overall, there is a large market opportunity for intracranial stenting devices that is not currently being taken advantage of. Approved medical devices could capitalize on this opportunity by funding carefully designed, randomized clinical trials. Additionally, new and innovative devices that build on technological advances made in coronary artery and aneurysm stents also have the potential to drive strong market growth.

About The Author

Alison Casey is a Medical Devices Analyst at GlobalData Healthcare with a focus on Neurology Devices and In Vitro Diagnostics. Her work collates information from primary participants, key opinion leaders, and secondary sources with real world data to analyze and forecast specific device markets across 39 different countries.

Alison has a PhD from Imperial College London, and a strong history of work in oncology. Before joining GlobalData, she worked as a post-doctoral fellow at Princess Margaret Cancer Centre, Toronto where she established collaborations with clinical experts and industry personnel, giving her a thorough understanding of the Canadian healthcare system.

Sources:

1. Oh Young Bang (2014) Intracranial Atherosclerosis: Current Understanding and Perspectives. Available at: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3961814

2. Al Kasab, S et al., (2018) Intracranial Large and Medium Artery Atherosclerotic Disease and Stroke. Available at: https://www.ncbi.nlm.nih.gov/pubmed/29602616

3. Chimowitz, MI et al., (2011). Stenting versus aggressive medical therapy for intracranial arterial stenosis (ClinicalTrials.gov Identifier: NCT00576693). Available at: https://www.ncbi.nlm.nih.gov/pubmed/21899409

4. Zaidat, OO et al., (2015). Effect of a balloon-expandable intracranial stent vs medical therapy on risk of stroke in patients with symptomatic intracranial stenosis: the VISSIT randomized clinical trial (ClinicalTrials.gov Identifier: NCT00816166). Available at: https://www.ncbi.nlm.nih.gov/pubmed/25803346

5. Narrowed Indications for Use for the Stryker Wingspan Stent System: FDA Safety Communication. Available at: https://wayback.archive-it.org/7993/20170406071845/https://www.fda.gov/MedicalDevices/Safety/AlertsandNotices/ucm314600.htm

6. Miao, Z et al., (2015). Thirty-Day Outcome of a Multicenter Registry Study of Stenting for Symptomatic Intracranial Artery Stenosis in China (ClinicalTrials.gov Identifier: NCT01968122). Available at: https://www.ncbi.nlm.nih.gov/pubmed/26286544

7. Post Market Surveillance Study of the Wingspan Stent System (WEAVE) (ClinicalTrials.gov Identifier: NCT02034058). Available at: https://clinicaltrials.gov/ct2/show/NCT02034058

8. Bernd Eckert (2016) Intracranial Stenting in Germany: The Reimbursement Decision has been made, but the Scientific Debate Continues. Available at: https://www.ncbi.nlm.nih.gov/pubmed/2789636