Major Shift in Demand For Oxygen Therapy Devices – New Study For 2021

By John Fraser and Kamran Zamanian, Ph.D., iData Research

The continual administration of medical oxygen, known as oxygen therapy, is used to treat a variety of medical conditions, such as cancer, cystic fibrosis, and chronic obstructive pulmonary disease (COPD). Generally, oxygen therapy devices are used to treat patients who can no longer receive adequate volumes of oxygen through regular breathing and those who require higher concentrations of oxygen. The long-term driver of sales for these devices is the movement away from traditional cylinder-based methods of oxygen delivery and toward portable concentrating technology.

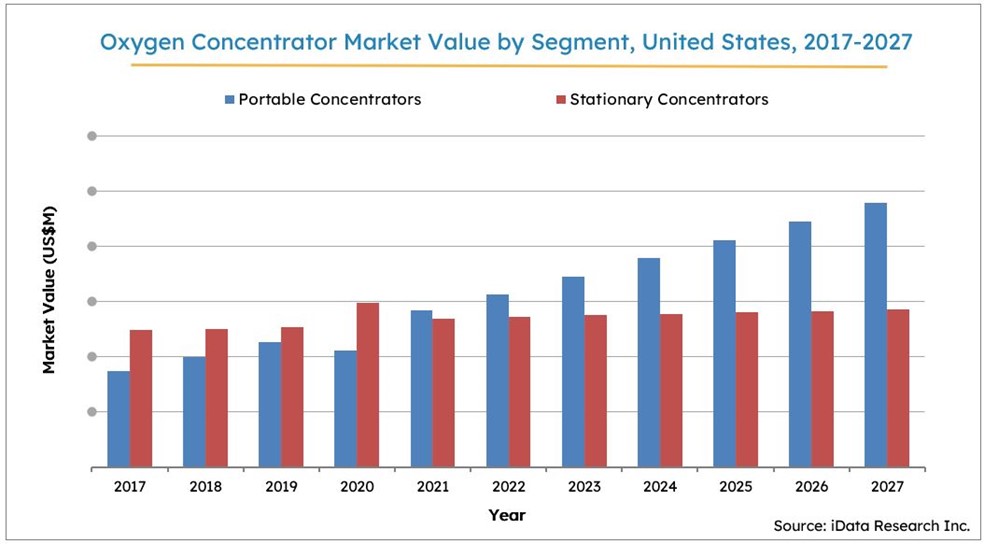

Alongside this trend is the growing preference for portable units over the less expensive stationary concentrators. While portable concentrators will always have a more expensive up-front cost to providers, the long-term benefits compared to alternative methods have been apparent. While concentrators and cylinders deliver oxygenated air to patients outside of the hospital, stand-alone high-flow nasal devices have emerged as an exemplary delivery system, especially within hospitals.

Oxygen Concentrators To Overtake Cylinders

The shift from aluminum cylinders to oxygen concentrators continues to be a principal trend in the market. Oxygen concentrators filter air in a room to generate medical oxygen, while cylinders rely on a limited supply of oxygen. These devices, specifically the more portable concentrators, are considered the next generation of oxygen therapy and could improve the lifestyles of patients. They have been generating great demand by allowing for more mobility and independence while offering more safety benefits and convenience. The new market study also projects an increasing growth in demand for portable devices over the next 6 years.

Figure 1: Access iData’s U.S. respiratory devices market report to view more granular data.

Portable concentrators, which can be towed like a suitcase or carried over the shoulder in a carrying case, are growing at a faster pace compared to stationary models. The carrying-case variety is particularly popular within the market, experiencing double-digit growth annually even prior to the COVID-19 pandemic. Due to rapid technological advancements, smaller products now have oxygen release rates, liters per minute (LPM), that were previously only achievable by larger, stationary machines. However, the market is limited by the fact that some patients require continuous flow, which is rarely offered by portable machines. Overall, the shift toward costlier portable concentrators in place of stationary models and oxygen cylinders is set to generate growth in the market, with the total market looking to grow in the mid-single digits for the future.

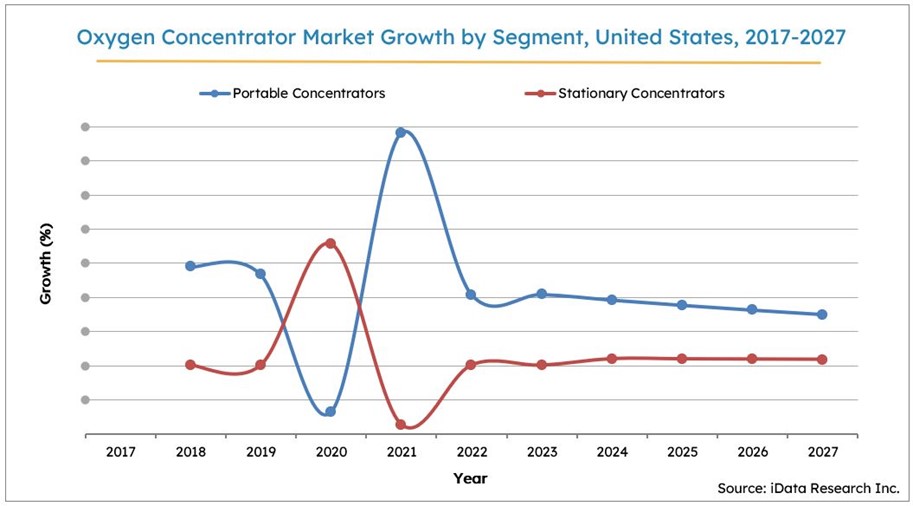

Figure 2: Access iData’s U.S. respiratory devices market report to view more granular data.

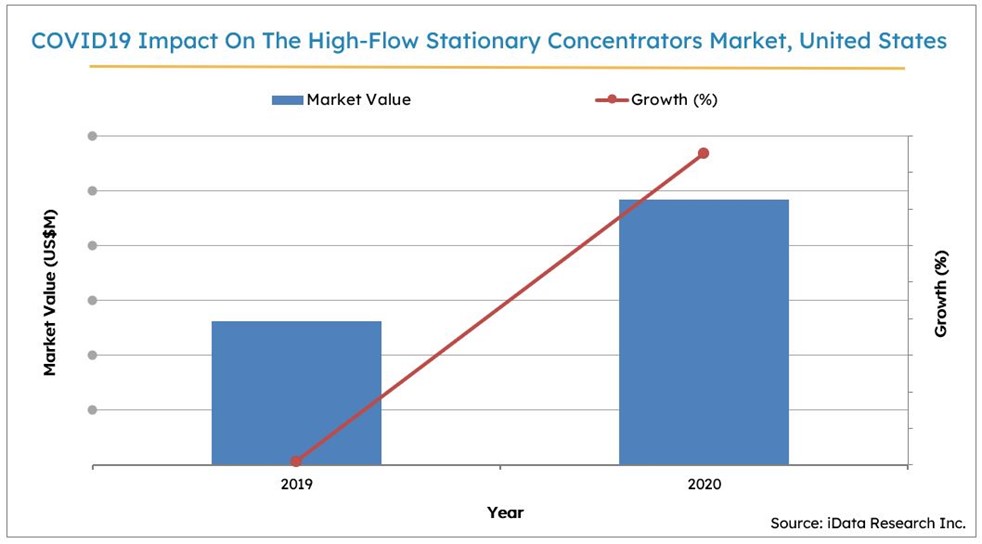

As most oxygen therapy clients are covered by some form of insurance policy, including a vast majority of them under Medicare coverage, the influence Medicare and insurance companies have over the market is significant. As a result, Medicare’s Competitive Bidding Program and insurance companies’ sway over product selection and promotion have traditionally driven the market in favor of the more cost-effective options. While the market projects to greatly favor portable concentrators over stationary units in the long run, 2020 saw a drastic COVID-19-related increase in the demand for stationary oxygen concentrators, specifically for the high-flow variant.

COVID-19’s Impact On The Oxygen Therapy Landscape

Oxygen therapy, specifically at high flow rates, has become a vital treatment option for COVID-19 patients whose ability to oxygenate has been altered. The overall market transition from stationary to portable concentrators was slowed in 2020 as health providers have been allocating more resources and aid toward the less costly stationary models. Also, fewer users required the feature of portability because of numerous stay-at-home orders and travel restrictions across the U.S. However, the portable market is expected to quickly recover and maintain high levels of future growth.

Figure 3: Access iData’s U.S. respiratory devices market report to view more granular data.

High-flow stationary concentrators experienced massive growth in 2020 due to their effectiveness in dealing with high-risk situations. While the high-flow concentrator market is limited on account of its niche nature, a steady growth in the future is anticipated because of the lack of substitutes in the home care market.

A general growing prevalence of respiratory issues in the aging U.S. population is also increasing the demand for oxygen therapy. Sixteen million Americans have been diagnosed with COPD, with millions more not being diagnosed. The progression of people suffering from COPD, which is known to increase the risk of severe illness from COVID-19, has resulted in the advancing adoption of treatments with a higher flow of oxygen, such as high-flow nasal therapy.

The Rapid Emergence Of High-Flow Nasal Therapy

High-flow nasal therapy involves the delivery of humidified oxygen at high rates of flow. The therapy is intended to reduce anatomic dead space, improve gas exchange, and considerably reduce the exertion of breathing. Specialized high-flow devices can reach rates of up to 60 L/min, while traditional oxygen therapy primarily resides in the 1 to 10 L/min range.

The stand-alone, high-acuity high-flow nasal therapy device market exploded in 2020, growing over 200%. These devices, such as Fisher & Paykel’s Airvo 2 Nasal High Flow system and Vapotherm’s Precision Flow Hi-VNI high-velocity oxygen therapy system, became imperative combatants in the fight against COVID-19 on account of the disease’s impact on the ability to oxygenate. An additional aspect of the devices’ popularity is the prominent increase in patient comfort and compliance. As the treatment grows in notability and use, the market is expected to continue to thrive, especially when accounting for unforeseen long-term COVID-19-related complications. The stand-alone, high-acuity market is currently dominated by two players, so it will be highly susceptible to the performance of those companies.

High-flow therapy devices are used in tandem with speciality cannula. High-flow nasal cannula saw a dramatic growth, with the market doubling from 2019 to 2020. As different therapies have been used on COVID-19 patients, high-flow nasal therapy proved to be an effective treatment. The high-flow cannula market is expected to stay relatively strong as high-flow nasal therapy devices become more and more widespread. Prices are not expected to drop significantly considering the low number of current players, but this could change as entrants with lower selling prices become more prevalent.

Closing Thoughts

The oxygen therapy market will experience continued pronounced growth in portable oxygen concentrators and high-flow nasal therapy devices. However, it was stationary concentrators that outperformed portable units in 2020 due to COVID-19-related factors. The positive benefits of oxygen concentrators over oxygen cylinders, such as ease of use and safety, proved to be even more valuable during the COVID-19 pandemic, which intensified an already existing trend. The stand-alone, high-flow nasal therapy device market was taken to new heights in 2020 and will continue to grow as the treatment is adopted by more care providers into the future.

About the Authors:

John Fraser is a research analyst at iData Research. He develops and composes syndicated research projects regarding the medical device industry, publishing the U.S. Anesthesia, Respiratory and Sleep Management Device report series.

John Fraser is a research analyst at iData Research. He develops and composes syndicated research projects regarding the medical device industry, publishing the U.S. Anesthesia, Respiratory and Sleep Management Device report series.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

About iData Research

For 16 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers its clients to trust the source of data and make important strategic decisions with confidence.