Market Assessment: PTA Balloon Catheters In The U.S., EU, And U.K.

By Dharini Hombal and Sheryl Tang, GlobalData

Peripheral artery disease (PAD) is characterized by the narrowing of arteries in the periphery due to the build-up of plaque. GlobalData estimates that the prevalence of PAD is between 8 and 10 percent worldwide, and continues to grow each year1.

PTA (percutaneous transluminal angioplasty) balloon catheters have now become the minimally-invasive device of choice for severe cases of PAD — particularly in small vessels below the knee, due to the tortuous nature and difficulty in stent placement there. Furthermore, balloon catheters are used for management of in-stent restenosis. In 2018, a meta-analysis published by Katsanos et al. suggested a potential link between the use of paclitaxel-coated devices and an increased risk of late mortality2.

This article analyzes the PTA balloon catheters market in the wake of the meta-analysis and updated FDA and MHRA guidelines.

Current Status

Among PTA balloon catheters, PTA drug-coated balloons (DCBs) quickly became preferred over standard non-coated balloons. Several studies, including LEVANT II and 5-year outcomes from the IN.PACT SFA randomized trial, have demonstrated superior outcomes in DCBs over standard PTA balloons.

Currently, two types of drugs are used for drug-coated devices on the market: Paclitaxel and Sirolimus. In studies, sirolimus-eluting stents have exhibited superiority over paclitaxel-eluting stents and could offer potential benefits over the current paclitaxel balloons. While both drugs are anti-restenotic, the SABRE trial suggests that a wider therapeutic range and sirolimus’ anti-inflammatory properties make it a safer alternative to paclitaxel3,4. The majority of DCBs, however, remain paclitaxel-based, given that drug’s faster absorption rate and longer retention rate compared to sirolimus. The recent development of nanolute and nanoactive technology in sirolimius balloons aims to overcome these delivery challenges.

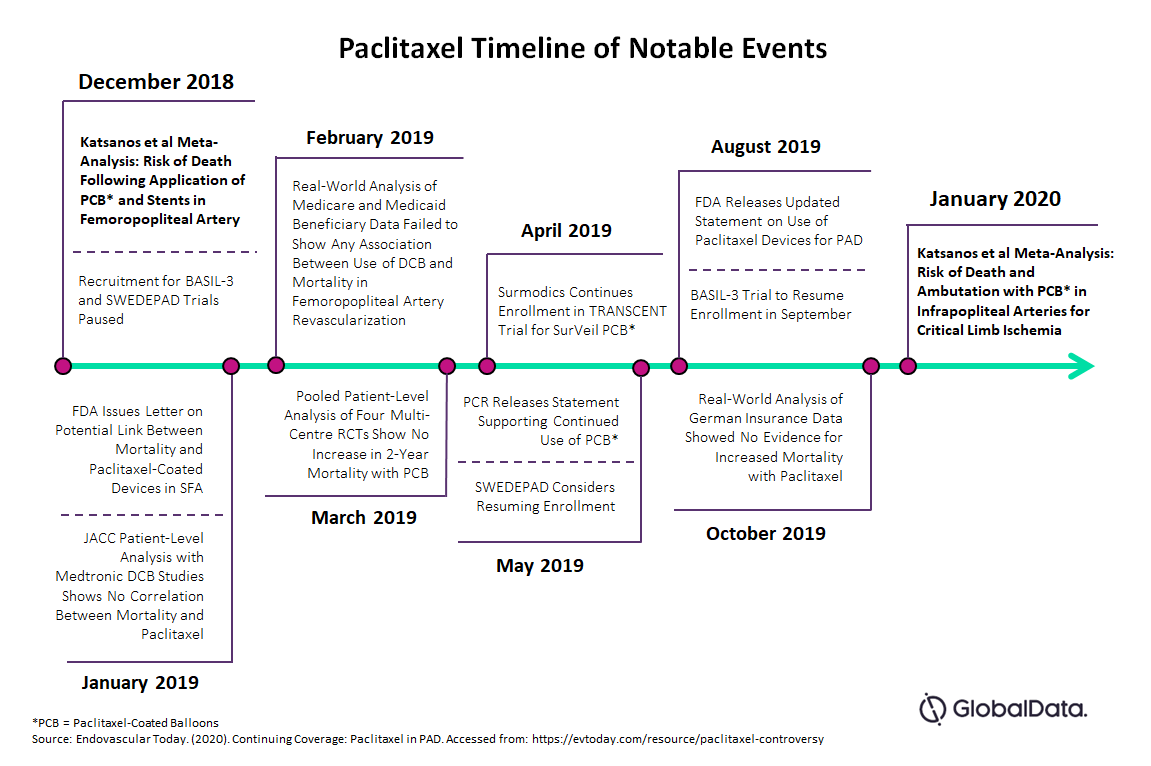

Following publication of the meta-analysis in 2018, there was an increase in activity within the scientific community, governing bodies, and manufacturers. Several patient-level studies were published showing no link between increased mortality and paclitaxel-coated devices. The meta-analysis prompted the FDA to conduct a preliminary pooled analysis of pivotal premarket RCTs and identified a potential link between increased long-term mortality and paclitaxel-coated balloons. However, both the FDA and PCR, while advising caution surrounding the use of these devices, have issued statements supporting continuous use on a best-judgement basis pending more definitive data.

Fig. 1

In January 2020, Katsanos et al. published a meta-analysis of the risk of death and amputation with the use of paclitaxel-coated balloons (PCB) in infrapopliteal arties for the treatment of critical limb ischemia (CLI). Findings concluded a possible link between increased mortality rates and amputation with the use of PCBs within the first year of treatment5.

Market Analysis

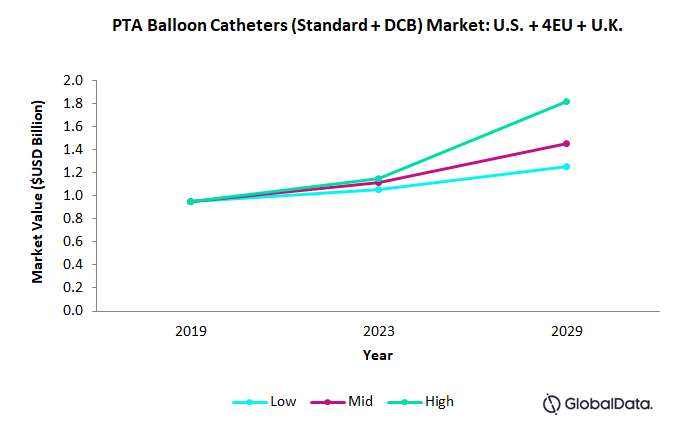

Even amidst doubts regarding the safety of PCB catheters, balloon angioplasty remains the treatment of choice for PAD; consequently, we expect that the PTA balloon catheters market will show positive growth in all adoption scenarios. This section will explore high-, medium-, and low-level adoption rate scenarios based on several factors to determine the overall opportunity of the market in the U.S., four major EU countries (France, Germany, Italy, Spain), and the U.K.

Fig. 2 – Market Forecast for U.S., France, Germany, Italy, Spain, and U.K. in High-, Medium-, and Low-Adoption Scenarios

Low-Level Adoption

In a low-level adoption scenario, we predict the PTA market will grow at a compound annual growth rate (CAGR) of 2.5 percent from 2019 to 2023. The growth rates are expected to increase slightly in the period 2023-2029, achieving a CAGR of 3 percent.

The adoption rate is based on the following assumptions:

- The use of PCB catheters for both intermittent claudication and CLI will decline further and the use of alternative devices, such as standard balloon catheters and stents, will increase.

- The entry of sirolimus-coated balloon (SCB) catheters in the market will help stabilize the declining DCB market. However, the low tissue absorption rate of sirolimus will act as a limiting factor to the device adoption rate unless the drug delivery issues are resolved.

High-Level Adoption

In a high-level adoption scenario, we predict the market will grow with a CAGR of 4.7 percent for 2019-2023 and 8 percent for 2023-2029.

The following assumptions were used to estimate the high adoption rate:

- Results from clinical trials like SWEDEPAD will establish the long-term safety of PCB. Consequently, the use of PCB will increase in CLI and restenosis cases once study results are published.

- Guidelines for PAD treatment may change, allowing the use of DCB in indications like intermittent claudication.

- The entry of SCB catheters in the market will further strengthen the PTA market.

Mid-Level Adoption

We predict that in a mid-level adoption scenario, the market will experience CAGRs of 4 percent and 4.5 percent for the 2019-2023 and 2023-2029 periods, respectively.

The mid-level adoption rate was inferred based on the following assumptions:

- The use of PCB catheters will become limited to cases of CLI and patients with a higher risk of developing in-stent restenosis.

- Advancements in sirolimus delivery method (such as Nanolute technology) will help overcome the slow absorption rates, providing a safer and efficient alternative to PCB.

Competitive Analysis

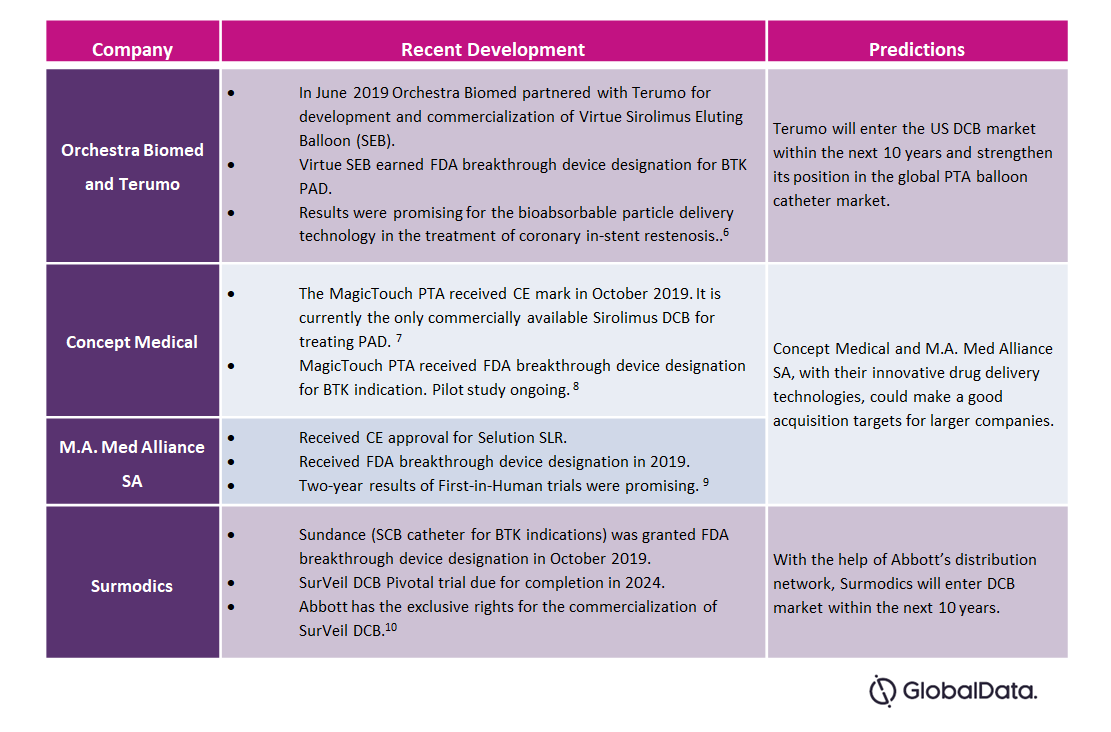

The U.S., “EU four,” and U.K. markets are currently dominated by BD and Medtronic. Boston Scientific lags behind due to its absence from the U.S. DCB market but, with the Ranger DCB catheter under FDA review, the scenario might change in the future.

Table 1 – Developments in the Peripheral DCB Market

Looking at the overall competitive landscape for the PTA balloon catheters market, we predict that the market leaders will retain their ranking, unless PCB catheters are replaced with SCB and the DCB market overtakes the standard balloon catheters market.

With uncertainty surrounding the safety of PCB catheters, an opportunity has been created in the market that can be beneficial for companies with SCB catheters. Provided the slow tissue absorption rates associated with sirolimus can be overcome, GlobalData expects the following changes in the competitive landscape:

- Concept Medical and M.A. Med Alliance SA will compete head-to-head in the European market. Since M.A. Med Alliance SA is headquartered in Switzerland, it will have an advantage over Concept Medical (headquartered in the U.S.), such as better distribution networks and lower device prices.

- Orchestra Biomed and Surmodics will enter the market at a later stage. The wide distribution network of Terumo and Abbott will enable a better market penetration compared to their competitors.

- We also expect the PCB catheters to lose a significant portion of their market to SCB catheters, as sirolimus is safer compared to Paclitaxel. However, if the safety of paclitaxel-coated devices is proven, the loss in PCB market will be compensated with the growth in DCB catheters market.

Outlook and Conclusion

The PTA balloon catheters market outlook is constantly changing due to a scientific community actively seeking definitive evidence of a link between mortality and paclitaxel-coated devices, as well as advancements in the devices themselves. In addition to its potential use of an alternative drug (sirolimus), several other factors may affect this market’s future:

- There are inherent limitations to the meta-analysis published by Katsanos et al.; it only suggests a potential link between higher risk of mortality and paclitaxel-coated devices, lacking:

- patient-level data

- long-term complete follow-up

- Identification of a specific cause or mechanism

- The potential shift in preferred interventional treatments for lower-extremity PAD will differ for above-the-knee and below-the-knee therapies.

- Sirolimus’ benefits are shown in drug-eluting stents due to having longer exposure in the vessel. Given the more favorable anatomy of arteries above the knee, the use of drug-eluting stents for PAD in this area may increase, provided the patient is not at high risk for in-stent restenosis.

- Given the tortuous vessels below-the-knee, balloons will continue to be the preferred intervention. While manufacturers continue to improve the delivery and absorption rates of sirolimus to be comparable to Paclitaxel, the use of standard non-coated balloons will steadily increase.

While numerous studies have been published since 2018 showing no statistically significant link between increased mortality and paclitaxel, its adoption continues to drop due to heightened concerns placing patient safety first, despite a lack of definitive data. GlobalData expects that until more studies — both from real-world patient data and randomized controlled trials — are able to provide concrete evidence that there is no causation mechanism and no link to increased mortality, the adoption of paclitaxel-coated devices will decline.

About The Authors

Dharini Hombal is a medical device analyst at GlobalData Healthcare with expertise in cardiovascular and neurology devices. Her work includes collating and analyzing data from key opinion leaders, secondary sources, and real-world data sources, developing medical device forecast models across 39 countries and assessing the competitive landscape. Before joining GlobalData, Dharini completed her Master of Technology in biotechnology from Amity University, Noida.

Sheryl Tang is a principal medical devices analyst at GlobalData Healthcare specializing in cardiovascular and neurology devices. She has acquired an in-depth understanding of both markets and currently manages the research and development of syndicated market forecast models across 39 countries, as well as being the lead analyst for cardiovascular or neurology-specific consulting projects. As a Master of Public Health graduate from Queen’s University, Sheryl has a strong background in epidemiology in addition to her expertise in market research.

Sources

- GlobalData. (2019). PTA Balloon Catheters – Cardiovascular Market Analysis and Forecast Model. Available at: https://store.globaldata.com/report/gdme348mm--pta-balloon-catheters-cardiovascular-market-analysis-and-forecast-model/

- Katsanos, K., et al. (2018). Risk of death following application of paclitaxel-coated balloons and stents in the femoropopliteal artery of the leg: A systematic review and meta-analysis of randomized control trials. Journal of the American Heart Association. 7(24). Available at: https://doi.org/10.1161/JAHA.118.011245

- Andreini, D. & Trabattoni, D. (2018). Is the sirolimus encapsulated balloon a reliable tool for treating the in-stent restenosis? – Insights from the SABRE trial. Journal of Thoracic Disease. 10(2). pp. 634-637. Available at: https://doi.org/10.1161/JAHA.118.011245

- STENTYS. (2018). Devoir: Sirolimus-Coated Balloon. Available at: https://www.stentys.com/media/2039/devoir-presentation-devoir-prez-20181018-rev2.pdf

- Katsanos, K. et al. (2020). Risk of death and amputation with use of paclitaxel-coated balloons in the infrapopliteal arteries for treatment of critical limb ischemia: A systematic review and meta-analysis of randomized controlled trials. Journal of Vascular and Interventional Radiology. 31(2). Pp 202-212. Available at: https://doi.org/10.1016/j.jvir.2019.11.015

- Orchestra Biomed. News & Events. Available at: https://www.orchestrabiomed.com/news-events/

- Vascular News (2019). Concept Medical granted CE certification for sirolimus-coated MagicTouch group of products. Available at: https://vascularnews.com/concept-medical-sirolimus-magictouch/

- Concept Medical. Press Release. Available at: https://www.conceptmedical.com/news/

- M.A. Med Alliance SA. News & Events. Available at: http://medalliance.com/news-events/

- Surmodics, Inc. (2019). Surmodics Investor Presentation (Q4). Available at: https://surmodics.gcs-web.com/static-files/95ed7030-4b6a-4254-87ab-b9d4317f3488