Market Assessment: Transcatheter Aortic Valve Replacement In The U.S. and EU

By Sheryl Tang and Ashley Young, GlobalData

Heart disease is the leading cause of death for both men and women in the United States.1 Specifically, aortic stenosis — a narrowing of the aortic valve opening — is one of the most common heart valve diseases, affecting an estimated 813,000 Americans over the age of 75 in 2019;2 it can range from mild to severe.

While the standard treatment for patients diagnosed with severe aortic stenosis is surgical aortic valve replacement/implantation (SAVR, or SAVI), transcatheter aortic valve replacement/implantation (TAVR, or TAVI) has become established as a reliable and robust alternative for elderly patients at high risk for open surgery due to their age, frailty, and other factors.

Not all people with severe aortic stenosis are at high risk for surgery; in fact, the majority of patients are at intermediate or low risk and would tolerate SAVR. However, given a choice, many of these people may still prefer TAVR due to its minimally invasive nature, lack of need for full sedation, shorter hospital stay, and faster recovery time.

TAVR’s Current Status

It’s an exciting time for TAVR, as the market has experienced exponential growth due to expanding indications of TAVR devices in recent years. TAVR devices were FDA-approved for patients at intermediate risk for surgery in 2016, and for those at low surgical risk just this year. With every new indication, more patients become eligible for TAVR.

Complications associated with TAVR, such as stroke and paravalvular leakage (PVL), consistently decrease with each new device generation. Early studies, such as the PARTNER trial in 2010, showed that stroke complications were more common after TAVR than after SAVR in high-risk patients. However, more recent trials from 2016 and 2017, such as the SURTAVI trial, reported similar or even lower rates of stroke after TAVR and SAVR.

Similarly, early studies examining PVL demonstrated higher rates in TAVR than SAVR. While all PARTNER trials have shown an increased rate of PVL in transcatheter groups compared to surgical, this rate has decreased with each PARTNER trial, demonstrating the continuous improvements in addressing PVL in TAVR.

TAVR adoption also has been bolstered by its reimbursement in many countries: the US and five EU countries (Germany, France, Spain, Italy, and the UK) all have some type of reimbursement scheme in place for TAVR.

Currently, two companies — Edwards LifeSciences and Medtronic — are the primary manufacturers of TAVR valves and thus control the majority of the global market. The only other player currently active in the US market is Boston Scientific (Lotus Edge device). A number of other TAVI devices are being used abroad, but have yet to receive approval in the US. In the five EU countries, the only other major player is Abbott Laboratories (Portico valve, obtained in Abbott’s St. Jude Medical acquisition).

Market Assessment: Through 2023 And Beyond

The proven advantages of TAVR compared to traditional surgical intervention, along with the recently expanded indication to low-risk patients, will drive explosive growth in TAVR procedures over the next five years; however, we expect this growth to begin to slow down after the five-year mark.

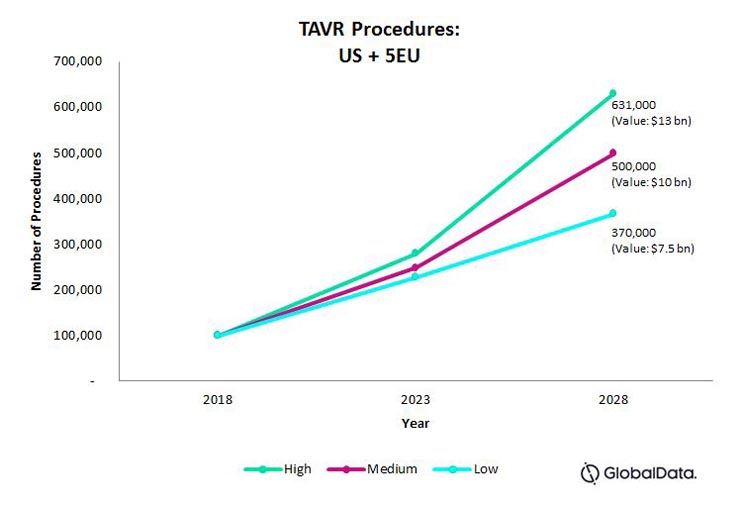

TAVR devices’ future outlook depends on a number of factors, including a limited number of ongoing studies examining the devices’ long-term outcomes. Below, we explore high-, medium-, and low-adoption rates for TAVR to determine the overall market opportunity in the U.S. and five EU countries (France, Germany, Italy, Spain, and the UK).

Fig. 1 — Projected total number of TAVR procedures for the U.S., France, Germany, Italy, Spain, and the UK, combined.

5-Year Outlook Through 2023

In all three adoption rate scenarios, we expect rates to grow at a similar, explosive compound annual growth rate (CAGR) of approximately 20 percent through 2023. Given decreasing complication rates and favorable pricing reimbursement in the U.S. and five EU nations discussed here, there are few barriers to a fast adoption rate.

Market Assessment 2023 – 2028: Low-Level Adoption

In a low-level adoption scenario, we predict that procedure growth will slow to a 10-percent CAGR. The underlying assumptions primarily hinge on TAVR devices’ two current drawbacks: pacemaker implantations after TAVR, and the devices’ long-term durability.

Several studies have shown an increased need for permanent pacemaker implantation after TAVR, compared to SAVR, with the incidence being higher in Medtronic’s CoreValve than Edwards’ Sapien valve. Further, while TAVR is widely accepted in patients aged 75+, few studies have examined TAVR devices’ durability past 10 years. As a result, it currently is unknown how TAVR will affect younger patients with regard to permanent pacemaker implantation and long-term durability.

The low-level adoption rate assumes that, between 2023 – 2028, studies will reveal that the incidence of pacemaker implantation still remains higher after TAVR procedures compared to SAVR. It also assumes that studies investigating TAVR devices’ long-term durability will be inconclusive, or even show inferior results compared to surgical heart valve devices. Both factors will act as barriers to expanding TAVR to younger patients, slowing the adoption rate.

Market Assessment 2023 – 2028: High-Level Adoption

In a high-level adoption scenario, we predict that the procedures will continue to experience high growth at 18-percent CAGR.

This high-level adoption scenario assumes that, in five to 10 years, continuous improvements to new generations of TAVR device will demonstrate a significantly lower rate of stroke and PVL complications compared to surgical heart valves procedures. It also assumes that TAVR device improvements will address pacemakers and uncertainty around durability (i.e., studies will show a decreasing rate of need for pacemaker implantations and a reasonable device lifespan).

These factors will likely result in expansion of TAVR to a younger patient pool, continuing explosive growth into the next ten years.

Market Assessment 2023 – 2028: Mid-Level Adoption

We predict that between 2023 – 2028, a mid-level adoption rate will continue to grow at a 15-percent CAGR.

This mid-level adoption scenario assumes that, in five to 10 years, new TAVR device generations will continue to improve on stroke and PVL complication rates. Also, although there may remain an increased incidence of pacemaker implantations in TAVR, the rates will slowly decrease. Finally, it assumes that, while long-term TAVR device durability remains inconclusive, there will be an increase in the number of studies looking at durability and long-term outcomes.

These factors will likely result in a steady, yet high, uptake of TAVR in older patients. In the mid-level adoption scenario, TAVR will expand to a slightly younger patient pool along with eligibility criteria, as there will still be uncertainties surrounding the procedure’s effects on younger patients.

In all adoption scenarios, TAVR will continue to experience a high growth over the next ten years, as there is solid evidence that transcatheter procedures demonstrate significantly better patient outcomes compared to surgery.

The competitive landscape will continue to change rapidly as new companies enter the space to capitalize on the market potential or as acquisition targets. Although TAVR devices remain at a much higher price point compared to SAVR devices, new entrants will drive the price of these devices down, further encouraging TAVR adoption.

Market Opportunities

Amid TAVR devices’ current explosive growth, additional potential for market expansion exists in a few key areas. If TAVR device manufacturers can successfully tap into these opportunities, the TAVR market could grow beyond even our high estimation.

- Earlier intervention: mild, moderate or asymptomatic aortic stenosis

While TAVR currently is indicated for patients with severe, symptomatic aortic stenosis, there is a much larger potential patient pool at less severe or asymptomatic stages of disease.3 Many patients with moderate or mild aortic stenosis (both are often asymptomatic) eventually progress to severe disease, suggesting that early intervention (potentially through TAVR) would be beneficial for this group.4

Studies investigating valve surgery outcomes on asymptomatic patients have produced mixed results, with some studies finding that valve surgery improved outcomes, while others found no difference, or worse outcomes, in the surgery group.5 Although these early studies used SAVR, the minimally invasive TAVR could be better-suited for this patient population, and two clinical trials currently are testing this theory:

- The Evaluation of Transcatheter Aortic Valve Replacement Compared to Surveillance for Patients With Asymptomatic Severe Aortic Stenosis (EARLY TAVR) trial is testing TAVR outcomes in asymptomatic patients with severe aortic stenosis; results are expected soon.

- The Danish National Randomized Study on Early Aortic Valve Replacement in Patients With Asymptomatic Severe Aortic Stenosis (DANAVR) trial is comparing either SAVR or TAVR to physician observation in patients with severe aortic stenosis that is asymptomatic.

More clinical trials studying TAVR devices’ benefits in patients with mild, moderate, and/or asymptomatic aortic stenosis are required to fully capitalize on these potential patient pools. Given the paucity of trials currently underway, it will likely be years before expansion into mild and moderate asymptomatic aortic stenosis affects the market.

- TAVR in younger patients

The younger population represents a large potential patient pool for TAVR devices, but heartcare teams rarely opt for TAVR on patients younger than 75 for a number of reasons.

These justifications including insufficient evidence of TAVR devices’ long-term durability and a lack of clinical evidence for TAVR in mild, moderate, and/or asymptomatic aortic stenosis patients. Additionally, there exists concern about how TAVR’s documented side effects (e.g., paravalvular leak, pacemaker implantation, etc.) will affect younger patients, given the degenerative nature of these side effects and the longer life expectancy of younger patients.

- The use of TAVR devices for other heart valves

Recently, Edwards Lifesciences completed studies demonstrating use of its Sapien XT valve in other anatomical locations, such as the pulmonary valve, with high procedural success rates.6 Further, the Edwards device has been approved by the FDA for patients with a failed surgical bioprosthetic aortic or mitral valve. If companies can show their devices’ utility in other valve locations, the potential patient pool would once again be significantly expanded, including patients with a wider array of congenital heart diseases. To capitalize on this potential, companies must provide solid evidence through rigorous clinical trial testing of their device in each potential new location.

Competitive Analysis and Future Outlook

As previously stated, Edwards LifeSciences and Medtronic currently dominate the US and 5 EU TAVR markets. Boston Scientific is the only other company with an FDA-approved TAVR valve currently available in the US, but the Lotus Edge valve was only recently approved, and thus commands only a small share of the market.

Edwards LifeSciences’ and Medtronic’s devices both have been approved for high, intermediate, and low surgical risk patients in the US, while Boston Scientific’s device only is approved for high surgical risk patients. This gives Edwards LifeSciences and Medtronic a huge competitive advantage, and it is likely to be years before any other company (including Boston Scientific) makes strides in closing that gap.

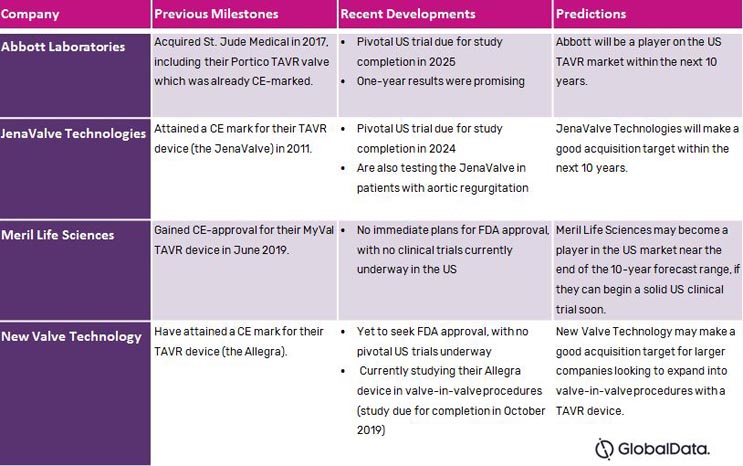

Indeed, only a handful of other companies have valves far enough into development, clinical testing, and regulatory approval in other countries as to be considered potential entrants into the US market within the next 10 years. Many of these companies have earned CE marks for their devices, meaning they already are players in the five EU markets. The table below summarizes these companies’ status and our predictions for their future in the TAVR market.

Table 1 — Companies with existing TAVR devices available in the five EU markets that are potential entrants into the US market in the next 10 years

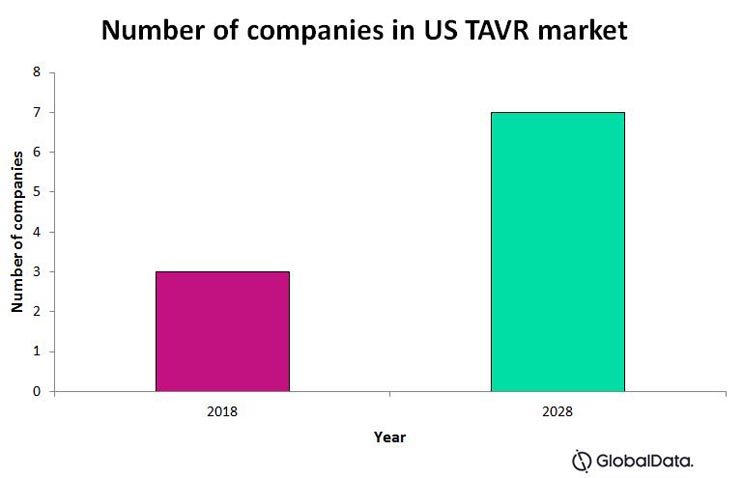

Fig. 2 depicts the US TAVR market, and our prediction for the number of companies that will be on the market within the next 10 years. This prediction assumes that each of the above listed companies manages to enter the US market, either by themselves or by acquisition, in 10 years or less.

Fig. 2

Some other small companies also have designed TAVR devices that are either in early stages of development or have yet to gain any type of regulatory approval. While these devices already are available in the five EU markets, we predict these companies’ impact on the US market will be relegated to the distant future — not within the next 10 years. These companies include Colibri Heart Valve, Braile Biomedica, and Heart Leaflet Technologies Inc.

Conclusion

The future for TAVR is bright. The market has experienced exponential growth in recent years due to expanding device indications and a plethora of study results highlighting the clinical advantages of TAVR over SAVR.

The main barriers to the TAVR market reaching its high potential are the higher rate of pacemaker implantation and the lack of evidence for long-term durability of TAVR devices. After these barriers have been addressed, the market could further expand by tapping into the mild, moderate, and asymptomatic aortic stenosis patient pools, or by using TAVR devices for valves other than the aortic.

In the short term, the US and five EU markets will continue to be dominated by Edwards LifeSciences and Medtronic. In the long term, the competitive landscape may change if other companies are able to make unique technological advancements that contribute to breaking down the market barriers.

About the Authors

Sheryl Tang is a senior medical devices analyst at GlobalData Healthcare specializing in cardiovascular and neurology devices. She has acquired an in-depth understanding of both markets and currently manages the research and development of syndicated market forecast models across 39 countries, as well as being the lead analyst for cardiovascular or neurology-specific consulting projects. As a master of public health graduate from Queen’s University, Sheryl has a strong background in epidemiology in addition to her expertise in market research.

Ashley Young, Ph.D., is a Medical Devices Analyst at GlobalData Healthcare with a focus on Neurology and Cardiology Devices. She collates information from key opinion leaders, secondary sources, and real world data sources to analyze and forecast specific device markets across 39 different countries. Ashley has a Ph.D. from University of Toronto, a strong background in biology and expertise in health and medicine. Before joining GlobalData, Ashley worked in healthcare communications where she collaborated with industry experts, giving her a thorough understanding of medical regulatory frameworks and the Canadian healthcare system.

References

- Centers for Disease Control and Prevention. (2017). Heart Disease Facts. Available at: https://www.cdc.gov/heartdisease/facts.htm [Accessed September 5, 2019]

- GlobalData. (2019). Transcatheter Aortic Valve Implantation (TAVI) Market Model.

- Osnabrugge, R.L. et al. (2013). Aortic stenosis in the elderly: disease prevalence and number of candidates for transcatheter aortic valve replacement: a meta-analysis and modeling study. Journal of the American College of Cardiology. 62(11): 1002-1012. Available at: https://www.sciencedirect.com/science/article/pii/S0735109713020792?via%3Dihub

- Otto, C.M. et al. (2004). Aortic stenosis: even mild disease is significant. European Heart Journal. 25(3): 185-187. Available at: https://academic.oup.com/eurheartj/article/25/3/185/563483

- Braunwald, E. (1990). On the natural history of severe aortic stenosis. Journal of the American College of Cardiology. 15(5): 1018-1020. Available at: https://www.sciencedirect.com/science/article/pii/073510979090235H?via%3Dihub

- Plessis, J. et al. (2018). Edwards SAPIEN transcatheter pulmonary valve implantation. JACC: Cardiovascular Interventions. 11(19): 1909-1916. Available at: http://interventions.onlinejacc.org/content/early/2018/09/05/j.jcin.2018.05.050