Market Cannibalization Underlies Cardiac Output Monitoring Market

By Kamran Zamanian, Ph.D., and Nolan Esplen, iData Research Inc.

Cardiac output (CO) — the volume of blood pumped by the heart per minute — is regarded as a fundamental component of hemodynamic monitoring in critically ill patients.1,2 Monitoring of this parameter has become routine in patients undergoing or emerging from high risk-surgeries, where fluid shifts or hemodynamic instability might be expected.2

Traditionally, CO measurements have been restricted to acute care settings, where invasive thermodilution methods could be employed through the use of a pulmonary artery catheter (PAC). However, over the past two decades, PAC use has declined and less-invasive technologies have emerged to meet the growing demand for CO monitoring in patients at various levels of surgical risk.2,3

Caregivers now are seeking to adopt these less-invasive modalities, as they are easier to use and may effectively replace traditional invasive technologies. This shift in demand has placed significant downward pressure on the invasive CO monitoring market, while also stimulating growth across the minimally invasive and non-invasive segments. In effect, the cardiac output monitor market is experiencing dramatic changes driven by market cannibalization, both between invasive and less invasive modalities and across minimally invasive platforms. These dynamics are poised to irrevocably alter the market’s trajectory, and have prompted leading competitors to re-focus their efforts into the development and advancement of less-invasive monitoring platforms.1

Complications And Controversy With PAC Usage

Pulmonary artery catheterization for CO monitoring has long been considered controversial due to the inherent risk and various complications that have been tied to PAC use.2,4,5 Furthermore, mounting evidence suggests that there is limited benefit, if any, to support the use of invasive PAC methods over modern, notably less-invasive, alternatives.2,6,7

These challenges against the efficacy of PAC-based CO monitoring have since inspired clinicians to move towards minimally or non-invasive devices. In addition, the skills required for PAC insertion continue to be lost without substitute as experienced physicians retire, and younger practitioners lack the requisite training.1 In light of these prevailing trends, PAC usage is decreasing rapidly, and the invasive CO market is contracting as a result.

Innovation And Validation: Less-Invasive Modalities Drive Growth

Traditional, invasive CO monitoring faces numerous barriers to adoption, not the least of which is the inherent surgical risk and training required for PAC insertion and management. Less invasive technologies thus provide clinicians a means by which they may avoid the adverse effects and technical errors that plague more invasive systems.1,2,7,8 Many of these less invasive platforms have been validated against the “gold standard” of PAC thermodilution methods and have proven capable of providing reliable, reproducible readings in patients with a variety of conditions during the perioperative period. Most notable are the minimally invasive pulse contour analysis and Esophageal Doppler (ED) systems, which now are accepted as effective alternatives to invasive (PAC based) CO monitoring.2,8,9

Minimally and non-invasive CO monitoring techniques also have been shown to be more accessible and cost-effective relative to invasive PAC methods.2,10 Consequently, the trend to adopt less-invasive CO monitoring has resulted in expanded market opportunity.1 Specifically, minimally invasive devices are seeing increased utilization within the ER and ICU, while non-invasive modalities have made CO monitoring accessible within lower-acuity settings.1,8 Furthermore, increased awareness generated through clinical trials and protocols for better fluid management will continue to support the adoption of less-invasive CO monitoring, in place of more invasive modalities.1

The minimally invasive segment currently overshadows the non-invasive market, but ongoing improvements in reading accuracy and validation of the underlying technologies is supporting increased adoption of the latter.8,9 Of particular importance are those systems marketed by Edwards Lifesciences (ClearSight) and Cheetah Medical (NICOM).1,2,8,9 Furthermore, the non-invasive segment stands to benefit from companies packaging their non-invasive consumables with more invasive CO monitoring systems, or even coupling non-invasive capabilities to devices that measure other hemodynamic parameters.1

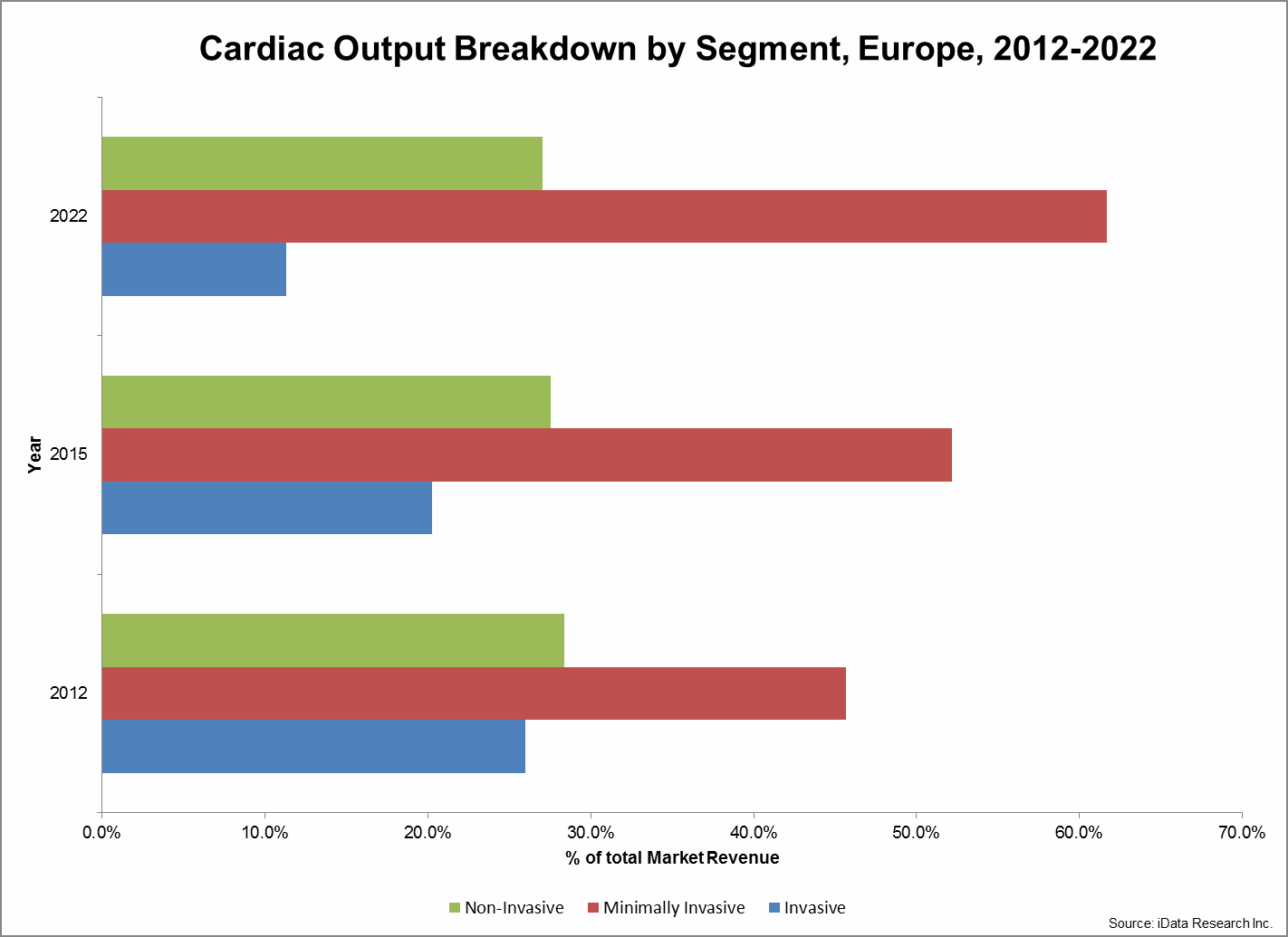

Visualizing The Demand For Less Invasive Devices

The perception that validated minimally and noninvasive CO platforms as reliable substitutes to invasive PAC based systems is driving cannibalization between those markets. Moreover, with technological advancements and improvements in accuracy across competing modalities, there now are fewer reasons to opt for complicated, PAC-based solutions.

In its present state, the total CO market continues to show bias towards minimally invasive platforms while the budding non-invasive market remains partially limited by a general lack of awareness. In 2015, roughly 20 percent of the market’s value was attributed to the invasive CO segment. However, by 2022, this share is expected to decrease to 11 percent. Coupled with the growing size of the total market, this shift represents a significant decline in demand for invasive capital equipment and PACs. A proportionate increase in demand is expected primarily within the minimally invasive segment, which is expected to grow from 52 percent to 62 percent of the total market by 2022.1

A Shifting Competitive Focus

As minimally and non-invasive cardiac output monitoring alternatives continue to gain traction at the expense of the invasive market, some competitors are being pressured to adapt or risk falling behind. In the context of the European cardiac output monitoring market, Edwards Lifesciences has long been considered the leading figure. While this has historically been attributed to the company’s control over the invasive PAC market, Edwards has been able to expand into the minimally and non-invasive space with its FloTrac and ClearSight (ccNexfin) systems, respectively.

The choice to diversify in this manner has enabled Edwards to mitigate the effects of a contracting invasive CO market and maintain its leading position. Cheetah Medical remains the preeminent non-invasive market leader, with its Bioreactance-based NICOM platform having the benefit of being simple to use, cost effective, and accurate even in patients experiencing low blood pressure or hemodynamic instability. As the non-invasive market is expected to gain traction in the coming years, Cheetah is poised to see growth within the scope of the total CO monitoring market.1

Other notable contenders include Pulsion Medical (PiCCO), Deltex (ED) and LiDCO (PulseCO), all of whom offer minimally invasive technologies that have been extensively validated. LiDCO recently entered the non-invasive space through its partnership with cnsystems, whose CNAP module integrates with the LiDCOrapidv2 minimally and non-invasive platform. Meanwhile, Deltex has begun to experience resistance in the U.K, its domestic and also largest market, in light of cannibalization within the minimally invasive segment. Pulsion, on the other hand, has been able to maintain its strong position behind Edwards, and its proprietary PiCCO technology is more frequently being used as a reference by which non-invasive modalities may be validated.

In consideration of present market trends, the competitive landscape is beginning to shift. LiDCO and Edwards, who have embraced progressively less invasive modalities, are expected to see growth motivated by increased demand for non-invasive solutions. However, as the minimally invasive market is expected to outpace the non-invasive market in terms of revenue growth, segment leaders Pulsion and Cheetah will maintain their respective positions in the total market.1

Conclusions

The reduced risk of complication and ease of use associated with less-invasive modalities, as well as the potential for non-invasive solutions to expand beyond the critical care setting, will continue to drive growth within the minimally and non-invasive markets at the expense of the invasive segment.

Moreover, modern non-invasive technologies are greatly improved, and are becoming more widely accepted as reliable alternatives to invasive CO monitoring in a variety of care settings. This trend is exemplified through increased adoption of Cheetah’s NICOM CO monitoring device. In an attempt to adapt to the market’s present trajectory, market leader Edwards Lifesciences has added to its portfolio ClearSight, a completely non-invasive solution that leverages validated finger arterial pulse contour analysis technology (Nexfin).

While the prevailing market trends are wholly detrimental to the health of the invasive monitoring segment, there is a small degree of insulation against cannibalization due to the continued acceptance of PAC thermodilution as the “gold standard” for CO monitoring. The minimally invasive segment will continue to account for the largest proportion of the market’s value. However, the prevailing demand for non-invasive technologies may facilitate a shift in the market, should these technologies see further validation or succession by increasingly advanced monitoring platforms.

This article was created using information from iData Research’s global report suite entitled European Market Report Suite for Patient Monitoring Equipment – 2016.

About the Authors

Nolan Esplen is a research analyst at iData Research and was the lead researcher for the 2016 European Patient Monitoring Equipment Report Suite. His current work includes the 2016 U.S. Patient Monitoring Equipment Market Report Suite.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research is an international market research and consulting group focused on providing market intelligence for medical device and pharmaceutical companies. iData covers research in: diabetes drugs, diabetes devices, pharmaceuticals, anesthesiology, wound management, orthopedics, cardiovascular, ophthalmics, endoscopy, gynecology, urology, and more.

Resources

- European Patient Monitoring Market – 2016. iData Research. Accessed May 19, 2016.

- Lee AJ, Cohn JH, Ranasinghe JS. Cardiac output assessed by invasive and minimally invasive techniques. Anesthesiol Res Pract. 2011;2011:475151.

- Ramsingh, Davinder, Brenton Alexander, and Maxime Cannesson. Clinical Review: Does It Matter Which Hemodynamic Monitoring System Is Used? Critical Care. 2014;17(2): 208.

- Domino KB, Bowdle TA, Posner KL, Spitellie PH, Lee LA, Cheney FW. Injuries and liability related to central vascular catheters: a closed claims analysis. Anesthesiology. 2004;100:1411–1418.

- Connors AF, Speroff T, Dawson NV, Thomas C, Harrell FE, Wagner D, Desbiens N, Goldman L, Wu AW, Califf RM, et al. The effectiveness of right heart catheterization in the initial care of critically ill patients. SUPPORT Investigators. JAMA. 1996;276:889–897

- Sandham JD, Hull RD, Frederick Brant R, et al. A randomized, controlled trial of the use of pulmonary-artery catheters in high-risk surgical patients. New England Journal of Medicine. 2003;348(1):5–14.

- Reade MC, Angus DC: PAC-Man: game over for the pulmonary artery catheter? Crit Care 2006;10(1):303. 10.1186/cc3977

- Mehta Y, Arora D. Newer methods of cardiac output monitoring. World Journal of Cardiology. 2014;6(9):1022-1029.

- Marik, Paul E. Noninvasive Cardiac Output Monitors: A State-of the-Art Review. Journal of Cardiothoracic and Vascular Anesthesia. 2012; 27(1): 121 – 134

- Malbrain ML, De Potter T, Deeren D. Cost-effectiveness of minimally invasive hemodynamic monitoring. In: Vincent JL, editor. Yearbook of Intensive Care and Emergency Medicine. Berlin: Springer-Verlag; 2005. p. 603-31