Medical Imaging Market: Companies Play A New Game

During the latest months, Yole Développement (Yole) identified numerous investments, mergers, acquisitions in the solid-state medical image sensors market. The research market and strategy consulting company confirms recently, in its latest technology & market analysis, Solid State Medical Imaging: X-ray and Endoscopy, the direct impact on the supply chain. With 2.1 million units in 2013, medical imaging market is evolving slowly with related players that strongly compete more to get an access to the market, than to develop and acquire new technologies.

Under this report, Yole provides a deep understanding of the medical imaging industry including the hottest industry news (Acquisitions – Innovative products launches- Technology mix …) and value chain analysis with players (Integrated devices manufacturers – Foundries - Design houses - Original Equipment Manufacturers) and infrastructure. Yole’s analysis is focused on the two fastest-evolving applications, endoscopy and X-ray imaging, that drive the solid-state medical image sensors market.

“The global medical image sensors market will grow in volume from 2.1 million units in 2013 to 6.7 million units by 2019”, announces Dr Benjamin Roussel, Activity Leader at Yole Développement in this report. He explains: “The global market is fueled by emerging endoscopy products like camera pills and disposable endoscopes. These emerging products will enjoy broad adoption in clinical practices, owing to incentives being provided in Europe and the U.S. to reduce nosocomial infections”.

From a revenue standpoint, the medical image sensors market will grow significantly. Indeed, the consulting company announces 11% CAGR between 2014 and 2019. According to Yole’s analysts, this market should reach $142M by 2019. Moreover, X-ray image sensors account for 93% of total medical image sensors market revenue, due to the high cost of X-ray sensors.

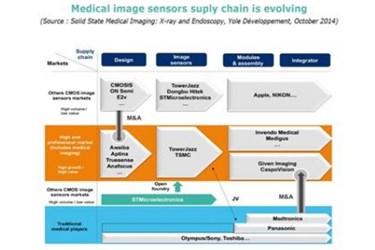

However the most important fact happening in this sector is probably the evolution of the supply chain (See illustration: Medical imaging supply chain in the MedTech gallery (http://www.yole.fr/2014-galery-MedTech.aspx)). Indeed the medical imaging companies expand and/or reinforce their positioning thanks to numerous mergers, acquisitions, joint ventures (JV) … Their objectives were clearly to acquire new competencies along the supply chain and gain market shares.

Yole’s analysts details some examples below:

- Panasonic and TowerJazz announced the JV completion on April 1st, 2014. “The JV will enable TowerJazz to offer its customers capacity of a state of the art 300mm technology fab including best of class 65nm CMOS image sensor dark current and quantum efficiency performance and additional 45nm digital technology, and added available capacity of approximately 800,000 wafers per year (8 inch equivalent) in three manufacturing facilities in Japan…” announced TowerJazz in its press release (source:www.towerjazz.com, news and events section, April 2014).

- CMOSIS, financially backed by TA Associates, a private equity investor and specialized in high-end applications, has acquired Awaiba. With this acquisition, CMOSIS is now able to develop its leadership in several high-end markets, including medical devices.

- Hua Capital Management, a Beijing-based private equity firm, hired Bank of America Corp. to provide funding for its $1.7B bid for OmniVision Technologies, a camera sensor maker.

At the integrator level, Yole observes some movements as well. Indeed traditional medical devices players adopt the same strategy and penetrate the market with mergers, acquisitions and collaborations. For example: Toshiba and CaspoVision - Given Imaging and Covidien (now part of Medtronics).

Source: Yole Développement