Medtech Category Insights In India: Surgical Instruments, Digital Devices, And Diagnostics

By Isha Suman, Decision Resources Group

Lately, medtech companies have realized the attractiveness of emerging countries and have been establishing R&D hubs in these regions in increasing numbers, as exemplified by Boston Scientific and GE Healthcare each recently establishing a direct presence in India. However, establishing a manufacturing center in India is not enough in itself to take advantage of the potential in this market; medtech companies also need to know which product segments offer the most attractive opportunities. This article is the first in a two-part series designed to identify these opportunities.

Due to critical differences in economic conditions — and unique unmet needs in the Indian market — what works well in the West may not succeed in India. While India’s medical devices and equipment market is growing strongly, a variety of factors specific to that market are impacting the performance of each product type. Therefore, success in each of these product segments depends on adapting to the Indian market’s particular needs.

Medical Devices And Equipment

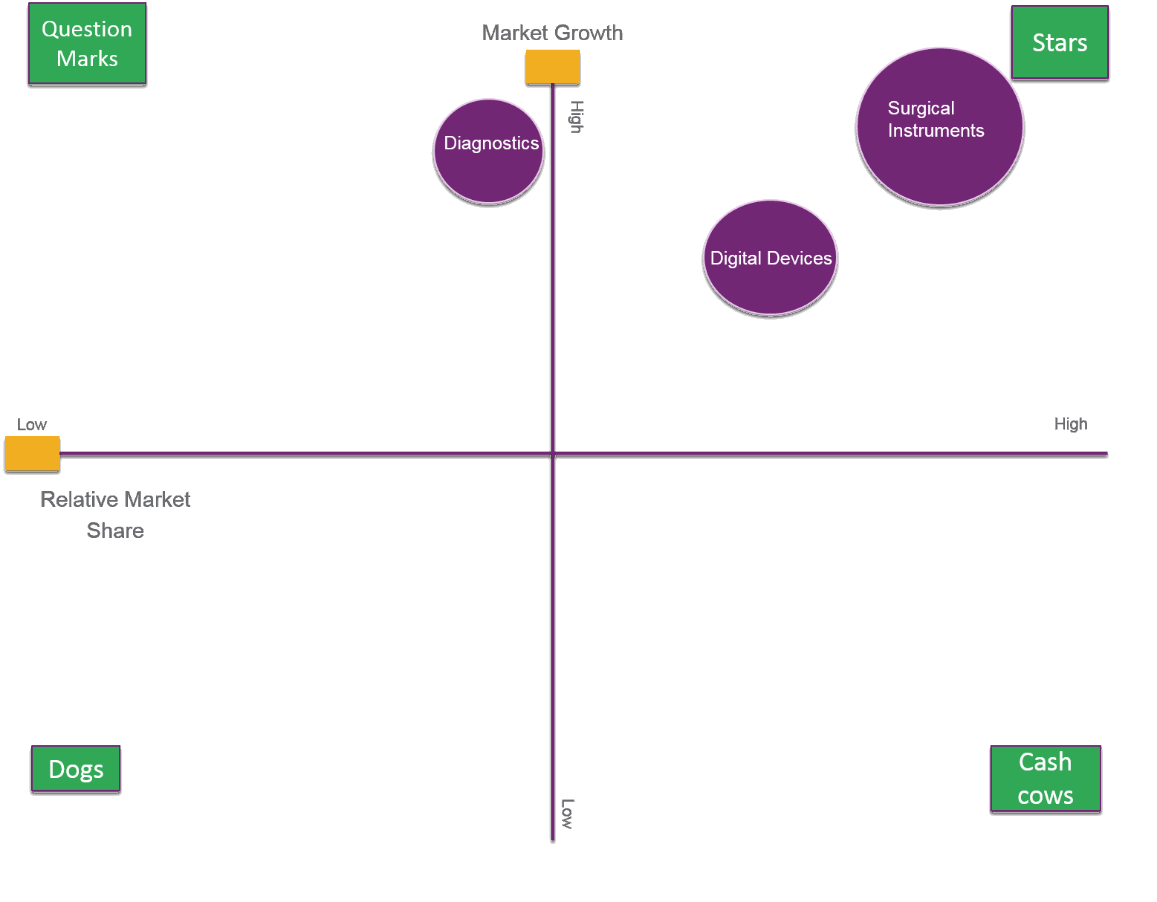

The Boston Consulting Group (BCG) growth share matrix shows, at a glance, which products are:

- High-market-share, high-growth “stars”

- High-share, low-growth “cash cows”

- Low-share, high-growth “question marks”

- Low-share, low-growth “dogs”

Below, a BCG growth share matrix for the medical devices and equipment segment of India’s medtech market shows the recent performance of several major product categories — namely, surgical instruments, digital devices, and diagnostics.

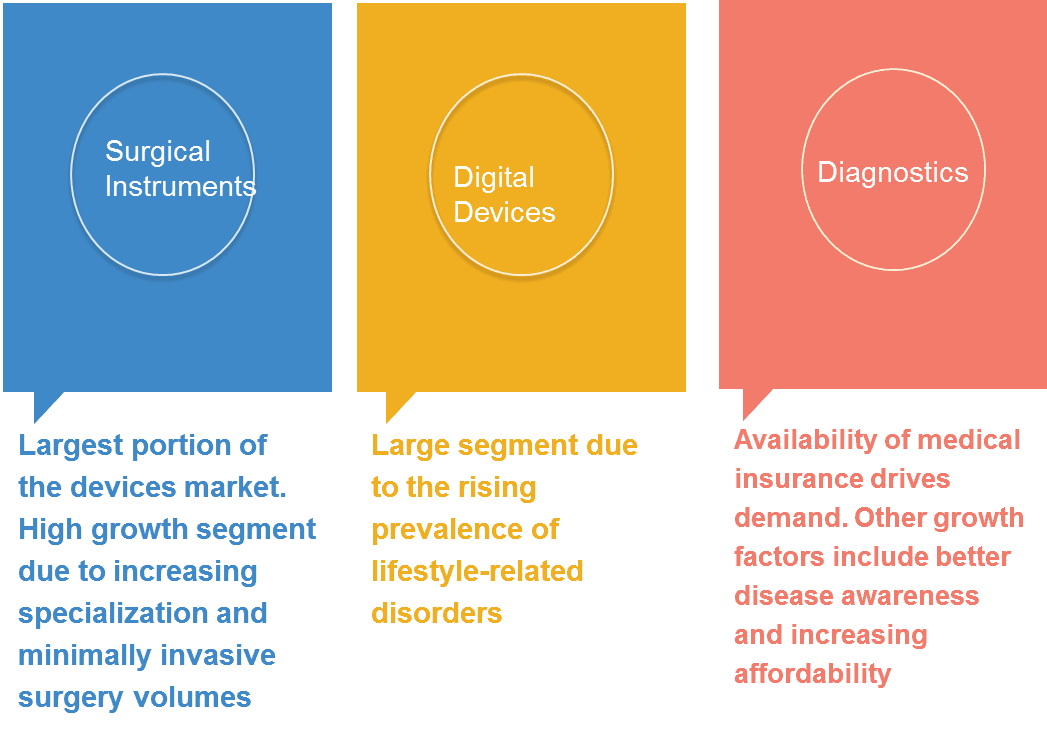

Surgical instruments and equipment form the largest portion of India’s medical devices and equipment segment, accounting for nearly 60 percent of the market. The market for these devices is expected to exhibit high growth in the future for a number of reasons. First, there is an increasing amount of specialization and advancement in these devices; even the smallest and most basic of these devices, like scalpels and knives made by local companies, have multiple designs suited for different requirements. Second, the volume of minimally invasive surgeries performed in India is increasing. Although this trend is limited to urban areas, the rise in minimally invasive procedures increases the total number of surgeries performed, and thus drives overall market demand for surgical instruments and equipment.

There is a mix of local manufacturers and multinational corporations (MNCs) competing in this segment. Corporate hospitals — organized chains of hospitals with set processes and standards, and usually having larger budgets compared to other hospitals — mostly prefer the premium-priced brands offered by MNCs. Lower-tier hospitals — independent facilities that mostly lack high-tech capability and usually are facing budget crunches — prefer lower-priced, locally manufactured products.

Digital devices — such as sphygmomanometers, glucometers, etc. — form the second-largest segment within India’s medical equipment market. Two factors are driving revenue growth for these devices: First, due to increasing urbanization, sedentary lifestyles, and changing dietary habits, the prevalence of a number of lifestyle-related disorders — such as type 2 diabetes, cardiovascular disease, and certain cancers — is rising. Second, pharmaceutical companies, hospitals, and the Indian government are raising awareness of a number of diseases through patient education programs. India has famously been coined the diabetes capital of the world, and due to the prevalence of this condition, there are numerous cases of diabetes-associated comorbidities, such as heart disease, high blood pressure, and diabetic retinopathy, among others.

The combination of these factors has led to high unit sales for convenient self-monitoring devices. Interestingly, due to high demand in this segment, many local companies have started offering economic alternatives to products by MNCs, which has further fueled demand for these devices in India and led to price competition in this segment.

The increasing incidence of lifestyle-related disorders also is contributing to growth in the diagnostic equipment segment, which includes cardiac imaging machines, CT scanners, and X-ray, ultrasound, and MRI imaging machines, among others. The number of diagnostic facilities in India is growing, spurring growth in diagnostic equipment revenues. Additionally, the availability of medical insurance and the rising middle class in India, increasingly able to afford medical treatment, also are driving growth in this space.

Furthermore, although medical insurance providers in India have tended to limit diagnostic coverage to procedures performed during hospital stays, certain providers now are working with equipment manufacturers to enable free diagnostic testing for patients who currently pay out-of-pocket, which has led to increased demand for diagnostic centers and equipment.

The high cost of certain diagnostic procedures has limited adoption to only the urban belts of the country, but complex diagnostic procedures will become available in less densely populated cities as both the central and state governments continue to place increasing emphasis on preventive care, and launch programs to assist more of the population in receiving health care. One such project is the Arogysri initiative by the Andhra Pradesh state government, a government-run health insurance scheme for people living below the poverty line that guarantees quality healthcare for all.

Trends in the medical device and equipment segment highlight a number of the challenges and opportunities facing the Indian medtech market. India’s high population, rising incomes, and the increasing prevalence of lifestyle-related conditions result in a substantial potential patient pool. However, many patients, particularly in more rural areas, continue to face difficulties accessing treatment, especially those therapies using more expensive or technologically-advanced devices.

Although government-backed programs are ameliorating this issue, resource disparity between urban and rural hospitals continues to shape the competitive dynamics in this market, favoring local competitors in rural regions and MNCs in urban centers. International competitors looking to capitalize on the growth potential of the Indian market will need to contend with the presence of these local manufacturers, and the price competition from their low-cost product offerings.

Medtech companies need to identify and target those corporate hospitals that are expanding their presence from urban to rural areas. Establishing their brands’ reputation for quality among these chains of hospitals can help medtech companies gain access to vast, underserved areas of the country. Furthermore, the increasing availability of diagnostic procedures will create attractive opportunities in the diagnostics space

Next week, part two of this series will look in-depth at product segment performance in the India’s medical consumable and implant markets, and explore what these trends mean to medtech companies.

About The Author

Isha Suman is a team lead, Research and Operations, at Decision Resources Group. She works on syndicated market research reports for medtech in the endoscopy division of the company. Isha holds a postgraduate degree in marketing from Indian Institute of Management and a bachelor’s degree in telecommunications from Visvesvariah Technological University.