Medtronic Buys Heart Failure Device Developer HeartWare For $1.1 Billion

By Jof Enriquez,

Follow me on Twitter @jofenriq

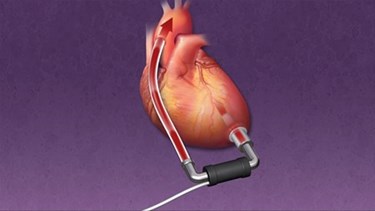

Medtronic has acquired HeartWare International, Inc., developer of miniaturized left ventricular assist devices (LVADs) for the treatment of heart failure, for $1.1 billion. The deal provides a shot in the arm for the struggling HeartWare, and gives Medtronic a foothold in the promising LVAD market.

Until recently, the market for LVADs – surgically implanted devices that mimic the heart's pumping action – was dominated by Thoratec and HeartWare. Thoratec, which controlled 60 percent of the market, was acquired in July last year by St. Jude Medical (St. Jude subsequently was bought by Abbott). That left HeartWare as the sole attractive target in this segment for the larger medical device companies.

HeartWare develops and markets its flagship HVAD System and the next-generation MVAD System. While Thoratec's Heartmate II is surgically implanted just below the diaphragm in the abdomen, HeartWare's HVAD is smaller, allowing for intrapericardial placement, as well as implantation via thoracotomy. The HeartWare System received CE Marking in 2009 and was approved by FDA in 2012 as a bridge to cardiac transplantation for patients who are at risk of death from refractory end-stage left ventricular heart failure. Currently, it holds 40 percent of the growing LVAD market, second only to Thoratec.

However, HeartWare also has encountered some setbacks: it received an FDA warning letter, encountered clotting-related side effects in a clinical trial for its smaller MVAD device, and had to cancel its planned purchase of interventional cardiology device firm Valtech.

"Medtronic is catching HeartWare at a near bottom which makes the acquisition premium more palatable," Cowen and Co. analysts wrote in a note, according to Reuters.

Under the deal, Medtronic will buy all outstanding shares of HeartWare common stock for $58.00 per share, in cash, for a total value of $1.1 billion. The transaction will close during Medtronic's second fiscal quarter, ending Oct. 28, 2016.

Medtronic said U.S. health spending for heart failure has reached $39 billion per year, and is expected to grow as the number of patients with heart failure exceeds eight million by 2030.

"The addition of HeartWare's innovative portfolio adds to our expanding portfolio of diagnostics, therapeutics and services that address heart failure patients," said Mike Coyle, EVP of the Cardiac and Vascular Group at Medtronic, in a news release.

Medtronic's solid financial and R&D resources should give a boost to HeartWare's technology, specifically with regards to successful clinical trials, manufacturing, and commercialization.

"HeartWare's HVAD System enhances the portfolio of our Cardiac & Vascular Group, a team with a proven track record of executing and a demonstrated ability to scale early stage concepts into large, sustainable end markets," said Medtronic CEO Omar Ishrak.

Analyst Sean Lavin at BTIG added in a note, "[Medtronic] ownership should help [HeartWare] better access the cardiologist channel and access to capital (i.e., investment in newer technology like MVAD and transcutaneous energy). Additionally, the combination should also help on the manufacturing side and [Medtronic] should be able to clear up the FDA warning letter."

Now that the two main players — Thoratec (Abbott, via St. Jude Medical) and HeartWare (Medtronic) — have been snapped up by medical device giants, LVADs could see both increased clinical adoption and market competition. LVADs increasingly have become "destination therapy" for many heart failure patients who may or may not be transplant candidates, as opposed to acting as a "bridge" to heart transplantation. A Mayo Clinic study indicates that more indications for LVADs are in the offing.