New Appropriate Use Guidelines & Their Impact On The U.S. Vascular Access Device Market

By Kamran Zamanian, Ph.D., and Sean Collins, iData Research Inc.

Midline catheters are used to obtain short- to intermediate-term peripheral venous access for infusing intravenous fluids and medication. Traditionally, midlines have occupied a niche market between peripherally inserted central catheters (PICCs) and peripheral intravenous catheters (PIVCs). However, recent initiatives from the Centers for Medicare and Medicaid Services (CMS), as well as new appropriate usage guidelines from the University of Michigan and Infusion Nursing Society (INS), are driving a surge in midline use. The uptick in midline insertions is exerting downward pressure on PICC sales, which, in turn, is contributing to moderation in the tip-placement device market.1

Rising Infection Concerns

In 2008, CMS discontinued payment for the estimated $32,000 cost tied to treating a central line-associated blood stream infection.2,3 In the wake of this decision, healthcare providers have placed increased weight on selecting the vascular access catheter with the lowest associated infection rate. Midlines, with an estimated infection rate well below that of PICCs, have come into vogue, offering an attractive alternative to PICCs in select cases.4,5

Evolving Best Practices

While reimbursement changes have shaped the trajectory of the midline market in recent years, future growth will be driven by the adoption of recently published appropriate usage guidelines from the University of Michigan and the INS.1

Released in September 2015, the Michigan Appropriateness Guide for Intravenous Catheters (MAGIC) is a collection of guidelines providing recommendations as to when one vascular access device is preferable to another.6 A recent application of the MAGIC assessment tool in one facility yielded a 35 percent decline in monthly PICC insertions, while monthly midline insertions almost tripled.7 Use of the MAGIC assessment tool is expected to increase over the next seven years, driving a shift in vascular access device usage from PICCs to midlines.1

The midline market is expected to gain additional momentum from the release of the INS’s 2016 Infusion Nursing Standards of Practice, which, relative to previous editions, includes reduced limitations on drugs and solutions administered through midlines.1,8,9 Most notably, pH alone is no longer an indication for the use of a central line.8,9 This change increases the volume of scenarios in which the use of a midline is appropriate. One such scenario is the short-term intravenous administration of vancomycin, a widely used antibiotic. Previous editions of the Infusion Nursing Standards of Practice have stated that infusates with a pH outside the recommended range of 5 to 9 should not be administered through a midline.9 Under this criteria, administering vancomycin, which has a pH of 3.9, would have typically required the placement of a PICC.10 The 2016 Infusion Nursing Standards of Practice, in contrast, does not rule out the use of a midline.

Quantifying The Shifting Mix Of Vascular Access Devices

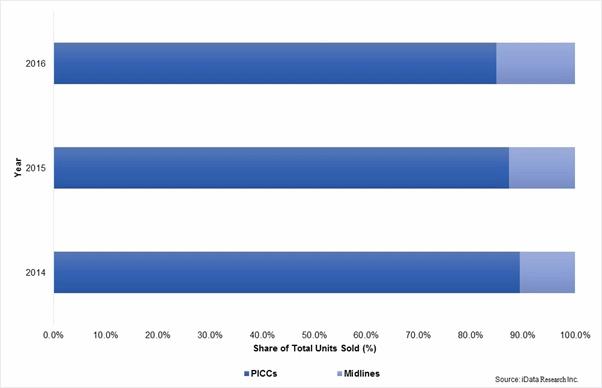

In 2015, midlines represented approximately 10 percent of combined midline and PICC unit sales in the United States. Increasing adherence to new appropriate usage guidelines, among other factors, is expected to drive this rate to reach about 15 percent by the end of 2016. With over 3 million PICCs placed in the U.S. on an annual basis, movement of this magnitude translates to robust midline unit sales growth.1

Total Midline & PICC Units Sold, by Type, U.S., 2014-2016

Diminished PICC Insertions Soften Tip-Placement Device Market

Tip-placement systems, such as C.R. Bard’s Sherlock 3CG, are often used in PICC insertion procedures to ensure the catheter tip is correctly positioned in the superior vena cava.1 A growing body of research supporting the efficacy of tip-placement systems has driven a substantial increase in utilization in recent years.1,11 Though the U.S. tip-placement device market is expected to continue expanding over the next seven years, growth is expected to decelerate, due in part to the shift in preference from PICCs to midlines.1 Unlike PICCs, midlines do not extend into the superior vena cava. As such, tip-placement systems are not used in midline insertions. Therefore, each midline inserted in the place of a PICC will contribute to a decrease in the potential value of the tip-placement device market.

Expanding Competitive Landscape

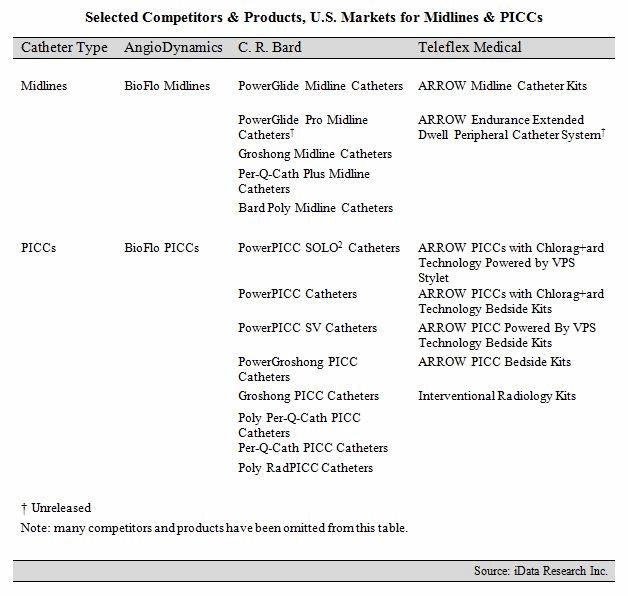

C.R. Bard’s PowerGlide Midline Catheters have dominated the U.S. midline market in recent history. The company’s commanding lead in the midline space is partially attributable to its supremacy in the PICC market, where it holds about seven times the share of its closest competitor. Bard also benefits from its extensive vascular access portfolio, offering midline kits featuring the popular StatLock IV Ultra Stabilization Device and GuardIVa Antimicrobial Hemostatic IV Dressing. The upcoming launch of the PowerGlide Pro Midline Catheter is expected to sustain Bard’s share in the U.S. midline market in 2016.1

But, competitors such as AngioDynamics and Teleflex Medical are gaining traction in the U.S. midline market, challenging C.R. Bard’s lead.1 AngioDynamics entered the midline market in August 2015 with the launch of the BioFlo Midline Catheter.12 BioFlo midlines are designed to reduce thrombus accumulation and are power-injectable. The company has incorporated BioFlo technology into many of its vascular access devices, including PICCs, ports, and dialysis catheters. BioFlo technology has experienced significant growth in select product areas in recent years and, as of April 2016, represented 42 percent of AngioDynamics’ total vascular access revenue.13

Teleflex Medical currently offers a diverse midline portfolio, which features both basic and maximal barrier precaution kits. Teleflex’s midline offerings are expected to expand in 2016 with the launch of its ARROW Endurance Extended Dwell Peripheral Catheter System, which received FDA approval in 2015.1,14 The company has traditionally been strongest in the acute central venous catheter (CVC) market, but has expanded its vascular access portfolio in recent years with product launches in the chronic CVC, PICC, and tip-placement device markets.1,15,16,17

Selected Competitors & Products, U.S. Markets for Midlines & PICCs

Conclusion

In the face of new appropriate usage guidelines, utilization of midline catheters is set to increase strongly in the near-term, causing PICC unit sales to moderate. Softening demand in the PICC market will reverberate throughout the market for tip-placement devices, causing growth to decelerate. Though C.R. Bard is expected to carry on a tradition of dominance, competition in the U.S. midline market is intensifying, with new firms stepping forward to chip away at Bard’s lead.

This article was created using information from iData Research’s global report suite entitled U.S. Vascular Access Device Market – 2016.

About the Authors

Sean Collins is a research analyst at iData Research and was the lead researcher for the 2016 U.S. Vascular Access Devices Report.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research is an international market research and consulting group focused on providing market intelligence for medical device and pharmaceutical companies. iData covers research in: diabetes drugs, diabetes devices, pharmaceuticals, anesthesiology, wound management, orthopedics, cardiovascular, ophthalmics, endoscopy, gynecology, urology, and more.

Resources

- U.S. Vascular Access Device Market – 2016. iData Research. Accessed May 2, 2016.

- Kim J, Holtom P, Vigen C. Reduction of catheter-related bloodstream infections through the use of a central venous line bundle: Epidemiologic and economic consequences. American Journal of Infection Control. 2011;39(8):640-646.

- Hospital-Acquired Conditions (Present on Admission Indicator) - Centers for Medicare & Medicaid Services [Internet]. Cms.gov. 2016 [cited 2 May 2016].

- Maki D, Kluger D, Crnich C. The Risk of Bloodstream Infection in Adults With Different Intravascular Devices: A Systematic Review of 200 Published Prospective Studies. Mayo Clinic Proceedings. 2006;81(9):1159-1171.

- Moureau N, Poole S, Murdock M, Gray S, Semba C. Central Venous Catheters in Home Infusion Care: Outcomes Analysis in 50,470 Patients. Journal of Vascular and Interventional Radiology. 2002;13(10):1009-1016.

- Chopra V, Flanders S, Saint S, Woller S, O'Grady N, Safdar N et al. The Michigan Appropriateness Guide for Intravenous Catheters (MAGIC): Results From a Multispecialty Panel Using the RAND/UCLA Appropriateness Method. Annals of Internal Medicine. 2015;163(6_Supplement):S1.

- Swaminathan L, Calleja Y, Bercea P. Using “MAGIC” to Facilitate Appropriate PICC Use: Implementation of a PICC Appropriateness Assessment Tool. Presentation presented at; 2016.

- Infusion therapy standards of practice. Norwood, MA: Infusion Nurses Society; 2016.

- Infusion nursing standards of practice. Norwood, MA: Infusion Nurses Society; 2011.

- Caparas J, Hu J. Safe administration of vancomycin through a novel midline catheter: a randomized, prospective clinical trial. The Journal of Vascular Access. 2014;15(4):251-256.

- Dale M, Higgins A, Carolan-Rees G. Sherlock 3CG Tip Confirmation System for Placement of Peripherally Inserted Central Catheters: A NICE Medical Technology Guidance. Appl Health Econ Health Policy. 2015;14(1):41-49.

- AngioDynamics. AngioDynamics Begins Shipment of New Midline Catheters [Internet]. 2015.

- AngioDynamics' (ANGO) CEO Jim Clemmer on Q3 2016 Results - Earnings Call Transcript [Internet]. Seekingalpha.com. 2016 [cited 2 May 2016].

- Endurance Approval Letter. U.S. Food and Drug Administration Web site. Published November 23, 2015. Accessed May 2, 2016.

- Teleflex Medical. Teleflex Launches ARROW JACC (Jugular Axillo-subclavian Central Catheter) with Chlorag+ard Technology, the First and Only Long-Term Antimicrobial and Antithrombogenic CVC [Internet]. 2013.

- Teleflex Medical. Teleflex Launches Triple-Lumen Version of Unique ARROW PICC with Chlorag+ard Technology [Internet]. 2015.

- Teleflex Medical. Teleflex Announces Launch of its Next Generation Vascular Positioning System [Internet]. 2013.