OEMs Vs. Third-Party Providers: Conquering The U.S. Endoscope Service Market

By Xi Chen, Decision Resources Group

An aging baby boomer generation and rising obesity rates have driven steady growth of the U.S. patient population. At the same time, increased use of endoscopy in the evaluation of many pathologies, as well as demand for less invasive treatments, will continue to propel the use of endoscopes. Consequently, there will be a growing need for a highly efficient endoscope servicing industry to help facilities maintain their endoscopes and keep up with expanding procedure volumes.

However, falling prices will hinder the endoscope service market. The Affordable Care Act (ACA) has introduced seemingly contradictory goals of delivering quality health care while simultaneously lowering costs. This stated policy has driven a major wave of hospital mergers and partnerships in the last two years. These mergers also include "vertical acquisitions," in which hospitals combine with outpatient clinics and private physician practices. This has led to a shift in the supplier-buyer dynamic, with group purchasing organizations (GPOs) and hospital financial organizations having a greater influence over purchasing decisions. These larger hospital conglomerates have more leverage to negotiate discounts from endoscope service providers, which has limited the provider's ability to raise prices to keep up with inflation and rising operating costs.

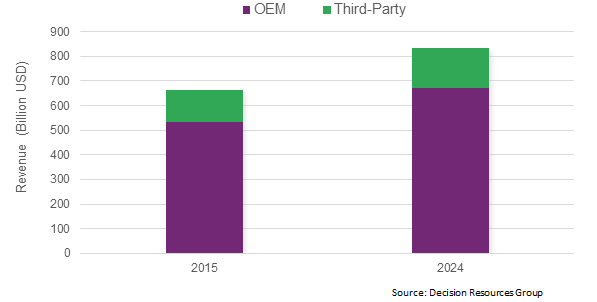

In addition, many third-party service providers have sprung up in the U.S. over the last 20 years to claim a share of the largest endoscope service market in the world. These companies have thrived under the demand from hospitals for more affordable services, as well as services for older endoscopes — which original equipment manufacturers (OEMs) often do not repair. Many third-party companies have proven themselves to offer reputable and high-quality endoscope repairs with turnaround times that are sometimes faster than those of OEMs. Consequently, these companies have grown over the years to hold a significant portion of the U.S. endoscope service business. At present, they service almost one-third of all endoscopes and generate about 20 percent of the revenues in this space, exerting tremendous competitive pressure on OEMs.

The Competition Between OEMs and Third-Party Service Providers

Healthcare reform and cost containment pressures have led to interesting dynamics between OEM and third-party competitors. While the upfront pricing advantages offered by third-party companies are becoming more attractive in an era of budget cuts, OEMs have increased their marketing efforts to highlight the benefits of OEM endoscope servicing, which include:

- Access to original parts and service manuals — Third-party companies must source generic parts or reverse-engineer parts, and may not have access to proprietary service manuals. The parts used by third parties are not always available or may be perceived as lower quality.

- Ability to repair newer and more specialized endoscopes — Specialized endoscopes are expensive capital investments and facility managers want to keep them in top condition. Hospitals also do not want to risk having their procedures delayed when third-parties are unable to perform a repair on time.

- FDA oversight — There is no requirement for third-party companies to maintain a quality management system, or to track and report adverse events to the FDA. While many third-party companies do have quality assurance certifications and practices in place, many customers still perceive their testing and auditing processes to be less extensive than those of OEMs.

- Comprehensive inventory — Endoscope exchanges and loans are more difficult for most third-party companies since they do not have an extensive inventory. Some third-party companies have overcome this obstacle by working as partners to source refurbished endoscopes from each other to offer as exchange units. Nevertheless, third-parties often cannot provide like-for-like exchanges or loaners; they will often replace a scope with another brand or an older model.

In response, third-party companies have brought forth a number of unique advantages, in addition to a lower upfront price tag:

- Brand neutrality — Third-party companies service multiple brands of endoscopes, as well as other types of medical equipment or devices. This provides a great deal of convenience and cost savings to a hospital's supply chain because it can work with just one equipment repair company, as opposed to having separate service contracts for every brand or type of equipment.

- Flexible and personalized service — OEMs tend to be less flexible due to their corporate culture and company policies. On the other hand, it is not uncommon for third-party business executives to be personally in touch with customers, or to make immediate decisions and one-off changes based on customer requests.

Where Does The Opportunity Lie?

Historically, third-party companies have a strong position in ambulatory service centers (ASCs) simply because most ASCs are for-profit motivated, particularly ones with physician ownership. Public hospitals have seen a more even split between OEM and third-party services, with third-parties primarily servicing older endoscopes that have come off contract with OEMs. For-profit hospitals tend to be more aggressive in banding together to form single owner conglomerates, which gives them leverage to negotiate more favorable deals with OEMs than most not-for-profit entities.

OEMs also have traditionally staked their claim to university hospitals and academic medical centers by investing heavily in the training of young surgeons to inculcate a preference for their products and services from a very early stage of the doctor’s career. In general, health care facilities that are less concerned about money have mostly stuck to OEM services because of the general perception that their repairs are of higher quality.

The Post-ACA Market Is Transforming The Third-Party Industry

Following the post-ACA hospital merger mania, some hospital conglomerates — particularly those owned by universities — have begun to take their newly acquired subsidiaries off third-party contracts, as they can negotiate better deals with OEMs. As a result, the third-party endoscope service industry has undergone considerable transformation in recent years.

Smaller, regional players are falling off the radar and many are banding together into larger national service networks. For example, health care service provider STERIS entered the endoscope repair business through its acquisition of Spectrum Surgical Instrument and Total Repair Express (TRE) in 2012. Since then, other third-party companies have been incorporated under the larger STERIS umbrella. These include Florida Surgical Repair, St. Louis Life Systems, and Alabama-based Integrated Medical Systems (IMS). Acquisition by larger health care entities like STERIS provides these third-party companies with substantial financial backing, advertising opportunities, and access to existing customer relationships nationwide.

The consolidation of these regional players also provides them with the necessary geographical coverage to effectively compete against OEMs for GPO contracts. In addition, the existing sterile processing business of STERIS complements endoscope repair, and can help to increase the company’s perceived credibility. These services also can be offered as a bundle, which can be particularly attractive to hospitals seeking to lower their operational expenses. Therefore, it is highly likely that the demand for third-parties will grow again if hospital profit margins continue to shrink going forward.

Evolving Strategies For OEMs

The threat from third-party companies is real. OEMs need to evolve with the market in order to retain as much of their business as possible. Strategies can include:

- Contracts — Hospital profit margins are shrinking and the hospitals are under increasing pressure to stay within yearly budgets. Capitated service agreements allow hospitals to plan their budgets ahead of time and avoid unexpected expenses during the year. In order to satisfy the large spectrum of customers, OEMs need to have certain degree of flexibility with their servicing agreements. Customers are always finding innovative ways to cut costs. For example, many smaller hospitals prefer short-term contracts to allow themselves the opportunity to switch service providers. Larger hospitals that place high importance on avoiding the hassle of renegotiating service contracts prefer long-term contracts (four to five years) to match the lifespan of their endoscopes.

- Innovation — OEMs hold the unique advantage of being able to bundle service contracts with original device sales. In some cases, the cost of the contract is included in the purchase price of the endoscope, which allows the OEMs to retain customers for at least a significant part of the device’s life span before third-party firms have the opportunity to offer their services. As most doctors like to get their hands on the latest and greatest technologies, continuous innovation provides the opportunity for customers to upgrade their units frequently and sign service contracts with the OEM at the time of purchase.

- Education — Physician training programs have been an established strategy for OEMs, and training should continue to facilitate surgeon familiarity and loyalty with OEM product lines and services. Teaching hospitals are good starting points for establishing such relationships, as physicians are more likely to continue using the same products and services as they progress through the early stages of their careers. Another strategy is to provide endoscope handling and maintenance education to facilities as part of service agreements. These education programs help facilities reduce scope damage, thereby lowering the frequency of endoscope repairs. Facilities ultimately aim to reduce costs. If their service expenditures can be lowered, they are more likely to stay with the same service provider.

Conclusions

There exist both opportunities and challenges in the U.S. market for endoscope service. On one hand, the increased use of endoscopes for disease diagnosis, as well as the growing demand for minimally invasive treatments, will continue to buoy the market. On the other hand, ongoing budget cuts and cost constraints of the post-ACA market have limited profit margins. As the third-party service industry continues to transform in response to new market challenges, it is imperative for OEMs to evolve in order to stay on top of the game.

About The Author

Xi Chen is an analyst at Decision Resources Group. He has authored reports on laparoscopic, ENT, and sports medicine devices in the endoscopy division of the company. Xi Chen holds a doctoral degree in biomedical engineering from the University of Toronto.