Overcoming Funding Challenges For Innovative Medtech In Germany: Learnings From The NUB Process

By Eva Marchese, Lorenzo D’Angelo, Anthony Barron, and Oriol Viader-Llargués, CRA

Germany is the leading medtech market in Europe, with a 22% market share. While funding for high-cost innovative medtech in Germany has evolved in recent years, there are still many challenges in securing reimbursement even as demand for these technologies surges. In a new analysis conducted by our Life Sciences Practice team at CRA, we explored how medtech companies should approach the reimbursement pathway for these devices when seeking to enter the German market.

In Germany, there are multiple pathways for medtech reimbursement depending on whether it is for capital equipment, for general reimbursement of outpatient services, for home use, or for use in the inpatient setting. In the inpatient setting, reimbursement for a treatment or procedure is determined via the German Diagnosis Related Groups (G-DRG) system and is billed by hospitals on a fee-per-case basis, which covers hospitalization costs and includes use of specific devices. Creating a new G-DRG tariff or increasing the reimbursement for an existing one requires collecting real-world data supporting use of that procedure.

Encouraging Uptake With The NUB Process

Many new innovative medical devices have limited clinical efficacy data at launch and insufficient funding by an existing G-DRG tariff, thus hospitals are often reluctant to adopt new medtech. As a result, it is difficult to provide a sufficient level of real-world evidence to justify modification of an existing G-DRG tariff or creation of a new one to obtain additional funding. To encourage broader uptake of innovative medtech among hospitals, Germany introduced the NUB (Neue Untersuchungs- und Behandlungsmethoden) process in 2005. This process provides hospitals with the additional funding required to adopt a method or procedure that uses a new device that is not sufficiently covered by an existing G-DRG tariff.

To secure NUB funding, there is a formal procedure, with each hospital or hospital network required to apply individually to the Hospital Remuneration System (Institut für das Entgeltsystem im Krankenhaus, or InEK). InEK will approve or deny NUB funding based on a new device’s demonstrated added clinical benefit compared with established procedures and devices, the number of patients being treated with it, the additional costs associated with staff and materials, and the reason why costs are not yet appropriately covered by existing G-DRG tariffs.

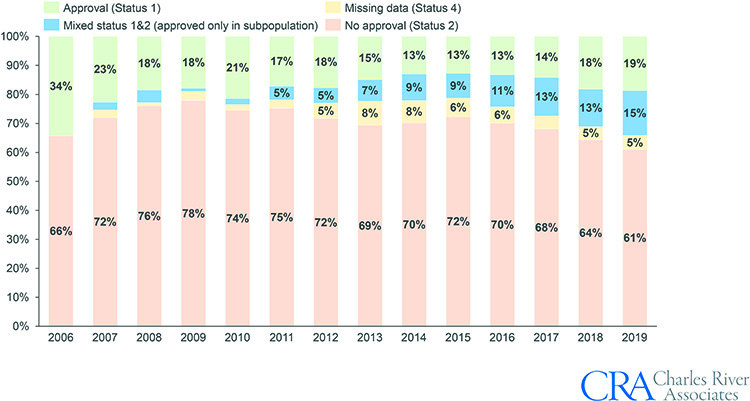

If InEK approves NUB funding (Status 1 or, for individual cases only, Status 4 – see Figure 1), the reimbursed price is negotiated between the applying hospital and the sick funds that provide care under the statutory health insurance (SHI) system. The supplementary payment is then only applicable to hospitals that applied for NUB funding. The annual application deadline is October 31 and InEK’s decision is released on January 31,, with price negotiations taking place between April and June. As NUBs are only valid for one year, they require annual updates.

Figure 1. Possible outcomes of the NUB process.

|

Status 1: Criteria of the NUB agreement are met. NUB fees can be agreed for these methods/services. |

Status 2: Criteria of the NUB agreement are not met. For these methods/services an agreement of NUB fees is not permitted. |

|

Status 3: The application was not evaluated within the set deadline. In principle, NUB fees can be agreed for methods/services with Status 3. |

Status 4: The information submitted with the application was implausible or not comprehensible. In justified individual cases, NUB fees can be agreed for methods/services with Status 4. |

Source: DRG Research Group

Strengths And Challenges Of The NUB Process

The NUB application process was established to address the funding gap with the introduction of innovative medtech into the G-DRG system, helping many innovative technologies to reach patients faster. The NUB process has several strengths for device manufacturers considering entering the German market, including:

- The NUB process is quick: NUB has a well-defined process with access to reimbursement for innovative medtech in a relatively short time frame (~eight months).

- The NUB process is increasingly well understood and used: There has been a steady decline in the percentage of applications rejected (Status 2), falling from 78% in 2009 to 61% in 2019 (see Figure 2), indicating an increased awareness and understanding of the NUB process among device manufacturers.

- NUB funding will lead to increased market penetration: Devices already approved for NUB funding in the previous year are likely to generate increased interest from hospitals in the following year, as the average number of individual NUB requests filed for a device tends to increase after first approval for NUB funding.

- NUBs can lead to subsequent integration into the G-DRG system: Medtech approved for NUB funding will be subsequently considered for integration into the G-DRG system based on sufficient use by hospitals or hospital networks, correct coding, and an approved cost profile.

Figure 2. Outcomes of medical devices evaluations by InEK per year, 2006-2019.

Note: Status 3 is not shown since applications with Status 3 are not evaluated by InEK.

Source: InEK, CRA analysis

While these advantages of using the NUB application process are important to consider, device manufacturers must also keep in mind several challenges that the process presents:

- Medtech users (hospitals) must put in significant effort to receive NUB approval: NUB funding only applies to submitting hospitals or hospital networks and requires bilateral negotiations between them and the German sick funds on the reimbursement level, given that NUB approval only grants the opportunity to negotiate. In addition, due to the strict application process, a NUB application for a new innovative device needs to be well-planned and timely.

- Substantial ongoing effort is required for continued NUB approval: A hospital needs to apply for NUB funding every year for each medtech, although the second time that a hospital applies for NUB funding the process is faster, as reimbursement for the product has already been negotiated.

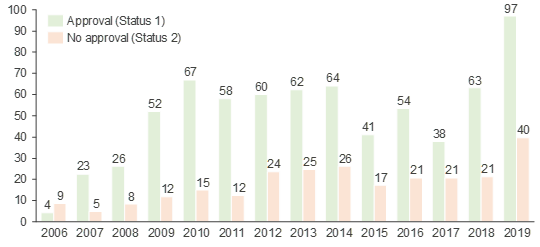

- Multiple NUB applications help facilitate approval, but smaller hospitals are less willing to apply: Only well-supported medtech products gain approval (Status 1) by InEK and thus multiple hospitals need to apply. Since the introduction of the NUB application process, the average number of individual requests filed for devices that ultimately received approval (Status 1) has been consistently higher than the number of requests filed for devices that were rejected (Status 2) (see Figure 3). While university hospitals are more willing to apply for NUB funding due to their higher likelihood of receiving approval and successfully negotiating with regional SHI boards, smaller hospitals generally have less experience with NUB applications.1

- Additional assessment for high-risk medtech: High-risk medtech (risk classes IIb or III, according to the EU Medical Devices Directive) representing a new theoretical or scientific concept must go through an additional early benefit assessment as part of the NUB process. This brings additional uncertainties for the manufacturer because in the case of an unquantifiable additional benefit, the Federal Joint Committee (Gemeinsamer Bundesausschuss, or G-BA) may either request an additional clinical study or the device may lose market access entirely.

- Time from NUB approval to new/improved G-DRG: Even though the NUB process can lead to subsequent integration into the G-DRG system, the integration process typically takes three to five years.

Figure 3. Average number of requests filed per device depending on achieved NUB status.

Source: InEK, CRA analysis

Conclusion

Medtech innovations can bring substantial benefits to patients, the healthcare system, and society. The NUB reimbursement pathway has proven to be a viable solution for innovative medtech manufacturers to establish their presence in the German market sooner, obtain reimbursement faster, and subsequently increase the chances of long-term reimbursement. Manufacturers can leverage the NUB process as a pathway to bring innovation to the market relatively quickly but may still face challenges in securing patient access. To overcome these challenges, we recommend device manufacturers approach the NUB process by:

- Understanding the unmet needs of hospitals, especially those that report directly to InEK, and ensuring the medtech under review addresses those unmet needs.

- Targeting specific academic hospitals or hospital networks to leverage experience in NUB application procedures and facilitate integration into the G-DRG system through real-world data reported to InEK.

- Targeting multiple hospitals to increase the likelihood of approval by InEK.

- Supporting hospitals applying for NUB funding to ensure their applications are filed within the strict timeline of ~eight months after the application process has been opened by:

- Providing information required for the application sections on details on the method (e.g., mode of action, technical and material details, frequency and duration of application) and additional costs involved (e.g., additional personnel and time requirement, additional qualifications required, material or implant costs)

- Helping in the coordination of applications to minimize duplication of efforts

- Reminding of and helping with the yearly re-application

- Providing to hospitals information on the clinical and/or (longer term) economic advantages expected by the technology use in support of the negotiation between the hospital and sick funds following NUB approval.

References

1. Hoffman and Kersting, 2019 – lnnovationen in der Krankenhausversorgung

About the Authors:

Eva Marchese (emarchese@crai.com) is a vice president in the Life Sciences Practice of CRA based in London. She specializes in competitive strategy, pricing, market access, and research primarily in the pharmaceutical, biotech, and life sciences industries. Dr. Marchese has an extensive consulting background with a focus on advising pharmaceutical and medtech companies on global pricing and market access.

Eva Marchese (emarchese@crai.com) is a vice president in the Life Sciences Practice of CRA based in London. She specializes in competitive strategy, pricing, market access, and research primarily in the pharmaceutical, biotech, and life sciences industries. Dr. Marchese has an extensive consulting background with a focus on advising pharmaceutical and medtech companies on global pricing and market access.

Lorenzo D’Angelo (ldangelo@crai.com) is a principal in the Life Sciences Practice of CRA based in Munich. Dr. D’Angelo is an experienced Life Sciences consultant helping global and medtech companies with their commercial strategies.

Lorenzo D’Angelo (ldangelo@crai.com) is a principal in the Life Sciences Practice of CRA based in Munich. Dr. D’Angelo is an experienced Life Sciences consultant helping global and medtech companies with their commercial strategies.

Anthony Barron (abarron@crai.com) is a principal in the Life Sciences Practice of CRA based in Brussels. He has been working on European and international policy issues for more than 10 years. He regularly advises clients on health financing and market access policy issues for healthcare technologies and has conducted a number of research projects for EFPIA, PhRMA, IFPMA, AdvaMed, and several medical device suppliers.

Anthony Barron (abarron@crai.com) is a principal in the Life Sciences Practice of CRA based in Brussels. He has been working on European and international policy issues for more than 10 years. He regularly advises clients on health financing and market access policy issues for healthcare technologies and has conducted a number of research projects for EFPIA, PhRMA, IFPMA, AdvaMed, and several medical device suppliers.

Oriol Viader-Llargués (oviader-llargues@crai.com) is a senior associate in the Life Sciences Practice of CRA based in Munich. He has provided commercial strategy support to several global pharmaceutical companies as well as smaller biotechs developing medical devices for cardiology indications. He also has experience in European drug pricing and market access strategy.

Oriol Viader-Llargués (oviader-llargues@crai.com) is a senior associate in the Life Sciences Practice of CRA based in Munich. He has provided commercial strategy support to several global pharmaceutical companies as well as smaller biotechs developing medical devices for cardiology indications. He also has experience in European drug pricing and market access strategy.

The views expressed herein are the authors’ and not those of Charles River Associates (CRA) or any of the organizations with which the authors are affiliated