Q1 Peripheral Vascular Market Analysis: Drug Coated Balloon Landscape Evolves, Surprise Buyer For Cordis

By Louise Murphy, Team Lead – Cardiovascular, Decision Resources Group

The first quarter of 2015 brought a bevy of exciting headlines in the always-dynamic world of peripheral vascular (PV) devices.

The PV market has experienced substantial growth based on increasing awareness and diagnosis of peripheral arterial disease (PAD), and also due to continual technology advancement, which allows physicians to treat more patients. Because the disease can be so different depending on the patient and its location within the vasculature, there is great opportunity for product innovation and new entrants.

Currently, drug-coated technologies including drug-coated balloons (DCBs) and drug-eluting stents (DESs) are the hottest devices in the PV space. These devices have been long-awaited in the United States and are experiencing rapid early adoption.

On the flip side, all of this innovation exists within the constraints of today’s cost-focused healthcare markets. With the U.S. taking steps towards major healthcare reform, device makers must be extremely mindful of selling practices, even if what they are selling is an eagerly-anticipated new device. Value-based selling — either through scale or through a proven health economic value proposition — will be paramount to success in today’s market.

In the following sections, we will explore four of the top stories from Q1 that are shaking up the PV market right now.

1. Boston Scientific To Sell C.R. Bard’s Lutonix DCB In The U.S.

This arrangement initially came as a bit of a surprise to me. Bard has built an extensive, well-rounded PV portfolio and seemed primed to drive sales of Lutonix (the first DCB in the U.S.). However, in the wake of Medtronic’s acquisition of Covidien, Lutonix needed more firepower.

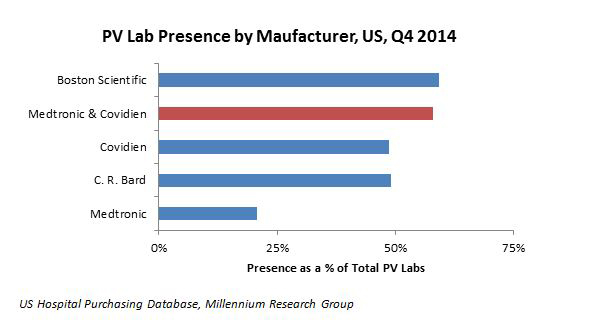

Medtronic’s In.Pact DCB has a strong clinical backing and was always going to pose a competitive threat to Bard’s Lutonix, but Bard had a much stronger presence in the PV space than Medtronic, giving the Lutonix a competitive edge. However, Medtronic’s Covidien acquisition creates a greater foothold in the PV market for the medtech giant. This can be seen in the chart below, illustrating the U.S. PV lab presence of these companies:

So what was Bard to do once it lost its competitive edge? The company made a smart, forward-thinking move: one-up the Medtronic-Covidien conglomerate by partnering with the most well-rounded portfolio in PV, Boston Scientific’s.

Now the playing fields are even, pricing has been relatively even so far, and the DCB race to the top is on.

2. Medicare Approves An Add-On Payment For Outpatient DCB Procedures

This is huge news for DCB adoption. The devices are currently priced higher than most stents, falling way out of range of normal balloon reimbursement coverage. The add-on payment is an acknowledgment of the value proposition of DCB — Medicare is willing to pay more with the expectation that DCB will lead to improved outcomes, including fewer reinterventions.

Approximately 50% of superficial femoral artery (SFA) procedures (for which DCB are indicated) in the U.S. are conducted in an outpatient setting. So this reimbursement eliminates the cost barrier to adoption for DCB in half the cases.

The scorecard for U.S. reimbursement is now outpatient for DCB and inpatient for its direct competitor, DES. Obviously, manufacturers of each device would like to extend into full inpatient/outpatient coverage, and will likely continue to work towards this outcome.

Office-based reimbursement remains elusive for both devices. Offices are playing an increasingly important role in the PV landscape, but they are extremely unlikely to adopt DCB and DES without a dedicated reimbursement to cover the additional cost. Vascular treatment offices are notoriously cost-conscious (physicians are business-owners and must cover their expenses), so the idea of these facilities paying out-of-pocket for premium-priced devices is unrealistic. Speaking to sales reps at the recent Society of Interventional Radiology (SIR) conference, I got the impression that it’s not worth their effort to market DES and DCB to offices unless there is a change to reimbursement.

3. Spectranetics’ STELLAREX Becomes Newest Entrant To The DCB Space

The device received European approval in mid-January and launched later that month. Spectranetics picked up the STELLAREX from Covidien, who had to divest from the DCB space in order to satisfy anti-competitive concerns regarding its merger with Medtronic (who already has a DCB). The European launch of STELLAREX immediately followed the completion of the merger.

Spectranetics was clearly eager to get into the DCB game. The company had already tried to purchase STELLAREX once before, so the Medtronic-Covidien announcement immediately set Spectranetics CEO Scott Drake’s wheels in motion.

Spectranetics now boasts a very unique portfolio of noteworthy PV devices: the only laser atherectomy catheter, the only scoring balloon (acquired in June 2014), the runaway favorite support catheter for chronic total occlusion (CTO) lesions, and now a DCB — one of the most buzzworthy devices in PV. This is advantageous for Spectranetics; the company can’t compete with the scale and reach of the Boston Scientifics and Medtronics of the PV world, but Spectranetics has ensured its significance to physicians by amassing a portfolio of original products.

4. Cardinal Health Comes Out Of Left Field To Purchase J&J’s Cordis PV Line

J&J has been shopping around for a buyer for its Cordis PV line for almost a year now. Usual suspects could have included fringe PV companies looking to grow their portfolios (e.g., Spectranetics) or larger cardiovascular-focused companies looking to expand their cath lab offerings with a PV portfolio (e.g., St Jude Medical). The thing is, J&J hasn’t been very focused on Cordis for the past couple of years, leaving a portfolio that is somewhat stale and has seen a substantial decline in share — not the most favorable purchase for a cardiovascular company pursuing growth.

In this regard, the acquisition by Cardinal Health makes strategic sense and represents an extremely interesting entrant to this market.

Cardinal Health is a distributor focused on providing low-cost solutions to hospitals. The cardiovascular space is of key interest to the company because it is one of the most significant contributors to hospital spending. There has been commoditization in many areas of cardiovascular (coronary DES price wars, for example), but so far PV has been relatively unscathed by cost-competition. The consensus on the exhibition floor at SIR (when this acquisition was announced) was that this would mean the introduction of a low-cost competitor. Reps and product managers that I spoke to seemed apprehensive about the news but took the opportunity to underscore the clinical value of each of their respective devices.

It will be very interesting to see how this element plays out. Will innovation and strategic device selection remain king in PV, or will the growing influence of hospital administrators over physicians shift PV purchases towards a low-cost option?

PV Outlook For 2015

The upcoming year will bring more ever-important long-term clinical data for DCB. Cook Medical’s Zilver DES has five years of clinical follow-up to support its efficacy, so it will be important for DCB manufacturers to follow suit. Long-term efficacy is the big question mark and opportunity for differentiation in PV.

I am looking forward to seeing how the DCB and DES trajectories play out in 2015, and how Cardinal Health will fit into the mix of traditional medtech companies. There are more options than ever before available to PV purchasers and end-users. This will strengthen their purchasing power, but it will also strengthen the PV market as a whole by contributing to its dynamic nature.

About The Author

Louise Murphy is the Medtech Cardiovascular Insights team lead at Decision Resources Group. She has authored and supervised projects covering several cardiovascular therapy areas, specializing in the global peripheral vascular market. She holds a BSc hons from McMaster University and a Master of Management of Innovation degree from the University of Toronto.