Pocket Guide To Medtech's Market Outlook In 2021

By Carlo Stimamiglio, Alira Health

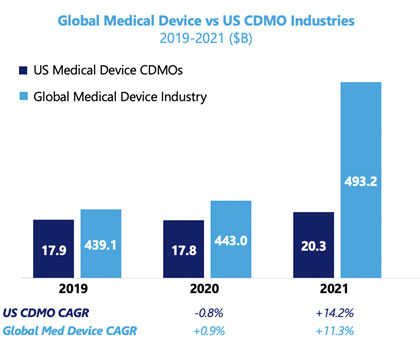

Over the last year, medtech original equipment manufacturers (OEMs) and contract development and manufacturing organizations (CDMOs) faced the complex challenges of the COVID-19 pandemic. Despite experiencing vulnerability in 2020, both industries are positioned to perform strongly in 2021 – and overall long-term trends reported in 2020 remain intact. This article summarizes Alira Health’s findings from its new 2021 MedTech Contract Manufacturing Report released on March 3, 2021.

While individual companies faced immediate challenges or opportunities based on their position in the market, downturns were counterbalanced with the upward trend in financing. The resilience of the industry as a whole in 2020 was largely due to the record number of M&A deals – also a good indication that the trajectory of growth and consolidation isn’t threatened by our current health emergency. In fact, for the medtech OEM industry, 2020 was also a record year for IPOs and venture fundraising. [Editor’s note: To read about recent life sciences deal-making at large, check out this article here.]

When you pair this financial activity with the normalization of the healthcare market in 2021, both medtech OEMs and CDMOs will see trends return to healthy growth of 11.4% average yearly growth through 2025.

The Impact Of COVID-19 On Medtech OEMs

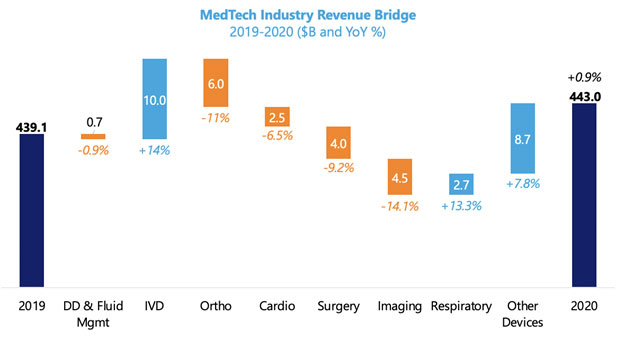

In 2020, the pandemic impacted the global medical device industry by causing the deferral of elective procedures and shifting the priority of hospitals’ purchasing departments to the diagnosis, treatment, and prevention of COVID-19. The dramatic decline of elective procedures led to revenue losses for device manufacturers as well as hospitals. When we look at the trend in the largest OEMs, it’s clear that those exposed to elective procedures had a down year, particularly in minimally invasive surgery and medical imaging. Additionally, the pandemic halted clinical research, slowing the release of new high-value products.

While not a lasting industry trend, some companies that were otherwise halted were able to pivot their manufacturing to support the emergency production of masks or respiratory equipment for hospitals, leveraging for example, the emergency U.S. government funds allocated to finance these efforts.

Those OEMs whose business already fit with the shift in medical priorities saw a significant boost to their revenue. As hospitals around the world managed surges in critical care patient volumes and adjusted workflows to improve infection prevention, diagnostics-focused businesses and critical care services were in demand.

Device manufacturers played a critical role in accelerating the production and supply of these necessities as the priority shift in hospital purchasing departments strained global supply chains and increased logistics costs for global manufacturers. This response has generated new revenue opportunities that are expected to continue into 2022, even surpassing the return of elective procedures. And, as COVID-19 testing and safety protocols continue, the production of masks, protective equipment, and other consumables looks to be in demand through the rest of 2021.

Financial Activity Trends For OEMs In 2021

The strong M&A and IPO activity in 2020 indicates that while the challenges of COVID-19 have been significant, the long-term growth of the OEM industry is stable.

Despite a decline in revenue and profits that started to emerge early in 2020, by year end, large medtech companies had funded the acquisition of both mature (≥6 deals worth >$1 billion) and VC-backed targets (16 deals*). Additionally, a record 11 IPOs took place in 2020, with median valuations of $469 million.

Such robust activity demonstrates an industry focus on long-term goals – founded in both the development of an innovation pipeline as well as the relative quick recovery from the near-term roadblocks of the pandemic. In fact, it was Medtronic and Stryker – two companies particularly exposed to the downturn of the elective procedure market – that led all 2020 M&As with four and three acquisitions, respectively.

2020 was also a record year for venture funding, with total fundraising by life sciences-focused VCs** hitting $16.8 billion, a peak of new liquidity that will fuel long-term investments in healthcare innovation. VC funding to in vitro diagnostic products (IVDs) and device companies grew year-over-year in 2020, with the diagnostics sector doubling the dollar amount raised in 2019. While the bulk of these funds was directed to late-stage and pre-IPO deals, the large number of exits is poised to attract more capital to the medtech industry, with positive long-term effects also for early-stage VC-backed companies.

The Impact Of COVID-19 On U.S. CDMOs

The overall performance of the U.S. CDMO industry in 2020 aligns with the global OEM industry, with revenue declining an estimated 0.8%. However, when we look closely, we see that trends varied across CDMO market segments.

The key driver of underperformance in U.S.-based CDMOs was high exposure to devices used in elective procedures. The decrease in orders for high-value devices and components significantly impacted the revenue of on-shore contract manufacturers. In particular, CDMOs serving the cardiovascular and orthopedic surgery market saw significant revenue decreases.

While these segments struggled, certain markets continued to grow, fueled by increased demand from diagnostic labs and the emergency and critical care departments of hospitals. Component manufacturers specializing in injection molding responded to this increased need, but by far the largest demand was for IVD consumables. Multiple surveyed manufacturers recorded a revenue boost of up to 50% – the result of the development and commercialization of COVID-19 tests.

In addition to these contractions of revenue in 2020, the operational model of CDMOs was challenged by COVID-19. The lower predictability of purchase orders and shifting priorities in inventory-management policies by medical device OEMs put pressure on the operational and financial performance of CDMOs.

Like OEMs, the deferral of clinical studies affected the demand for product development services and manufacturing. However, CDMOs also saw early-stage VC-backed device companies ration funding of outsourced R&D in tandem with the deferral of clinical trials, resulting in an average revenue decline of 12.5%. Vendors of R&D, product design, prototyping, engineering services, and small-batch manufacturing all took the hardest hits.

Market Segment Outlooks For U.S. CDMOs In 2021

While hospitals continue to manage COVID-19 through 2021, the return of elective procedures and chronic disease management will help CDMO segments negatively impacted by COVID-19 bounce back. And, in preparation for the resumed – and in some cases increased – volume of procedures, purchasing groups of OEMs will start to build inventory ahead of increased demand.

Clinical trials will also resume and, given the financing activity last year, there will be more capital than ever to develop new products. This will accelerate R&D programs and benefit emerging device companies. Design and development services are expected to offset much of the revenue losses experienced in 2020 and expect the most improved year-over-year performance in 2021, with a median 16.7% projected revenue growth.

Other manufacturers expecting a positive outlook for 2021 based on the return of elective procedures include those offering downstream finishing services like CNC machining and precision laser cutting, as well as CDMOs offering both manual and automated assembly services.

Financial Activity Trends For CDMOs In 2021

When it comes to M&A transactions, the CDMO sector had a record year in 2020 with 30 global deals. The drive for inorganic growth continues to propel industry consolidation despite the uncertainty caused by the pandemic. Likewise, the consolidation in the U.S. CDMO market continued at a fast pace, with 22 M&A deals led by corporate and private equity (PE)-backed buyers in 2020.

Given that the volume of financial activity wasn’t deterred by the downturn in revenue caused by COVID-19, 2021 is certainly poised to see many deals as financial performances rebound. In particular, look for smaller, independent CDMOs to approach the market to be acquired in the second part of the year.

Similarly, private equity investors were very active in 2020, with 15 deals and, for the first year since 2016, strategic buyers matched the number of PE-backed deals. PE-backed exits will return primarily in the second half of 2021 and will continue steadily into 2022, with several assets approaching the end of the amenable holding period.

Overall, both corporate and PE-backed CDMOs will continue to compete to acquire highly prized independent targets to consolidate market share and acquire differentiated capabilities that may secure long-term lucrative contracts. And, cross-border deals are expected to increase, with large Europe and Asia-based CDMO generalists attracted to the U.S. medical device space and looking to establish an on-shore footprint.

Comprehensive 2021 Outlook: Long-term Trends Prevail

Without question, COVID-19 challenged OEMs and CDMOs, but the fundamental trajectory of both industries remains on track with long-term trends. As the strong financial activity continues through 2021, it’s clear the overall response of the industry has been one of innovation and resiliency.

Notes

*M&A deals counted if up-front payments are equal to $50 million or above.

**Includes fundraising in the segments of biotech/pharma and digital health.

About the Author:

Carlo Stimamiglio is a partner in Alira Health’s Transaction Advisory practice and focuses on helping medical device, digital health, and pharmaceutical companies in the execution of strategic and M&A deals. Besides his focus on healthcare technologies, Stimamiglio is a leader of Alira Health’s Contract Manufacturing specialty practice and has been an active strategy and transaction advisor to global CDMOs. He is a registered investment banker with FINRA Series 79 and 63 licenses, and he earned an MS in finance from the University of Verona and an MBA from IE Business School.

Carlo Stimamiglio is a partner in Alira Health’s Transaction Advisory practice and focuses on helping medical device, digital health, and pharmaceutical companies in the execution of strategic and M&A deals. Besides his focus on healthcare technologies, Stimamiglio is a leader of Alira Health’s Contract Manufacturing specialty practice and has been an active strategy and transaction advisor to global CDMOs. He is a registered investment banker with FINRA Series 79 and 63 licenses, and he earned an MS in finance from the University of Verona and an MBA from IE Business School.