Remote Patient Monitoring: A Booming Industry Across The Globe

By Graham Diett and Kamran Zamanian, Ph.D., iData Research

Remote patient monitoring (RPM) is transforming healthcare by enabling real-time tracking of vital signs through home-based devices. By leveraging technology, RPM empowers patients to manage their health more effectively while providing clinicians with critical data for proactive care.

From blood pressure cuffs to glucose monitors and pulse oximeters, these solutions ensure seamless communication between patients and healthcare providers. Vital signs data is transmitted to a central server, where information can be viewed by a clinician or the patient. This allows caregivers to monitor a patient’s condition and take appropriate action to manage health. This reduces hospital visits and allows for more personalized patient treatment plans.1

As healthcare continues to evolve, RPM has emerged as a game changer, addressing challenges such as physician shortages, aging populations, and the rising burden of chronic diseases. With rapid advancements in wireless technology, RPM is poised for explosive growth across the globe.

The Components Of RPM

Remote patient monitoring solutions encompass two key elements:

- Peripheral Devices – Blood pressure monitors, weight scales, glucose meters, and pulse oximeters tailored to patients' specific conditions.

- Data Transmission Systems – Secure communication channels using telephone lines, broadband, GSM, or Bluetooth to relay patient data.

Beyond general health monitoring, RPM is also widely used for cardiac implantable electronic devices (CIEDs), which include pacemakers, implantable loop recorders, implantable cardioverter defibrillators (ICDs), cardiac resynchronization therapy devices (CRT-Ds), and hemodynamic monitors. These innovations reduce the need for in-office follow-up visits while ensuring that devices function correctly and that patients remain in stable health.1

Key Drivers Of Global Growth

The convenience remote patient monitoring devices provide to both patients and healthcare facilities is driving growth across all regional markets across the globe. This surge in RPM adoption is driven by several factors, including an increasing prevalence of health conditions, advancements in technological infrastructure, artificial intelligence, and predictive analytics, a rising demand for personalized healthcare and wearable devices, as well as decreased availability of healthcare professionals.

1. Rising Prevalence of Chronic Diseases

Conditions such as chronic obstructive pulmonary disease (COPD), diabetes, hypertension or high blood pressure, chronic heart failure, and tachycardia are all supported by RPM devices. Some conditions are becoming more prevalent, such as COPD,2 and as a by-product, the RPM market is experiencing growth.

2. Advancements in Technological Infrastructure

Wireless data transmission networks will facilitate the development of improvements and increased accessibility to platforms for RPM. Countries with strong preexisting wireless infrastructure are expected to experience accelerated adoption of RPM technologies, further pushing industry growth. Closer to hospitals, improvements in interoperability between remote patient monitoring systems and electronic health records are enabling real-time alerts and automated documentation that fits seamlessly into physician workflows.1

3. Artificial Intelligence and Predictive Analytics

The data-rich environment of the RPM sector is fueling a surge in artificial intelligence (AI) integration. AI algorithms are increasingly being embedded into RPM platforms and devices to move beyond passive data collection toward predictive, actionable insights. One notable example is the HeartLogic algorithm, which can forecast heart failure events days before any symptoms appear, empowering clinicians to intervene proactively and reduce hospitalizations.3 This trend is driving a wave of acquisitions and strategic partnerships between established medical device firms and emerging AI-focused startups. As of May 2024, GE HealthCare lead the industry with 72 AI-enabled device clearances via the FDA’s 510(k) pathway, highlighting the scale at which AI is reshaping both patient monitoring and the broader medical device landscape.4

4. Personalized Healthcare and Wearable Devices on the Rise

As patients increasingly seek care tailored to their individual needs, health conditions, and lifestyles, remote patient monitoring is uniquely positioned to meet this demand. RPM platforms allow physicians and patients to customize which health metrics are monitored based on the individual’s health condition, geographic location, and lifestyle. This shift toward personalized care is further accelerated by the rapid adoption of multiparameter wearable devices. Innovations such as continuous glucose monitors, smartwatches with ECG capabilities, and wearable blood pressure monitors offer passive, always-on tracking with minimal patient involvement. Emerging form factors like smart patches and rings enhance comfort and social acceptability, making continuous health monitoring more accessible and less intrusive.1

As these technologies become more advanced and widely accepted, they not only improve adherence and data quality but also expand the clinical insights available to healthcare providers, fueling further growth in the RPM market.1

5. Shortage of Healthcare Professionals

Across the globe, there are fewer healthcare professionals available to provide care services to the increasing number of chronically ill patients. This is especially detrimental for rural populations that already experience limited care provision on account of modern migratory trends, which greatly favor metropolitan areas. Moreover, the accelerated population growth is expected to place greater pressure on healthcare providers as they struggle to cope with increasing admission rates and reduced bed availability. As a result, there will be a greater need for accessible and timely treatment programs throughout the care continuum, which telehealth monitoring may help to meet. Healthcare policies for patients in rural areas have already been put in place in the last several years and will provide such individuals with access to telemedicine, thereby stimulating market growth.1

Expansion In Foreign Markets

Even in regions facing economic and geopolitical challenges, where other medical markets have seen a drop in activity, RPM is making inroads. For instance:

- Ukraine has embraced RPM due to the ongoing war, shifting from traditional monitoring methods to telehealth solutions.5

- Latin America has seen steady growth in usage since 2010, with countries like Colombia implementing policies and regulations to promote telemedicine.6

- Asia-Pacific is also witnessing a surge in RPM adoption, with Japan and Australia leading the way in pacemaker and ICD usage. Aging populations and improvements in economic conditions in other nations are further accelerating this trend.7

Challenges And Barriers

In markets such as North America and Western Europe, barriers to adoption are not as prevalent, allowing the RPM market to thrive relative to other patient monitoring markets in these regions. However, regions such as Eastern Europe and Latin America have fewer options in place to reimburse the use of telehealth products. This significantly restricts adoption in these regions as the device costs will need to be passed on to either the patient or the manufacturer.1

These barriers present opportunities for further innovation and investment. Expanding reimbursement options and improving infrastructure could unlock RPM’s untapped potential in emerging markets.

Looking Ahead

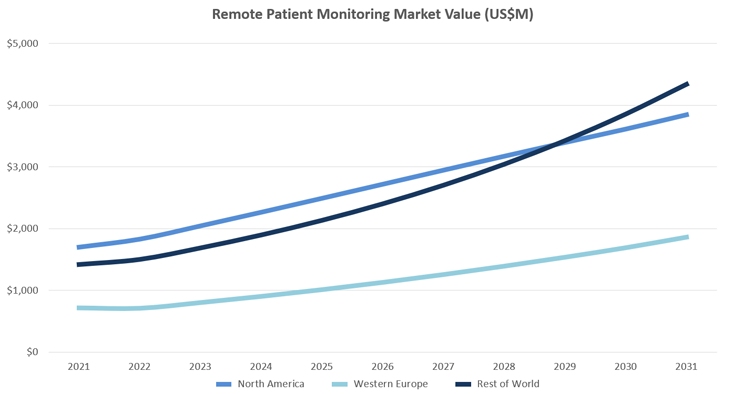

Despite challenges, the global RPM market is on an upward trajectory, driven by increasing chronic disease prevalence and various technological advancements. While disease condition management currently sees higher adoption rates than cardiac implantable electronic devices, both sectors are expected to experience sustained growth in the coming years.

With ongoing improvements in connectivity, affordability, and regulatory support, RPM is set to redefine healthcare delivery, making quality medical care more accessible than ever before.

References

- iData Research Inc. (2025). Global Patient Monitoring Equipment Market. Vancouver: iData Research Inc.

- Blanco, I., Diego, I., Bueno, P., Casas-Maldonado, F., & Miravitlles, M. (2019, July). Geographic distribution of COPD prevalence in the world displayed by Geographic Information System maps. PubMed, pp. 18-54.

- Singh, J. P., Wariar, R., Ruble, S., Kwan, B., Averina, V., Stolen, C. M., & Boehmer, J. (2024). Prediction of Heart Failure Events With the HeartLogic Algorithm: Real-World Validation. Journal of Cardiac Failure, 509-512.

- GE Healthcare. (2024, May 22). GE HealthCare Tops List for Third Year in a Row with Highest Number of AI-Enabled Medical Device Authorizations. Retrieved from https://www.gehealthcare.com/about/newsroom/press-releases/ge-healthcare-tops-list-for-third-year-in-a-row-with-highest-number-of-ai-enabled-medical-device-authorizations

- Poberezhets, V., Demchuk, A., & Mostovoy, Y. (2022, September 14). How Russian-Ukrainian War Changed the Usage of Telemedicine: A Questionnaire-Based Study in Ukraine. Retrieved from ankaramedj.com: https://ankaramedj.com/jvi.aspx?pdir=amj&plng=eng&un=AMJ-08455&look4=

- Chueke, D. (2023, October 11). Persisting Barriers to the Adoption of Telemedicine in Latin America After the COVID-19 Pandemic. Telehealth and Medicine Today.

- Lau, C.-P., & Zhang, S. (2013, June 15). Remote monitoring of cardiac implantable devices in the Asia-Pacific. PubMed, pp. 65-68.

About the Authors:

Graham Diett is a research analyst team lead at iData Research. He develops and composes syndicated research projects regarding the medical device industry, publishing the EU Patient Monitoring Equipment report series.

Graham Diett is a research analyst team lead at iData Research. He develops and composes syndicated research projects regarding the medical device industry, publishing the EU Patient Monitoring Equipment report series.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.