Robotically Assisted Surgical Devices: Ripe For Innovation

By David Stuart and Yaara Avitzur, RSM Canada

The global robotics market was valued at roughly $30 billion in 2020 and is estimated to grow to over $70 billion by 2026. The potential market opportunity differs among economists, but there’s consensus that the robotic device industry is here to stay and will continue to grow. Ongoing advancements in the fields of machine learning and artificial intelligence will continue to expand robots’ applicability and efficiency. Today, across numerous industries and applications there are measurable benefits of the work of robots compared to that of humans, including improved accuracy, better reliability, and cost savings.

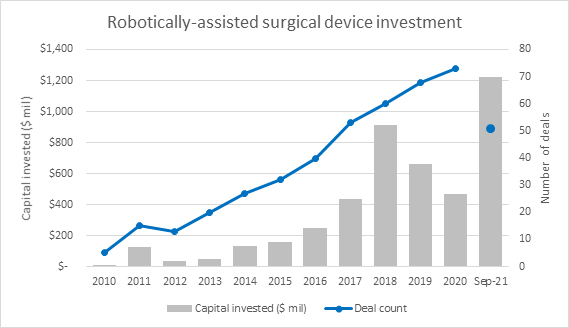

In the healthcare industry, the robotically assisted surgical (RAS) device sector is dominated by a few key players. In the future, several new companies are expected to enter the industry at lower prices, thus decreasing the cost barriers for customers and accelerating RAS device adoption. However, the industry is expected to remain highly consolidated, as competitive pricing will limit the number of successful players. Competition is heating up; private investment from venture capital and private equity has grown significantly over the last decade. Year to date, investment has already eclipsed $1 billion, driven largely by a $600 million investment into CMR Surgical, which is focused on developing robotic systems designed to bring the benefits of minimal access surgery to patients.

Source: PitchBook, RSM US

The Aging Population Problem

Private capital is betting big on the expected market opportunity for RAS devices. Investors are looking closely at demographics and labor trends to determine this opportunity. The national population is expected to grow by 10.6% over the next 15 years, and the over 65-year-old demographic is expected to grow the most during that period, increasing by an expected 42.4%. On the labor front, a study from June 2021 by the Association of American Medical Colleges projected a shortfall of between 37,800 and 124,000 physicians by 2034. Surgical specialists make up 15,800 to 30,200 of that total. Additionally, more physicians are expected to retire in the next decade. This is due to the fact that more than two of every five active physicians will reach the age of 65 by 2034.1

There are three ways the medical community can address this shortfall. First, increase the number of graduates entering the workforce. This requires a collaborative effort among medical schools, medical institutions, and the government. In 2021, the Consolidated Appropriations Act of 2021 provided medical schools and institutions with the funds to increase the number of students in American medical schools by 200 each year from 2023 to 2027, resulting in an additional 1,600 physician positions from 2028 to 2034. On average, it takes approximately 12 years to become a licensed physician from the time an individual completes their high school education until the end of a residency program. However, becoming an experienced surgeon takes longer, as surgery residencies range between five and eight years, while the average residency across all specialties is four years. Therefore, while the 2021 Consolidated Appropriations Act partially alleviates the shortage, more funds must be invested into increasing the educational resources. Additionally, due to the length of training required per each physician, the labor deficit will not be mitigated in the short term. A second solution is to grant permanent residency to foreign physicians. However, long-term planning is difficult due to ever-changing immigrant and visa application rules.

Third, we can leverage RAS devices to reduce the number of physicians and resources needed per procedure. While surgeons still need to be present for RAS device surgeries, the devices are expected to shorten the time per procedure and will often provide surgeons with the ability to sit while working. Additionally, the in-hospital post-operative time per surgery is expected to be shortened as many of the devices have been proven to reduce the risk of infection. This will create an opportunity for surgeons to dedicate more time to complex surgeries for which RAS devices have not been developed, while decreasing the physical pain and fatigue surgeons experience during RAS device-assisted surgeries. Overall, the decrease in time spent on certain surgeries, combined with the reduction in physician burnout due to lower fatigue levels, could lead to a decrease in the physician shortage, thus supporting the investment in RAS devices. However, due to the early stages at which the market is currently in, continued validation of RAS devices through clinical trials is needed to prove that devices result in better outcomes and improve physician efficiency while reducing discharge and recovery time.

Addressing The Challenges Ahead

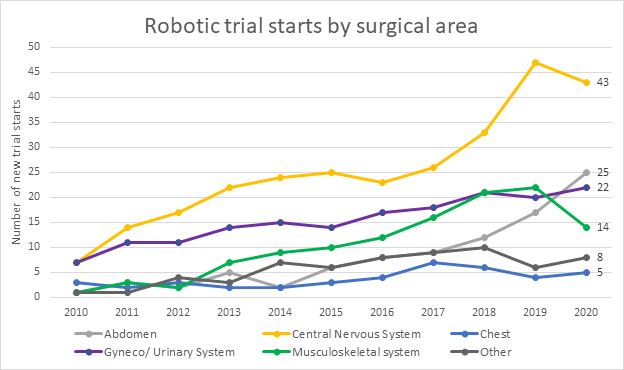

The successful commercialization of the traditional robotic industry is a fairly straightforward formula. Does the output and profitability gain outpace the investment required? In the healthcare sector, the formula is much more complicated. The safety and efficacy of these devices is most important and takes significant investment, time, and human trials to validate. Over the last few years, the FDA has sounded the alarm numerous times on the use of RAS devices, citing concerns primarily focused on device efficacy and safety.2 Concern from the FDA is valid; there is still limited clinical data to support device safety and efficacy. Trial starts as a percentage of private capital invested continues to lag. The global pandemic has exacerbated the problem, as clinical trials across all sectors slowed. The impact is expected to be temporary, as we’re beginning to see an increase in the number of trial starts, but it will take time to regain the momentum lost. In the meantime, as investment dollars continue to pour into the development of RAS devices, significantly more trials are needed across all focuses to validate the results and safety of these new devices.

Source: ClinicTrials.gov, RSM US

The Opportunity Ahead

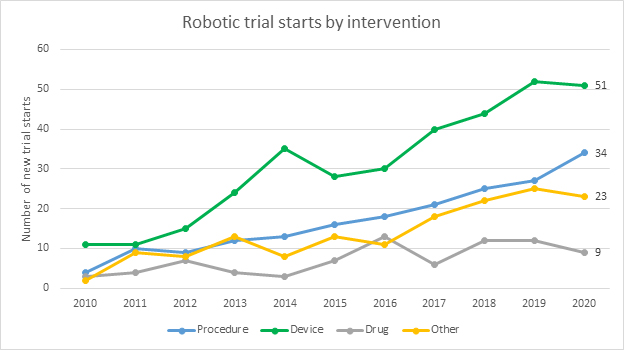

People over the age of 65 are estimated to undergo approximately 50% of all surgeries despite making up only 16% of the population.3 The most common procedures are knee and hip replacements and cataract and heart surgeries. There is an opportunity for RAS device makers to focus on these areas as demand for these procedures will outpace all others. Additionally, complications during and post procedure are most often multifactorial rather than being specific to any given process or organ system. Due to this, the current trend in surgery for the elderly is a move to less invasive procedures. The desired effect of this trend is to reduce intraoperative risk, the trauma of the invasive procedure, postoperative pain, infective complications, and length of hospital stays. Future trials should focus on minimally invasive procedures. By addressing this growing trend, the RAS device market has the opportunity to expand and continue to raise high levels of capital from investors.

Source: ClinicTrials.gov, RSM US

The Takeaway

Recent developments in the fields of machine learning and artificial intelligence have greatly improved robots’ dexterity, vision, and usefulness in complex environments. There is a significant opportunity for RAS device makers to leverage this technology to improve surgical procedure success and recovery times. Successful commercialization of RAS devices will require additional time and resources to validate results. Human trials lag device development, so it is critical that device makers remain proactive and focused on future areas of need to successfully compete in this highly concentrated and competitive market. Shifting demographic and labor trends will create a significant market opportunity that, if addressed correctly, will benefit device makers, physicians, and, most importantly, the patients.

About The Authors:

David Stuart is director and life sciences senior analyst at RSM Canada. He has more than nine years of corporate finance and capital markets experience supporting debt and equity transactions for various industries, including life sciences, technology, telecommunications, renewable energy, and consumer products. David is responsible for supporting local and cross-border transactions and leading M&A and capital advisory transactions in the private and public sectors. He focuses on providing advisory services for buy- and sell-side mandates, specializing in transaction structuring and closing support.

David Stuart is director and life sciences senior analyst at RSM Canada. He has more than nine years of corporate finance and capital markets experience supporting debt and equity transactions for various industries, including life sciences, technology, telecommunications, renewable energy, and consumer products. David is responsible for supporting local and cross-border transactions and leading M&A and capital advisory transactions in the private and public sectors. He focuses on providing advisory services for buy- and sell-side mandates, specializing in transaction structuring and closing support.

Yaara Avitzur is a senior associate at RSM Canada and a current CPA designation holder. She has experience performing merger and acquisition advisory work for financial and strategic buyers and sellers across a broad range of industries. Prior to that, she worked for two years at KPMG in their Financial Institutions and Real Estate Audit Practice, where she began her career in 2017 as an intern.

Yaara Avitzur is a senior associate at RSM Canada and a current CPA designation holder. She has experience performing merger and acquisition advisory work for financial and strategic buyers and sellers across a broad range of industries. Prior to that, she worked for two years at KPMG in their Financial Institutions and Real Estate Audit Practice, where she began her career in 2017 as an intern.